U.S. Dental Service Organization Market Size and Trends

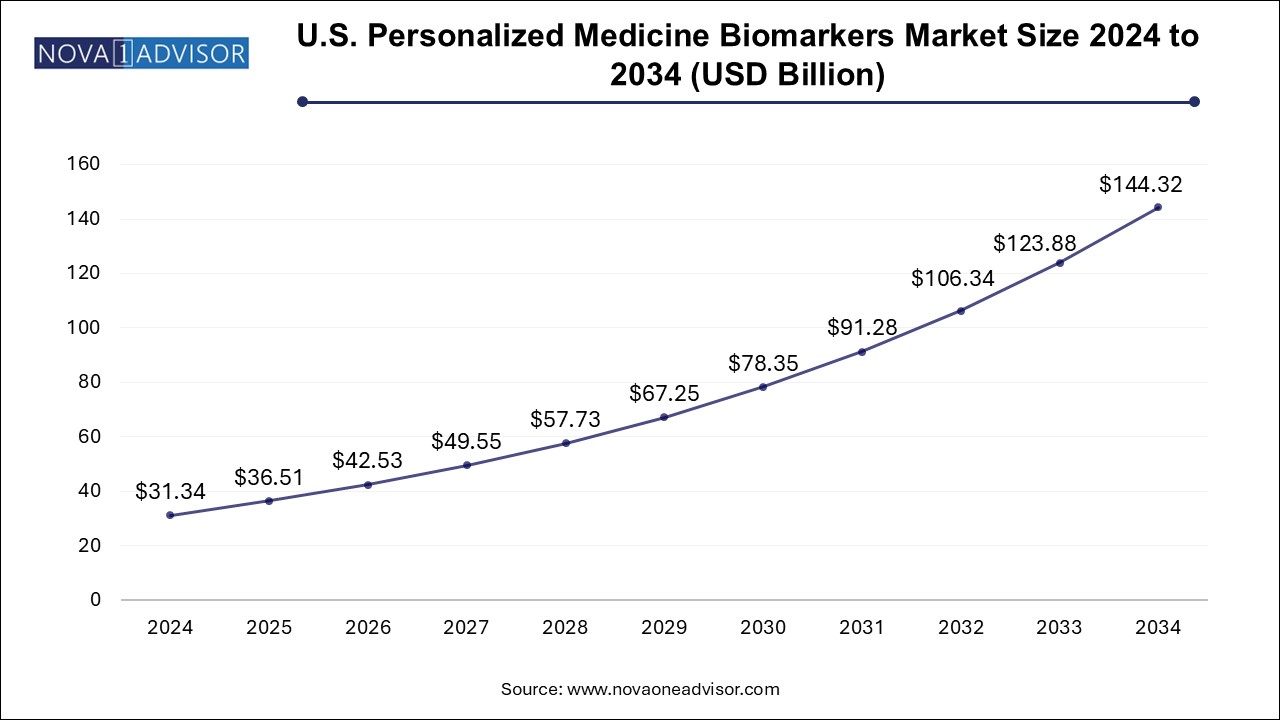

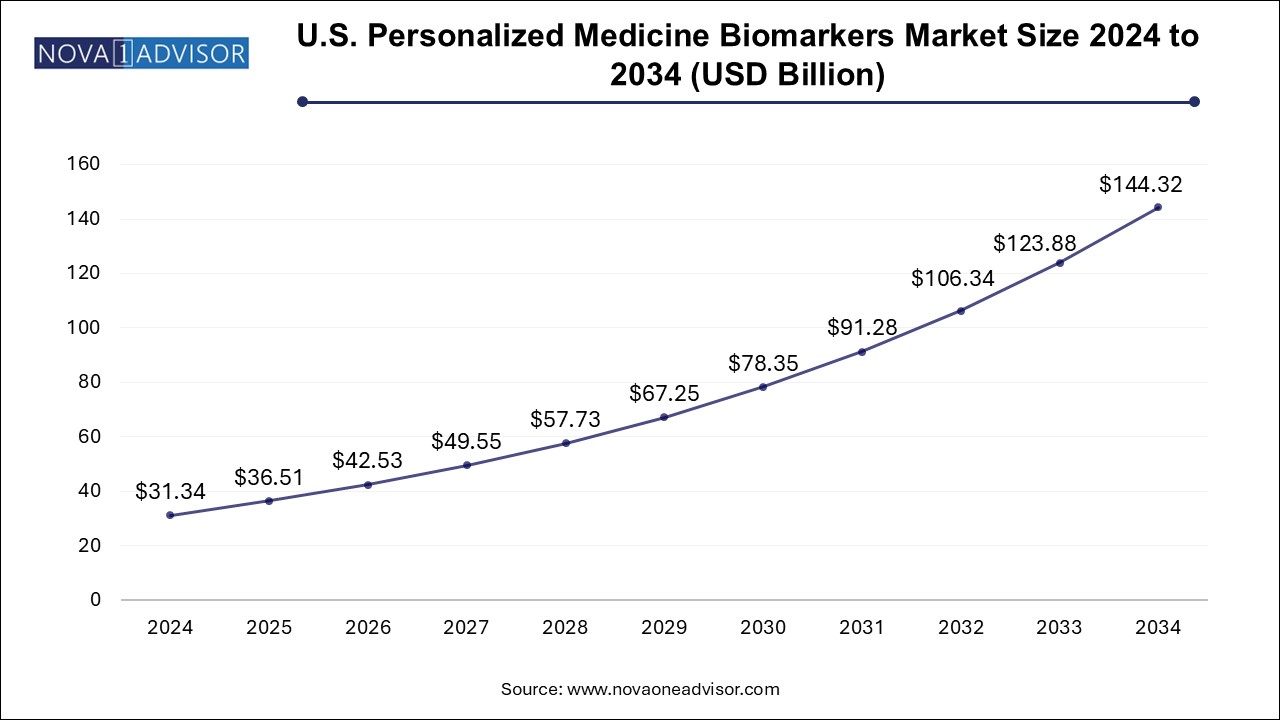

The U.S. dental service organization market size was exhibited at USD 31.34 billion in 2024 and is projected to hit around USD 144.32 billion by 2034, growing at a CAGR of 16.5% during the forecast period 2025 to 2034.

Market Overview

The U.S. Dental Service Organization (DSO) market has experienced rapid expansion over the last decade and continues to redefine the business of dental care across the country. DSOs offer a non-clinical support structure to dental practices, enabling dental professionals to focus on patient care while the business operations—including HR, billing, procurement, marketing, and regulatory compliance—are handled by the organization. This separation of clinical and administrative responsibilities enhances operational efficiency, boosts revenue performance, and ensures regulatory adherence in a highly competitive and compliance-driven sector.

As of 2024, DSOs serve thousands of dental offices nationwide, with the model increasingly popular among both solo practitioners and group dental practices. The scalability of DSOs, their technology integration, and ability to drive down procurement and marketing costs have made them a key element in the consolidation of the dental industry. In response to rising operational costs, evolving patient expectations, and regulatory complexities, more dentists are aligning with DSOs to benefit from their centralized expertise and resource-sharing model.

The dental industry in the U.S. is also witnessing a generational shift. New dental graduates, often burdened with student loans, prefer joining DSO-supported practices due to job security, mentorship opportunities, and lower business risks. Simultaneously, aging independent practitioners view DSOs as viable exit strategies that can maintain the legacy of their practices while offering financial liquidity. DSOs also cater to underserved regions and Medicaid populations through economies of scale and streamlined care delivery systems.

With technology adoption, AI-driven diagnostics, teledentistry, and data analytics transforming patient care, DSOs are playing a pivotal role in modernizing dental practices across urban and rural settings. As the U.S. healthcare ecosystem becomes more outcomes-focused and patient-centric, DSOs are evolving from administrative hubs into strategic growth enablers in the dental domain.

Major Trends in the Market

-

Surge in Private Equity Investments: A significant number of DSOs are receiving funding from private equity firms, fueling acquisitions and nationwide expansions.

