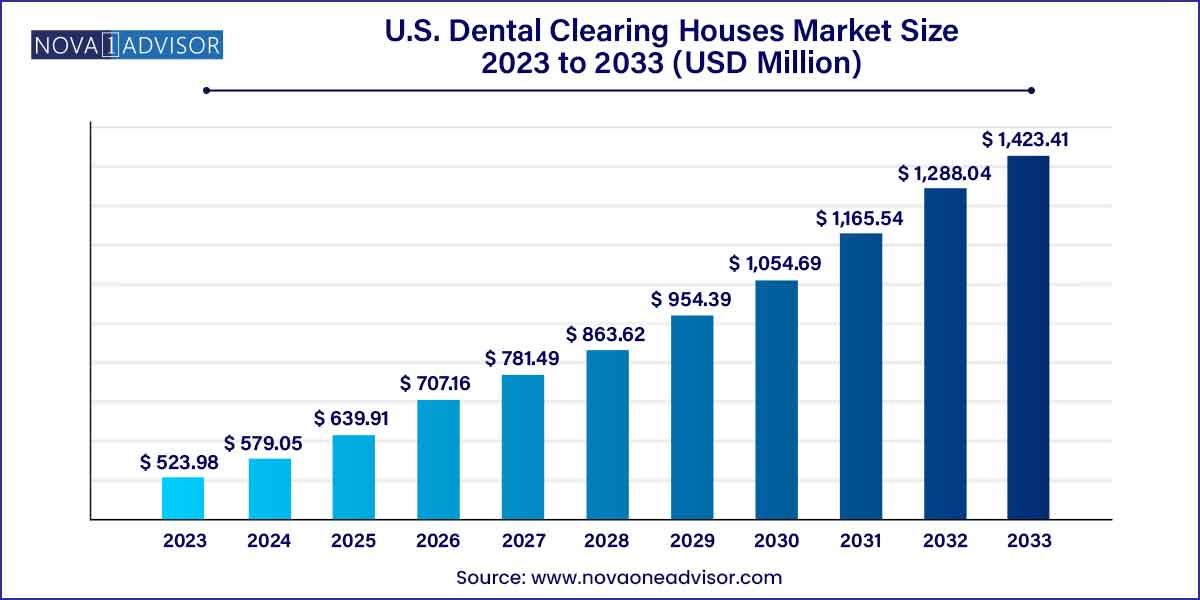

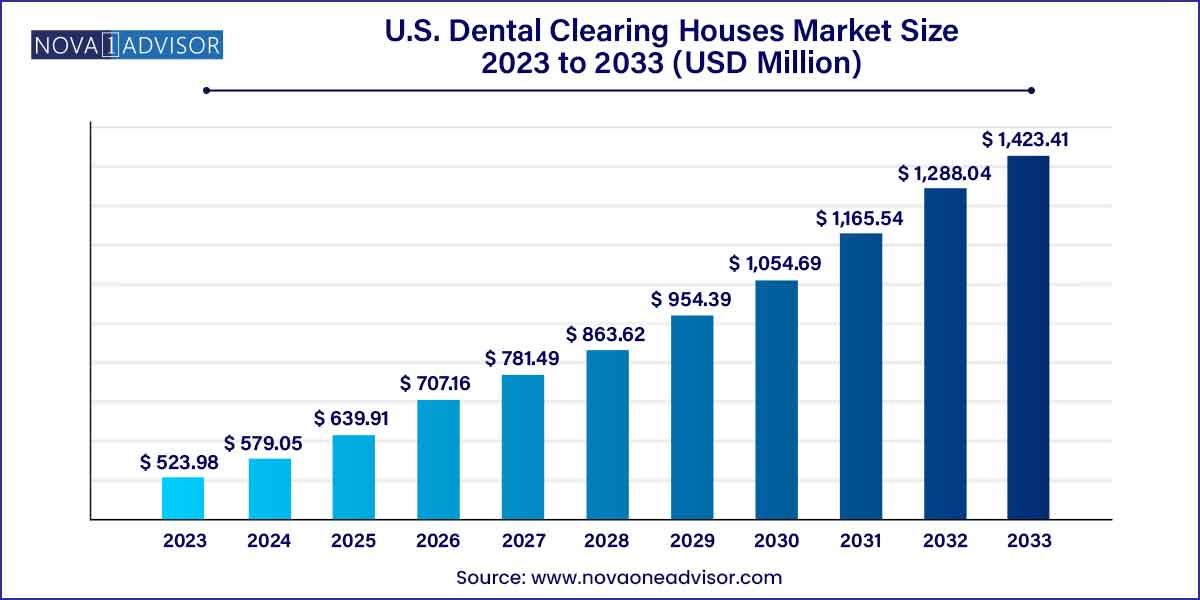

The U.S. dental clearing houses market size was estimated at USD 523.98 million in 2023 and is expected to surpass around USD 1,423.41 million by 2033 and poised to grow at a compound annual growth rate (CAGR) of 10.51% during the forecast period 2024 to 2033.

