U.S. Clinical Oncology Next Generation Sequencing Market Size and Research

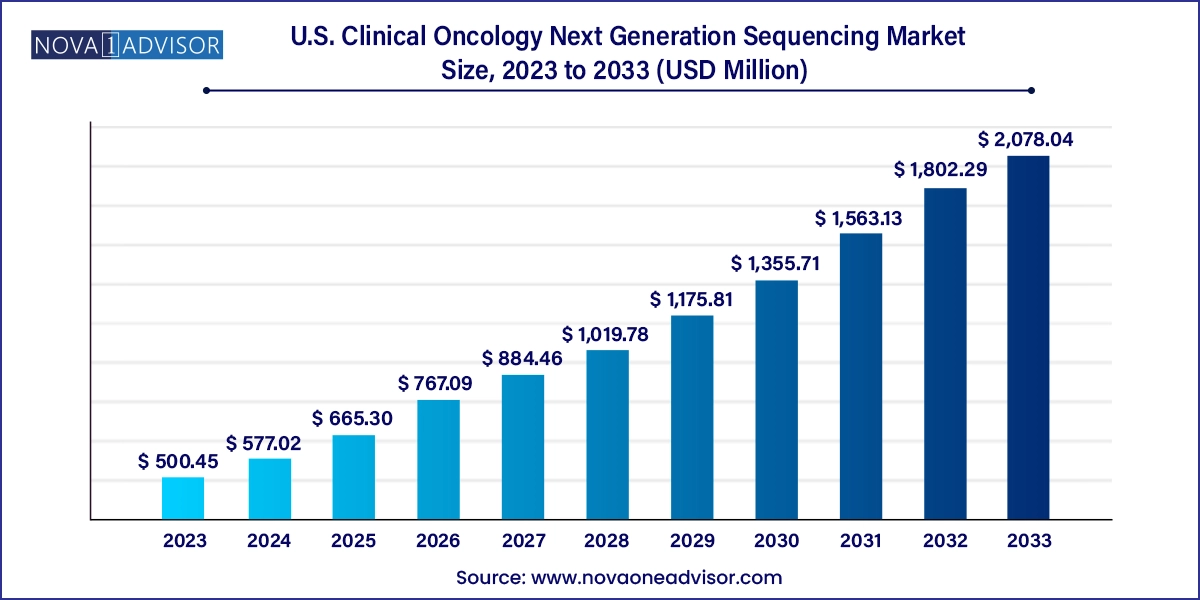

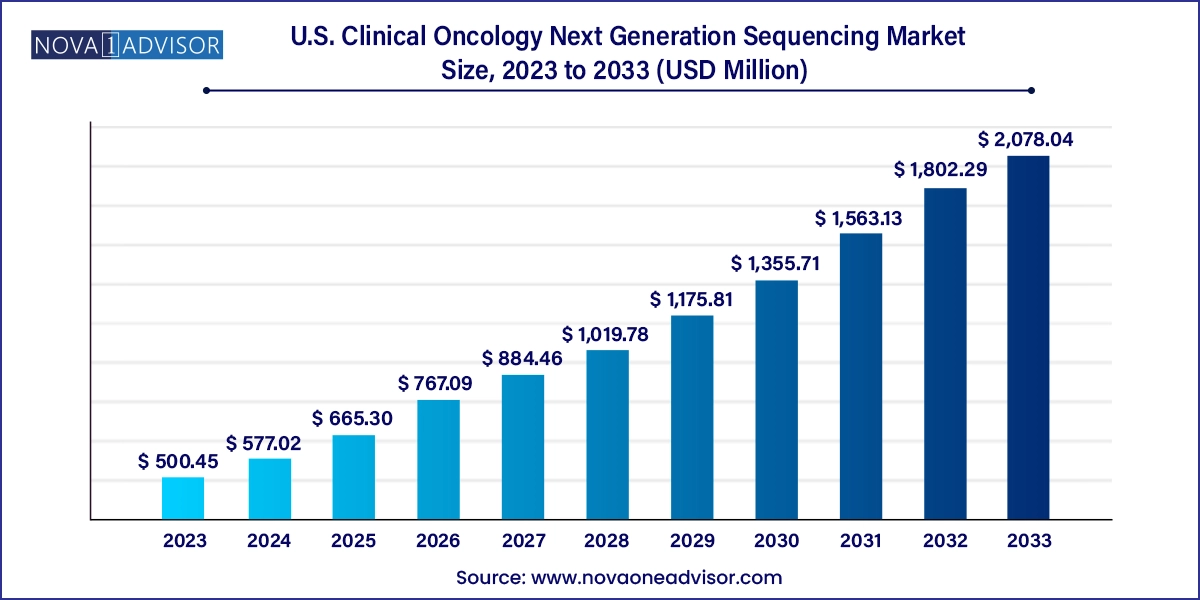

The U.S. clinical oncology next generation sequencing market size was exhibited at USD 500.45 million in 2023 and is projected to hit around USD 2,078.04 million by 2033, growing at a CAGR of 15.3% during the forecast period 2024 to 2033.

U.S. Clinical Oncology Next Generation Sequencing Market Key Takeaways:

- The targeted sequencing & resequencing segment accounted for the largest revenue share of 72.9% in 2023.

- The NGS sequencing held an enormous share of 55.6% in 2023 in the workflow segment, and it is anticipated to expand at the highest CAGR from 2024 to 2033.

- Screening accounted for an enormous revenue share of over 80.6% in 2023.

- The companion diagnostics segment is expected to register the highest CAGR of 20.1% over the forecast period.

- The laboratories segment held the largest market share, with a revenue share of over 65.4% in 2023.

- As an end-use, clinics are expected to witness the highest CAGR over the forecast period

Market Overview

The U.S. clinical oncology next-generation sequencing (NGS) market has emerged as a transformative force in the field of cancer diagnostics and precision medicine. With its ability to analyze multiple genes simultaneously and detect mutations, rearrangements, and other genomic variations, NGS is revolutionizing how oncologists approach cancer diagnosis, prognosis, and treatment planning. In an era where personalized medicine is becoming the standard of care, NGS provides deep molecular insights that inform targeted therapy decisions and improve patient outcomes.

The adoption of NGS in clinical oncology is supported by the increasing prevalence of cancer, particularly complex cancers like lung, breast, and colorectal, where molecular profiling is critical. Institutions across the U.S., including academic medical centers, community hospitals, and diagnostic laboratories, are integrating NGS panels into routine clinical workflows. The availability of targeted sequencing panels, whole exome, and