-

Technology-Driven Practice Management: DSOs are investing in AI-based imaging, cloud-based EHRs, and patient engagement tools to modernize clinical workflows.

-

Shift Toward Multi-Specialty Practices: DSOs are increasingly integrating specialists—orthodontists, periodontists, endodontists—within single platforms to deliver comprehensive care.

-

Increased Focus on Value-Based Dentistry: With payers shifting towards outcome-based models, DSOs are adopting standardized protocols to track clinical outcomes and optimize patient retention.

-

Rise of De Novo Practices: DSOs are launching new, ground-up dental practices in high-growth regions instead of solely acquiring existing ones.

-

Centralized Procurement Optimization: Streamlining of medical supplies procurement through bulk purchasing is reducing cost per procedure and improving margins.

-

Enhanced Career Pathways for Dentists: DSOs offer structured growth plans, training programs, and leadership tracks for early-career and mid-level dental professionals.

Report Scope of U.S. Dental Service Organization Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 36.51 Billion |

| Market Size by 2034 |

USD 144.32 Billion |

| Growth Rate From 2025 to 2034 |

CAGR of 16.5% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

Service, End-use, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Key Companies Profiled |

Pacific Dental; Heartland Dental; Aspen Dental; DentalCare Alliance; 42North Dental; Colosseum Dental Group; GSD Dental Clinics; Dentelia; MB2 DENTAL |

Key Market Driver: Rising Operational Complexity in Independent Dental Practices

A primary driver of the U.S. DSO market is the increasing operational and administrative complexity faced by independent dental practices. Today’s dental offices must navigate a labyrinth of challenges—from managing payer contracts and credentialing to ensuring compliance with OSHA and HIPAA regulations. Simultaneously, they must also handle marketing, recruitment, financial forecasting, and supplier negotiations.

This level of multitasking often leads to burnout, reduced patient focus, and suboptimal business performance. DSOs alleviate these burdens by offering centralized, expert-led support functions across human resources, accounting, procurement, and regulatory affairs. This allows dentists to prioritize patient care while scaling their practice with improved profitability and risk management. The shift from clinician-as-entrepreneur to clinician-as-provider is a notable structural change in the U.S. dental landscape—and DSOs are at the heart of it.

