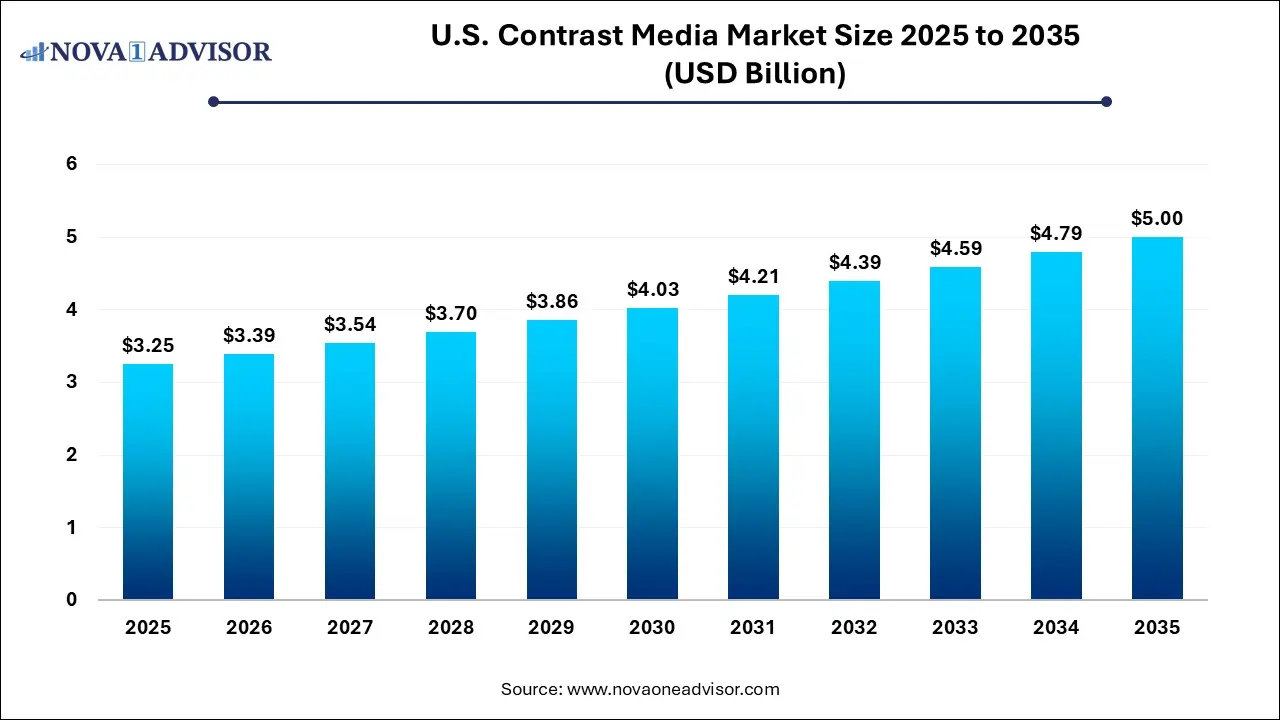

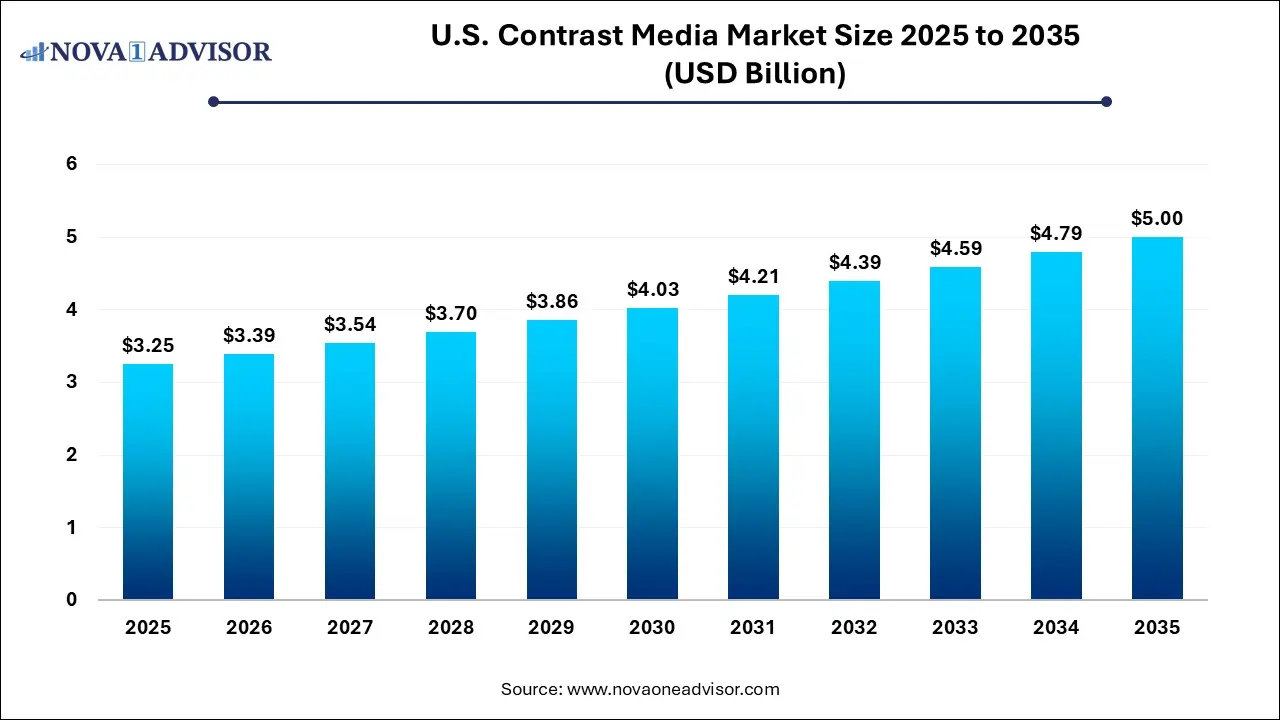

The U.S. contrast media market size was exhibited at USD 3.25 billion in 2025 and is projected to hit around USD 5.00 billion by 2035, growing at a CAGR of 4.4% during the forecast period 2026 to 2035.

Market Overview

The U.S. contrast media market plays a crucial role in enhancing the accuracy and effectiveness of diagnostic imaging procedures. Contrast agents, or contrast media, are substances used in medical imaging to enhance the visibility of specific areas of the body, thereby allowing for clearer images in various diagnostic techniques like X-rays, CT scans, MRI, and ultrasound. These agents are essential in diagnosing a wide range of medical conditions, including cardiovascular diseases, neurological disorders, and cancers.

The market for contrast media in the U.S. has experienced consistent growth, driven by advancements in imaging technologies, an increasing number of diagnostic procedures, and the growing prevalence of chronic diseases. As healthcare providers continue to adopt more precise and efficient diagnostic imaging techniques, the demand for high-quality contrast media is expected to rise significantly. Moreover, the U.S. market is witnessing innovations in contrast agent formulations, with newer types offering enhanced image quality, reduced side effects, and better patient comfort.

Growth Factors

- Rising Prevalence of Chronic Diseases: The increasing incidence of diseases such as cancer, cardiovascular diseases, and neurological disorders is significantly driving the demand for diagnostic imaging procedures, which rely on contrast media for clearer imaging results. As these diseases require frequent imaging for diagnosis and monitoring, the demand for contrast agents is expected to grow.