whole genome sequencing tools has made testing more flexible, allowing clinicians to balance cost, turnaround time, and genomic breadth. Additionally, regulatory support for companion diagnostics and growing partnerships between diagnostics companies and pharmaceutical firms are expanding access to NGS-based cancer testing.

Major Trends in the Market

-

Rapid integration of targeted sequencing panels in routine oncology diagnostics

-

Expansion of companion diagnostics with FDA-approved targeted therapies

-

Increasing use of liquid biopsy for non-invasive tumor profiling

-

Development of AI-based tools for interpreting complex sequencing data

-

Growth of decentralized testing through partnerships with regional laboratories

-

Adoption of NGS for minimal residual disease (MRD) monitoring

-

Broader coverage of NGS tests by private insurers and Medicare

-

Use of NGS data for real-world evidence generation in oncology research

Report Scope of U.S. Clinical Oncology Next Generation Sequencing Market

| Report Coverage |

Details |

| Market Size in 2024 |

USD 577.02 Million |

| Market Size by 2033 |

USD 2,078.04 Million |

| Growth Rate From 2024 to 2033 |

CAGR of 15.3% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Technology, Workflow, Application, End-use |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Country scope |

U.S. |

| Key Companies Profiled |

Illumina, Inc.,Thermo Fisher Scientific, F. Hoffmann-La Roche Ltd., Agilent Technologies, Myriad Genetics, Beijing Genomics Institute (BGI), Perkin Elmer, Foundation Medicine, Pacific Bioscience, Oxford Nanopore Technologies Ltd.,Qiagen , Macrogen, Inc. |

Key Market Driver: Rising Demand for Precision Oncology and Targeted Therapies

A significant driver of the U.S. clinical oncology NGS market is the growing demand for precision oncology and targeted therapy selection. Unlike traditional treatment approaches, which often apply a one-size-fits-all model, precision oncology uses a patient’s genetic profile to match them with the most effective therapies. This model relies heavily on the detailed genetic information provided by NGS tests.

