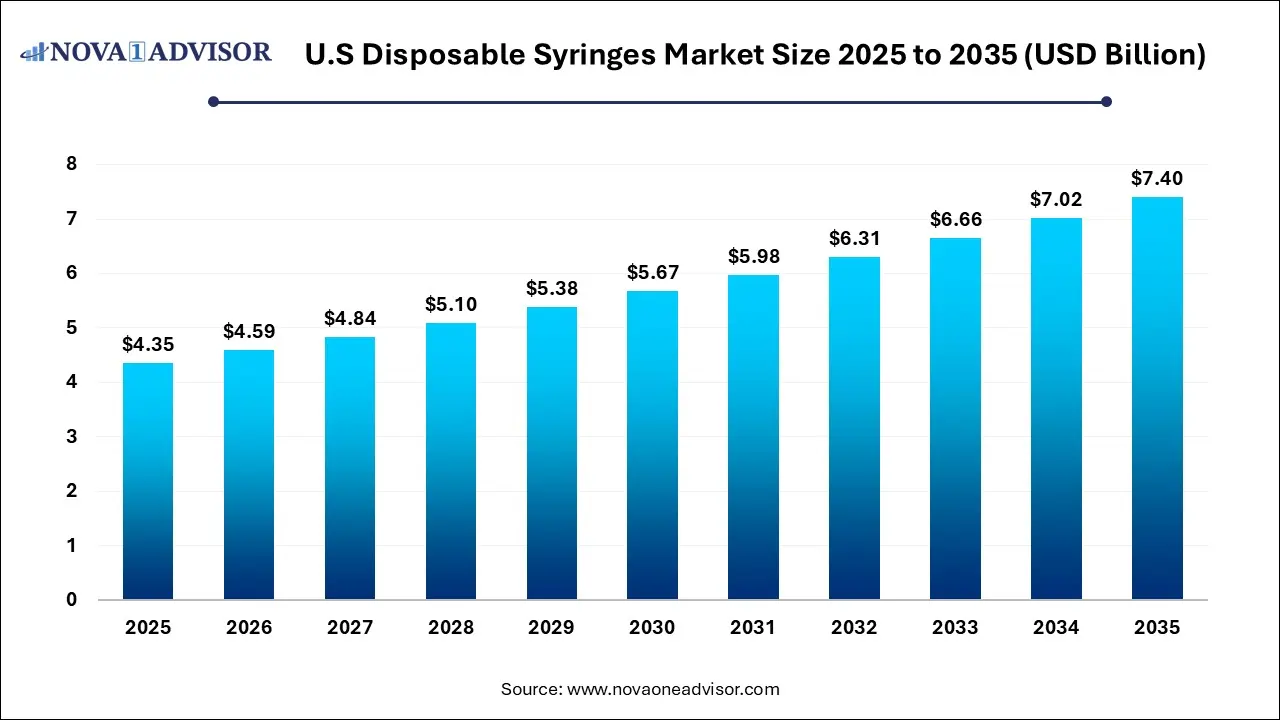

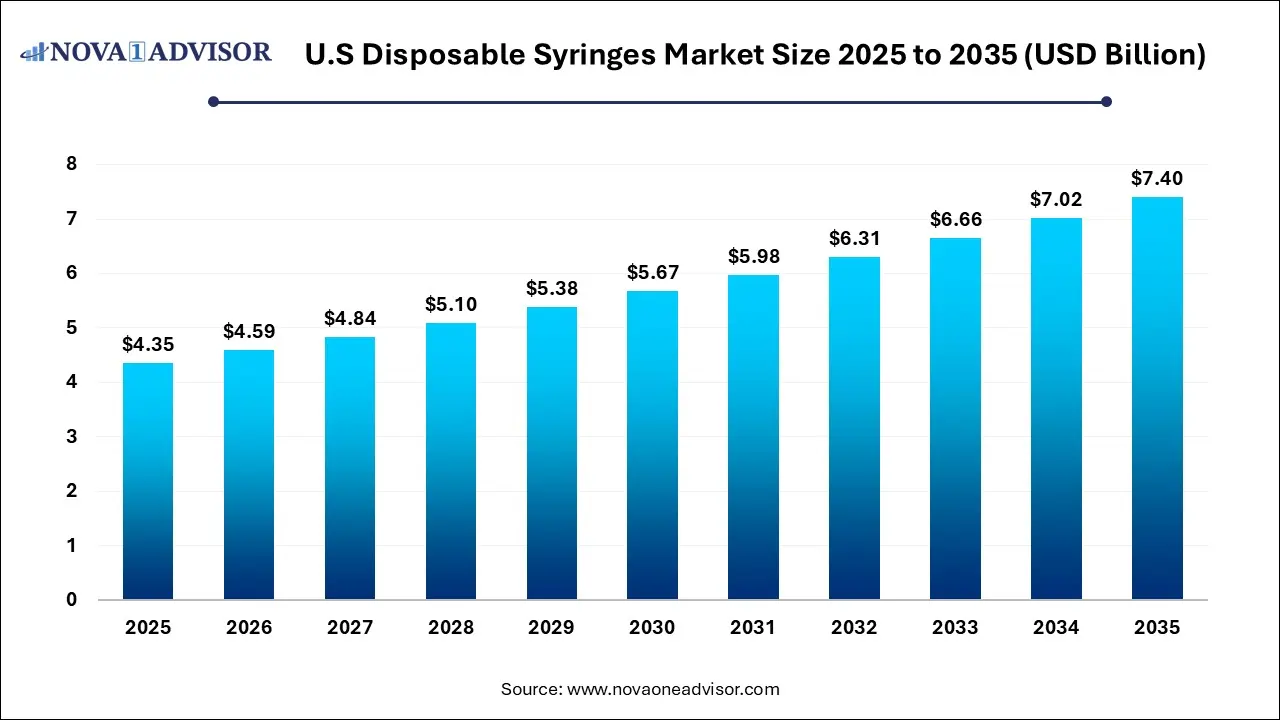

U.S. Disposable Syringes Market Size and Growth

The U.S. disposable syringes market size was exhibited at USD 4.35 billion in 2025 and is projected to hit around USD 7.40 billion by 2035, growing at a CAGR of 5.46% during the forecast period 2026 to 2035.

Key Takeaways:

- The safety syringes held the largest market share of 64.5% in 2025.

