U.S. Emergency Contraceptive Pills Market Size and Research

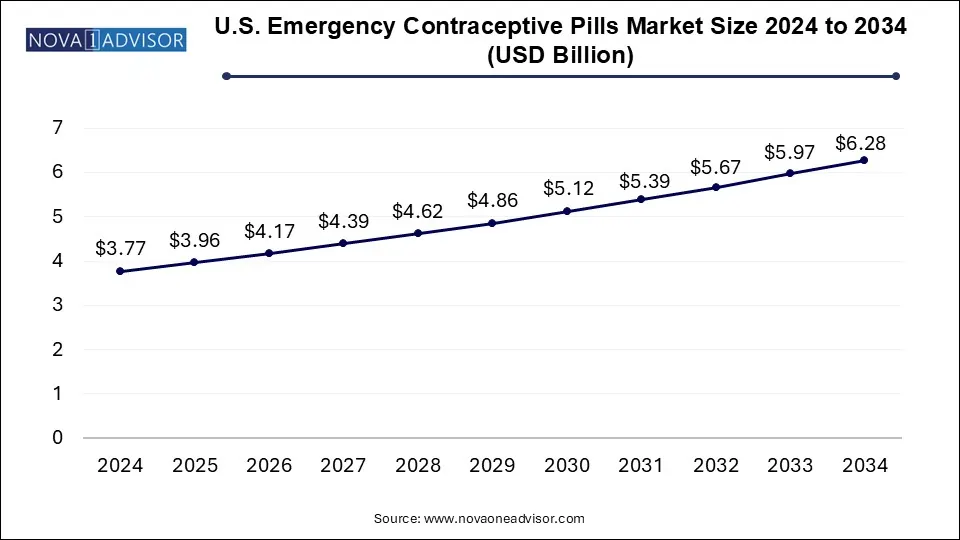

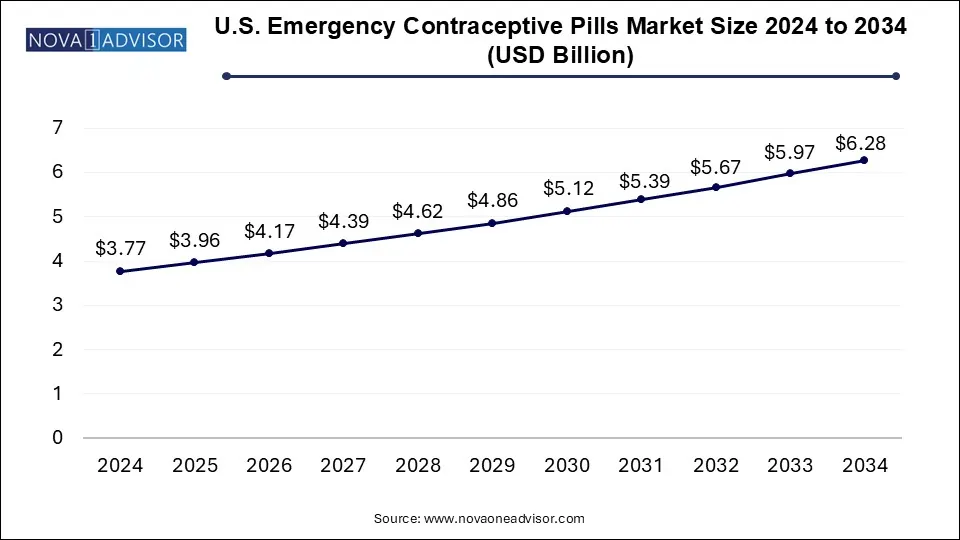

The U.S. emergency contraceptive pills (ECPs) market size was exhibited at USD 3.77 billion in 2024 and is projected to hit around USD 6.28 billion by 2034, growing at a CAGR of 5.25% during the forecast period 2025 to 2034.

U.S. Emergency Contraceptive Pills Market Key Takeaways:

- The progesterone pills segment dominated the market, holding the largest revenue share of 45.3% in 2024.

- The combination pills segment is expected to witness the fastest CAGR during the forecast period.

- The retail store segment held the largest market share of 57.0% in 2024.

- The online store segment is anticipated to witness the fastest growth during the forecast period.

- The Southeast region dominated the U.S. emergency contraceptive pills market with the largest revenue share of 28.6% in 2024.

Market Overview

The U.S. Emergency Contraceptive Pills (ECPs) Market is a dynamic and socially significant segment of the broader reproductive health and pharmaceutical landscape. Emergency contraceptive pills, often referred to as “morning-after pills,” are used to prevent pregnancy after unprotected sex or contraceptive failure. In the United States, these pills have become increasingly vital in empowering reproductive autonomy, especially amid evolving societal attitudes, healthcare policies, and legal rulings surrounding women’s reproductive rights.

