U.S. Cold Storage Market Size and Growth

The U.S. cold storage market size was valued at USD 44.19 billion in 2023 and is projected to surpass around USD 113.17 billion by 2033, registering a CAGR of 9.86% over the forecast period of 2024 to 2033.

.webp)

U.S. Cold Storage Market Key Takeaways

- In terms of revenue, the public segment dominated the market with a share of 80.9% in 2023

- The private and semi-private segment is expected to portray a significant CAGR of 11.2% from 2024 to 2033.

- The production stores segment held the largest share in 2023 and is estimated to grow at the highest CAGR exceeding 15.7% from 2024to 2033.

- The frozen segment accounted for the largest share exceeding 83.12% in 2023.

- The chilled segment is anticipated to witness a notable shift in growth over the forecast period.

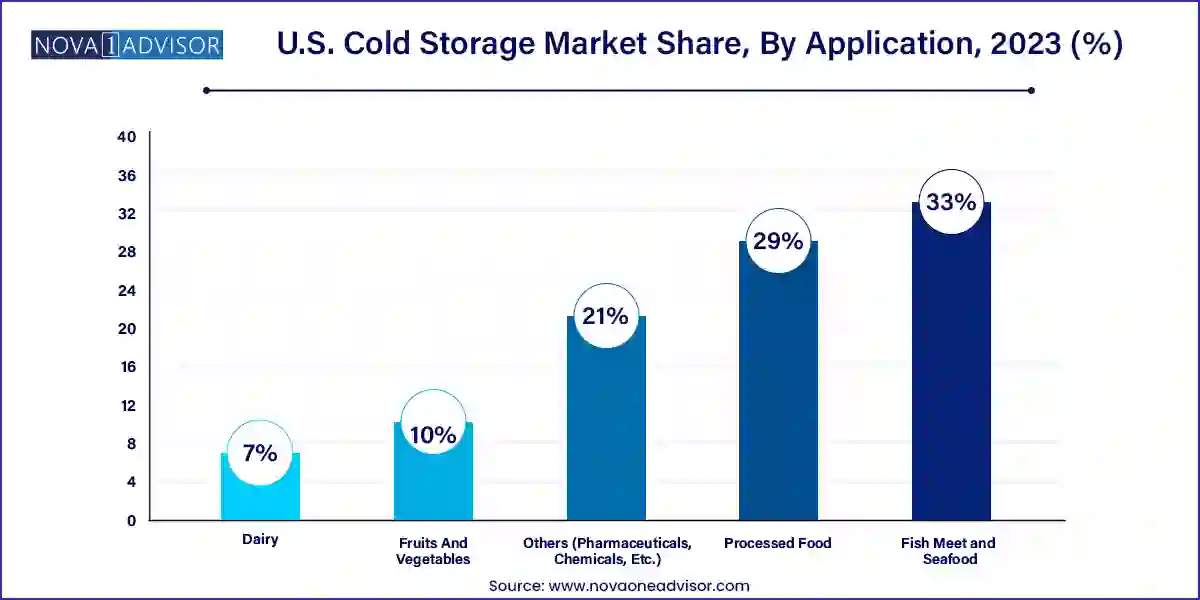

- In terms of revenue and market share, the fish, meat & seafood application segment captured the largest market share of 33.00% in 2023.

- The processed food segment is projected to witness highest growth of 16.9% from 2023 to 2033.

- The processed food segment is expected to witness the highest CAGR over the forecast period.

- California held the largest share in terms of revenue in 2023 and is projected to maintain its dominance in the market from 2024 to 2033.

- North Carolina and South Carolina are some of the highest-growing markets which are expected to witness a CAGR of over 15.2% and 14.7%, respectively, from 2024 to 2033.

