U.S. Durable Medical Equipment Market Size and Trends

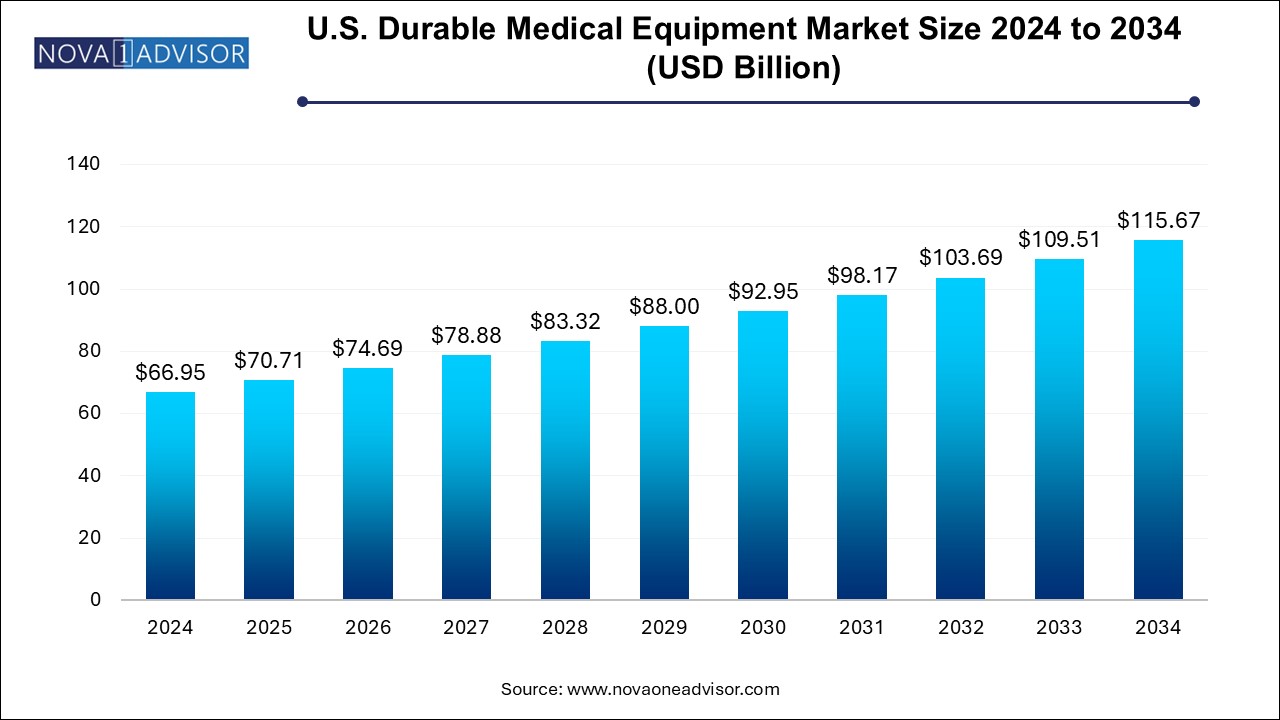

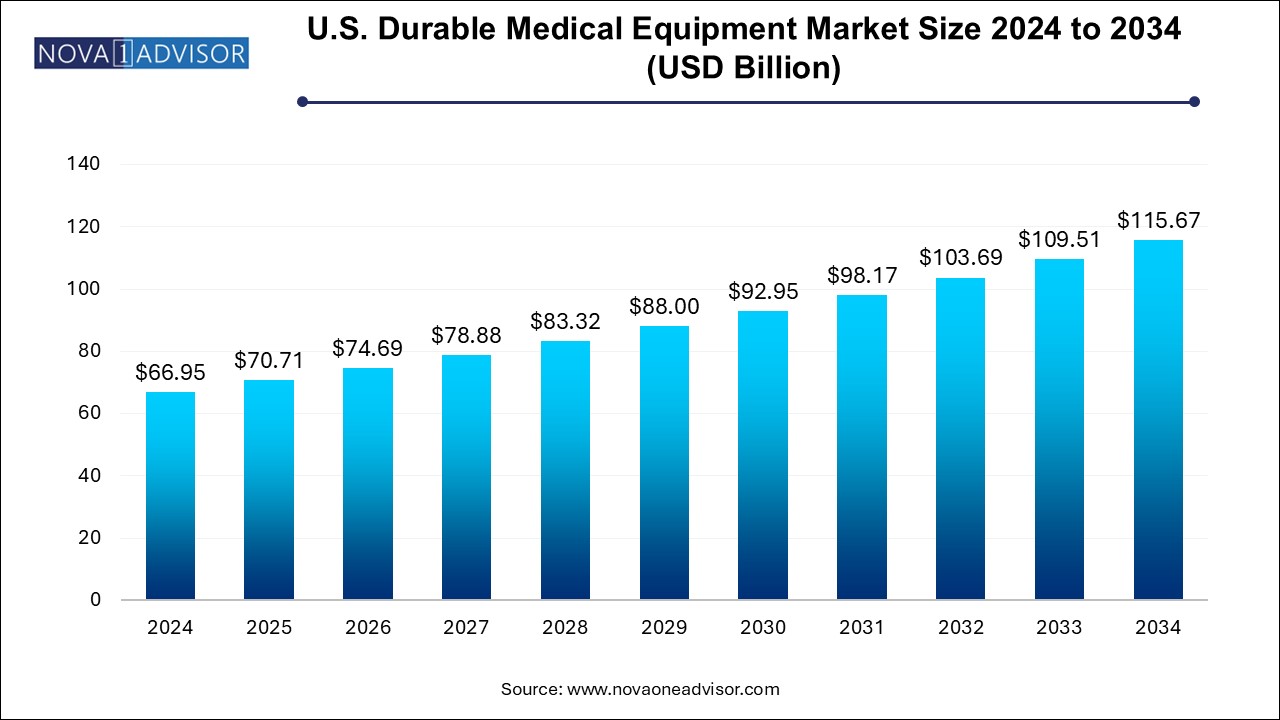

The U.S. durable medical equipment market size was exhibited at USD 66.95 billion in 2024 and is projected to hit around USD 115.67 billion by 2034, growing at a CAGR of 5.64% during the forecast period 2024 to 2034.

U.S. Durable Medical Equipment Market Key Takeaways:

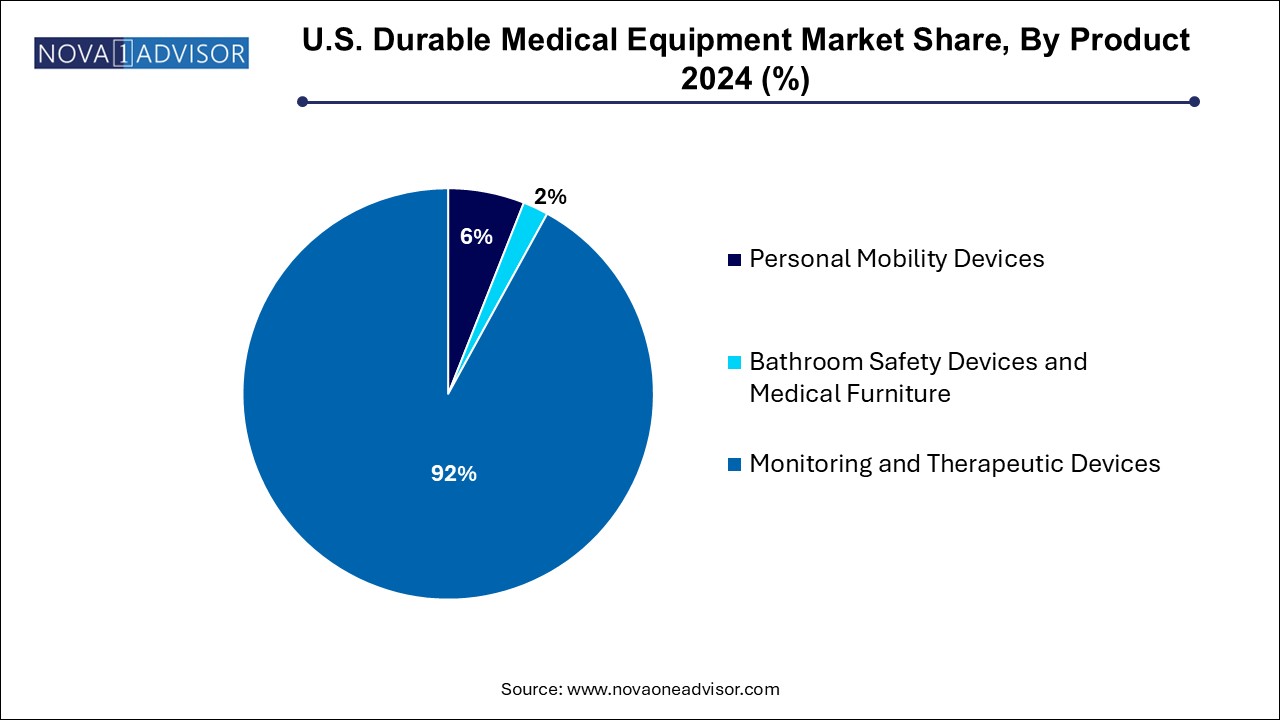

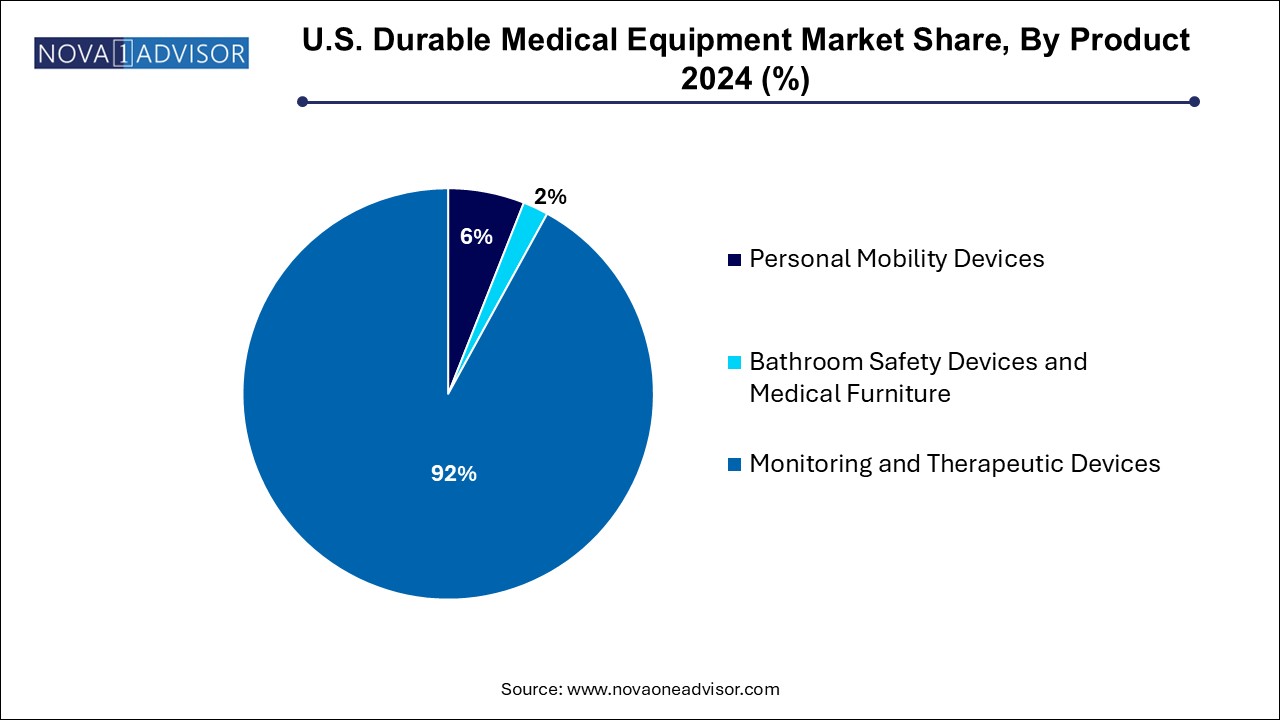

- The monitoring and therapeutic devices segment held the largest revenue share of over 92.0% in 2024.

- The personal mobility devices segment is anticipated to register the fastest growth rate during the forecast period.

- Hospitals segment dominated the market in 2024 driven by a surge in patients with rising chronic diseases in the country.

- Home healthcare is expected to witness the highest growth rate over the forecast period.

Market Overview

The U.S. Durable Medical Equipment (DME) Market is a crucial pillar in the continuum of healthcare, providing patients with medical devices and tools that serve long-term therapeutic or diagnostic needs. These products are essential for individuals with chronic conditions, temporary impairments, or mobility challenges, and are used across a wide range of settings, including hospitals, outpatient clinics, rehabilitation centers, and homes. From wheelchairs and hospital beds to glucose monitors and oxygen equipment, DME supports both clinical outcomes and patient independence.

