U.S. Electro-medical And Electrotherapeutic Apparatus Market Size and Research

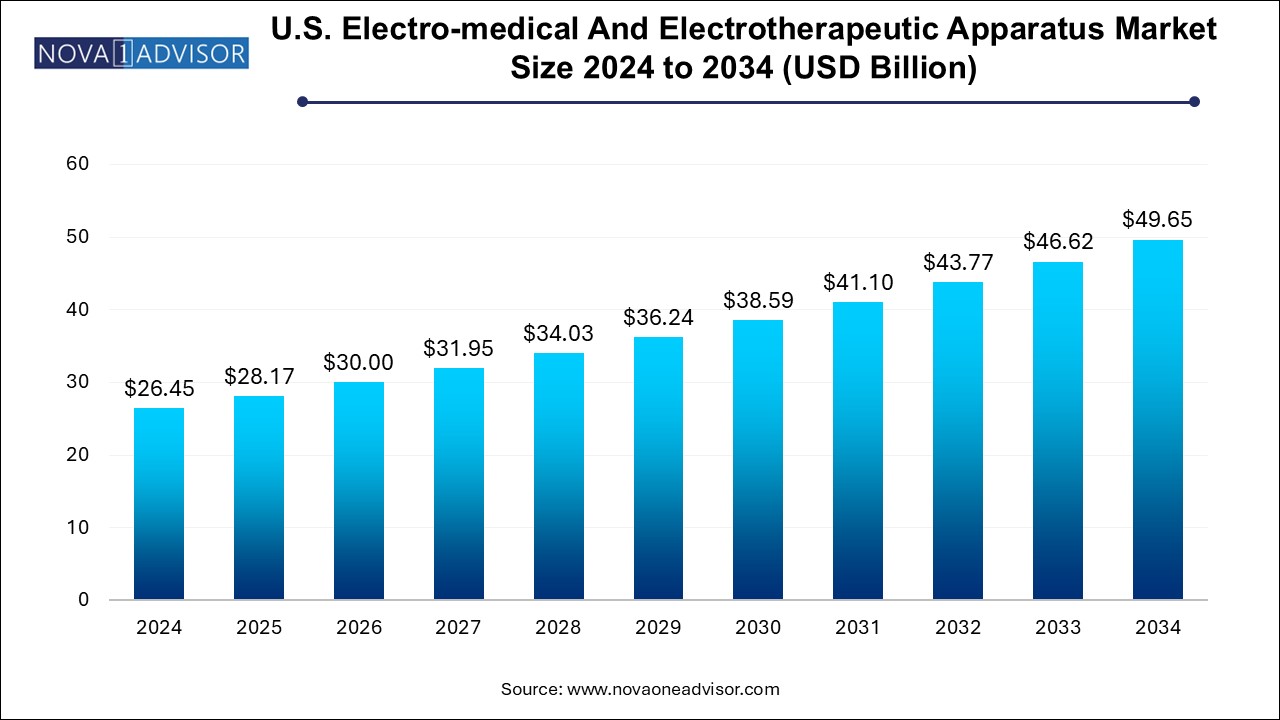

The U.S. electro-medical and electrotherapeutic apparatus market size was exhibited at USD 26.45 billion in 2024 and is projected to hit around USD 49.65 billion by 2034, growing at a CAGR of 6.5% during the forecast period 2024 to 2034.

U.S. Electro-medical And Electrotherapeutic Apparatus Market Key Takeaways:

- Diagnostic equipment segment held the largest market share of about 38.2% in 2024.

- Therapeutic equipment segment is expected to grow at a fastest CAGR of 7.2% over the forecast period.

- The cardiology segment dominated the market by capturing a share of more than 25% in 2024.

- The neurology segment is expected to grow at a CAGR over the forecast period.