The FDA's approval of multiple targeted cancer therapies, each linked to a specific genetic mutation, has created a strong clinical imperative for genomic testing. Drugs such as osimertinib (for EGFR-mutated lung cancer) and larotrectinib (for NTRK fusion-positive cancers) are prescribed only after a confirmed genetic diagnosis. NGS enables comprehensive profiling to detect these and other actionable alterations from a single tissue or blood sample. As oncologists and payers recognize the value of personalized treatment, the use of NGS in routine cancer care continues to expand rapidly.

Key Market Restraint: High Cost and Reimbursement Complexity

Despite the clinical advantages of NGS, the high cost of testing and complex reimbursement landscape continue to limit widespread adoption. Depending on the test type and number of genes analyzed, clinical NGS panels can range from several hundred to several thousand dollars. This cost can be prohibitive for patients if not covered by insurance, especially in cases where testing is performed proactively rather than as a last resort.

Moreover, reimbursement policies vary by payer and cancer type. While Medicare has expanded coverage for certain FDA-approved companion diagnostics, private insurers often impose stringent medical necessity criteria or prefer single-gene testing over broader panels. These inconsistencies can delay testing, discourage provider adoption, and create uncertainty for labs offering NGS services. Regulatory clarity and harmonized payer policies are critical to ensuring equitable access to this powerful diagnostic tool.

Key Market Opportunity: Emergence of Liquid Biopsy and Non-Invasive Genomic Profiling

A major opportunity in the U.S. clinical oncology NGS market lies in the emergence of liquid biopsy technologies, which allow genomic profiling of tumors using blood or other bodily fluids. Liquid biopsies are particularly valuable for patients who cannot undergo invasive tissue biopsies, or when tumor tissue is insufficient for genomic analysis. By detecting circulating tumor DNA (ctDNA), liquid biopsies offer a non-invasive, repeatable, and faster method for tracking tumor evolution, treatment resistance, and recurrence.

Leading diagnostics companies are developing blood-based NGS assays for both tumor profiling and minimal residual disease (MRD) monitoring. These tests can detect actionable mutations and guide therapy decisions without requiring surgical tissue collection. As liquid biopsy platforms gain regulatory approval and clinical validation, they are expected to play a central role in cancer screening, monitoring, and therapeutic response evaluation—greatly expanding the clinical utility and adoption of NGS in oncology.

U.S. Clinical Oncology Next Generation Sequencing Market By Technology Insights

Targeted sequencing and resequencing dominate the U.S. clinical oncology NGS market, primarily due to their cost-effectiveness and clinical relevance. These panels focus on known cancer-related genes and mutations, providing actionable results with faster turnaround times. Oncologists widely use these panels for tumor profiling, therapy selection, and prognosis. Commercial offerings such as FoundationOne CDx and Oncomine panels have become standard tools in cancer diagnostics.

Whole genome sequencing (WGS) is the fastest-growing technology, driven by its ability to uncover rare mutations and structural variants not detectable by targeted panels. Although WGS is currently more resource-intensive and less frequently used in routine care, it holds immense potential in complex or rare cancer cases, research settings, and comprehensive molecular profiling. As sequencing costs decline and data interpretation tools improve, WGS adoption is expected to grow significantly in clinical oncology.

U.S. Clinical Oncology Next Generation Sequencing Market By Workflow Insights

NGS pre-sequencing currently holds the largest share of the workflow segment, encompassing sample collection, nucleic acid extraction, library preparation, and quality control. These steps are critical to the accuracy and reliability of NGS tests. Clinical labs are investing in automation and standardization of pre-analytical processes to minimize errors and ensure consistency across large test volumes.

