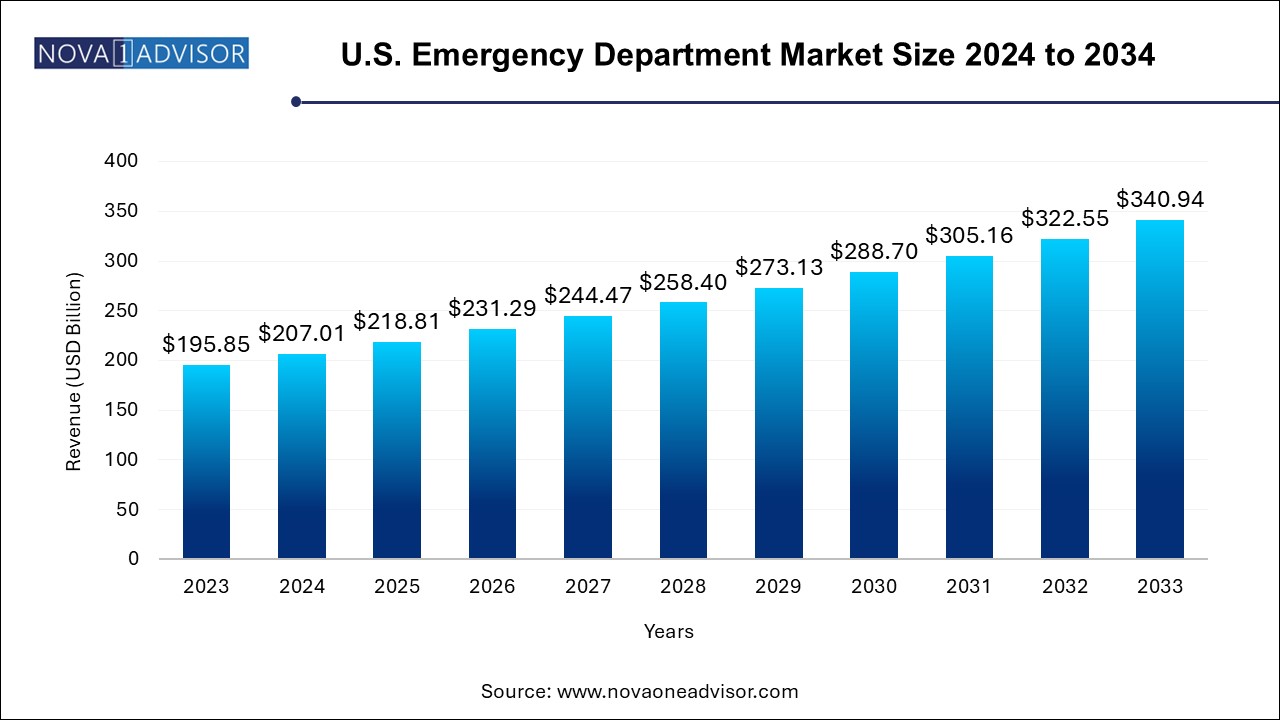

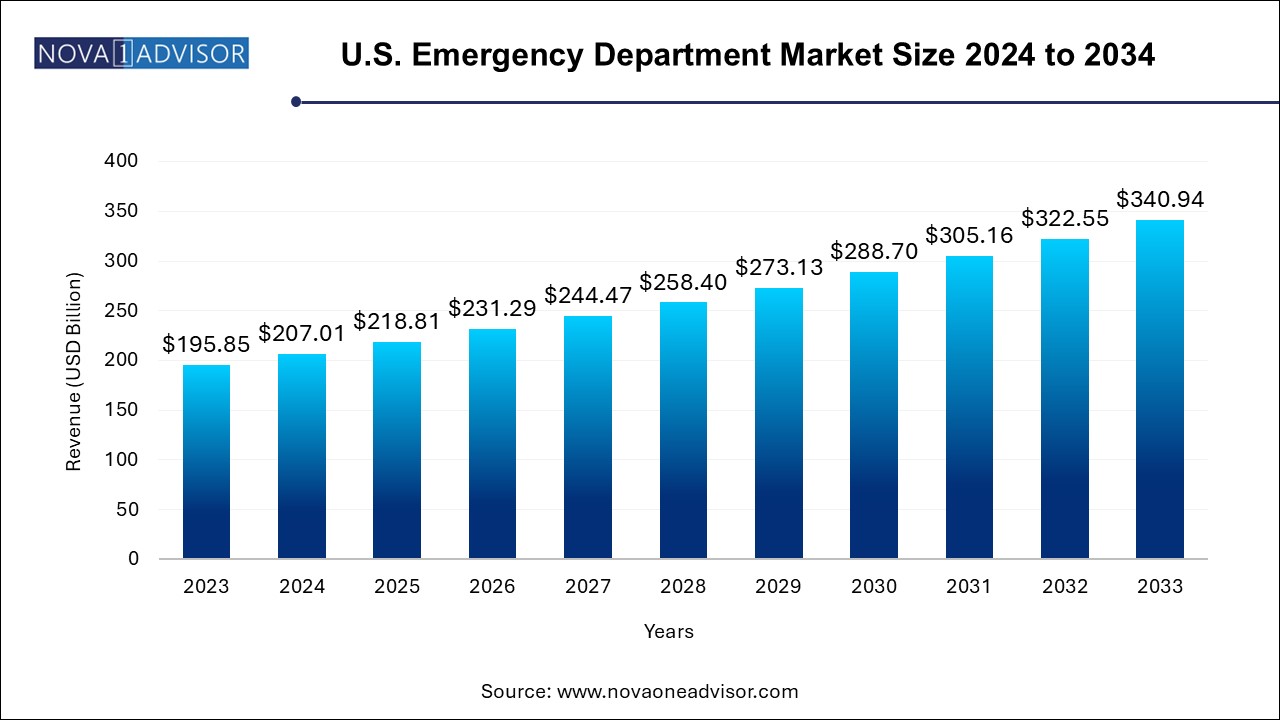

U.S. Emergency Department Market Size and Growth

The U.S. emergency department market size was exhibited at USD 195.85 billion in 2023 and is projected to hit around USD 340.94 billion by 2033, growing at a CAGR of 5.7% during the forecast period 2024 to 2033.

U.S. Emergency Department Market Key Takeaways:

- Hospital emergency department segment dominated the market in 2023 with a revenue share of 94.15% and is anticipated to witness the fastest growth rate during the forecast period.

- The emergency department services segment accounted for the largest revenue share in 2023.

- Furthermore, the imaging services segment is expected to witness the fastest growth rate during the forecast period.

- Infectious segment held the largest market share in 2023 and is expected to register the fastest growth over the coming years.

Market Overview

The U.S. Emergency Department (ED) market is a critical pillar of the American healthcare system, acting as the first line of response for acute and life-threatening medical issues. Emergency departments serve a dual role providing timely, lifesaving interventions while also acting as the primary care provider for underinsured and underserved populations. The complexity, unpredictability, and intensity of services delivered in EDs necessitate continuous improvements in clinical operations, staffing, infrastructure, and technology. Over the past decade, the U.S. ED market has grown significantly, not only in volume but in scope, as the demographic and epidemiological landscape of the country continues to evolve.

According to the CDC, U.S. emergency departments recorded over 130 million visits annually in recent years, and the number continues to climb due to population aging, increased prevalence of chronic diseases, and limited access to primary care. From trauma and cardiovascular emergencies to psychiatric crises and