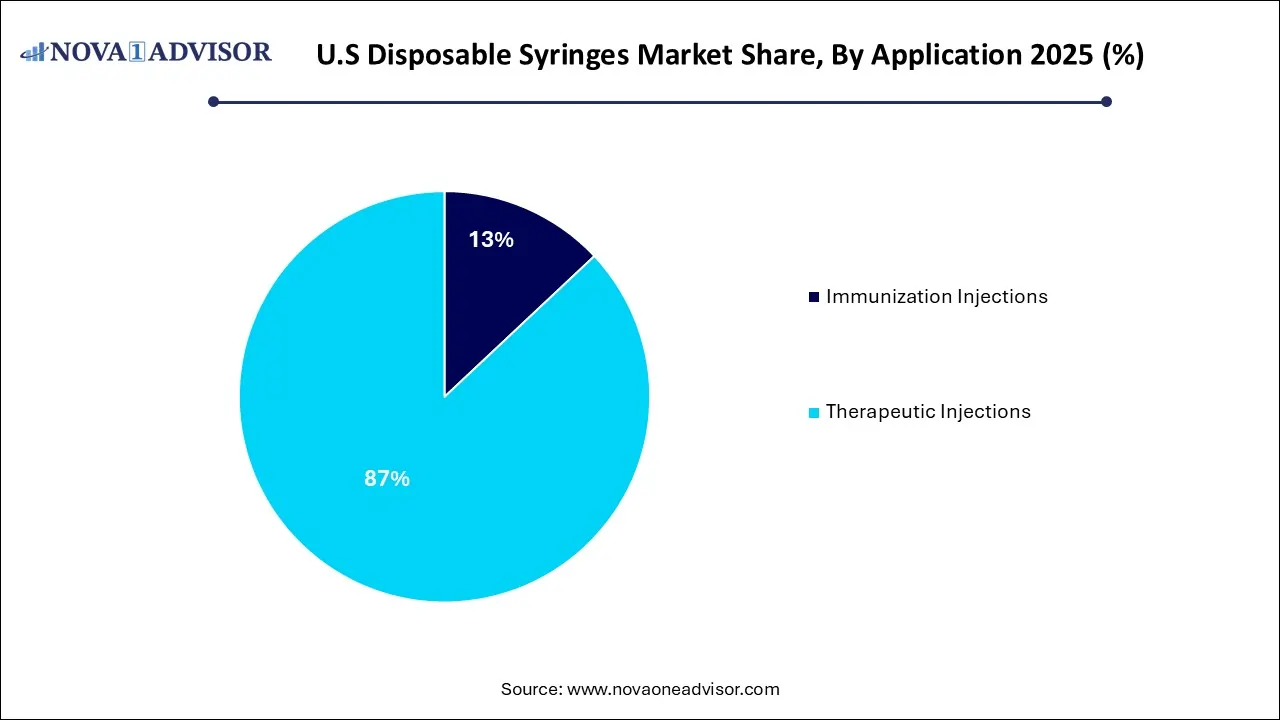

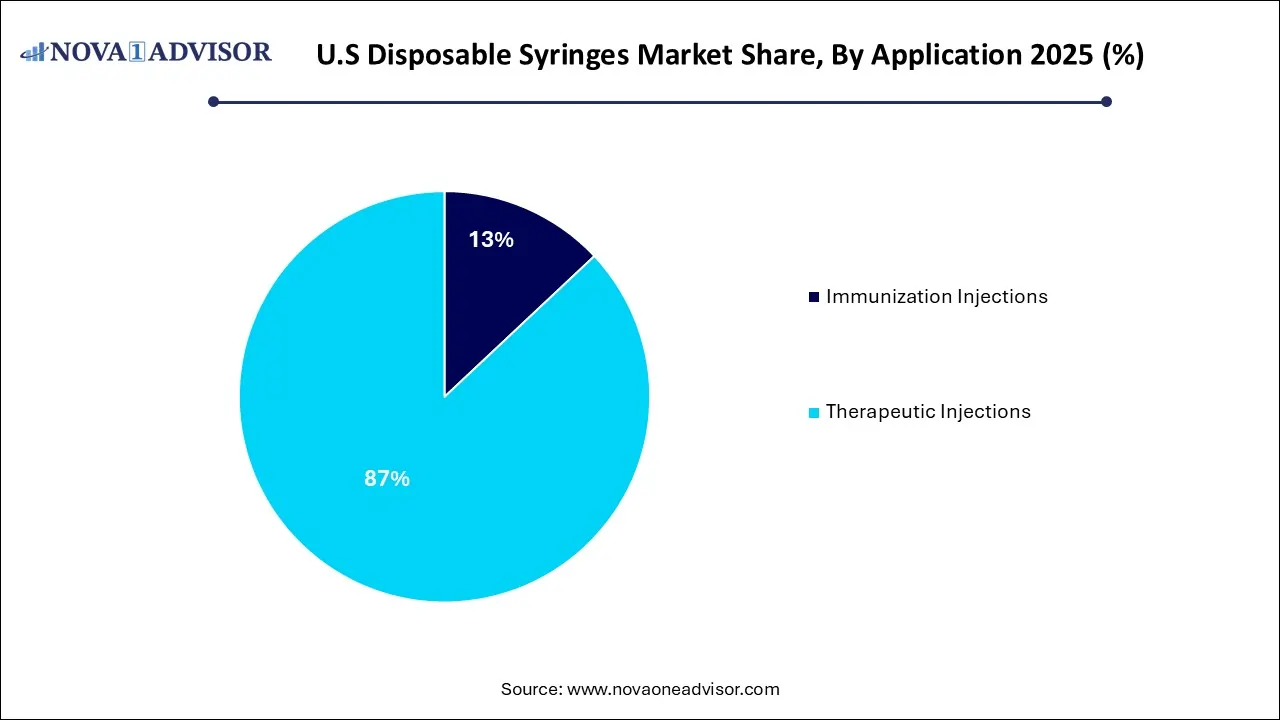

- Therapeutic injections led the market and accounted for 87% share in 2025.

- The immunization injections segment is projected to exhibit the fastest growth over the forecast period.

Market Overview

The U.S. Disposable Syringes Market is a vital component of the country’s healthcare ecosystem, serving both clinical and outpatient settings across public and private institutions. Disposable syringes are single-use instruments designed to prevent the transmission of infectious diseases and cross-contamination. Their use spans across therapeutic procedures, immunizations, diagnostic purposes, and drug administration. These devices have become indispensable in modern healthcare due to the heightened focus on patient safety, stringent infection control practices, and the rising prevalence of chronic and infectious diseases.

With the growing pressure on healthcare systems to deliver safe, cost-effective, and high-quality patient care, disposable syringes have gained immense traction. The increasing shift toward outpatient and home healthcare services is also contributing significantly to market growth. Moreover, advancements in syringe design such as retractable needles and self-destructing mechanisms—are pushing innovation boundaries and encouraging widespread adoption in various medical scenarios.

The COVID-19 pandemic brought disposable syringes into sharper focus due to mass vaccination drives. This period witnessed a dramatic surge in demand, which triggered heightened production, government contracts, and supply chain expansion initiatives across the country. Post-pandemic, the momentum persists due to an increased awareness regarding immunization and safety in injection practices.