Market Overview

The U.S. Cold Storage Market represents a critical component of the nation's logistics and supply chain infrastructure, serving as a backbone for various industries including food and beverages, pharmaceuticals, biotechnology, and retail. As the demand for perishable products continues to rise, the need for efficient temperature-controlled storage facilities has become paramount. Cold storage warehouses preserve product quality, prevent spoilage, and extend shelf life, thereby playing an indispensable role in minimizing food waste and ensuring the safety of sensitive medical supplies.

In recent years, the market has witnessed exponential growth fueled by the expansion of e-commerce grocery platforms, increasing consumption of frozen and processed foods, and the emergence of temperature-sensitive pharmaceutical products such as vaccines and biologics. The COVID-19 pandemic further highlighted the sector's importance, bringing a new wave of investment and digital transformation to the space. Both private and public sector players have accelerated the development of state-of-the-art cold chain logistics systems, embracing automation, energy efficiency, and real-time monitoring solutions to enhance operational capabilities.

From densely populated urban regions to agricultural heartlands and coastal ports, cold storage facilities are now integral to supporting a resilient, flexible, and safe supply chain ecosystem across the United States.

Major Trends in the Market

-

Expansion of E-commerce and Online Grocery Delivery: Surge in consumer preference for home-delivered groceries is driving demand for distributed cold storage facilities near urban centers.

-

Technological Integration: Adoption of IoT, AI, and blockchain for temperature monitoring, predictive maintenance, and inventory tracking.

-

Sustainability Focus: Increasing investments in green cold storage facilities utilizing solar panels, CO2 refrigerants, and energy-efficient insulation systems.

-

Growth in Pharmaceutical and Biotech Cold Chains: Rising production and distribution of temperature-sensitive biologics and vaccines.

-

Rise of Automated Warehousing: Use of robotics, conveyor belts, and autonomous systems to enhance warehouse productivity and reduce labor costs.

-

Regional Expansion: Growth of cold storage facilities in secondary and tertiary cities to support decentralized supply chain models.

-

Private Equity Investment: High interest from investment firms in cold storage real estate due to its recession-resistant nature.

U.S. Cold Storage Market Report Scope

| Report Attribute |

Details |

| Market Size in 2024 |

USD 48.55 Billion |

| Market Size by 2033 |

USD 113.17 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 9.86% |

| Base Year |

2023 |

| Forecast Period |

2024 to 2033

|

| Segments Covered |

Warehouse Type, Construction Type, Temperature Type, Application, and State |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled |

Americold Logistics, Inc., Burris Logistics, LINEAGE LOGISTICS HOLDING, LLC, Wabash National Corporation, United States Cold Storage, Tippmann Group, NFI Industries, Penske, Seafrigo Group, NewCold |

Market Driver: Rising Demand for Frozen and Processed Foods

The increasing consumer appetite for frozen and processed foods is a major driver of the U.S. cold storage market. Changes in lifestyle, urbanization, and the growing number of dual-income households have led to a demand for ready-to-eat and easy-to-prepare meal options. Products like frozen pizzas, vegetables, ice creams, and processed meats require consistent cold storage to maintain safety and flavor integrity. As more consumers stock up on such items for convenience and longer shelf life, retailers and food manufacturers are compelled to expand their cold storage capabilities.

Additionally, global food trade and imports of exotic perishables necessitate cold chain storage throughout the supply process. Retailers are increasingly investing in cold storage infrastructure to manage their inventory more efficiently and meet consumer expectations for variety, availability, and freshness.

Market Restraint: High Operational and Capital Costs

Despite the growing demand, the cold storage industry faces a significant barrier in the form of high operational and capital costs. Constructing a cold storage warehouse is substantially more expensive than traditional warehousing due to the need for specialized insulation, refrigeration systems, temperature control mechanisms, and backup power supplies. Moreover, ongoing maintenance and high energy consumption contribute to recurring costs, particularly in states with extreme climates.

Labor shortages and the need for skilled technicians further inflate operational expenses. Additionally, businesses must comply with stringent food safety regulations, which involve continuous monitoring and periodic upgrades to systems. These factors can deter small and medium enterprises from entering the market or expanding their storage capacities.