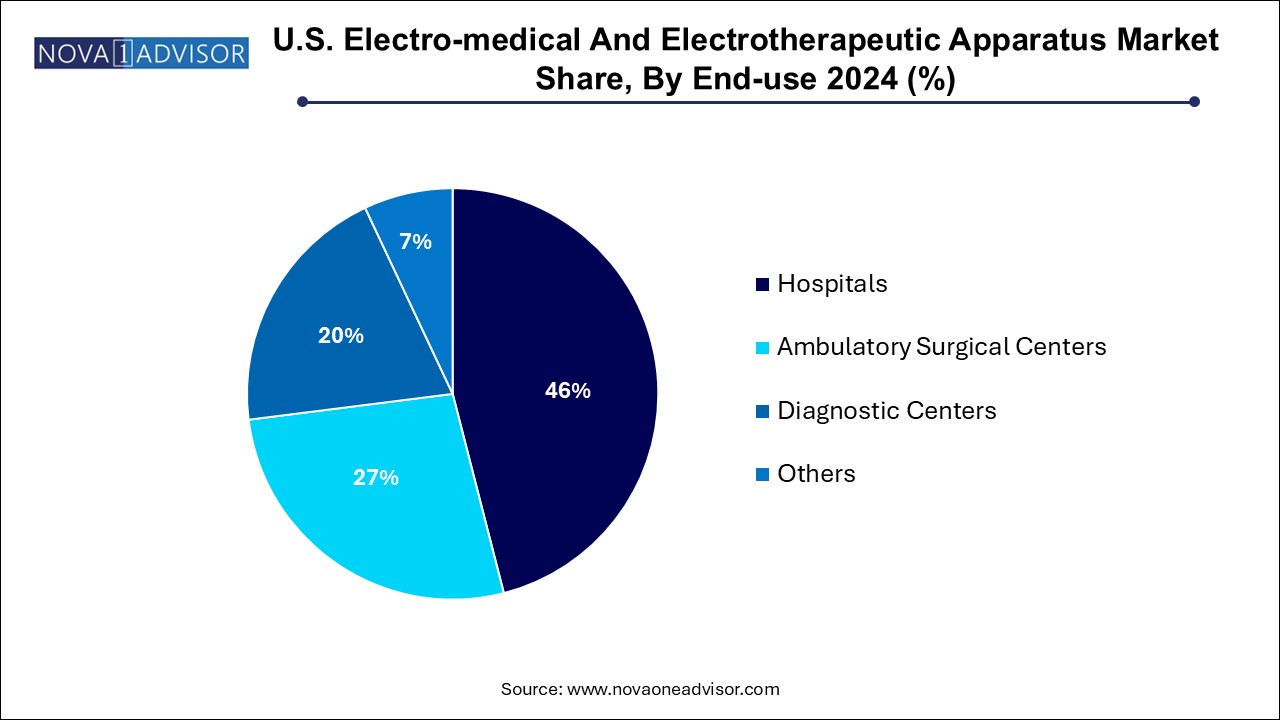

- Hospitals segment dominated the market with a share of nearly 46.0% in 2024.

- The diagnostic imaging centers segment is anticipated to experience the fastest growth over the forecast period.

Market Overview

The U.S. Electro-medical and Electrotherapeutic Apparatus Market represents a cornerstone of modern healthcare delivery, supporting a wide range of diagnostic, therapeutic, and monitoring applications. These devices employ electrical impulses, radiation, and other forms of energy to diagnose and treat medical conditions. From MRI machines and EEG monitors to transcutaneous electrical nerve stimulation (TENS) units and deep brain stimulators, electro-medical and electrotherapeutic apparatuses are central to advanced clinical care in hospitals, specialty clinics, ambulatory surgical centers, and even home healthcare environments.

This market encompasses a broad array of technologies designed to improve the precision, efficacy, and outcomes of medical procedures. Electro-medical apparatuses aid in imaging and physiological monitoring, while electrotherapeutic devices deliver therapeutic stimulation or ablation to treat conditions ranging from chronic pain to epilepsy and cancer. The integration of artificial intelligence, robotics, miniaturization, and remote monitoring is redefining the landscape, with a growing emphasis on patient-centered, data-driven care.