Key Market Restraint: Concerns Around Clinical Autonomy and Standardization

One of the key restraints affecting DSO adoption is the perceived erosion of clinical autonomy. Critics argue that DSO-led practices, in some cases, may prioritize business metrics over individualized patient care. Dentists operating within such structures often report feeling pressured to meet production quotas, potentially at the cost of optimal treatment planning.

While many DSOs enforce ethical practice standards and uphold clinical freedom, the standardized protocols, KPI tracking, and central decision-making can be seen as limiting to highly experienced practitioners. Additionally, there are ongoing legal and ethical debates about non-dentists owning or influencing clinical operations under the DSO model, further complicating public and professional perception in some states.

Key Market Opportunity: Expanding Access to Care in Underserved and Medicaid Regions

The U.S. has long struggled with uneven dental care access, especially in rural, low-income, and Medicaid-dependent areas. DSOs, due to their scale, structured management, and technological integration, are uniquely positioned to bridge this gap. By optimizing care delivery across multiple sites and utilizing centralized operations, DSOs can deliver affordable, standardized, and high-quality dental services to these populations.

Additionally, DSOs can absorb the administrative challenges of dealing with Medicaid billing and compliance—an area that independent practices often avoid due to its complexities. Several leading DSOs have already expanded into these underserved markets, enhancing access to preventative and restorative care. In the long term, public health agencies and state governments may further incentivize DSO participation in these regions through partnerships and policy support, creating an important growth corridor.

U.S. Dental Service Organization Market By End-use Insights

General dentists are the leading end-use segment, comprising the majority of DSO-affiliated professionals. These dentists perform a broad spectrum of treatments, including cleanings, fillings, crowns, and cosmetic procedures. DSOs offer general dentists an environment that minimizes administrative distractions, provides clinical tools and mentorship, and guarantees steady patient flow. Moreover, these practitioners benefit from shared infrastructure and access to continuing education within the DSO network.

The fastest-growing segment, however, is endodontists, who are increasingly being integrated into multi-specialty DSO platforms. Root canal procedures and other endodontic treatments are high-value services that require specialized tools and expertise. Rather than referring patients externally, DSOs are incorporating these specialists in-house to retain revenue, reduce patient leakage, and enhance care continuity. As the U.S. population ages and demand for complex dental procedures rises, the role of in-network specialists like endodontists is expected to grow substantially.

U.S. Dental Service Organization Market By Service Insights

Human resources services dominated the DSO market in 2024, owing to the critical need for efficient recruitment, onboarding, and retention of dental professionals. DSOs manage vast dental networks and need to consistently fill roles across dentists, hygienists, assistants, and office staff. These services also include credentialing, performance management, and continuing education programs. With the dental industry facing talent shortages, DSOs are enhancing HR capabilities to attract and retain skilled professionals through benefits administration, flexible work schedules, and structured career growth plans.

The fastest-growing segment is medical supplies procurement, driven by the rising importance of cost containment in clinical operations. DSOs utilize centralized purchasing systems to negotiate better terms with suppliers, reduce inventory overhead, and ensure standardization of materials across locations. This streamlining enhances procedural quality and drives down per-unit treatment costs. With rising inflation in dental consumables and the proliferation of disposable products in infection control, procurement efficiency has become a strategic focus for DSO leadership.

Some of the prominent players in the U.S. dental service organization market include:

- Pacific Dental

- Heartland Dental

- Aspen Dental

- DentalCare Alliance

- 42North Dental

- Colosseum Dental Group

- GSD Dental Clinics

- Dentelia

- MB2 DENTAL

U.S. Dental Service Organization Market Recent Developments

-

In March 2025, Heartland Dental announced the launch of its "Next Gen Practice Support Platform," an AI-powered management system for HR, scheduling, and patient analytics, designed to enhance operational transparency across over 1,700 affiliated practices.

-

Pacific Dental Services (PDS) partnered with Epic Systems in February 2025 to roll out integrated medical-dental EHRs across its network—becoming one of the first DSOs to bridge dental data with broader healthcare systems.

-

Aspen Dental, a division of the TAG – The Aspen Group, opened 25 new locations in January 2025, with a focus on underserved and rural areas in Alabama and Mississippi, supporting their mission to improve access to care.

-

In December 2024, Dental Care Alliance acquired a 15-practice group in the Midwest, reinforcing its position as one of the largest DSO networks in the region with over 400 locations nationwide.

-

Benevis, in November 2024, launched a new pediatric and family dental care initiative called Healthy Smiles Alliance, targeting communities with limited dental access across the Southeast, in partnership with regional Medicaid programs.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the U.S. dental service organization market

By Service

- Human Resources

- Marketing & Branding

- Accounting

- Medical Supplies Procurement

- Others

By End-use

- Dental Surgeons

- Endodontists

- General Dentists

- Others

By Regional

- West

- Midwest

- Northeast

- Southwest

- Southeast