Market Opportunity: Growth in Pharmaceutical Cold Chain Logistics

A substantial growth opportunity lies in the increasing demand for pharmaceutical cold chain logistics. With the surge in biologics, gene therapies, and mRNA vaccines, many of which require ultra-low temperature storage, the pharmaceutical sector is becoming a major customer of cold storage facilities. The COVID-19 vaccination rollout emphasized the need for reliable and distributed cold chains, prompting a re-evaluation of the infrastructure and supply chain resilience.

Moreover, ongoing research and development in the biotech sector, coupled with aging population trends, are driving demand for temperature-sensitive medications. The healthcare industry's shift toward personalized medicine and specialty drugs further underscores the need for specialized cold storage services. This opens avenues for operators to diversify their portfolio and serve high-value clients beyond the food sector.

U.S. Cold Storage Market By Warehouse Type Insights

Public cold storage facilities dominated the U.S. market due to their accessibility and flexibility. Public warehouses serve a wide array of clients, providing cost-effective storage solutions for businesses that do not require full-time, private facilities. These warehouses typically operate on a pay-per-use basis, enabling seasonal businesses or small manufacturers to store inventory as needed. The public model allows greater scalability, making it attractive for companies with fluctuating volumes. In sectors like agriculture and seafood, where product flow is seasonal, public cold storage facilities have become indispensable.

U.S. Cold Storage Market, By Warehouse Type, 2022-2032 (USD Million)

| By Warehouse Type |

2022 |

2023 |

2027 |

2031 |

2032 |

| Private |

25,200 |

27,775.7 |

42,862.6 |

61,503.2 |

66,163.4 |

| Public |

14,232.2 |

15,896.8 |

25,858.9 |

38,305.4 |

41,417 |

Conversely, private and semi-private warehouses are emerging as the fastest-growing segment as large retailers and logistics companies seek more control over their supply chains. Retail giants such as Walmart and Amazon are increasingly investing in proprietary cold storage infrastructures to improve turnaround times and reduce third-party dependency. This trend aligns with the broader goal of vertical integration in supply chain operations, especially for time-sensitive and high-margin goods.

U.S. Cold Storage Market By Construction Type Insights

Bulk storage facilities dominated the construction type segment, primarily due to their ability to accommodate large quantities of perishable commodities like grains, dairy, and meat. These massive, temperature-controlled environments are designed for long-term storage and cater to wholesalers, exporters, and large-scale food processors. Their cost-efficiency and ability to support national and international trade have led to widespread deployment, particularly near major transportation hubs.

On the other hand, port-based cold storage facilities are the fastest-growing, driven by the globalization of food supply chains. The surge in seafood imports, meat exports, and cross-border pharmaceutical shipments has necessitated the development of temperature-controlled facilities adjacent to seaports and airports. These facilities offer critical support for time-sensitive and compliance-driven logistics operations, reducing transit times and improving product traceability.

U.S. Cold Storage Market By Temperature Type Insights

Frozen cold storage facilities currently dominate the temperature type segment, owing to the high volume of frozen food consumed in the U.S., including poultry, seafood, frozen vegetables, and desserts. These products demand sub-zero environments to retain quality over extended periods. The frozen category also caters to high-margin processed foods, which are becoming increasingly popular among urban consumers.

U.S. Cold Storage Market, By Temperature Type, 2022-2032 (USD Million)

| By Temperature Type |

2022 |

2023 |

2027 |

2031 |

2032 |

| Frozen |

29,872.7 |

32,885.4 |

50,490.7 |

72,216.3 |

77,647.7 |

| Chilled |

9,559.5 |

10,787.1 |

18,230.8 |

27,592.3 |

29,932.7 |

Chilled storage is experiencing rapid growth, particularly due to the expansion of fresh food delivery services. Online grocers and farm-to-table platforms are driving demand for cold rooms that maintain temperatures above freezing but below ambient levels. The need to store items like dairy, fresh fruits, and beverages under chilled conditions is promoting investments in multi-temperature zone warehouses.