Emergency contraceptive pills function primarily by delaying ovulation, preventing fertilization, or inhibiting implantation of a fertilized egg. They are most effective when taken within 72 hours of unprotected intercourse, though efficacy can extend up to five days depending on the formulation. Two major types are commonly used in the U.S.: pills containing levonorgestrel, a type of progesterone, and those containing ulipristal acetate, a selective progesterone receptor modulator.

The growth of this market in the U.S. is propelled by a mix of public health initiatives, over-the-counter (OTC) availability, increasing awareness campaigns, and rising incidences of unplanned pregnancies. According to the Guttmacher Institute, nearly 45% of all pregnancies in the United States are unintended, reflecting the ongoing need for accessible emergency contraceptive options. Following the 2022 overturning of Roe v. Wade, demand for emergency contraceptives saw a significant surge as more individuals sought out backup methods of pregnancy prevention.

Pharmaceutical companies, women’s health advocates, and digital health platforms are all contributing to expanding access and information regarding ECPs. Retail availability, online pharmacies, and telehealth platforms are becoming central distribution channels. Simultaneously, legal and political debates surrounding reproductive rights continue to shape public discourse and affect the regulatory landscape, further influencing the market trajectory.

Major Trends in the Market

-

Surging Demand Post-Roe v. Wade Overturn: Emergency contraceptive sales spiked following legal changes, with some online retailers reporting a 600% increase in demand in mid-2022.

-

Growth of Telemedicine and Online Distribution: Online pharmacies and virtual consultations have emerged as major sales channels for ECPs, offering discreet and timely access.

-

Increased Focus on OTC Accessibility: Advocacy for making ulipristal acetate available OTC is gaining momentum, similar to levonorgestrel’s OTC status.

-

Rising Awareness Among Younger Demographics: Educational campaigns and social media influencers are promoting awareness about emergency contraception among Gen Z and Millennials.

-

Corporate Involvement in Reproductive Health Benefits: Companies like Amazon and Google have expanded healthcare plans to cover emergency contraception and related reproductive services.

-

Bundling with Other Women's Health Products: ECPs are increasingly marketed alongside pregnancy tests, ovulation kits, and contraceptive counseling as part of bundled women’s health solutions.

-

Legislative Push for Protection of Contraceptive Access: Federal and state-level bills are being introduced to safeguard access to ECPs amid tightening abortion regulations.

Report Scope of U.S. Emergency Contraceptive Pills Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 3.96 Billion |

| Market Size by 2034 |

USD 6.28 Billion |

| Growth Rate From 2025 to 2034 |

CAGR of 5.25% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

Type, Distribution Channel, Regional |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Key Companies Profiled |

Purdue Pharma L.P.; Janssen Global Services, LLC; Hikma Pharmaceuticals PLC; Pfizer Inc.; AbbVie Inc.; Sanofi; Sun Pharmaceutical Industries Ltd.; Mallinckrodt Pharmaceuticals; Endo Pharmaceuticals; Teva Pharmaceutical Industries |

Key Market Driver: Rising Incidence of Unintended Pregnancies

A major driver fueling the U.S. emergency contraceptive pills market is the persistently high rate of unintended pregnancies. Despite advances in regular contraception and public awareness, a substantial portion of sexually active individuals continue to experience contraceptive failure or engage in unprotected intercourse. Factors such as inconsistent use of birth control, lack of education, and limited access to healthcare services contribute to this issue.

Levonorgestrel-based pills, sold under brand names like Plan B One-Step and generic equivalents, have become widely used post-coital contraceptive options due to their convenience and over-the-counter availability. Emergency contraception has gained additional significance among populations with limited reproductive healthcare access, such as adolescents, uninsured individuals, and those in rural or underserved areas. The increasing focus on personal reproductive planning, autonomy, and women’s rights continues to push the demand for emergency contraceptive options in the U.S.

Despite broader acceptance and access, social stigma and misinformation continue to hinder the growth of the emergency contraceptive pills market. ECPs are often confused with abortifacients, leading to public misconceptions about their function and moral implications. This confusion has been further amplified by political debates and misleading narratives in both social and traditional media, resulting in hesitancy among potential users.

Moreover, some retail and pharmacy chains have imposed internal policies or stocking limits due to employee objections or concerns about community backlash. In rural or conservative areas, customers may face judgment or questioning when purchasing ECPs, even when legally accessible. These psychological and logistical barriers limit the reach of emergency contraceptives and create unequal access across socioeconomic and geographic divides.

Key Market Opportunity: Expansion of Online and Telehealth Channels

The digital transformation of healthcare has opened a compelling growth opportunity for the emergency contraceptive pills market through online retail and telehealth services. With increasing smartphone penetration and consumer preference for discreet and quick healthcare solutions, ECPs are now frequently accessed through digital platforms. Companies like Nurx, Hers, and Amazon Pharmacy have revolutionized the delivery of contraceptive care by offering same-day or next-day delivery services, often accompanied by online consultations.