Key Takeaways:

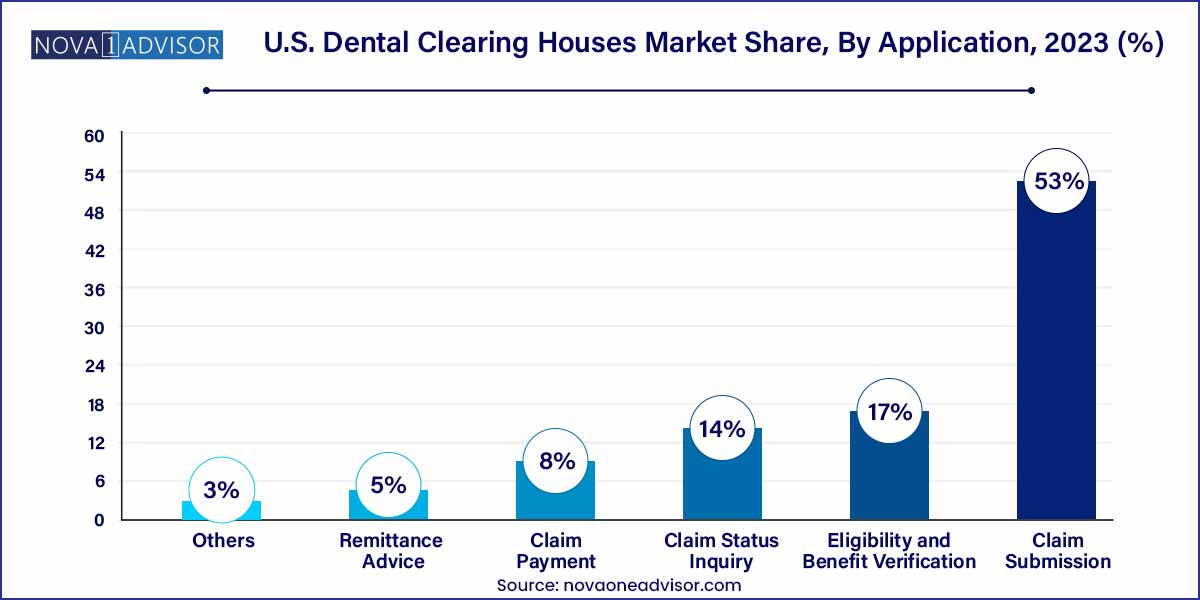

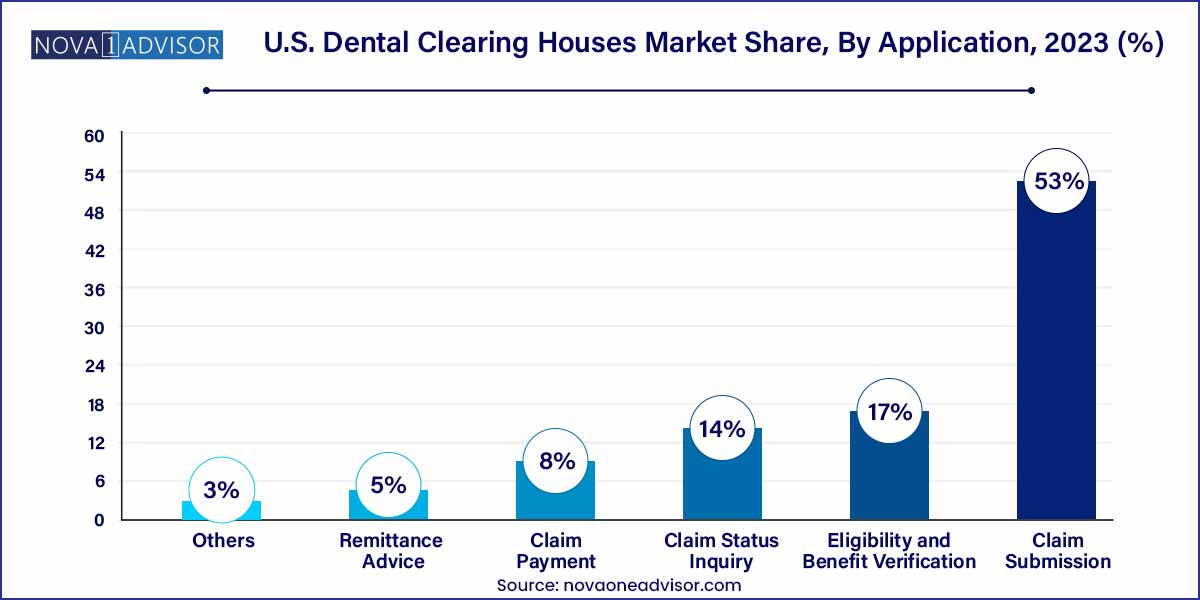

- The claim submission segment dominated the market with a revenue share of 53% in 2023.