- Technological Advancements in Imaging Systems: Innovations in imaging modalities, such as the introduction of high-definition MRI, advanced CT scanners, and ultrasound machines, have led to greater demand for high-quality contrast agents that can provide sharper and more accurate images for diagnosis.

- Growing Geriatric Population: The aging population in the U.S. is one of the key drivers of the contrast media market. Older adults are more susceptible to chronic conditions like cancer, cardiovascular diseases, and neurodegenerative disorders, all of which require imaging for accurate diagnosis and monitoring. This demographic shift is fueling the demand for contrast media in various diagnostic procedures.

| Report Coverage |

Details |

| Market Size in 2026 |

USD 3.39 Billion |

| Market Size by 2035 |

USD 5.00 Billion |

| Growth Rate From 2026 to 2035 |

CAGR of 4.4% |

| Base Year |

2025 |

| Forecast Period |

2026-2035 |

| Segments Covered |

Type, Modality, Application |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Key Companies Profiled |

Bayer AG; GE Healthcare; Guerbet; Bracco Diagnostic, Inc; Nano Therapeutics Pvt. Ltd.; CMC Contrast AB; Lantheus Medical Imaging, Inc.; IMAX Diagnostic Imaging; Trivitron Healthcare |

Driver

The primary driver for the growth of the U.S. contrast media market is the increasing number of diagnostic imaging procedures. As imaging technology advances and the need for accurate diagnostic tools becomes more pronounced, the role of contrast agents has become indispensable. For instance, CT scans and MRIs, which are frequently used to detect a range of conditions, require contrast media to enhance image quality, thereby making it easier for healthcare providers to make accurate diagnoses.