The market has seen consistent growth, driven by an aging population, rising prevalence of chronic diseases such as diabetes, COPD, and cardiovascular ailments, and the increasing preference for home-based care. The COVID-19 pandemic further spotlighted the relevance of DME, with surging demand for oxygen concentrators, ventilators, and remote monitoring tools. Additionally, technological advancements have expanded the range and functionality of equipment, while evolving reimbursement models have made certain high-cost devices more accessible to patients.

Private insurance and Medicare/Medicaid play critical roles in shaping the market, influencing both utilization and innovation through reimbursement policies and regulations. In response, manufacturers and suppliers are adopting more patient-centric business models, including rental programs, direct-to-consumer delivery, and subscription-based platforms. As healthcare delivery becomes more decentralized, the demand for reliable, portable, and user-friendly durable medical equipment is poised for continued expansion in the U.S.

Report Scope of The U.S. Durable Medical Equipment Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 70.71 Billion |

| Market Size by 2034 |

USD 115.67 Billion |

| Growth Rate From 2024 to 2034 |

CAGR of 5.62% |

| Base Year |

2024 |

| Forecast Period |

2024-2034 |

| Segments Covered |

Product, end-use |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

U.S. |

| Key Companies Profiled |

Invacare Corp.; Sunrise Medical; Arjo; Medline Industries, Inc.; GF Healthcare Products, Inc.; Carex Health Brands, Inc.; Cardinal Health; Drive DeVilbiss Healthcare; NOVA Medical Products; Kaye Products, Inc. |

Market Driver: Aging Population and Rise in Chronic Diseases

One of the key drivers of the U.S. Durable Medical Equipment Market is the rapidly aging population and the corresponding increase in chronic health conditions. According to the U.S. Census Bureau, the number of Americans aged 65 and above is projected to exceed 80 million by 2040. This demographic is more susceptible to conditions such as arthritis, osteoporosis, respiratory diseases, and cardiovascular disorders that require long-term device support for mobility, monitoring, and therapy.

For instance, the use of electric wheelchairs, oxygen concentrators, CPAP machines, and home-based dialysis equipment has become more prevalent among seniors. These devices enable patients to remain independent while reducing the need for frequent hospital visits. Simultaneously, the growing demand for in-home care services complements the adoption of DME, positioning the market for robust, sustainable growth.

Market Restraint: Reimbursement Challenges and Regulatory Complexity

A significant restraint affecting the DME market in the U.S. is the complexity and limitations surrounding reimbursement policies. Although Medicare and Medicaid provide coverage for a wide array of durable medical equipment, the reimbursement process is often cumbersome, slow, and subject to change. Strict documentation requirements, prior authorization protocols, and capped rental rules can delay access to necessary equipment and place financial burdens on both providers and patients.

Additionally, evolving FDA regulations and compliance standards related to safety, traceability, and cybersecurity in smart devices add another layer of operational challenge for manufacturers. These constraints can deter smaller companies from entering the market and limit the pace of innovation, especially for niche or specialized equipment categories.

Market Opportunity: Technological Innovation in Portable and Smart DME

The advancement of portable and smart DME presents a significant opportunity for market expansion. With rising demand for real-time health data and continuous care, medical devices that integrate sensors, Bluetooth connectivity, and mobile app compatibility are becoming increasingly popular. These features are especially valuable for managing chronic conditions like diabetes, hypertension, and sleep apnea.

For example, insulin pumps that automatically adjust dosage, CPAP machines that sync with patient smartphones, and smart wheelchairs with navigational assistance enhance both user experience and clinical outcomes. Such innovations not only improve compliance and safety but also empower patients and caregivers with actionable insights. As the digital health ecosystem matures, the intersection of DME and connected health is expected to generate new value streams and attract broader healthcare partnerships.

U.S. Durable Medical Equipment Market By Product Insights

Personal Mobility Devices dominate the U.S. DME market, accounting for the largest share due to the high prevalence of age-related mobility challenges and post-operative recovery needs. This segment includes electric and manual wheelchairs, scooters, walkers, rollators, and crutches. With increasing rates of musculoskeletal conditions, joint replacements, and spinal injuries, the demand for mobility aids has steadily risen. Furthermore, innovations like foldable electric scooters and lightweight aluminum rollators make mobility more accessible and user-friendly. Hospitals, rehab centers, and home healthcare providers continue to prioritize mobility devices to ensure patient autonomy and fall prevention.

