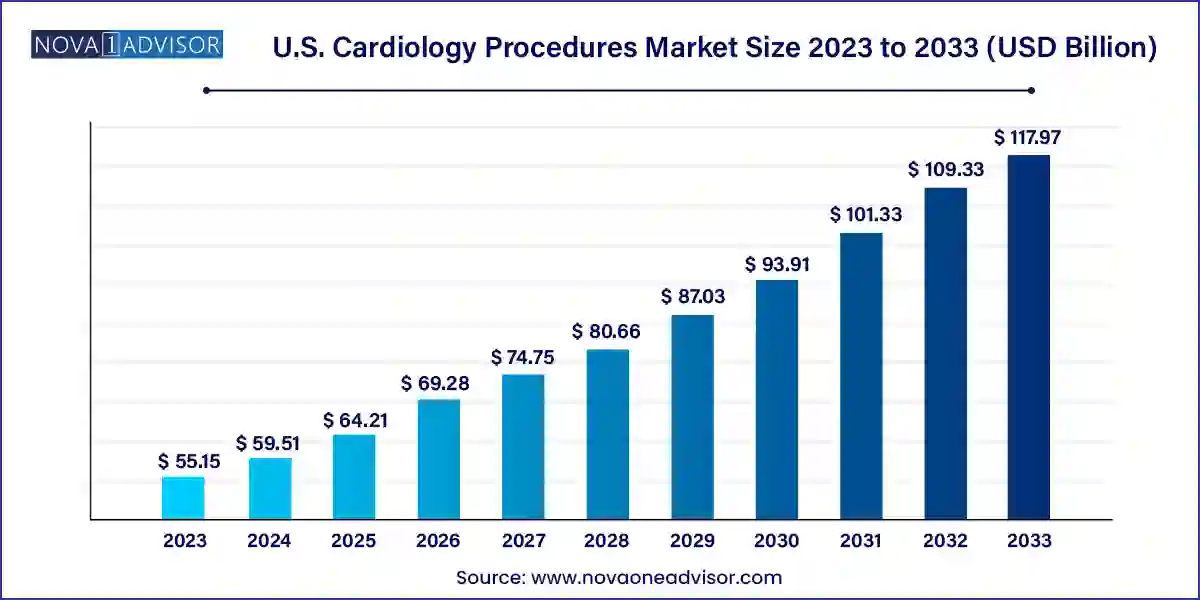

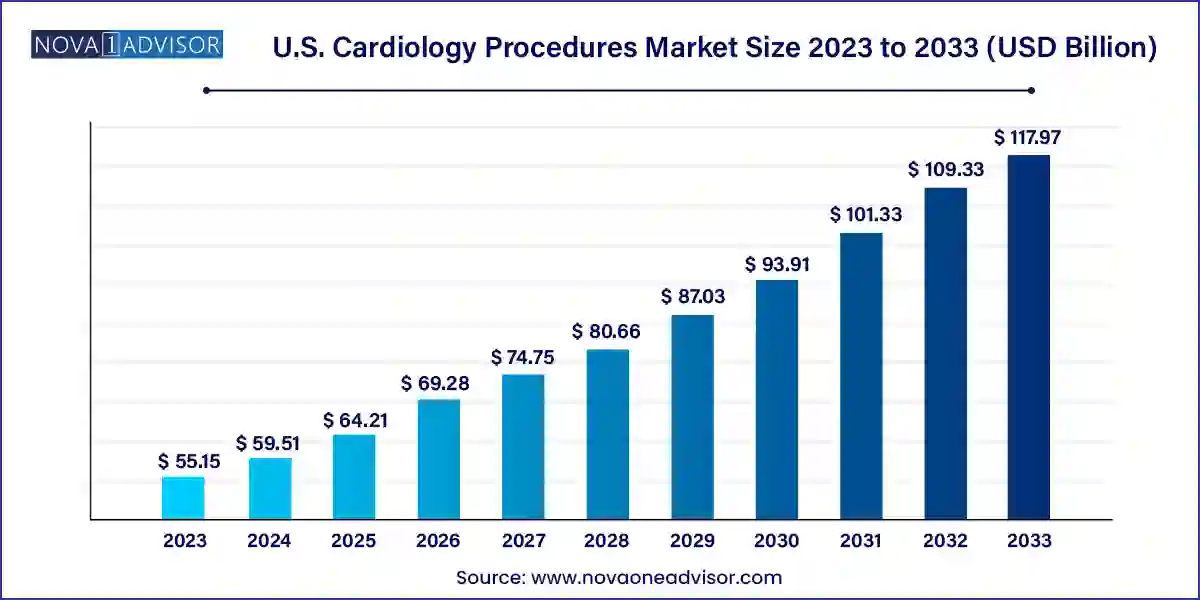

U.S. Cardiology Procedures Market Size and Growth

The U.S. cardiology procedures market size was exhibited at USD 55.15 billion in 2023 and is projected to hit around USD 117.97 billion by 2033, growing at a CAGR of 7.9% during the forecast period 2024 to 2033.

U.S. Cardiology Procedures Market Key Takeaways:

- Based on procedure, the interventional procedures segment dominated the market and accounted for the largest revenue share of 53.74% in 2023.

- This segment is anticipated to grow at the fastest CAGR of 8.1% over the forecast period.

Market Overview

The U.S. cardiology procedures market represents one of the most dynamic, high-value sectors of the nation’s healthcare system. Cardiology procedures encompass a broad range of interventions and diagnostic modalities aimed at treating and managing cardiovascular diseases (CVDs) the leading cause of death in the United States. The market includes both minimally invasive and complex open-heart procedures designed to address a multitude of heart conditions such as coronary artery disease (CAD), arrhythmias, valvular disorders, and congenital defects.

An aging population, increasing incidence of lifestyle-related disorders (e.g., obesity, diabetes, hypertension), and improved access to advanced diagnostics have propelled the demand for cardiology interventions. The U.S. healthcare ecosystem, characterized by state-of-the-art facilities, skilled interventional cardiologists, and a well-established reimbursement framework, creates a fertile ground for growth in procedural volumes and innovations.

Advances in medical technology from drug-eluting stents and percutaneous valve repair systems to AI-driven electrophysiology mapping have redefined the scope and safety of cardiac procedures. Moreover, the shift from open-heart surgery to catheter-based and image-guided interventions has significantly reduced recovery time and postoperative complications. As a result, both patients and providers increasingly prefer minimally invasive alternatives for coronary, structural, and electrophysiological treatments.

