U.S. Deep Brain Stimulation In Parkinson’s Disease Market Size, Trends 2026 to 2035

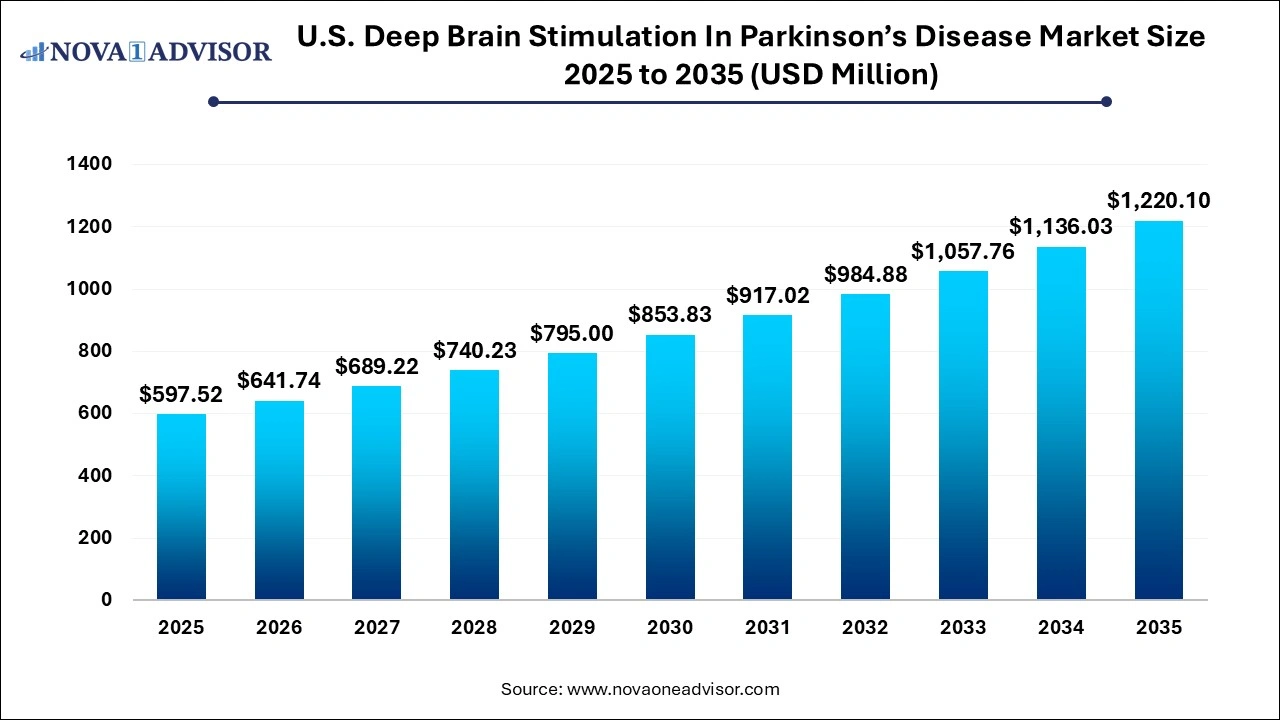

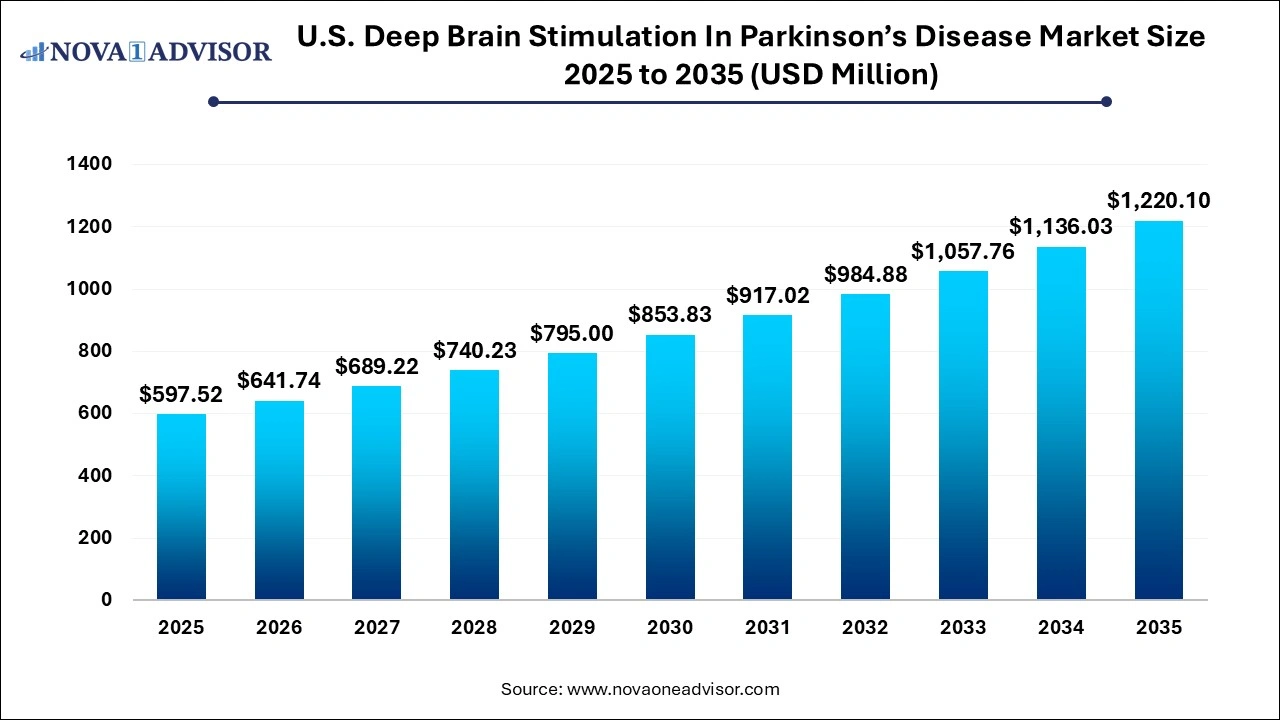

The U.S. deep brain stimulation in parkinson’s disease market size was valued at USD 597.52 million in 2025 and is expected to hit USD 1,220.10 million by 2035, growing at a compound annual growth rate (CAGR) of 7.4% from 2026 to 2035.

Key Takeaways:

- By product, the dual-channel segment accounted for the largest revenue share of over 55.9% in 2025. Dual-channel DBS offers the best overall support, exhibiting greater effectiveness in reducing patient tremors and enhancing the quality of life

- The single-channel product segment is estimated to register the highest CAGR over the forecast period. This is due to the cost of dual-channel DBS is high. Single-channel DBS offers patients suffering from progressed or complicated PD a chance to recover a part of their motion at a comparatively lower cost. Single-channel DBS is also easier to program and it offers greater room for operational flexibility

- The industry is highly competitive. Market players are adopting various strategies, including partnerships, mergers and acquisitions, product innovations, and product launches to improve their position in the market.

U.S. Deep Brain Stimulation In Parkinson’s Disease Market Growth

The increasing prevalence of Parkinson’s Disease (PD) is a high-impact rendering driver for the deep brain stimulation devices market. After Alzheimer's Disease (AD), PD is the most common neurodegenerative disorder. It is caused by a combination of genetic (mutations in the alpha-synuclein gene) and environmental factors (repeated head injuries), with age being the major risk factor.

As per estimates by the Parkinson’s Foundation Prevalence Project, the number of people living with PD will increase to 1.2 million by 2030, from 930,000 in 2020. This is more than the number of patients suffering from muscular dystrophy, multiple sclerosis, and amyotrophic lateral sclerosis. Approximately 60,000 people in the U.S. are diagnosed with PD every year. Its growing prevalence has raised the demand for DBS as an alternative therapy, which has proven to be vital in providing therapeutic solutions for PD symptoms.