Monitoring and Therapeutic Devices are emerging as the fastest-growing segment, supported by the surge in chronic disease management and telehealth adoption. Devices like blood glucose monitors, infusion pumps, CPAP machines, and oxygen equipment are now integral to at-home therapy. Notably, CPAP machines have seen increased demand due to growing awareness around sleep apnea. Portable oxygen concentrators are widely used for COPD patients, enabling travel and active lifestyles. As healthcare transitions toward decentralized and patient-managed models, monitoring and therapeutic DME will continue to gain traction across both clinical and consumer channels.

U.S. Durable Medical Equipment Market By End Use Insights

Hospitals represent the largest end-use segment of the U.S. DME market due to their broad usage of medical furniture, diagnostic devices, and respiratory and monitoring tools. Acute and chronic care environments rely on a wide range of durable equipment, from traction beds and commodes to suction pumps and cardiac monitors. As hospitals focus on reducing inpatient duration and enhancing post-discharge support, they continue to partner with DME vendors to ensure seamless care continuity. Furthermore, integrated health systems are centralizing procurement and maintenance operations to reduce costs and improve asset utilization.

Home Healthcare is the fastest-growing end-use segment, fueled by patient preference for home-based recovery and the economic advantages of outpatient care. In-home use of CPAP machines, glucose monitors, and orthopedic supports is growing rapidly, especially among elderly patients and individuals with mobility impairments. Home healthcare providers are leveraging mobile DME delivery, remote monitoring, and training services to ensure patients can safely manage complex therapies at home. This shift aligns with payer incentives for reducing hospital readmissions and supports long-term cost containment strategies.

Country-Level Analysis

In the United States, the durable medical equipment landscape is shaped by healthcare infrastructure, demographic trends, insurance policies, and innovation dynamics. High healthcare expenditure, a strong regulatory framework, and a growing chronic disease burden make the U.S. a major global hub for DME development and consumption. States with larger elderly populations, such as Florida, Texas, and Pennsylvania, exhibit higher DME demand, especially in the home healthcare segment.

Reimbursement from Medicare Part B remains a key enabler of market activity, covering equipment like oxygen devices, hospital beds, and diabetic testing supplies. However, discrepancies in reimbursement rates and delays in claims processing affect both vendors and patients. Efforts by CMS to modernize reimbursement models, as well as pilot programs promoting home-based care, are improving DME accessibility. Additionally, public health emergencies, such as the COVID-19 pandemic, have accelerated demand for respiratory and remote monitoring equipment across the country.

Some of the prominent players in the U.S. durable medical equipment market include:

- Invacare Corp.

- Sunrise Medical

- Arjo

- Medline Industries, Inc.

- GF Healthcare Products, Inc.

- Carex Health Brands, Inc.

- Cardinal Health

- Drive DeVilbiss Healthcare

- NOVA Medical Products

- Kaye Products, Inc.

Recent Developments

-

ResMed (March 2025): Introduced a new AI-enabled CPAP machine with real-time feedback and sleep quality tracking.

-

Drive DeVilbiss Healthcare (February 2025): Launched a lightweight travel oxygen concentrator tailored for COPD patients.

-

3M Healthcare (January 2025): Announced expansion into the orthopedic brace and incontinence DME categories with new product lines.

-

Invacare Corporation (December 2024): Completed a facility upgrade to increase U.S.-based production of wheelchairs and mobility scooters.

-

Medline Industries (November 2024): Rolled out a national DME logistics platform to support same-day delivery for home healthcare providers.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the U.S. durable medical equipment market

By Product

- Personal Mobility Devices

-

-

- Electric Wheelchairs

- Manual Wheelchairs

-

- Scooters

- Walker and Rollators

- Canes and Crutches

- Door Openers

- Other Devices

- Bathroom Safety Devices and Medical Furniture

-

- Commodes and Toilets

- Mattress & Bedding Devices

- Monitoring and Therapeutic Devices

-

- Blood Glucose Monitors

- Continuous Passive Motion (CPM)

- Infusion Pumps

- Nebulizers

- Oxygen Equipment

- Continuous Positive Airway Pressure (CPAP)

- Suction Pumps

- Traction Equipment

- Others Equipment

-

-

- Insulin Pumps

- Ostomy Bags & Accessories

- Wound Care Products

- Cardiology Devices

- Vital Signs Monitor

- Respiratory Supplies

- Urinary Supplies

- Diabetic Supplies

- Incontinence Products

- Orthopedic Braces & Support

- Muscle Stimulators

- Others

By End-use

- Hospitals

- Specialty Clinics

- Ambulatory Surgical Centers

- Diagnostic Centers

- Home Healthcare

- Others