U.S. Cold Storage Market By Application Insight

Fruits and vegetables dominated the cold storage market by application, largely due to the perishability and seasonal availability of fresh produce. The cold chain is crucial to maintaining nutritional value, preventing spoilage, and reducing post-harvest losses. From farms in California to consumer plates in New York, cold storage ensures year-round availability of produce, even for out-of-season or exotic items.

In contrast, pharmaceuticals are the fastest-growing application segment, driven by the rise in cold chain-dependent drugs and vaccines. Companies are seeking storage solutions capable of maintaining specific temperature ranges required for stability and efficacy. The emergence of personalized medicine, which often involves smaller, distributed shipments, is also pushing demand for flexible, scalable cold storage options.

U.S. Cold Storage Market, By Application, 2022-2032 (USD Million)

| By Application |

2022 |

2023 |

2027 |

2031 |

2032 |

| Fruits & Vegetables |

3,930.8 |

4,380.4 |

7,061.6 |

10,405.8 |

11,241.9 |

| Dairy |

3,348.2 |

3,755.0 |

6,202.4 |

9,268.7 |

10,035.2 |

| Fish, Meat & Seafood |

12,588.4 |

13,896.6 |

21,580.5 |

31,088.5 |

33,465.5 |

| Processed Foods |

11,144.7 |

12,267.6 |

18,828.7 |

26,924.7 |

28,948.7 |

| Others (Pharmaceuticals, Chemicals, Etc.) |

8,420.0 |

9,373.0 |

15,048.2 |

22,120.9 |

23,889.1 |

U.S. Cold Storage Market Recent Developments

-

Lineage Logistics (March 2025): Announced the acquisition of a 200,000-square-foot cold storage facility in Texas to support e-commerce grocery fulfillment and last-mile delivery services.

-

Americold Realty Trust (February 2025): Expanded its operations in Georgia with a new automated cold storage warehouse focused on supporting pharmaceutical distribution.

-

United States Cold Storage (January 2025): Opened a new facility in Pennsylvania with 50,000 pallet positions and multi-temperature storage zones.

-

NewCold (December 2024): Broke ground on a fully automated cold storage center in Idaho, incorporating renewable energy and AI-based monitoring systems.

-

RLS Partners (November 2024): Partnered with regional grocers in the Midwest to develop distributed cold storage solutions aimed at reducing food waste and improving delivery timelines.

U.S. Cold Storage Market Top Key Companies:

- AmericoldLogistics, Inc.

- AGRO Merchants Group North America

- Burris Logistics

- Henningsen Cold Storage Co.

- Lineage Logistics Holdings, LLC

- Nordic Logistics

- Preferred Freezer Services

- VersaCold Logistics Services

- United States Cold Storage

- Wabash National Corporation

U.S. Cold Storage Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. Cold Storage market.

By Warehouse Type

- Private & Semi-private

- Public

By Construction Type

- Bulk Storage

- Production Stores

- Ports

By Temperature Type

By Application

- Fruits & Vegetables

- Dairy

- Fish, Meat & Seafood

- Processed Food

- Pharmaceuticals

By State

- Maine

- Massachusetts

- Vermont

- New Jersey

- New York

- Pennsylvania

- Delaware

- Florida

- Georgia

- Maryland

- North Carolina

- South Carolina

- Virginia

- Illinois

- Indiana

- Michigan

- Ohio

- Wisconsin

- Alabama

- Kentucky

- Mississippi

- Tennessee

- Iowa

- Kansas

- Minnesota

- Missouri

- Nebraska

- North Dakota

- South Dakota

- Arkansas

- Louisiana

- Oklahoma

- Texas

- Arizona

- Idaho

- New Mexico

- Utah

- California

- Oregon

- Washington

- Others

.webp)