- The eligibility and benefit verification segment is expected to witness the fastest growth over the forecast period.

- Market players operating in the market include DentalXChange (EDI Health Group, dba), Dentrix (Henry Schein One), Change Healthcare, Vyne Dental (Napa EA/MEDX LLC), and Electronic Dental Services

- In August 2022, Smart Data Solutions (SDS) acquired ClaimLynx, a medical claim clearing house based in Minnesota. This acquisition expanded the features of Stream Clearinghouse, including dental, professional, or facility medical claim submissions.

Market Overview

The U.S. dental clearing houses market plays a pivotal role in streamlining administrative workflows between dental providers and payers. These intermediaries manage the secure transmission, translation, and verification of electronic data interchange (EDI) transactions including insurance claims, payment remittance, eligibility checks, and claim status inquiries. As the dental industry moves towards complete digital transformation, clearing houses are becoming essential service providers in reducing operational inefficiencies and enhancing revenue cycle management.

Dental clearing houses operate as secure hubs that validate and scrub claims, minimizing errors and rejections before submission to insurance companies. In an environment where time and compliance are critical, these platforms help dental clinics, group practices, and DSOs (Dental Service Organizations) accelerate reimbursements while maintaining data integrity and HIPAA compliance.

The U.S. market is particularly well-positioned due to the widespread adoption of dental practice management software (PMS) and increased emphasis on value-based care and administrative cost containment. With more than 200,000 active dentists and thousands of dental clinics in the country, the volume of EDI transactions managed daily necessitates scalable, efficient clearing house services.

Major Trends in the Market

-

Integration of AI and Automation: Clearing houses are embedding artificial intelligence and RPA (robotic process automation) for real-time claim validation and automated follow-ups.

-

All-in-One Revenue Cycle Platforms: Providers are opting for clearing houses offering integrated solutions that include billing, claims, and patient engagement in a single dashboard.

-

Expansion of Dental Service Organizations (DSOs): The rise of DSOs is leading to greater consolidation and higher demand for enterprise-grade clearing house solutions.

-

Cloud-Based and API-Enabled Platforms: Modern clearing houses offer cloud-native and API-compatible systems to seamlessly integrate with dental PMS and EHRs.

-

Focus on Patient Financial Transparency: Solutions are evolving to provide real-time eligibility verification and out-of-pocket cost estimation to improve patient satisfaction.

-

Interoperability and Compliance Readiness: Increased focus on HIPAA, CAQH CORE standards, and seamless integration with CMS and private payers.

U.S. Dental Clearing Houses Market Report Scope

| Report Attribute |

Details |

| Market Size in 2024 |

USD 579.05 Million |

| Market Size by 2033 |

USD 1,423.41 Million |

| Growth Rate From 2024 to 2033 |

CAGR of 10.51% |

| Base Year |

2023 |

| Forecast Period |

2024 to 2033 |

| Segments Covered |

Application |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled |

DentalXChange (EDI Health Group, dba); Dentrix (Henry Schein One); Change Healthcare; Vyne Dental (Napa EA/MEDX LLC); Electronic Dental Services |

Market Driver: Rising Need for Administrative Efficiency in Dental Practices

A key driver of the U.S. dental clearing houses market is the increasing need for administrative efficiency across solo and group dental practices. With shrinking profit margins, labor shortages, and heightened compliance requirements, dental providers are seeking solutions that reduce administrative burden and accelerate reimbursements.

Dental clearing houses offer streamlined digital workflows for claims management, eligibility checks, remittance posting, and status inquiries, replacing manual data entry and paperwork. These platforms also help reduce claim denials and errors by using real-time eligibility checks and coding verification tools before claim submission.

For example, a general dentistry clinic processing over 500 insurance claims per month can save significant time and reduce errors by automating claim status checks and integrating with clearing house platforms. This ensures faster cash flow, reduced days in A/R (Accounts Receivable), and higher staff productivity directly benefiting both small practices and large DSOs.

Market Restraint: Complexity of Payer Integration and Technical Limitations

A significant restraint in the market is the complexity of integration with various payer systems and legacy software platforms. While clearing houses bridge the communication between providers and insurance payers, not all payers offer seamless EDI compatibility, and many still rely on semi-automated or manual processes.