infectious diseases, EDs now manage a vast range of conditions requiring urgent intervention. The surge in mental health-related visits post-COVID-19, increased opioid-related incidents, and rising pediatric and geriatric emergencies are all contributing to the heightened demand for ED services.

Moreover, the operational diversity of the U.S. ED market encompassing hospital-based and freestanding EDs—allows for greater reach and flexibility in emergency care delivery. This diversity, however, introduces variability in access, cost, and quality, thereby pushing stakeholders to innovate through digital integration, real-time analytics, staffing optimization, and expansion of specialized services like mobile stroke units and behavioral health triage centers.

Major Trends in the Market

-

Rise of Freestanding Emergency Departments (FSEDs): Especially in suburban and rural areas, FSEDs are filling access gaps left by hospital closures or undersupply of care.

-

Integration of Behavioral Health Services: With mental health cases rising, EDs are increasingly incorporating behavioral crisis units and psychiatric specialists.

-

Technological Advancements in Diagnostics: EDs are rapidly adopting AI-enhanced imaging, point-of-care testing, and decision-support systems for faster diagnostics.

-

Expansion of ED Observation Units: Many hospitals are investing in ED observation units to avoid unnecessary admissions and manage short-term monitoring.

-

Tele-triage and Remote Assessment Tools: Emergency departments are leveraging telehealth for pre-visit screening, which helps manage overcrowding and improve patient flow.

-

Value-Based ED Services: The focus is shifting from volume to value, incentivizing efficient throughput, accurate diagnosis, and lower readmission rates.

-

Workforce Burnout and Staffing Crisis: Shortages of emergency physicians, nurses, and support staff are leading to increased wage costs and innovative staffing models.