Meanwhile, NGS data analysis is emerging as the most rapidly evolving segment, due to the complexity of interpreting massive genomic datasets. The integration of bioinformatics pipelines, variant annotation tools, and decision-support software is crucial for transforming raw sequence data into clinically actionable insights. Companies are increasingly incorporating AI and machine learning to streamline variant classification, prioritize mutations, and flag clinically significant findings, enhancing the utility of NGS in real-time oncology care.

U.S. Clinical Oncology Next Generation Sequencing Market By Application Insights

Companion diagnostics dominate the application segment, serving as the bridge between genomic testing and targeted therapy. These tests are essential for determining patient eligibility for specific drugs, as required by the FDA and many payers. The growing list of targeted therapies approved with associated companion diagnostics underscores the central role of NGS in treatment planning.

In contrast, screening for inherited and sporadic cancers is gaining momentum, especially in populations with family history or elevated risk factors. Genetic screening helps identify germline mutations such as BRCA1/2, Lynch syndrome, and others that predispose individuals to cancer. As awareness of preventive oncology grows, NGS-based cancer screening is increasingly being offered through specialty clinics, at-home testing services, and integrated care networks.

U.S. Clinical Oncology Next Generation Sequencing Market By End-use Insights

Hospitals remain the largest end-user segment for clinical oncology NGS, particularly academic medical centers and large cancer institutes. These institutions possess the infrastructure, clinical expertise, and patient volumes required to support in-house NGS programs. They often use sequencing data not only for patient care but also for research and clinical trial enrollment.

Laboratories are the fastest-growing end-users, especially commercial diagnostic labs and specialized genomics service providers. These facilities offer centralized, high-throughput testing and cater to a broad client base, including hospitals, clinics, and biopharmaceutical companies. Their scalability, turnaround time, and technical capabilities make them essential players in expanding access to clinical oncology NGS nationwide.

Country-Level Analysis (United States)

In the United States, the clinical oncology NGS market is characterized by a highly dynamic ecosystem of academic research institutions, diagnostics developers, and health systems. Leading cancer centers such as MD Anderson, Dana-Farber, and Memorial Sloan Kettering have pioneered the use of tumor genomic profiling in routine oncology. These institutions also collaborate with biotech firms and data companies to advance NGS-based precision medicine.

The U.S. FDA has established a regulatory framework for NGS-based companion diagnostics, facilitating test commercialization alongside drug approvals. The Centers for Medicare & Medicaid Services (CMS) have also expanded coverage for NGS testing in advanced cancer patients, boosting clinical utilization. Public and private payers are increasingly recognizing the value of genomic insights in optimizing oncology care and reducing ineffective treatments, further fueling NGS adoption.

Some of the prominent players in the U.S. clinical oncology next generation sequencing market include:

- Illumina, Inc.

- Thermo Fisher Scientific

- F. Hoffmann-La Roche Ltd.

- Agilent Technologies

- Myriad Genetics

- Beijing Genomics Institute (BGI)

- Perkin Elmer

- Foundation Medicine

- Pacific Bioscience

- Oxford Nanopore Technologies Ltd.

- Macrogen, Inc.

- Qiagen

Recent Developments

-

March 2025: Foundation Medicine launched a new liquid biopsy panel for pan-cancer profiling using ctDNA, expanding its existing FoundationOne Liquid portfolio.

-

January 2025: Thermo Fisher Scientific received FDA clearance for its Oncomine Dx Target Test as a companion diagnostic for ROS1-positive lung cancer.

-

November 2024: Illumina announced a partnership with the American Cancer Society to promote early detection using NGS-based screening platforms.

-

September 2024: Guardant Health introduced its Guardant360 TissueNext test, complementing its liquid biopsy solutions with tissue-based NGS.

-

August 2024: Caris Life Sciences opened a new molecular profiling lab in Texas to meet growing demand for comprehensive genomic testing.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. clinical oncology next generation sequencing market

Technology

- Whole Genome Sequencing

- Whole Exome Sequencing

- Targeted Sequencing & Resequencing Centrifuges

Workflow

- NGS Pre-Sequencing

- NGS Sequencing

- NGS Data Analysis

Application

-

- Inherited Cancer

- Sporadic Cancer

- Companion Diagnostics

- Other Diagnostics

End-use

- Hospitals

- Clinics

- Laboratories