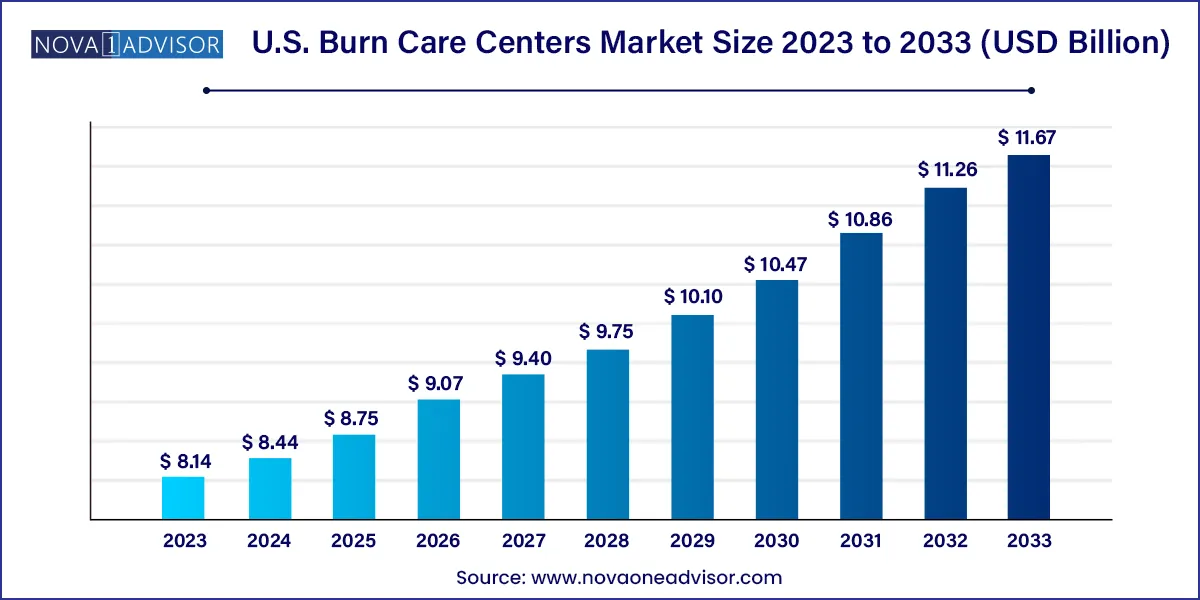

The U.S. burn care centers market size was valued at USD 8.14 billion in 2023 and is anticipated to reach around USD 11.67 billion by 2033, growing at a CAGR of 3.67% from 2024 to 2033.

Key Takeaways:

- Based on facility type, the market is bifurcated into in-hospital and standalone. The standalone segment dominated with the largest revenue share of 59.15% in 2023 and is expected to witness the fastest growth over the forecast period.

- Based on procedure type, the wound debridement segment dominated the market with the largest revenue share of 35.37% in 2023.

- The skin graft segment is expected to witness the fastest growth over the forecast period.

- Based on burn severity, the partial-thickness burns segment dominated with the largest revenue share of 66.22% in 2023.

- The full-thickness burn severity segment is expected to register the fastest CAGR over the forecast period.