Report Scope of U.S. Emergency Department Market

| Report Coverage |

Details |

| Market Size in 2024 |

USD 207.01 Billion |

| Market Size by 2033 |

USD 340.94 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 5.7% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Type, Service, Condition |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Key Companies Profiled |

Parkland Health; Lakeland Regional Health; St. Joseph’s Health; Natchitoches Regional Medical Center; Schoolcraft Memorial Hospital; Clarion Hospital; USA Health; Baptist Health South Florida; Montefiore Medical Center; LAC+USC Medical Center; Tenet Healthcare Corporation; Universal Health Services, Inc.; Community Health System; HCA Management Services, L.P.; Legacy Lifepoint Health, Inc.; Ardent Health Services; Ascension Health; Deerfield Management Company; Emerus; USA Health |

Market Driver: Increased Chronic Disease Prevalence

One of the most influential drivers in the U.S. emergency department market is the rising incidence of chronic diseases. Conditions such as diabetes, congestive heart failure, chronic obstructive pulmonary disease (COPD), and hypertension now account for a significant share of emergency visits, especially among adults over 50. These diseases often lead to complications or acute exacerbations requiring immediate care, especially in populations with poor outpatient follow-up or social support.

The chronic disease burden is compounded by socioeconomic and geographic disparities. In many communities, emergency departments serve as the de facto entry point into the healthcare system due to lack of access to primary care. This constant influx of high-acuity patients has led to expanded capabilities in EDs, including specialized triage protocols, chronic disease management initiatives, and tighter care coordination with post-acute services. For example, many EDs now deploy nurse practitioners for chronic care navigation, while others integrate remote monitoring tools for post-discharge follow-up, enhancing outcomes and lowering re-admissions.

Market Restraint: Overcrowding and Throughput Delays

A critical restraint on the U.S. ED market is the chronic problem of overcrowding. According to a March 2024 study published on PR Newswire, EDs across the U.S. are increasingly stressed by long wait times, boarding of admitted patients, and a surge in behavioral health emergencies. Emergency rooms frequently operate above their designed capacity, resulting in delays in care, patient dissatisfaction, increased medical errors, and provider burnout.

This bottleneck effect is exacerbated by a shortage of inpatient beds, especially in urban hospitals, leading to admitted patients being "boarded" in EDs for extended periods. Consequently, it affects throughput for new incoming emergencies and can compromise patient safety. Additionally, reimbursement models often undercompensate EDs for non-emergent visits, placing financial strain on institutions and discouraging investments in capacity expansion. Solving ED overcrowding requires a multi-tiered approach including enhanced primary care access, real-time patient flow optimization, and stronger community-based support systems.

A promising opportunity lies in leveraging digital tools for operational excellence and clinical accuracy in emergency departments. Many EDs are transitioning from traditional paper workflows to AI-enabled triage systems, predictive analytics for surge forecasting, and integrated EHRs for seamless data sharing. For instance, advanced clinical decision support tools can now help physicians prioritize diagnostic workups and detect early signs of sepsis, myocardial infarction, or stroke—improving outcomes significantly.

Moreover, real-time dashboards that display wait times, imaging turnaround, and room availability help streamline operations. Hospitals partnering with health IT startups are creating ‘smart EDs’ where IoT-enabled beds, wearable monitors, and mobile charting devices improve efficiency. The expansion of telehealth into emergency medicine—particularly in psychiatric care and stroke response—has enabled rapid specialist consultation and triage in under-resourced settings. As reimbursement policies continue to support digital care, emergency departments that embrace tech-driven care models are poised to benefit substantially.

U.S. Emergency Department Market By Type Insights

Hospital emergency departments (HEDs) dominate the U.S. ED market due to their comprehensive capabilities, 24/7 availability of multidisciplinary teams, and seamless access to operating rooms, ICUs, and imaging services. These facilities handle high volumes of critical cases, including polytrauma, cardiac arrests, sepsis, and pediatric emergencies. Their integration with tertiary and quaternary care allows for continuity of treatment, which is essential for complex or time-sensitive cases. Major urban hospitals like the Mayo Clinic, Johns Hopkins, and Massachusetts General handle tens of thousands of emergency visits annually, showcasing the centrality of HEDs in emergency care delivery.

Conversely, freestanding emergency departments (FSEDs) are gaining traction as the fastest-growing segment, especially in suburban and exurban areas. These facilities, often affiliated with larger hospital networks, provide rapid access to emergency care without the extended wait times common in larger hospitals. FSEDs cater to a growing population seeking convenience, faster service, and accessibility. Moreover, new CMS guidelines around emergency reimbursement and scope of services are encouraging the expansion of FSEDs, particularly in states like Texas and Florida, where hospital EDs face capacity challenges.

U.S. Emergency Department Market By Service Insights

ED services form the core of this market, encompassing triage, acute care, life-saving interventions, and resuscitation. These services include trauma care, stabilization, medication administration, and initial diagnosis for various emergencies. Every patient who enters an emergency department receives ED services, making it the backbone of all associated segments. With increasing case complexity, EDs are also evolving into high-acuity hubs with on-site surgical, critical care, and procedural capabilities, particularly in trauma-designated centers.