The U.S., with its robust healthcare infrastructure, active pharmaceutical sector, and growing emphasis on health awareness, is positioned as one of the leading markets for disposable syringes globally. The presence of major global and domestic syringe manufacturers also contributes to the country's commanding presence in this space.

Major Trends in the Market

-

Rising Preference for Safety Syringes: Due to concerns over needle-stick injuries and transmission of infections like HIV and Hepatitis B & C, the demand for safety syringes has skyrocketed.

-

Increased Adoption of Retractable Syringes: These syringes automatically retract the needle into the barrel after use, reducing injury risk and are favored in hospitals and immunization programs.

-

Governmental Push for Immunization: Ongoing vaccination campaigns for influenza, COVID-19 boosters, and pediatric immunizations are creating consistent syringe demand.

-

Growth in Home Healthcare Services: Self-injection devices and insulin delivery at home have increased the usage of disposable syringes among diabetics and elderly patients.

-

Sustainability Initiatives: Efforts to develop biodegradable syringes and reduce plastic waste are gaining ground amid increasing environmental consciousness.

-

Technological Integration: Smart syringes with pre-measured doses and tamper-proof designs are being introduced to improve dosing accuracy and prevent misuse.

-

Rise in Chronic Diseases: Conditions like diabetes, arthritis, and hormonal disorders are driving the need for regular injections, thereby increasing syringe utilization.

-

Strategic Collaborations and OEM Manufacturing: Companies are forming alliances with healthcare institutions and Original Equipment Manufacturers (OEMs) to increase their footprint.

Report Scope of The U.S. Disposable Syringes Market

| Report Coverage |

Details |

| Market Size in 2026 |

USD 4.59 Billion |

| Market Size by 2035 |

USD 7.40 Billion |

| Growth Rate From 2026 to 2035 |

CAGR of 5.46% |

| Base Year |

2025 |

| Forecast Period |

2026-2035 |

| Segments Covered |

Product, Application |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

U.S. |

| Key Companies Profiled |

Medtronic; Nipro Corp.; Fresenius Kabi AG; Baxter; Braun Medical, Inc.; Becton, Dickinson and Company (BD); Flextronics International Vita Needle Company; Terumo Corp.; Novo Nordisk; Ultimed, Inc.; Henke-Sass Wolf; Retractable Technologies, Inc. |

Market Driver: Rise in Chronic Diseases and Associated Therapies

A significant market driver is the increasing prevalence of chronic diseases such as diabetes, cancer, and autoimmune disorders, which require frequent drug administration via injections. The Centers for Disease Control and Prevention (CDC) reports that 6 in 10 Americans live with at least one chronic disease. Diabetic patients often require insulin administration multiple times a day, significantly boosting syringe consumption.

In oncology, the need for precise drug dosing and the delivery of biologics via injectables ensures a steady demand for disposable syringes. Moreover, as more advanced therapies such as biologics, monoclonal antibodies, and gene therapies require injection-based delivery, the relevance of syringes continues to grow. These trends indicate an underlying and ever-growing need for reliable and safe drug administration tools particularly those that minimize infection risks—thereby making disposable syringes an essential tool in therapeutic regimens.

Market Restraint: Environmental Concerns and Plastic Waste Management

Despite their utility, disposable syringes contribute significantly to medical waste, particularly plastic waste, which poses a serious environmental challenge. The U.S. healthcare system generates around 5.9 million tons of waste annually, a substantial portion of which comprises single-use plastic medical devices, including syringes. Improper disposal of syringes can lead to accidental injuries, environmental pollution, and potential biohazards.

Additionally, the rising awareness among consumers and institutions regarding sustainability is pressuring manufacturers to rethink their material choices. However, transitioning to biodegradable alternatives can be cost-intensive and technologically challenging. Moreover, regulatory barriers and standardization issues related to eco-friendly syringes further delay innovation in this space, acting as a barrier to market growth.

Market Opportunity: Surge in At-home Treatment and Self-administration Devices

An emerging opportunity in the U.S. market is the growing trend of home healthcare and self-administration of medications. With the rising burden of chronic illnesses and a growing elderly population, patients increasingly prefer the comfort and cost-efficiency of receiving treatment at home. Devices like pre-filled syringes and user-friendly disposable injectors cater to this trend and have seen considerable innovation.

Pharmaceutical companies are now designing drug formulations compatible with at-home injection use, fueling demand for safe, easy-to-use disposable syringes. The U.S. government and private insurers are also supporting home-based care through reimbursement programs, expanding access and driving market opportunity. This trend not only increases syringe consumption but also influences syringe design innovations tailored for non-professional use.