The U.S. market also benefits from a robust clinical trial pipeline, with new technologies and techniques frequently emerging from academic institutions, biotech startups, and medtech giants. The resulting interplay of patient demand, provider capabilities, and technological advancements creates a competitive and innovation-driven environment for cardiology procedures.

Major Trends in the Market

-

Shift Toward Minimally Invasive Procedures: Increasing adoption of catheter-based interventions like transcatheter aortic valve replacement (TAVR) and percutaneous coronary intervention (PCI).

-

Artificial Intelligence in Cardiology: AI-powered diagnostic and procedural planning tools are gaining traction, especially in electrophysiology and rhythm management.

-

Outpatient Cardiac Care Expansion: Growth in ambulatory surgical centers offering interventional cardiology services to reduce hospital costs and improve patient turnaround.

-

Personalized and Precision Cardiology: Use of genomic and biomarker data to tailor cardiac interventions and drug therapy.

-

Rise in Structural Heart Interventions: Rapid adoption of procedures like left atrial appendage closure and mitral valve repair using minimally invasive devices.

-

Growth of Robotic-Assisted Cardiac Surgery: Enhanced procedural accuracy and improved surgical outcomes are boosting robotic adoption in cardiac catheterization labs.

-

Remote Monitoring and Telecardiology: Integration of implantable devices with cloud-based monitoring systems to track patient health in real-time post-intervention.

-

Advanced Imaging for Procedure Guidance: Fusion imaging and real-time 3D echocardiography are revolutionizing precision during structural and electrophysiological procedures.

