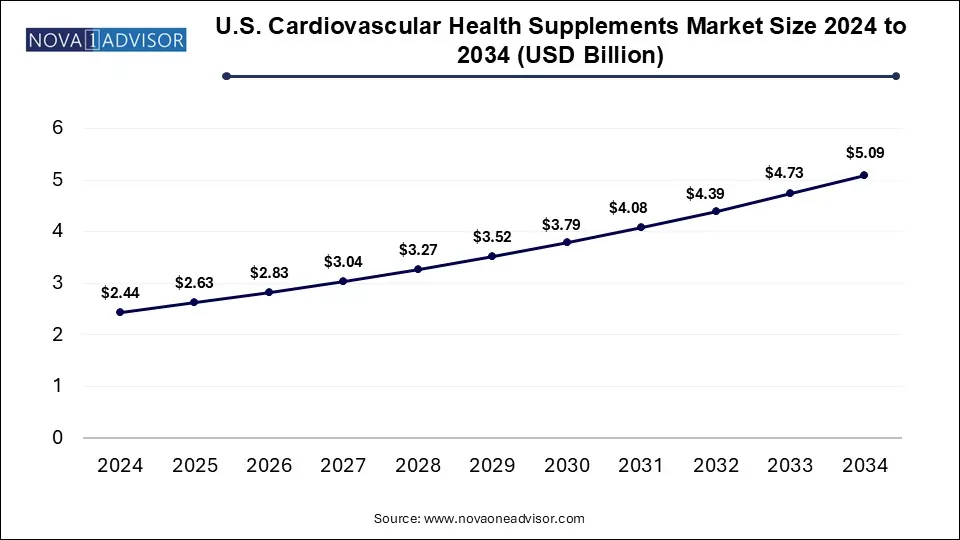

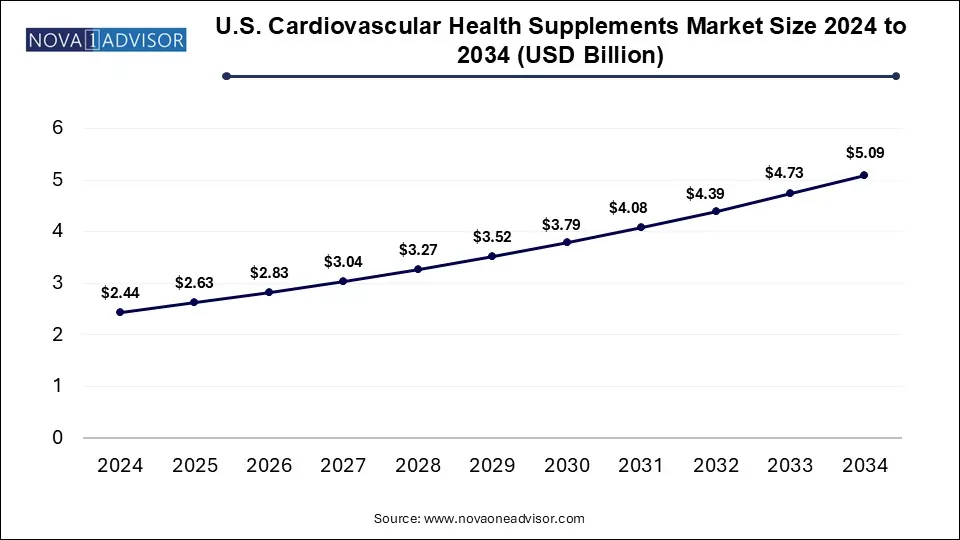

U.S. Cardiovascular Health Supplements Market Size and Growth

The U.S. cardiovascular health supplements market size was exhibited at USD 2.44 billion in 2024 and is projected to hit around USD 5.09 billion by 2034, growing at a CAGR of 7.63% during the forecast period 2025 to 2034.

Key Takeaways:

- The omega fatty acids held the largest revenue share of 27.36% in 2024

- Natural supplements held the largest revenue share in 2024

- The softgels held the largest revenue share of 36.91% in 2024.