U.S. Disposable Syringes Market By Product Insights

Safety syringes dominated the U.S. disposable syringes market in 2025, primarily due to regulatory mandates and institutional policies promoting their use in clinical settings. The Occupational Safety and Health Administration (OSHA) mandates the use of safer medical devices, including safety syringes, to protect healthcare workers from needlestick injuries. These syringes have mechanisms such as sliding sheaths or retractable needles that reduce the likelihood of accidental exposure. Hospitals and clinics are increasingly transitioning from conventional to safety syringes, particularly in emergency rooms and surgical wards, where speed and safety are critical. Their adoption is further encouraged by compliance requirements and reduced legal liability for healthcare institutions.

Retractable safety syringes are anticipated to be the fastest growing sub-segment. These advanced devices offer enhanced safety by automatically retracting the needle into the barrel after injection, thus completely eliminating exposure. Unlike non-retractable variants, which may still leave the needle exposed after activation, retractable syringes offer superior protection, making them ideal for mass immunization campaigns and use in high-risk zones. The increasing adoption of these syringes in outpatient and public health initiatives, combined with recent FDA approvals for newer models, positions them as a key growth segment over the next decade.

U.S. Disposable Syringes Market By Application Insights

Therapeutic injections held the largest share of the U.S. disposable syringes market, owing to the high volume of drug administration procedures in hospitals and outpatient settings. These injections are essential for delivering antibiotics, insulin, cancer therapies, and hormone treatments. Chronic illnesses that require repeated, scheduled injections contribute heavily to syringe consumption. Furthermore, the demand for injectable biologics and biosimilars is expanding, with more pharmaceutical companies opting for injectable formulations over oral ones for improved efficacy. These dynamics make therapeutic injections a critical application domain, supported by increasing clinical visits and healthcare consumption per capita in the United States.

Immunization injections are the fastest-growing application, driven largely by mass vaccination campaigns, booster programs, and preventive healthcare policies. The aftermath of the COVID-19 pandemic established a new baseline for immunization preparedness in the U.S. Regular flu shots, emerging virus inoculations, pediatric vaccines, and adult booster campaigns contribute to a continuous demand. Government bodies such as the CDC and public-private collaborations are investing in long-term vaccine infrastructure, including syringe stockpiling and distribution frameworks. This proactive approach toward immunization is fueling growth, especially among public health departments and school immunization programs.

Country-Level Analysis

The United States represents a mature yet dynamically evolving landscape for disposable syringes. As of 2025, healthcare expenditure per capita is among the highest globally, allowing widespread access to quality healthcare and enabling the implementation of advanced safety protocols. The country’s large elderly population and high chronic disease incidence drive syringe consumption significantly.

Federal and state agencies, including the FDA and CDC, strongly influence syringe usage through regulatory mandates and immunization policies. The country’s inclination toward innovation, coupled with government-supported medical safety initiatives, keeps the market technologically progressive. Moreover, the presence of leading syringe manufacturers such as Becton, Dickinson and Company headquartered in the U.S., ensures domestic availability, strategic sourcing, and accelerated adoption of cutting-edge syringe solutions.

Recent Developments

-

In March 2025, Becton, Dickinson and Company (BD) announced the expansion of its U.S. production facility in Nebraska to scale up the manufacturing of retractable safety syringes, with an investment exceeding $100 million. This move supports government vaccination programs and boosts domestic self-reliance in medical supply chains.

-

In January 2025, Retractable Technologies Inc. entered into a partnership with a leading pharmaceutical company to supply specially designed retractable syringes for a home-administered biologics product, furthering its market presence in the home healthcare domain.

-

In October 2024, Cardinal Health introduced a new line of eco-friendly disposable syringes made from recyclable plastic alternatives, aiming to address sustainability concerns in medical device waste management.

-

In August 2024, Smiths Medical launched a digital awareness campaign promoting safety syringes in outpatient settings, targeting clinics, dental offices, and independent pharmacies to boost adoption of protective injection practices.

Some of the prominent players in the U.S. disposable syringes market include:

- MEDTRONIC (Covidien)

- Nipro Corporation

- Fresenius Kabi AG

- Baxter International, Inc.

- B. Braun Melsungen AG

- BD

- Terumo Corporation

- Novo Nordisk

- UltiMed, Inc.

- Henke-Sass, Wolf

- Retractable Technologies

- Flextronics International Vita Needle Company

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2035. For this study, Nova one advisor, Inc. has segmented the U.S. disposable syringes market

Product

- Conventional Syringes

- Safety Syringes

-

- Retractable Safety Syringes

- Non-retractable Safety Syringes

Application

- Immunization Injections

- Therapeutic Injections