COVID-19 has had a negative impact on the market growth, affecting demand and production directly, disrupting the supply chain, and increasing the financial burden on businesses. During the pandemic, neurological surgeries were regularly postponed and/or canceled to prevent the spread of COVID-19. Neurosurgical procedures decreased by 55% in the worst-hit countries, including the U.S., Russia, India, Brazil, France, the U.K., Italy, and Spain. Growing evidence suggests that the COVID-19 virus causes brain fog and other neurological symptoms.

Manufacturers faced difficulties serving surgeons owing to hospitals operating with restricted access. This negatively affected procedural volumes in 2020, limiting the market growth. However, an increase in the adoption of tele-consultancy globally for follow-ups and routine checkups to address the symptoms of Parkinson's disease during the pandemic is playing a key role in boosting the market growth. Thus, such trends are expected to have a significant impact on the adoption of DBS in the coming years.

Furthermore, the market is expected to increase in the near future mostly owing to the increased sales volumes in the neuromodulation industry. Pricing pressure on DBS due to the competition in the U.S. and other key markets mitigated some of this growth. Moreover, the majority of players operating in the U.S. market are strengthening their market position through launching a more comprehensive and technologically advanced product portfolio, mergers & acquisitions, and geographic expansion in new markets.

For instance, in February 2022, Aleva Neurotherapeutics, a developer of implants for deep brain stimulation (DBS) in important neurological disorders such as essential tremor and Parkinson's disease, announced that they have gained FDA approval for an Investigational Device Exemption (IDE) research. The protocol has been approved to collect data on efficacy and safety in the preparation for a future PMA application. The FDA issued the approval after an extensive exchange of information between the FDA and Aleva, during which all clinical data and safety testing were thoroughly investigated. As a result of this, the market is expected to grow in the near future.

Report Scope of the U.S. Deep Brain Stimulation In Parkinson’s Disease Market

| Report Coverage |

Details |

| Market Size in 2026 |

USD 454.10 Million |

| Revenue Projection By 2035 |

USD 850.19 Million |

| Growth Rate |

CAGR of 7.4% from 2026 to 2036 |

| Base Year |

2025 |

| Historical data |

2017 - 2035 |

| Forecast Period |

2026 to 2035 |

| Segments Covered |

Product |

| Companies Mentioned |

Boston Scientific Corporation; Abbott; Medtronic; Functional Neuromodulation; Nuvectra Corporation; Aleva Neurotherapeutics SA |

Furthermore, as per a study published by the U.S. National Library of Medicine, enhancements in electrode design can enhance the efficiency of DBS devices by reducing the frequency of surgical replacements and the chances of adverse effects. During traditional surgery, DBS current is provided using a four-contact lead with stacked cylindrical electrodes. The newly improvised lead designs offer an eight-contact electrode that can deliver current to wider regions and multiple targets. The growing demand for minimally invasive treatments for neurological illnesses and resistant neuropsychiatric conditions has increased interest in neuromodulatory techniques like DBS. Clinical studies, which are the pinnacle of evidence that will define DBS treatment, must be well-designed and conducted as the field grows.

Innovations in deep brain stimulation in Parkinson’s disease have been ongoing for the past decade with significant efforts focused on increasing the application of DBS in controlling motor dysfunction, reducing motor dysfunction, and increasing the adoption of DBS in other areas such as depression and dystonia. Many key market players are constantly trying to develop new products or upgrade their products to meet the changing need of the patients by patient basis. In the future, technologies such as the use of light-based deep brain stimulation in Parkinson’s disease are likely to get approved. These technologies will help to cater to the need of the patients suffering from Parkinson’s disease in a better way.