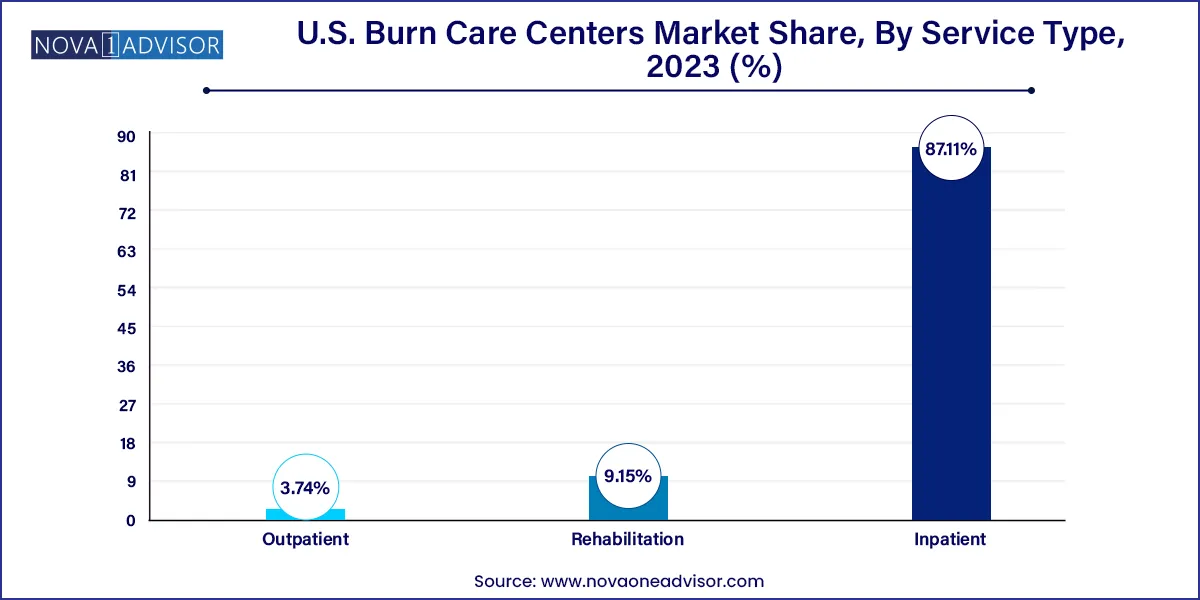

- Based on service type, the inpatient service segment dominated with the largest revenue share of 87.11% in 2023 and is expected to witness the fastest growth over the forecast period.

- The Southeast U.S. region dominated with the largest revenue share of 21.48% in 2023.

- The Northeast region is expected to witness the fastest growth over the forecast period.

Market Overview

The U.S. burn care centers market represents a specialized and critical segment of the healthcare ecosystem, dedicated to the treatment and rehabilitation of patients suffering from thermal, electrical, chemical, and radiation burns. With over 450,000 burn injuries requiring medical treatment annually in the United States according to the American Burn Association (ABA) the demand for specialized, multidisciplinary burn care services is substantial and growing.

Burn care centers are designed to handle complex cases involving partial to full-thickness burns, often necessitating a combination of surgical interventions, respiratory care, psychological support, and long-term rehabilitation. These centers are usually equipped with dedicated burn units, intensive care services, skilled nursing, and interdisciplinary teams of surgeons, dermatologists, pain specialists, and therapists.

Factors contributing to burn injuries in the U.S. include residential fires, industrial accidents, electrical injuries, vehicular incidents, and scalds. Vulnerable populations such as children, the elderly, and low-income communities are particularly at risk. Public safety initiatives and improved fire safety regulations have helped reduce fatalities, but the number of non-fatal burn injuries requiring prolonged medical attention remains significant.

Technological advancements in skin grafting, wound management, and regenerative therapies are significantly improving patient outcomes and expanding the capabilities of burn care centers. Coupled with increasing government funding for trauma and emergency care services, the market is poised for continued expansion, especially as more regional and tertiary hospitals aim to develop or enhance burn-specific treatment wings.

Major Trends in the Market

-

Integration of Advanced Wound Healing Technologies: Use of biosynthetic dressings, stem cell therapies, and nanomaterials is transforming wound care outcomes.

-

Rise in Dedicated Pediatric Burn Units: More burn centers are developing specialized programs for children, including tailored pain management and psychological services.

-

Increase in Outpatient Burn Clinics: For minor and partial-thickness burns, outpatient centers offering follow-up and rehabilitative services are growing.

-

Focus on Tele-burn Services: Remote consultation, triaging, and follow-up are becoming popular for rural or underserved regions.

-

Growth in Multidisciplinary Burn Recovery Programs: Inclusion of nutritionists, psychologists, and occupational therapists in post-burn recovery plans.

-

Adoption of Electronic Health Records (EHR) in Burn Management: Enhanced tracking of wound progression and integration with emergency services.

-

Public-Private Partnerships (PPP) for Burn Facility Expansion: Collaboration between governments, NGOs, and private players is improving access to burn care.

-

Improved Training and Accreditation Standards: Programs such as those endorsed by the American Burn Association are enhancing care quality across centers.

-

Growing Emphasis on Pain Management Protocols: New medications and techniques, including regional nerve blocks and virtual reality distraction, are being adopted.

-

Trauma-Informed Psychological Care: Long-term psychological support and PTSD management are being integrated into standard burn rehabilitation.