In particular, the rising incidence of chronic diseases such as cancer, heart disease, and neurological disorders is propelling the need for diagnostic imaging, thus driving the demand for contrast media. With more patients requiring imaging for diagnosis and monitoring, the market for contrast media is expected to witness sustained growth.

Restraint

Despite its robust growth, the U.S. contrast media market faces several challenges that could hinder its progress. One of the major restraints is the side effects and adverse reactions associated with some contrast agents. Although most contrast media are safe, certain individuals may experience allergic reactions or other side effects, which could limit their usage in some patients. The occurrence of adverse reactions to contrast agents, such as nausea, headaches, and in rare cases, more severe reactions like anaphylaxis, can hinder market growth as healthcare providers may limit their use in certain populations.

Another significant restraint is the high cost of contrast media and the related diagnostic imaging procedures. The cost of advanced contrast agents, along with the expenses associated with imaging procedures, can be a barrier for some healthcare institutions, particularly in resource-limited settings. This high cost could limit the accessibility of these services in certain parts of the U.S., thereby slowing market growth.

Opportunity

The U.S. contrast media market offers several opportunities for growth, primarily driven by technological advancements and the increasing demand for diagnostic imaging.

- Innovation in Contrast Media: There is significant potential for innovation in the development of next-generation contrast agents that offer improved safety profiles and fewer side effects. Innovations such as non-iodinated contrast agents that reduce the risk of adverse reactions and enhance patient comfort could present new growth opportunities in the market.

- Expansion of Imaging Modalities: The continued expansion and adoption of advanced imaging technologies, such as high-resolution MRI and multislice CT, offer opportunities for growth in the contrast media market. As these technologies demand more sophisticated contrast agents, manufacturers can capitalize on these innovations to provide tailored products.

In 2025, the X-ray/CT segment led the U.S. contrast media market, holding the largest market share. This segment remains dominant due to the widespread use of CT scans in diagnosing a variety of medical conditions, including cancers, cardiovascular diseases, and trauma. The growing adoption of multislice CT scanners that offer high-resolution images with the aid of contrast media is fueling the growth of this segment. Additionally, the ultrasound imaging segment is anticipated to witness the fastest growth during the forecast period due to the increasing use of ultrasound in obstetrics, cardiology, and emergency diagnostics.

In terms of type, iodinated contrast media dominated the U.S. market in 2025 and is expected to maintain a significant market share. Iodinated contrast agents are commonly used in X-ray and CT imaging due to their high efficacy in enhancing the quality of the images. These contrast agents are widely preferred for their ability to provide clear and detailed images, essential for accurate diagnosis. On the other hand, there is an increasing shift towards non-iodinated agents in specific cases to minimize the risk of side effects, providing opportunities for manufacturers to diversify their product offerings.

The neurological disorder segment dominated the U.S. contrast media market in 2025, holding the largest share. Imaging of the brain and spinal cord, particularly through MRI and CT, is crucial in diagnosing and monitoring neurological conditions such as tumors, strokes, and neurodegenerative diseases. As the prevalence of neurological disorders increases, the demand for contrast agents in this application continues to rise.

Country-level Analysis

The U.S. remains the largest and most dominant market for contrast media. The country boasts a highly developed healthcare infrastructure, with cutting-edge imaging technologies and extensive healthcare research facilities. Moreover, the increasing demand for diagnostic procedures due to the rising burden of chronic diseases like cancer, cardiovascular disease, and neurological disorders is further accelerating the growth of the contrast media market in the U.S.

The U.S. government’s focus on enhancing healthcare services and access, along with the increasing number of imaging centers and diagnostic labs, also supports market growth. Additionally, advancements in imaging technology and the development of more patient-friendly contrast agents provide further opportunities for expansion.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2035. For this study, Nova one advisor, Inc. has segmented the U.S. contrast media market

By Type

- Microbubble Contrast Media

- Gadolinium-based Contrast Media

- Iodinated Contrast Media

- Barium-based Contrast Media

By Modality

- Ultrasound

- Magnetic Resonance Imaging (MRI)

- X-ray/Computed Tomography (CT scan)

By Application

- Cardiovascular

- Neurological Disorders

- Gastrointestinal Disorders

- Cancer

- Nephrological Disorders

- Musculoskeletal Disorders

- Others