- The offline segment held the largest market share in 2024.

Market Overview

The U.S. cardiovascular health supplements market is witnessing consistent growth, driven by increasing awareness of heart health, rising incidences of cardiovascular diseases (CVDs), and the growing consumer shift toward preventive healthcare. Cardiovascular diseases are the leading cause of death in the U.S., accounting for nearly 1 in every 5 deaths according to the CDC. Factors like sedentary lifestyles, high cholesterol, poor dietary habits, and chronic stress have contributed to this growing public health concern. Consequently, consumers are actively seeking preventive solutions among which heart health supplements have emerged as a non-invasive and easily accessible option.

These supplements range from omega-3 fatty acids and Coenzyme Q10 (CoQ10) to vitamins, minerals, and plant-based antioxidants that claim to reduce blood pressure, improve lipid profiles, support arterial function, and reduce inflammation. The growth of this market is being further amplified by demographic shifts such as an aging population and the expanding health-conscious millennial consumer base. Cardiologists, dietitians, and even general practitioners are increasingly recommending over-the-counter supplements to complement medical treatments, while lifestyle-focused brands are emphasizing heart-healthy formulas in their marketing.

In addition to clinical efficacy, product innovation, branding, and regulatory compliance are playing vital roles in shaping consumer behavior. The Food and Drug Administration (FDA) and Federal Trade Commission (FTC) guidelines for labeling and health claims have prompted brands to substantiate their cardiovascular claims, ensuring a more credible and trustworthy product landscape. The shift toward clean-label, plant-based, and sustainable ingredient sourcing is also influencing purchasing decisions, particularly among urban and educated populations.

Major Trends in the Market

-

Growing Demand for Omega-3 and Plant-Based Alternatives: Traditional fish oil supplements are being supplemented or replaced by algae-derived omega-3 products for vegan consumers.

-

Rise of Personalized Heart Health Formulations: Companies are offering DNA- or biomarker-based supplement plans tailored to individual cardiovascular risk profiles.

-

Increased Preference for Natural and Clean-Label Products: Consumers are gravitating toward non-GMO, gluten-free, organic cardiovascular supplements.

-

Integration with Wearable Tech and Health Apps: Some supplement brands now link usage data with health monitoring apps and smartwatches.

-

Proliferation of Subscription-Based E-Commerce Models: Online platforms are offering curated heart-health supplement kits delivered monthly.

-

Pharmaceutical-Supplement Hybrids (Nutra-pharma): Blurring of lines between supplements and prescription drugs, particularly in formulations containing clinically studied ingredients like CoQ10.

-

Increased Clinical Trials and Evidence-Based Marketing: Brands are funding studies to support efficacy claims, building physician and consumer trust.

Report Scope of U.S. Cardiovascular Health Supplements Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 2.63 Billion |

| Market Size by 2034 |

USD 5.09 Billion |

| Growth Rate From 2025 to 2034 |

CAGR of 7.63% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

Ingredient, type, Form, Distribution Channel |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Key Companies Profiled |

NOW Foods; Bright Lifecare Private Ltd (Truebasics.com); Natural Organics, Inc.; DaVinci Laboratories of Vermont; Nordic Naturals; Thorne.; Nestlé Health Science (Pure Encapsulations, LLC.); Amway Corp.; InVite Health; GNC Holdings, LLC |

Market Driver: Rising Prevalence of Cardiovascular Diseases and Preventive Health Focus

One of the primary drivers of the U.S. cardiovascular health supplements market is the sharp rise in CVD incidence across all age groups. According to the American Heart Association, nearly half of all U.S. adults have some form of cardiovascular disease. Hypertension, high cholesterol, and coronary artery disease are increasingly being diagnosed not just in older adults, but also in younger, sedentary populations. As consumers become more proactive about their health, the demand for supplements that help manage blood pressure, improve heart rhythm, and reduce arterial plaque is rising sharply.