U.S. Burn Care Centers Market Report Scope

| Report Attribute |

Details |

| Market Size in 2024 |

USD 8.44 Billion |

| Market Size by 2033 |

USD 11.67 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 3.67% |

| Base Year |

2023 |

| Forecast Period |

2024 to 2033 |

| Segments Covered |

Facility type, procedure type, burn severity, service type, region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled |

Dignity Health (Saint Francis Memorial Hospital Bothin Burn Center); LAC+USC Medical Burn Center; Weill Cornell Medicine (Weill Cornell Medicine William Randolph Hearst Burn Center); Temple University Health System, Inc. (Temple University Hospital Adult Burn Center); Parkland Health; MedStar Health (MedStar Washington Hospital Center); RWJBarnabas Health (St. Barnabas Burn Center); UMC Lions Burn Center; The University of Chicago Medical Center (University of Chicago Burn Center); The Ohio State University Wexner Medical Center; Jackson Health System (University of Miami Jackson Memorial Hospital Burn Center); Brigham and Women’s Hospital |

Market Driver: Increasing Incidence of Burn Injuries and Demand for Specialized Trauma Care

A significant driver for the U.S. burn care centers market is the persistent occurrence of burn-related trauma and the growing recognition of the need for specialized care. Burn injuries are among the most painful and life-threatening forms of trauma, requiring immediate attention and prolonged management. From residential fires and industrial hazards to vehicular accidents and electrical burns, the incidence of burn injuries continues to demand specialized medical intervention.

In particular, urban centers and regions with dense industrial zones report higher cases of chemical and electrical burns, which require comprehensive care protocols beyond general wound management. The U.S. fire departments respond to over 1.3 million fires annually, and despite better safety protocols, the number of injuries requiring hospitalization remains considerable.

Burn care centers not only provide surgical interventions such as skin grafts and debridement but also serve as hubs for infection control, psychological recovery, and reintegration. The long duration of care and the multidisciplinary nature of treatment makes specialized centers the gold standard for burn trauma, fueling their growth and resource expansion.

Market Restraint: High Operational and Infrastructure Costs

A major constraint on the growth of burn care centers in the U.S. is the high capital investment required to establish and maintain specialized facilities. Burn care requires unique infrastructure, including isolation units, hydrotherapy equipment, sterile surgical suites, and dedicated staff trained in both acute trauma and long-term rehabilitation. This often results in a higher per-patient cost compared to general care units.

Additionally, maintaining readiness for low-volume but high-acuity cases is a financial burden for many regional hospitals. Staffing burn centers with highly trained personnel surgeons, anesthesiologists, nurses, and rehabilitation specialists further adds to the expense. As a result, many hospitals either operate without full-fledged burn units or refer complex cases to larger tertiary centers, resulting in capacity and access limitations.

Reimbursement policies for long-term wound care and inpatient services can also be inconsistent, especially when it comes to integrating psychological support and post-discharge rehabilitation. This financial complexity can deter smaller institutions from investing in dedicated burn care facilities, despite growing demand.

Market Opportunity: Technological Advancements in Skin Regeneration and Grafting

A major opportunity in the U.S. burn care centers market lies in the integration of cutting-edge technologies in skin regeneration and wound healing. Recent advances in bioengineered skin substitutes, 3D bioprinting, and stem cell-based therapies are transforming the way partial and full-thickness burns are treated. These innovations are not only improving aesthetic and functional recovery but are also reducing the duration of hospital stays and the need for repeat surgeries.

Companies are developing artificial skin grafts using collagen scaffolds and autologous cells to accelerate healing and minimize donor site morbidity. Meanwhile, hydrogel-based dressings and nanofiber matrices embedded with antimicrobials are helping control infection and promote faster re-epithelialization. Additionally, research on gene therapy for burn-induced scarring and pigmentation disorders is gaining traction.

By adopting these technologies, burn care centers can differentiate their service offerings, improve clinical outcomes, and reduce long-term care costs. The availability of government grants and support from academic medical centers is further encouraging the clinical validation and adoption of these advanced techniques.

U.S. Burn Care Centers Market By Service Type Insights

Inpatient services dominate the service landscape, given the intensity of care required for moderate to severe burn injuries. This includes prolonged hospital stays, continuous wound care, surgical interventions, infection control, and nutritional management. Such patients often require multi-week or multi-month hospital admissions, justifying investment in large-scale inpatient facilities.

Outpatient services are expanding rapidly, particularly for wound dressing, minor debridement, post-operative follow-ups, and scar management. The shift toward outpatient care is reducing healthcare costs and increasing patient comfort, especially when supported by telemedicine for remote consultations and dressing guidance.

U.S. Burn Care Centers Market By Facility Type Insights

In-hospital burn care centers dominate the U.S. market, leveraging existing hospital infrastructure and trauma response capabilities. These centers benefit from integrated access to emergency departments, surgical units, ICUs, and diagnostic imaging, allowing for immediate and comprehensive care. The multidisciplinary care model enables acute management, surgical procedures, and rehabilitation in a seamless environment, enhancing both survival rates and long-term outcomes.