Report Scope of U.S. Cardiology Procedures Market

| Report Coverage |

Details |

| Market Size in 2024 |

USD 59.51 Billion |

| Market Size by 2033 |

USD 117.97 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 7.9% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Procedures |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

U.S. |

| Key Companies Profiled |

Cleveland Clinic; Mayo Clinic; Johns Hopkins Hospital; Massachusetts General Hospital; Stanford Health Care; Cedars-Sinai Medical Center; and Northwestern Memorial Hospital. |

Market Driver: Rising Prevalence of Cardiovascular Diseases in the U.S.

The most significant driver of the U.S. cardiology procedures market is the escalating burden of cardiovascular diseases, which continues to rise across all demographics. According to the American Heart Association (AHA), approximately 121.5 million adults in the U.S. are living with some form of cardiovascular disease. Factors such as sedentary lifestyles, poor dietary habits, increased stress levels, and the aging baby boomer population contribute to this trend.

As cardiovascular conditions become more prevalent, the demand for timely and effective diagnosis and treatment rises correspondingly. Interventional procedures like angioplasty, stenting, and catheter ablations offer life-saving results with fewer complications and shorter hospital stays compared to traditional surgery. With an increasing number of patients presenting with complex comorbidities such as diabetes and renal failure, the need for nuanced and multimodal interventions has become even more pronounced. This scenario fuels the growth of both established procedures and emerging cardiac technologies.

Market Restraint: High Procedural and Equipment Costs

Despite the clinical importance of cardiology procedures, high costs remain a limiting factor in broader adoption, particularly for advanced structural and electrophysiological interventions. Many of these procedures rely on specialized devices such as implantable cardioverter defibrillators (ICDs), catheter ablation tools, or robotic surgical systems—all of which entail significant capital investment and recurring costs.

Hospitals must also employ highly skilled personnel and maintain sophisticated imaging systems to perform these procedures safely, further elevating operational costs. Although Medicare and private insurers cover many cardiac interventions, reimbursement is often complex and subject to stringent guidelines. Delayed approval for new devices or limited coverage for newer technologies can impede growth, particularly in small-to-mid-sized hospitals and outpatient centers. These financial pressures can restrict access and delay patient referrals, especially in underinsured or rural populations.

Market Opportunity: Technological Integration in Outpatient Settings

One of the most promising growth opportunities lies in expanding interventional cardiology procedures into outpatient and ambulatory settings. With increasing emphasis on cost reduction and value-based care, the healthcare industry is witnessing a gradual shift of complex procedures from inpatient hospitals to office-based labs (OBLs) and ambulatory surgical centers (ASCs). These settings allow for faster turnover, lower costs, and enhanced patient comfort.

Technological advancements have enabled procedures like percutaneous coronary interventions and electrophysiology studies to be conducted safely outside of traditional hospital environments. Portable imaging systems, integrated hemodynamic monitoring, and compact robotic cath lab units now allow clinicians to perform complex cardiac procedures with the same level of precision as hospital settings. This trend is supported by favorable regulatory and reimbursement adjustments, particularly for low-risk patients. As ASCs and OBLs gain popularity, device manufacturers and service providers have an opportunity to tailor solutions to these rapidly expanding care models.

U.S. Cardiology Procedures Market By Procedures Insights

Interventional procedures, including coronary angioplasty, stent placement, and balloon dilation, dominate the U.S. cardiology procedures market due to their widespread use in managing coronary artery disease (CAD). These procedures have become standard care for patients with angina, acute coronary syndrome, and heart attacks. The advancement of drug-eluting stents, radial access techniques, and same-day discharge protocols has further cemented their role. High patient throughput, broad physician expertise, and proven outcomes make interventional cardiology the foundational pillar of procedural cardiac care in the U.S.

