U.S. Continuous Renal Replacement Therapy Market Size and Research

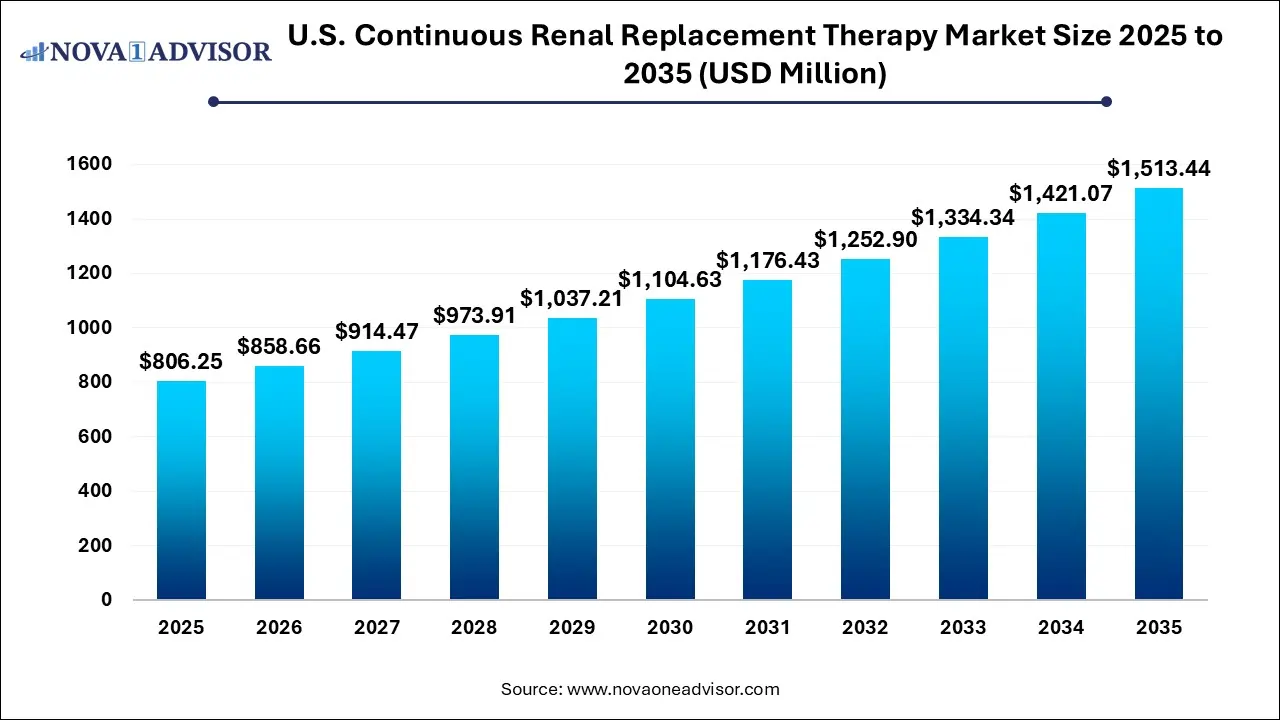

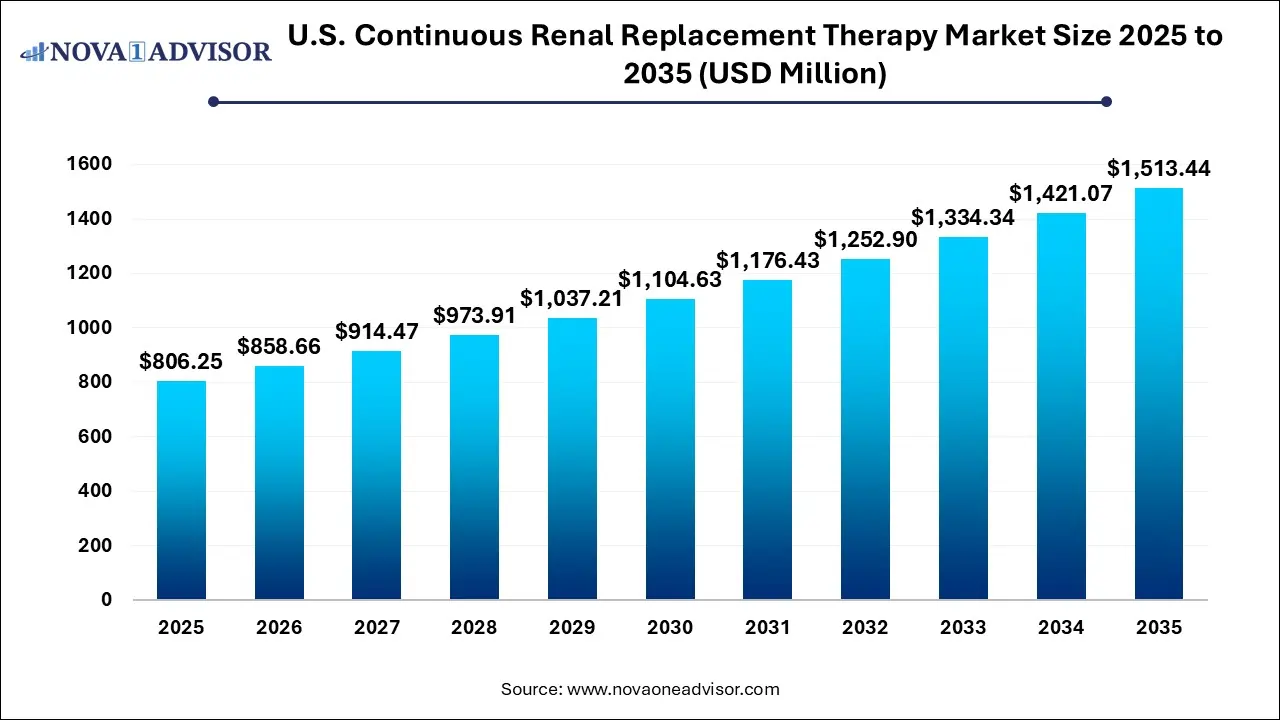

The U.S. continuous renal replacement therapy market size was exhibited at USD 806.25 million in 2025 and is projected to hit around USD 1,513.44 million by 2035, growing at a CAGR of 6.5% during the forecast period 2026 to 2035.

U.S. Continuous Renal Replacement Therapy Market Key Takeaways:

- In 2025, the liquids segment dominated the U.S. market with a revenue share of over 60.0%.

- In 2025, the continuous venovenous hemodialysis (CVVHD) segment dominated the market with a volume share of over 32.0% in terms of procedure/treatment.

- The continuous venovenous hemodiafiltration (CVVHDF) segment is expected to expand at the highest volume-based CAGR of 6.25% from 2026 to 2035.

Market Overview

The U.S. Continuous Renal Replacement Therapy (CRRT) market is witnessing steady growth, fueled by rising cases of acute kidney injury (AKI) in critically ill patients and the increasing adoption of intensive care services in hospital settings. CRRT refers to a blood purification therapy predominantly used for hemodynamically unstable patients in intensive care units (ICUs), where traditional intermittent hemodialysis could pose a risk due to rapid fluid shifts. CRRT provides a slower, more controlled method of toxin and fluid removal, making it particularly valuable for patients with multi-organ failure, sepsis, or severe fluid overload.

In the United States, the burden of AKI is intensifying. According to data from the National Kidney Foundation and CDC, nearly 1 in 5 hospitalized patients may develop some level of kidney dysfunction, and up to 50% of ICU patients face the risk of AKI, with mortality rates remaining high. CRRT offers an essential lifeline in these scenarios, and its role is becoming increasingly indispensable in critical care.

With expanding ICU infrastructure across tertiary and quaternary care centers, enhanced training of nephrologists and intensivists, and improvements in CRRT device portability and safety, the U.S. market is poised for continuous advancement. Additionally, government initiatives encouraging better chronic disease management and early detection of kidney-related complications further support the adoption of CRRT technologies.

Major Trends in the Market

-

Miniaturization and Automation of CRRT Systems: Compact and smart machines integrated with AI-based monitoring are enabling greater precision in fluid management and toxin clearance.