In the U.S., this market is propelled by high healthcare spending, robust infrastructure, and an innovation-centric medical technology ecosystem. Additionally, the presence of globally leading manufacturers and favorable FDA regulatory pathways contributes to the development and commercialization of cutting-edge technologies. With increasing demand for non-invasive therapies, personalized medicine, and home-based health solutions, the U.S. market is expected to experience steady and strategic expansion over the coming years.

Major Trends in the Market

-

Rising Adoption of Wearable Electrotherapeutic Devices: Portable and wearable devices for pain relief, cardiac rhythm monitoring, and neurostimulation are becoming mainstream in both clinical and home care settings.

-

Integration of Artificial Intelligence (AI): AI is being integrated into diagnostic imaging systems and therapy planning tools, enhancing accuracy, automation, and patient outcomes.

-

Growing Preference for Minimally Invasive Therapies: Devices offering radiofrequency ablation, TENS, and high-frequency ultrasound are gaining traction as alternatives to traditional surgical procedures.

-

Expansion of Telehealth-Compatible Devices: Electro-medical apparatuses with remote connectivity and data-sharing capabilities are supporting the rise of telemedicine and home-based care models.

-

Increased Use of Neuromodulation Techniques: Electrotherapeutic devices for vagus nerve stimulation, spinal cord stimulation, and deep brain stimulation are being more widely adopted for chronic neurological conditions.

-

Advanced Imaging Innovations: The evolution of hybrid imaging (PET/CT, MRI/PET) and portable ultrasound machines is reshaping the diagnostic landscape.

-

Personalization Through Biofeedback and Sensor Technology: Electro-medical devices are being personalized with biofeedback loops and sensor data, enabling real-time therapy adjustments.

Report Scope of U.S. Electro-medical And Electrotherapeutic Apparatus Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 28.17 Billion |

| Market Size by 2034 |

USD 49.65 Billion |

| Growth Rate From 2024 to 2034 |

CAGR of 6.5% |

| Base Year |

2024 |

| Forecast Period |

2024-2034 |

| Segments Covered |

Product, Application, End-use |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Key Companies Profiled |

GE HealthCare; Koninklijke Philips N.V.;Siemens Healthineers AG; Medtronic; Abbott; Boston Scientific Corporation; Fujifilm Holdings Corporation; Zimmer Biomet; Nihon Kohden Corporation; OMRON Healthcare, Inc.; Invacare Corporation |

Market Driver: Increasing Prevalence of Chronic and Neurological Disorders

A key growth driver for the U.S. electro-medical and electrotherapeutic apparatus market is the increasing prevalence of chronic and neurological diseases, which necessitate continuous monitoring and long-term therapeutic interventions. According to the Centers for Disease Control and Prevention (CDC), nearly 60% of U.S. adults live with at least one chronic disease, such as cardiovascular conditions, diabetes, or chronic pain disorders. These conditions often require not only diagnostic equipment like ECG or EEG monitors but also therapeutic modalities such as TENS and spinal cord stimulators.

Neurological conditions—such as Parkinson’s disease, epilepsy, and multiple sclerosis—are also on the rise, especially among the aging population. Electrotherapeutic devices, including deep brain stimulators and vagus nerve stimulators, are providing patients with effective symptom relief and improved quality of life. The demand for continuous, non-invasive, and patient-centric solutions has created a fertile environment for the adoption of advanced electro-medical devices. Furthermore, the chronic nature of these diseases ensures a recurring demand for these technologies, providing consistent revenue streams for manufacturers.

Market Restraint: High Capital Investment and Maintenance Costs

Despite their clinical benefits, high initial capital investments and maintenance requirements act as a significant barrier to broader adoption of electro-medical and electrotherapeutic apparatuses in smaller healthcare facilities and rural settings. Sophisticated imaging systems such as MRI or PET/CT machines can cost millions of dollars, not including the cost of installation, maintenance contracts, and skilled personnel training. Similarly, advanced therapeutic devices require significant upfront expenditure and regular servicing.