At the same time, structural heart procedures are emerging as the fastest-growing segment. Interventions such as transcatheter aortic valve replacement (TAVR), mitral valve repair, and left atrial appendage closure are experiencing exponential growth, driven by aging demographics and the preference for less invasive alternatives to open-heart surgery. For example, TAVR was initially reserved for inoperable patients but is now approved for low-risk populations. Clinical trials, such as PARTNER 3 and COAPT, have accelerated FDA approvals and expanded indications. As a result, hospitals across the U.S. are investing in structural heart programs and hybrid cath lab infrastructures, positioning this segment for sustained growth.

Procedures: Heart Rhythm Management Dominated in Specialty Volume

Heart rhythm management procedures, including pacemaker and defibrillator implantation and cardiac resynchronization therapy, represent another critical segment. These procedures are vital for managing bradyarrhythmias, heart failure, and sudden cardiac death risk. Device-based therapies are well-established and widely reimbursed, leading to stable procedural volumes. Innovations in leadless pacemakers and subcutaneous ICDs have improved safety and broadened adoption. Moreover, remote device monitoring has strengthened post-procedure care and reduced hospital readmissions.

Simultaneously, electrophysiology (EP) procedures are the fastest-growing niche, owing to their expanding role in treating atrial fibrillation (AFib), the most common sustained arrhythmia in the U.S. Advanced ablation techniques using cryoablation or contact force-sensing catheters have improved procedural success and reduced recurrence rates. With the increasing availability of 3D mapping systems, real-time imaging, and AI-based signal analysis, EP labs are becoming more efficient and accurate. As AFib becomes more prevalent in aging populations, and as evidence supports early rhythm control, EP procedures are forecasted to rise steeply.

Country-Level Analysis

In the United States, the cardiology procedures market thrives on the back of a sophisticated healthcare infrastructure, a highly skilled medical workforce, and a culture of rapid technology adoption. Major medical centers, particularly in states like California, Texas, New York, and Florida, serve as national hubs for advanced cardiac procedures, research, and training.

The federal government, through agencies like CMS and NIH, plays a pivotal role in promoting cardiovascular health and innovation. Reimbursement frameworks, including bundled payments for cardiac care, have incentivized efficient procedural models. Additionally, the U.S. boasts one of the highest volumes of clinical trials for cardiovascular devices globally, with regulatory pathways encouraging innovation through initiatives like the FDA’s Breakthrough Devices Program.

At the provider level, both academic medical centers and community hospitals are expanding cath lab capacity to meet the growing demand for interventional and structural procedures. The integration of telecardiology, AI diagnostics, and mobile health monitoring also supports procedure planning, follow-up, and chronic disease management, positioning the U.S. as a leader in holistic, tech-enabled cardiac care.

U.S. Cardiology Procedures Market By Recent Developments

-

March 2025 – Edwards Lifesciences announced positive 2-year outcomes from its EARLY TAVR trial, supporting the safety of TAVR in low-risk asymptomatic patients and potentially expanding the market significantly.

-

January 2025 – Abbott Laboratories launched its new Navitor TAVR system in the U.S., with enhanced sealing and delivery mechanisms aimed at reducing paravalvular leak in patients with aortic stenosis.

-

November 2024 – Boston Scientific received FDA approval for its FARAPULSE Pulsed Field Ablation (PFA) system for atrial fibrillation, following promising safety and efficacy results in the ADVENT trial.

-

August 2024 – Medtronic completed its acquisition of CathWorks, a company specializing in AI-based fractional flow reserve (FFR) assessments, enhancing Medtronic’s presence in non-invasive functional imaging for coronary diagnostics.

-

May 2024 – Siemens Healthineers unveiled its ARTIS icono ceiling-mounted angiography system optimized for cardiovascular and electrophysiology procedures, with enhanced imaging flexibility and reduced radiation exposure.

Some of the prominent players in the U.S. cardiology procedures market include:

- Cleveland Clinic

- Mayo Clinic

- Johns Hopkins Hospital

- Massachusetts General Hospital

- Stanford Health Care

- Cedars-Sinai Medical Center

- Northwestern Memorial Hospital

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. cardiology procedures market

Procedures

- Interventional Procedures

- Peripheral Vascular Procedures

- Heart Rhythm Management Procedures

- Structural Heart Procedures

- Electrophysiology Procedures

- Others