This digital ecosystem not only broadens access for populations hesitant to buy in person, but also improves accessibility in regions lacking brick-and-mortar pharmacies. During the COVID-19 pandemic and following major political changes in 2022, these platforms experienced a surge in new users, many of whom have continued using them for routine reproductive health needs. As telehealth regulations evolve, especially regarding prescription rules, the opportunity to reach new consumer segments via online models remains substantial.

U.S. Emergency Contraceptive Pills Market By Type Insights

Progesterone-based pills dominated the U.S. emergency contraceptive pills market, largely due to the widespread availability and recognition of levonorgestrel products. These pills are available over the counter without age restrictions, making them highly accessible. Products such as Plan B One-Step, Take Action, and My Way are trusted household names and are frequently stocked in pharmacies, supermarkets, and even gas station convenience stores. Their fast-acting mechanism, general affordability, and FDA approval for non-prescription use have entrenched their dominance in the U.S. market. Additionally, their familiarity among healthcare providers contributes to their routine recommendation as first-line emergency contraception.

Ulipristal acetate is the fastest-growing type, gaining popularity due to its superior efficacy in certain cases, particularly for women with higher body weight or those who are further along in their post-intercourse window (up to 120 hours). Marketed under the brand name ella, ulipristal requires a prescription, which has somewhat limited its uptake. However, increasing awareness among healthcare professionals and advocacy groups is driving demand for broader access. Discussions are underway to transition ulipristal to OTC status, which, if successful, could significantly boost its adoption. Telehealth services are also contributing to its growth by enabling quick prescriptions and mail-order delivery.

U.S. Emergency Contraceptive Pills Market By Distribution Channel Insights

Retail stores continue to dominate distribution of emergency contraceptive pills in the U.S., including chain pharmacies like CVS, Walgreens, and Rite Aid, as well as supermarkets like Walmart and Target. Consumers typically prefer in-person purchases due to the urgency associated with ECP use. Retail stores also allow for immediate acquisition, which is critical since effectiveness diminishes over time. In major urban centers, pharmacies frequently keep these products on open shelves, enhancing privacy and reducing barriers. In addition, many retailers have implemented price-matching strategies to make generic ECPs more affordable for younger or uninsured consumers.

Online stores are the fastest-growing distribution channel, driven by increasing internet penetration, comfort with e-commerce, and demand for discretion. Online pharmacy platforms offer convenience, competitive pricing, and overnight shipping options that align with the time-sensitive nature of emergency contraception. Companies such as Nurx, The Pill Club, and Hers have leveraged this trend by bundling ECPs with telehealth consultations, creating a seamless user experience. Following the 2022 spike in ECP demand, many online providers expanded their delivery infrastructure and began offering subscription models for contraceptive care, cementing their role in the future of the market.

U.S. Emergency Contraceptive Pills Market By Regional Insights

The United States represents the entirety of the U.S. emergency contraceptive pills market, and its trajectory is deeply influenced by legal, political, and social factors. Federal-level regulatory frameworks, such as the FDA’s rulings on OTC availability, set the baseline for access, but state-specific laws can further enhance or restrict this access. For example, states like California and Oregon have empowered pharmacists to directly prescribe ECPs, improving access, while others have imposed age or notification requirements that complicate use.

The U.S. market also reflects significant geographic variation. In urban and coastal states, access to a broad range of contraceptive options is often robust, supported by public health programs and progressive healthcare policies. Conversely, in parts of the South and Midwest, political conservatism and healthcare provider shortages create disparities. Despite these challenges, national awareness campaigns, judicial protections for contraception, and the rise of digital access platforms are helping to close the accessibility gap.

Some of the prominent players in the U.S. emergency contraceptive pills (ECPs) market include:

Recent Developments

-

In February 2025, the FDA announced it was reviewing a proposal to make ulipristal acetate available OTC, following extensive lobbying from reproductive health advocacy organizations.

-

In December 2024, Amazon Pharmacy began offering one-hour delivery of Plan B in select U.S. metro areas, partnering with local courier services.

-

In October 2024, Nurx reported a 300% year-over-year increase in emergency contraceptive prescriptions, driven by growing use of its telemedicine platform post-Dobbs v. Jackson ruling.

-

In August 2024, HRA Pharma (a Perrigo company) initiated a clinical trial to support reclassification of ulipristal to OTC status, citing safety data comparable to levonorgestrel.

-

In July 2024, CVS and Walgreens began placing Plan B One-Step in locked cabinets in some locations, sparking criticism and a subsequent reversal of policy in high-traffic stores after public backlash.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the U.S. emergency contraceptive pills (ECPs) market

By Type

- Combination Pills

- Progesterone Pills

- Ulipristal Acetate

By Distribution Channel

- Retail Store

- Online Store

- Others

By Regional

- Northeast

- Southeast

- Midwest

- West

- Southwest