The aging baby boomer population, many of whom are entering their 60s and 70s, is especially fueling demand for daily-use cardiovascular supplements. Public health campaigns, growing awareness of lifestyle-related risk factors, and the rising costs of long-term pharmaceutical use have pushed consumers toward preventative care approaches. Brands that offer natural alternatives with fewer side effects compared to prescription drugs have gained considerable traction in the last five years.

Despite its growth, the cardiovascular supplement market in the U.S. faces the persistent challenge of regulatory ambiguity and consumer skepticism. Unlike pharmaceuticals, dietary supplements are not subject to pre-market FDA approval. While this allows quicker time-to-market, it also leads to variability in product quality, efficacy, and safety. Several brands have been reprimanded for misleading health claims or inaccurate labeling, which can erode consumer trust across the entire category.

Additionally, misinformation propagated via online channels can create confusion. Some consumers may believe supplements are substitutes for medical therapy, which can lead to under-treatment of serious cardiovascular conditions. This misuse, combined with insufficient regulatory enforcement, contributes to hesitancy among both consumers and healthcare providers, limiting broader adoption, especially in clinical settings.

Market Opportunity: Integration with Telehealth and Preventive Diagnostics

One of the most promising opportunities in the U.S. cardiovascular health supplements market lies in integration with digital health platforms. As telehealth and remote diagnostics become more common, especially post-pandemic, supplement companies have a chance to partner with digital health providers to offer bundled preventive care packages. These may include virtual heart health assessments, lifestyle coaching, and personalized supplement recommendations based on biomarkers or genetic testing.

For instance, a startup offering at-home blood pressure and cholesterol testing could integrate CoQ10 or omega-3 supplement subscriptions into its offerings. Likewise, wearable tech companies can alert users about rising heart rates or anomalies and suggest heart-health supplements tailored to their profiles. This synergistic ecosystem can provide scientifically guided, consumer-friendly solutions that support both preventive care and ongoing cardiovascular management.

Segmental Analysis

Ingredient Outlook

Omega fatty acids dominated the ingredient segment, largely due to the vast clinical evidence supporting their role in reducing triglycerides, improving endothelial function, and lowering blood pressure. Omega-3 supplements—traditionally sourced from fish oil—are among the most recommended non-pharmaceutical interventions for cardiovascular health. Increasingly, vegan and algae-based alternatives are being introduced to cater to plant-based consumers, expanding the reach of this segment. Well-established consumer trust and frequent endorsements by cardiologists further contribute to omega fatty acids’ leadership in the category.

Coenzyme Q10 (CoQ10) is emerging as the fastest-growing ingredient, gaining popularity due to its role in improving energy metabolism in heart cells and reducing statin-related muscle fatigue. CoQ10 supplements have seen a surge among older adults and those on cholesterol-lowering medications. Recent research demonstrating CoQ10’s antioxidant properties and its ability to support heart rhythm has led to its inclusion in both standalone and multi-ingredient formulations. Its association with energy, endurance, and heart muscle recovery also makes it attractive to fitness-conscious consumers.

Type Outlook

Natural supplements dominated the market, as U.S. consumers show a strong preference for plant-based, clean-label products perceived as safer and more environmentally friendly. Supplements made from turmeric, garlic, hawthorn berry, and flaxseed are increasingly marketed as natural solutions for heart health, often bundled with lifestyle advice for comprehensive prevention. This trend aligns with a broader cultural movement toward “food as medicine,” in which supplements are seen as an extension of dietary choices.

Synthetic supplements are the fastest-growing segment, particularly in formulations containing bioengineered or lab-extracted compounds like standardized CoQ10 or niacin. These supplements offer higher purity, controlled dosing, and more predictable clinical outcomes. Pharmaceutical companies entering the supplement space are increasingly focused on synthetics, developing hybrid products with strong clinical validation and targeting cardiologists for distribution.