-

Increased Use of CRRT in Pediatric ICUs: A growing number of children’s hospitals and neonatal ICUs are implementing CRRT, with devices tailored to pediatric patients.

-

Bundled Procurement by Hospital Systems: Integrated healthcare delivery networks are shifting toward bundled procurement of CRRT systems, disposables, and consumables to reduce operational costs.

-

Growing Preference for Disposable Kits: Infection control policies and COVID-19’s aftermath have accelerated the demand for single-use CRRT disposables, enhancing safety and reducing cross-contamination.

-

Customized Dialysate and Replacement Fluid Production: On-site preparation and customization of CRRT liquids for critically ill patients based on individual metabolic needs are gaining momentum.

Report Scope of U.S. Continuous Renal Replacement Therapy Market

| Report Coverage |

Details |

| Market Size in 2026 |

USD 858.66 Million |

| Market Size by 2035 |

USD 1,513.44 Million |

| Growth Rate From 2026 to 2035 |

CAGR of 6.5% |

| Base Year |

2025 |

| Forecast Period |

2026-2035 |

| Segments Covered |

Product, Modality |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Key Companies Profiled |

Baxter; B. Braun Melsungen AG; Fresenius Medical Care AG; Medtronic; Asahi Kasei Medical Co., Ltd.; Nipro Corporation |

Key Market Driver: Rising Incidence of Acute Kidney Injury (AKI) in Critical Care

A primary growth driver for the U.S. CRRT market is the increasing incidence of acute kidney injury among patients admitted to intensive care units. AKI, characterized by a rapid decline in renal function, frequently arises due to sepsis, hypotension, drug toxicity, or surgical trauma. In the ICU, where patients are already dealing with severe systemic challenges, even mild kidney dysfunction can have devastating outcomes.

According to a study published in Critical Care Medicine in 2025, over 20% of all ICU admissions in the U.S. lead to some form of AKI, with CRRT being the preferred modality in over 60% of cases due to its hemodynamic stability and continuous clearance efficiency. Hospitals increasingly recognize CRRT not just as a renal therapy but as a crucial component in managing multi-organ dysfunction. This has prompted the allocation of budgetary resources toward the acquisition of CRRT machines, staff training, and inventory of disposables.

Key Market Restraint: High Cost of CRRT Infrastructure and Consumables

One of the notable restraints in the U.S. CRRT market is the significant cost burden associated with setting up and maintaining CRRT therapy in critical care units. CRRT machines themselves are high-value capital equipment, with prices often exceeding $25,000 per unit. Beyond the device, recurring expenses such as disposable filter kits, dialysate and replacement fluids, bloodline sets, and anticoagulants contribute substantially to overall treatment costs.

Additionally, CRRT demands specialized clinical staff trained in critical care nephrology, which further increases labor costs. Smaller hospitals and rural healthcare facilities often lack the budget or expertise to maintain 24/7 CRRT availability. While reimbursement policies have improved in recent years, inconsistencies across private insurers and Medicare in covering consumables and ancillary costs limit full adoption across all tiers of healthcare providers.

Key Market Opportunity: Integration of CRRT into ECMO and Multimodal Organ Support

A key opportunity in the U.S. CRRT market lies in its integration with extracorporeal membrane oxygenation (ECMO) and other organ support systems. Critically ill patients, especially those suffering from ARDS (Acute Respiratory Distress Syndrome), sepsis, or post-cardiac surgery complications, often require simultaneous support for lungs, heart, and kidneys. Integrating CRRT with ECMO creates a comprehensive extracorporeal life support system that ensures precise volume management and toxin removal.

Recent studies suggest that nearly 30–40% of ECMO patients experience renal failure necessitating CRRT. Advanced machines are now being designed to synchronize seamlessly with ECMO circuits, reducing catheter-related complications and streamlining patient care. This multimodal approach is gaining popularity in high-acuity hospitals, presenting equipment manufacturers and clinical training providers with a valuable expansion avenue.