In addition, some dental practices use outdated or non-standard PMS that lack robust EDI support. This creates friction during onboarding and data migration, requiring costly custom configurations or middleware. Moreover, discrepancies in payer-specific rules, coverage policies, and formatting requirements can lead to increased rejections or delays even with clearing house involvement.

These challenges are more pronounced in rural or independently operated practices with limited IT infrastructure, restricting the adoption of full-service clearing house platforms despite evident long-term benefits.

Market Opportunity: Growth of DSOs and Demand for Scalable Multi-location Solutions

The expanding footprint of Dental Service Organizations (DSOs) in the U.S. presents a major opportunity for dental clearing houses. DSOs, which manage multiple dental clinics under one umbrella, require centralized, scalable solutions to handle complex revenue cycle operations across geographies and payers.

Clearing houses that offer multi-tenant architecture, consolidated reporting, and enterprise-grade integrations are well-positioned to become strategic partners for DSOs. Features like bulk claims processing, centralized patient eligibility checks, and dashboard analytics for A/R performance are highly sought after.

This opportunity is further amplified by the trend of practice acquisitions and group consolidations in metropolitan and suburban regions. Clearing houses that can support multi-state compliance, integrate with varied PMS systems, and offer dedicated account support for large DSOs will gain significant market share in the coming years.

Segments Insights

Application Insights

Eligibility and Benefit Verification Dominated the Market

Among the various applications, eligibility and benefit verification dominated the U.S. dental clearing houses market. Real-time eligibility verification is a crucial step in revenue cycle management, helping front-office staff determine a patient’s coverage before treatment. This reduces the risk of claim denials, improves patient satisfaction, and supports accurate treatment planning.

Dental clearing houses offer automated tools that connect with payers to retrieve up-to-date insurance coverage details, co-payments, deductibles, and treatment limitations. These tools are integrated directly into practice management systems, allowing seamless verification at the point of care. For example, a dental practice using real-time verification through a clearing house reduces coverage-related denials by up to 30%, enhancing cash flow and minimizing rework.

Claim Payment is the Fastest-Growing Segment

Claim payment processing is the fastest-growing application, driven by the shift toward electronic remittance advice (ERA) and automated payment reconciliation. Dental practices are moving away from paper checks and Explanation of Benefits (EOB) documents to digital formats that integrate directly with financial software and bank accounts.

Clearing houses now provide ERA delivery, auto-posting features, and payment discrepancy detection, enabling quicker revenue realization. These platforms also offer batch payment reconciliation tools for DSOs handling thousands of transactions across multiple clinics. As providers aim to shorten revenue cycles and increase payment transparency, demand for advanced claim payment solutions is accelerating.

Country-Level Analysis

In the United States, the dental clearing houses market is flourishing due to high dental insurance penetration, widespread use of electronic health records (EHRs), and regulatory initiatives supporting EDI adoption. The U.S. healthcare system’s complexity, with over 900 dental insurance carriers and various plan types, creates a natural demand for intermediaries that can translate, validate, and route transactions efficiently.

Federal mandates around HIPAA 5010 standards and state-level electronic claims submission requirements have further encouraged dental providers to adopt clearing house platforms. Additionally, the increasing number of multi-location practices and group networks is expanding the need for scalable revenue cycle management solutions.

Companies based in the U.S. are leading innovation in clearing house services, offering cloud-native platforms, AI-enhanced claim scrubbing, and smart analytics dashboards tailored for dental practices. Partnerships with major practice management software providers such as Dentrix, Eaglesoft, and Open Dental have strengthened the domestic ecosystem and improved interoperability.

Recent Developments

-

April 2025 – DentalXChange announced a strategic partnership with a leading DSO to deploy real-time benefits verification tools across over 300 clinics, enhancing claims accuracy and patient financial planning.

-

March 2025 – Vyne Dental introduced AI-powered claim status notifications, allowing dental staff to receive proactive alerts about stalled claims and avoid processing delays.

-

February 2025 – ClaimX launched a cloud-based multi-location dashboard aimed at DSOs, integrating claims submission, ERA posting, and analytics in a unified interface.

-

January 2025 – E-Assist Dental Solutions rolled out an automation suite to handle back-end RCM workflows, including follow-ups on unpaid claims and patient billing support.

-

December 2024 – Dental Intelligence acquired a dental clearing house startup to enhance its revenue analytics suite and integrate EDI tracking directly into its practice performance tools.

Key U.S. Dental Clearing Houses Companies:

- DentalXChange (EDI Health Group, dba)

- Dentrix (Henry Schein One)

- Change Healthcare

- Vyne Dental (Napa EA/MEDX LLC)

- Electronic Dental Services

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. Dental Clearing Houses market.

By Application

- Eligibility and Benefit Verification

- Claim Status Inquiry

- Claim Payment

- Remittance Advice

- Others