In outpatient settings and diagnostic centers with limited budgets, acquiring high-end equipment may not be feasible. Furthermore, reimbursement complexities and uncertainty around coverage—especially for newer or less established electrotherapeutic interventions—can deter healthcare providers from investing in these technologies. Maintenance downtime, software updates, and the need for specialized technical support also add to the total cost of ownership. These challenges limit access to advanced care in underserved regions, creating a disparity in healthcare quality.

Market Opportunity: Integration with AI and Robotics for Precision Therapy

The integration of AI and robotics into electro-medical and electrotherapeutic systems presents a transformative opportunity for the market. Artificial intelligence is enhancing imaging diagnostics through automated detection of abnormalities, reducing human error and improving workflow efficiency. In radiation therapy and neuromodulation, AI-driven treatment planning tools allow for better targeting, dosage optimization, and adaptive therapy techniques based on real-time data.

Robotic-assisted surgical platforms are increasingly utilizing electrotherapeutic components such as ablation probes and high-frequency energy sources to perform minimally invasive procedures with precision. The U.S. market, being at the forefront of medical technology adoption, is fertile ground for these advancements. Startups and established firms alike are collaborating with AI software developers and robotics companies to create next-generation devices. This convergence not only improves patient outcomes but also opens new revenue streams through service contracts, data analytics, and predictive maintenance platforms.

U.S. Electro-medical And Electrotherapeutic Apparatus Market By Product Insights

Diagnostic equipment segment held the largest market share of about 38.2% in 2024. driven by high utilization rates in hospitals, imaging centers, and clinics. Equipment such as MRI scanners, CT machines, ultrasound systems, and ECG/EEG monitors form the backbone of diagnostic medicine, enabling early and accurate identification of conditions across cardiology, neurology, and oncology. The growing emphasis on preventive care, early diagnosis, and chronic disease management has reinforced the central role of diagnostic equipment. Additionally, the development of portable and point-of-care diagnostic devices is expanding the accessibility of advanced diagnostics beyond tertiary hospitals.

Therapeutic equipment segment is expected to grow at a fastest CAGR of 7.2% over the forecast period. Devices like transcutaneous electrical nerve stimulation (TENS) units, spinal cord stimulators, radiofrequency ablation systems, and neuromodulation devices are gaining popularity for their efficacy in treating chronic pain, movement disorders, and psychiatric conditions. In particular, wearable therapeutic devices are revolutionizing home-based rehabilitation and long-term care. As clinical trials validate their effectiveness across broader indications, therapeutic equipment is becoming an essential component of modern patient care.

U.S. Electro-medical And Electrotherapeutic Apparatus Market By Application Insights

The cardiology segment dominated the market by capturing a share of more than 25% in 2024. Electrocardiography (ECG), Holter monitors, cardiac pacemakers, defibrillators, and ablation systems are widely used across the U.S. healthcare system. With cardiovascular diseases being a leading cause of death in the country, hospitals are heavily investing in both diagnostic and therapeutic electro-medical equipment to improve patient survival rates and reduce hospital readmissions. The continuous innovation in wearable cardiac monitors and AI-based arrhythmia detection tools further strengthens this segment.

The neurology segment is expected to grow at a CAGR over the forecast period. The growing availability of non-invasive brain stimulation technologies—such as vagus nerve stimulation (VNS), deep brain stimulation (DBS), and transcranial magnetic stimulation (TMS)—is transforming neurological care. Moreover, AI-enhanced EEG and brain imaging tools are making neurological diagnostics more precise. As mental health disorders and neurodegenerative diseases rise in prevalence, especially among the elderly, demand for specialized electrotherapeutic solutions is expected to surge.