U.S. Continuous Renal Replacement Therapy Market By Product Insights

Disposables dominated the CRRT product segment in the U.S. market. This segment includes filters, dialyzers, tubing kits, and replacement fluids that are essential for each treatment session. Given that CRRT is typically administered for 24–72 hours continuously, each patient requires several sets of disposables during their therapy duration. The high frequency of ICU admissions requiring CRRT and strict hospital protocols favoring single-use components have kept the demand for disposables consistently high. Additionally, the shift toward pre-assembled kits with minimal touchpoints has boosted infection control outcomes and streamlined workflows in overburdened ICU settings.

CRRT systems are the fastest-growing product segment, driven by technological innovations aimed at enhancing ease-of-use and treatment customization. Modern CRRT machines feature touchscreen interfaces, AI-driven flow controls, and connectivity with hospital EMRs for real-time treatment monitoring. The need for portable devices that can be used in bedside settings, ambulances, or even during patient transport between facilities has created a competitive innovation landscape. Leading manufacturers are investing in compact, versatile systems with plug-and-play configurations that reduce setup time, enhance safety, and minimize operator errors.

U.S. Continuous Renal Replacement Therapy Market By Modality Insights

Continuous Venovenous Hemodialysis (CVVHD) has emerged as the dominant CRRT modality in U.S. ICUs. CVVHD allows precise fluid removal while providing efficient diffusion-based clearance of uremic toxins, making it suitable for patients with both fluid overload and metabolic derangements. Its ability to gently dialyze critically ill patients while preserving hemodynamic stability makes it the most preferred modality, particularly in cases of sepsis-induced AKI. Hospitals often initiate CVVHD due to its flexibility, ease of management, and broad spectrum efficacy in ICU settings.

Continuous Venovenous Hemodiafiltration (CVVHDF) is projected to be the fastest-growing modality, offering a combination of convective and diffusive clearance. This hybrid approach provides superior toxin removal, particularly of middle molecules, making it valuable in complex clinical presentations involving rhabdomyolysis, drug overdoses, or severe sepsis. The increasing clinical preference for "high-efficiency CRRT" in tertiary care facilities is propelling demand for CVVHDF. Equipment manufacturers are responding with integrated software presets and advanced safety alarms tailored for this modality, further boosting adoption.

Country-Level Analysis

In the United States, the CRRT market benefits from a sophisticated critical care infrastructure and a well-established clinical training ecosystem. Major urban hospitals, especially those affiliated with academic institutions, have advanced ICU departments equipped with the latest CRRT modalities. The country’s leading role in nephrology research has resulted in early adoption of innovations, such as citrate anticoagulation protocols and real-time monitoring systems for CRRT.

However, disparities exist. While large hospitals offer comprehensive CRRT services, rural and smaller community hospitals often refer patients to larger centers due to lack of expertise or infrastructure. Federal initiatives, such as the Advancing American Kidney Health initiative launched in 2019, have indirectly supported CRRT growth by emphasizing value-based renal care. Additionally, improvements in CRRT-related CPT coding and increased awareness among nephrologists and critical care specialists have enhanced treatment accessibility.

Some of the prominent players in the U.S. continuous renal replacement therapy market include:

Recent Developments

-

Baxter International (March 2025) introduced the PrismaFlex Pro System in the U.S., featuring adaptive fluid management and integration with hospital EMRs for enhanced patient monitoring in CRRT.

-

Fresenius Medical Care (February 2025) announced a new disposable filter set tailored for pediatric CRRT, addressing the unique fluid and metabolic needs of neonates and children in critical care.

-

Medtronic (December 2024) revealed a collaborative research initiative with multiple U.S. hospitals to develop AI-enabled algorithms for predicting CRRT initiation and optimizing dosing schedules.

-

Nikkiso America (January 2025) launched a next-generation blood pump designed for longer runtime during CRRT, reducing device changeover frequency and improving workflow in high-volume ICUs.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2035. For this study, Nova one advisor, Inc. has segmented the U.S. continuous renal replacement therapy market

By Product

- CRRT System

- Disposables

- Liquids

By Modality

- Slow Continuous Ultrafiltration (SCUF)

- Continuous Venovenous Hemofiltration (CVVH)

- Continuous Venovenous Hemodialysis (CVVHD)

- Continuous Venovenous Hemodiafiltration (CVVHDF)