Imaging services represent the fastest-growing category within the service segment. Rapid diagnostics are central to effective ED operations, and modalities such as CT, MRI, ultrasound, and digital X-rays are being increasingly integrated with AI for faster interpretation. Emergency physicians often rely on immediate imaging results to make decisions for stroke, fractures, internal bleeding, and organ failure. The growth of AI-powered radiology platforms like Aidoc and Viz.ai, which prioritize critical findings and alert physicians, is revolutionizing ED imaging and enabling faster treatment pathways.

U.S. Emergency Department Market By Condition Insights

raumatic conditions ranging from road traffic accidents and gunshot wounds to falls and industrial injuries dominate ED visits in the U.S. The prevalence of trauma centers across all states, many designated as Level 1 or Level 2 centers, underlines the importance of emergency response systems. Trauma care requires a multidisciplinary approach involving surgeons, emergency physicians, orthopedic specialists, and critical care teams. The U.S. has invested heavily in trauma networks, and air medical transport services further enhance outcomes by ensuring rapid trauma team activation.

Psychiatric emergencies are witnessing the fastest growth due to the mental health crisis exacerbated by the COVID-19 pandemic, economic distress, and substance abuse epidemics. EDs are now frontline responders for behavioral crises involving suicidal ideation, acute psychosis, and overdose. In 2024, major hospital systems such as Mount Sinai and UCLA Health reported record psychiatric consults within their EDs. The lack of inpatient psychiatric beds has led to the boarding of behavioral health patients in EDs, prompting hospitals to build dedicated behavioral crisis units and employ psychiatric nurse practitioners to manage surge volumes.

U.S. Country-Level Analysis

The U.S. emergency department landscape is shaped by distinct regional dynamics, healthcare policies, and demographic factors. States with large urban populations such as California, Texas, Florida, and New York report the highest emergency department volumes, while rural states grapple with limited access. In Texas, freestanding emergency departments have proliferated in response to suburban sprawl and long travel times to hospital-based EDs. In contrast, cities like New York have implemented urgent care triage programs to reduce non-emergent ED use.

Federal programs like EMTALA (Emergency Medical Treatment and Labor Act) mandate all EDs to treat patients regardless of insurance, making EDs safety nets for uninsured populations. Medicaid expansion under the ACA also reduced some ED usage for non-urgent care in expansion states, while non-expansion states saw little change. The national shortage of ED nurses and physicians has led to interstate recruitment, telemedicine partnerships, and alternative staffing models like physician assistants and virtual rounding. The U.S. is also witnessing legislative interest in boarding reduction policies and ED wait time transparency to improve patient experiences nationwide.

Key U.S. Emergency Department Company Insights

The market is highly fragmented, with the presence of multiple major players. Key players are adopting growth strategies to enhance their market presence, including collaborations and mergers & acquisitions. Hospitals face the challenge of ED overcrowding and use strategies such as expanding EDs and partnering with emergency service management providers. The market is highly competitive, and hospitals aim to improve patient experience by obtaining accreditations and certifications to increase their credibility among patients.

Some of the prominent players in the U.S. emergency department market include:

- Hospital Emergency Departments:

- Parkland Health

- Lakeland Regional Health

- St. Joseph’s Health

- Natchitoches Regional Medical Center

- Schoolcraft Memorial Hospital

- Clarion Hospital

- USA Health

- Baptist Health South Florida

- Montefiore Medical Center

- LAC+USC Medical Center

- Freestanding Emergency Departments:

- Tenet Healthcare Corporation

- Universal Health Services, Inc.

- Community Health System

- HCA Management Services, L.P.

- Legacy Lifepoint Health, Inc.

- Ardent Health Services

- Ascension Health

- Deerfield Management Company

- Emerus

- USA Health

U.S. Emergency Department Market Recent Developments

-

April 2024 – New Study by ACEP and PR Newswire revealed that EDs in the U.S. are increasingly overburdened due to rising psychiatric emergencies and a lack of inpatient beds. The study called for federal support in mental health infrastructure and ED funding enhancements.

-

February 2024 – HCA Healthcare expanded its network of freestanding EDs in Texas and Georgia, announcing 10 new facilities with 24/7 imaging and laboratory services, citing increased suburban demand and operational efficiency.

-

January 2024 – Mount Sinai Health System launched a real-time ED patient monitoring and flow optimization dashboard to reduce wait times and improve care coordination, using AI algorithms.

-

November 2023 – Tenet Healthcare introduced a behavioral health integration program across its EDs in California and Florida, including on-site crisis teams and telepsychiatry services.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. emergency department market

Type

- Hospital Emergency Department

- Freestanding Emergency Department

Service

- Emergency Department (ED) Service

- Imaging Service

- Laboratory Service

Condition

- Traumatic

- Infectious

- Gastrointestinal

- Psychiatric

- Neurologic

- Cardiac

- Others