Tablets dominated the market by form, primarily due to their stability, affordability, and ease of packaging and distribution. Consumers are familiar with this format, and manufacturers can easily include multiple active ingredients in a single daily-use tablet. Tablets are also the preferred choice in multivitamin-style heart health formulations, allowing combinations like omega-3s with CoQ10 or magnesium with potassium for holistic cardiovascular support.

Softgels are the fastest-growing form, particularly for fat-soluble ingredients like omega-3s and vitamin D. Softgels offer better bioavailability and are easier to swallow, especially for elderly users. They are ideal for high-dose single-ingredient supplements and have gained traction among premium brands that emphasize absorption and user experience. Moreover, softgel technology has improved to allow enteric coatings and slow-release features, enhancing their therapeutic value.

Distribution Channel Outlook

Offline distribution channels currently dominate, led by pharmacies, grocery stores, health stores, and specialty supplement outlets like GNC and Vitamin Shoppe. In-store channels offer instant purchase access, personalized consultation, and loyalty programs. Major pharmacy chains such as CVS and Walgreens often feature dedicated cardiovascular supplement sections, providing convenience and accessibility to a wide consumer base.

Online distribution is the fastest-growing channel, accelerated by pandemic-era purchasing habits and the rise of D2C wellness brands. Online platforms allow for detailed product comparisons, customer reviews, and subscription options. Leading players like Amazon, iHerb, and brand-owned websites are increasingly adopting AI-based recommendation engines to personalize product offerings based on consumer health profiles. Additionally, influencer marketing and social media have turned online platforms into discovery engines for niche and emerging supplement brands.

Country-Level Analysis: United States

The U.S. stands as the most lucrative market for cardiovascular health supplements globally, backed by a large health-conscious population, advanced retail infrastructure, and widespread access to nutritional education. Urban centers such as New York, Los Angeles, Chicago, and Houston drive significant market demand, with an increasing number of consumers integrating heart health supplements into their daily routines. The high prevalence of chronic diseases and a robust healthcare system that supports preventive strategies have further reinforced supplement adoption.

Federal initiatives like the Dietary Guidelines for Americans and educational campaigns by the American Heart Association promote lifestyle and nutritional modifications for heart health. Moreover, access to third-party lab testing, FDA-registered facilities, and compliance with Good Manufacturing Practices (GMP) give consumers confidence in product safety and quality. Additionally, tech-savvy younger generations are leveraging digital health platforms and fitness tracking devices, often pairing data insights with heart-health supplementation, especially in urban and suburban markets.

Some of The Prominent Players in The U.S. Cardiovascular Health Supplements Market Include:

- NOW Foods

- Bright Lifecare Private Ltd (Truebasics.com)

- Natural Organics, Inc.

- DaVinci Laboratories of Vermont

- Nordic Naturals

- Thorne.

- Nestlé Health Science (Pure Encapsulations, LLC.)

- Amway Corp.

- InVite Health

- GNC Holdings, LLC

Recent Developments

-

March 2025 – Nature’s Bounty launched a new line of advanced CoQ10 + Vitamin D softgels aimed at consumers over 50, designed to support heart rhythm and bone health simultaneously.

-

January 2025 – MegaFood introduced a DNA-based supplement customization service in partnership with a genetic testing company, offering heart health packs tailored to individual biomarkers.

-

November 2024 – NOW Foods expanded its vegan omega-3 product line with an algae-derived DHA & EPA formulation, specifically targeting cardiovascular wellness.

-

August 2024 – GNC Holdings announced a collaboration with a telehealth startup to bundle cardiovascular screening with monthly supplement deliveries.

-

June 2024 – Life Extension published results from a clinical trial showing significant LDL cholesterol reduction using their plant sterol complex, prompting a surge in demand across online channels.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the Operating room equipment market

By Ingredient

- Vitamins & Minerals

- Herbs & Botanicals

- Omega Fatty Acids

- Coenzyme Q10 (CoQ10)

- Others

By Type

- Natural Supplements

- Synthetic Supplements

By Form

- Liquid

- Tablet

- Capsules

- Softgels

- Powder

- Others

By Distribution Channel