Standalone burn care centers are the fastest-growing segment, particularly in metropolitan areas where outpatient care for minor burns, follow-up procedures, and physical therapy can be administered without full hospital admission. These facilities are more cost-effective, accessible, and often equipped with advanced wound care technologies. The rise in cosmetic procedures and elective treatments for burn scarring is also contributing to their expansion.

U.S. Burn Care Centers Market By Procedure Type Insights

Wound management dominates the procedural segment, as it represents the most frequent and critical aspect of burn treatment across all severity levels. This includes debridement, infection control, dressing changes, and wound monitoring using imaging and software. Effective wound management is essential for preventing complications like sepsis and scarring and forms the foundation of acute and follow-up care.

Skin graft procedures are growing rapidly, supported by advancements in synthetic grafts, autologous transplantation, and donor site management. Skin grafting is especially vital for patients with full-thickness burns and has seen innovation through spray-on skin systems and enzymatic debridement. As technology reduces recovery time and improves cosmetic results, more centers are equipped to offer these specialized procedures.

U.S. Burn Care Centers Market By Burn Severity Insights

Partial thickness burns account for the majority of treatment volume, as they include second-degree burns that damage the dermis but preserve skin appendages. These burns are common in residential and occupational settings and require specialized wound care, pain management, and sometimes minor grafting.

Full thickness burns, while less frequent, drive the highest resource utilization, involving complex surgeries, longer ICU stays, and multidisciplinary rehabilitation. Burn care centers that can manage full-thickness cases are recognized as regional centers of excellence and often serve as training hubs for advanced trauma care.

Country-Level Analysis

The United States maintains one of the most advanced burn care infrastructures globally, with over 120 verified burn centers accredited by the American Burn Association (ABA) and the American College of Surgeons. These centers are primarily located in urban regions and are supported by trauma systems that ensure rapid transfer and specialized care for burn patients.

Funding from federal and state trauma care programs, as well as nonprofit foundations, plays a significant role in maintaining burn care readiness across the country. Initiatives such as the U.S. Army Institute of Surgical Research and the National Institute on Disability, Independent Living, and Rehabilitation Research (NIDILRR) have also contributed to research and training in burn care.

However, rural and underserved areas often lack access to full-scale burn centers, prompting the development of mobile burn units and tele-burn consultations to extend care. As the healthcare system increasingly emphasizes preparedness, post-disaster response, and value-based care, burn care centers are expected to receive greater attention and funding.

U.S. Burn Care Centers Market Top Key Companies:

- Brigham and Women’s Hospital

- LAC+USC Medical Burn Center

- MedStar Health (MedStar Washington Hospital Center)

- The Ohio State University Wexner Medical Center

- Parkland Health

- Dignity Health (Saint Francis Memorial Hospital Bothin Burn Center)

- RWJBarnabas Health (St. Barnabas Burn Center))

- Temple University Health System, Inc. (Temple University Hospital Adult Burn Center)

- UMC Lions Burn Center

- The University of Chicago Medical Center (University of Chicago Burn Center)

- Jackson Health System (University of Miami Jackson Memorial Hospital Burn Center)

- Weill Cornell Medicine (Weill Cornell Medicine William Randolph Hearst Burn Center)

Recent Developments

-

March 2025: The Shriners Children's Boston Burn Center announced the expansion of its pediatric burn unit, adding a new ICU wing with advanced wound monitoring systems and family accommodations.

-

February 2025: University of Texas Medical Branch (UTMB) upgraded its burn trauma simulation center to improve training for surgeons and emergency responders in managing large-scale burn disasters.

-

January 2025: Healogics, a major wound care provider, launched a partnership with regional burn centers in California to integrate outpatient burn wound healing protocols into their hyperbaric therapy services.

-

December 2024: Burn and Reconstructive Centers of America (BRCA) completed a nationwide standardization of its electronic health records system to improve outcomes tracking and interoperability across 20+ facilities.

-

November 2024: The American Burn Association published new clinical guidelines on integrating regenerative therapies and psychological screening in standard burn treatment protocols.

U.S. Burn Care Centers Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. Burn Care Centers market.

By Facility Type

By Procedure Type

- Wound Debridement

- Skin Graft

- Wound Management

- Respiratory Intubation & Ventilation

- Blood Transfusion

- Pain Management

- Infection Control

- Rehabilitation

By Burn Severity

- Minor Burns

- Partial Thickness Burns

- Full Thickness Burns

By Service Type

- Inpatient

- Outpatient

- Rehabilitation

By Regional

- Northeast

- Southeast

- Southwest

- Midwest

- West