Product Insights

The dual-channel led the market and accounted for more than 55.2% share in 2025. High-frequency DBS has become a widely utilized procedure for the management of severe momentum disorders when the symptoms can no longer be improved by medical treatment. The procedure is safe, bilateral, and reversible. It can be performed by bilateral implantation of leads into the target areas. Growing adoption of double-channel DBS for the treatment of numerous neurological disorders, such as Parkinson’s disease, dystonia, Alzheimer’s disease, and epilepsy, is a key factor fueling segment growth.

Moreover, technological advancements and new product launches are further impelling segment growth. For instance, in January 2020, Abbott’s Infinity DBS system secured FDA approval for the treatment of Parkinson's disease from the U.S. FDA. This system will allow targeting of a specific area of the brain called internal Globus Pallidus (GPi), which is associated with Parkinson's disease symptoms. In addition, Vercise, Vercise PC, & Vercise Gevia DBS systems by Boston Scientific; Activa PC & Activa RC by Medtronic; and Infinity by Abbott are some of the key offerings under the segment.

The single-channel segment is anticipated to witness the fastest growth over the forecast period. A Deep Brain Stimulator (DBS) device is also known as brain pacemaker and has been clinically used over the past 25 years for the treatment of Parkinson's disease. The single-channel DBS systems are used for patients who have only one lead implanted. Healthcare professionals consider that a single channel offers the neurologist more programming options and provides better motor results, which led to the increased preference for single-channel DBS.

A rise in the geriatric population, which is more prone to developing Parkinson’s disease, and growing awareness about neurological movement disorders among patients are anticipated to impel the growth of the segment. For instance, as per the World Ageing 2019 report, it is estimated that globally, there were about 703 million people aged 65 years in 2019. Furthermore, in March 2018, the Brain & Spine Foundation (BSF) and Neurological Alliance launched “Brain Awareness Week,” a global campaign to increase awareness about progress in diagnosis, treatment, and prevention of neurological conditions. One of the key products offered under this segment is Activa SC, which is a single-channel DBS offered by Medtronic. Activa SC controls one-DBS electrode, which has been approved for the treatment of Parkinson’s disease.

Key Companies & Market Share Insights

U.S. manufacturers of deep brain stimulation for Parkinson's disease are working more quickly to obtain licenses for their products so that mass production may start. To further improve their position in the market, the market players are implementing a variety of strategies, including partnerships, mergers and acquisitions, product innovations, and launches like the introduction of U.S. deep brain stimulation in Parkinson's disease products. For instance, in January 2020, the Percept PC neurostimulator from Medtronic has been given the CE mark of approval. With the use of BrainSense technology, this DBS system will be the first to be made available to patients with Parkinson's disease in Europe. Some prominent players in the U.S. deep brain stimulation in Parkinson’s disease market include:

Boston Scientific Corporation

- Abbott

- Medtronic

- Functional Neuromodulation

- Nuvectra Corporation

- Aleva Neurotherapeutics SA

Segments Covered in the Report

This research report offers market revenue, sales volume, production assessment and prognoses by classifying it on the basis of various aspects. Further, this research study investigates market size, production, consumption and its development trends at U.S. for the period of 2017 to 2030

By Product

- Single-channel

- Dual-channel

Key Points Covered in U.S. Deep Brain Stimulation In Parkinson’s Disease Market Study:

- Growth of U.S. Deep Brain Stimulation In Parkinson’s Disease in 2025

- Market Estimates and Forecasts (2026-2035)

- Brand Share and Market Share Analysis

- Key Drivers and Restraints Shaping Market Growth

- Segment-wise

- Competition Mapping and Benchmarking

- Recommendation on Key Winning Strategies

- COVID-19 Impact on Demand for U.S. Deep Brain Stimulation In Parkinson’s Disease and How to Navigate

- Key Product Innovations and Regulatory Climate

- U.S. Deep Brain Stimulation In Parkinson’s Disease Consumption Analysis

- U.S. Deep Brain Stimulation In Parkinson’s Disease Production Analysis

- U.S. Deep Brain Stimulation In Parkinson’s Disease and Management