U.S. Electro-medical And Electrotherapeutic Apparatus Market By End-use Insights

Hospitals segment dominated the market with a share of nearly 46.0% in 2024, From critical care units to diagnostic imaging departments and surgical theaters, hospitals rely on a wide array of electro-medical apparatuses to deliver quality care. Their capacity to invest in high-cost equipment, coupled with round-the-clock operation and a multidisciplinary workforce, makes them the leading buyers of electro-medical and electrotherapeutic systems.

However, ambulatory surgical centers (ASCs) are emerging as the fastest-growing end-use segment, thanks to the nationwide trend toward outpatient care. These centers offer same-day procedures and rely on compact, efficient, and cost-effective equipment to perform diagnostic and therapeutic interventions. ASCs are increasingly using electrotherapeutic devices for pain management, orthopedic procedures, and minor cardiac interventions. Their ability to deliver high-quality care at lower costs has made them popular among insurers and patients alike, driving investments in portable imaging systems and compact electrotherapy devices tailored for outpatient settings.

Country-Level Analysis

As the sole country in focus for this market, the United States stands as a global leader in the electro-medical and electrotherapeutic apparatus industry, both in terms of consumption and innovation. The U.S. benefits from one of the most advanced healthcare systems, with strong institutional support for R&D, favorable reimbursement structures, and early adoption of cutting-edge technologies.

Regulatory oversight by the U.S. Food and Drug Administration (FDA) ensures a high level of safety and efficacy for approved products, which in turn builds trust among healthcare providers and patients. Public-private collaborations, such as the NIH BRAIN Initiative and partnerships between academic research centers and medtech firms, foster rapid development and clinical validation of novel electrotherapeutic approaches.

Additionally, the U.S. healthcare system’s focus on value-based care and outcome improvement is pushing institutions toward data-driven, technology-enabled solutions. The growing emphasis on home healthcare, fueled by policy shifts and consumer preferences, is opening doors for wearable and portable electro-medical devices. States like California, Texas, and New York are hotspots for medtech startups and large-scale hospital networks, making them key contributors to national market dynamics.

Some of the prominent players in the U.S. electro-medical and electrotherapeutic apparatus market include:

- GE HealthCare

- Koninklijke Philips N.V.

- Siemens Healthineers AG

- Medtronic

- Abbott

- Boston Scientific Corporation

- Fujifilm Holdings Corporation

- Zimmer Biomet

- Nihon Kohden Corporation

- OMRON Healthcare, Inc.

- Invacare Corporation

U.S. Electro-medical And Electrotherapeutic Apparatus Market Recent Developments

-

In March 2024, Medtronic announced the expansion of its U.S. neurostimulation portfolio with the launch of the Intellis™ spinal cord stimulation system with AI-driven pain mapping, enabling clinicians to personalize therapy more precisely.

-

GE HealthCare launched its next-generation portable MRI system in January 2024, designed for bedside use in emergency departments and critical care units across U.S. hospitals.

-

In February 2024, Boston Scientific received FDA approval for its Vercise Genus™ Deep Brain Stimulation System, which includes enhanced battery life and wireless connectivity features tailored for Parkinson’s and dystonia treatment.

-

Abbott Laboratories introduced a wearable TENS-based pain relief device under the brand name “NeuroEase” in April 2024, targeting the growing consumer-driven pain management segment.

-

Siemens Healthineers unveiled a strategic partnership with Mayo Clinic in November 2023 to co-develop AI-integrated diagnostic imaging systems optimized for cardiology and oncology applications.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the U.S. electro-medical and electrotherapeutic apparatus market

By Product

- Diagnostic Equipment

- Therapeutic Equipment

- Surgical Devices

- Patient Assistive Devices

- Others

By Application

- Cardiology

- Neurology

- Oncology

- Orthopedics

- Gynecology

- Urology

- Others

By End-use

- Hospitals

- Ambulatory Surgical Centers

- Diagnostic Centers

- Others