U.S. Emergency Medical Services Products Market Size Trends Analysis and Forecast till 2035

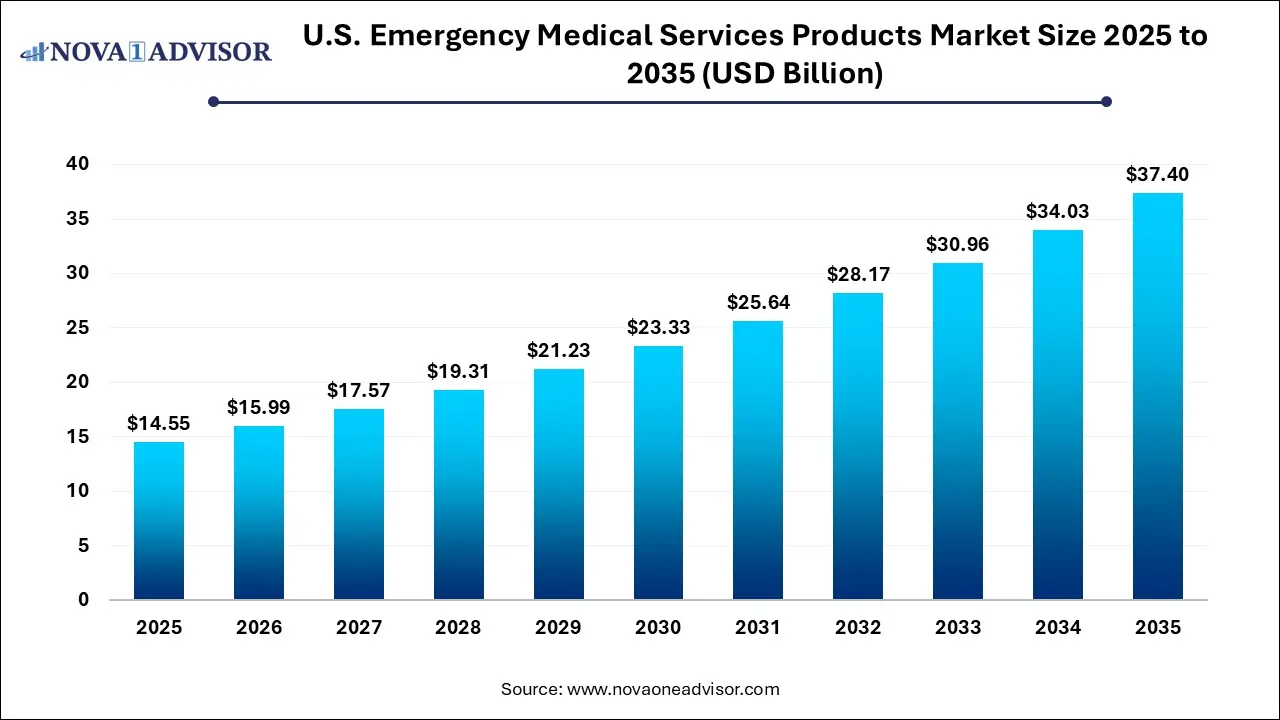

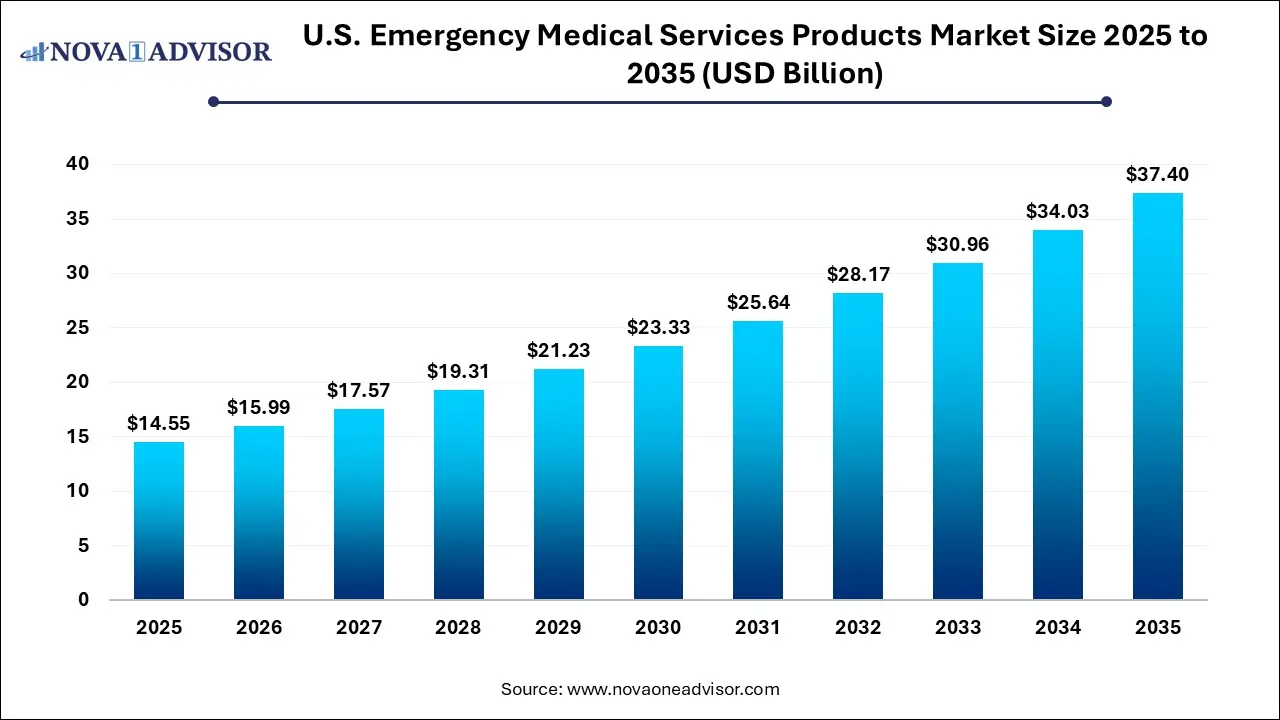

The U.S. emergency medical services products market size was exhibited at USD 14.55 billion in 2025 and is projected to hit around USD 37.40 billion by 2035, growing at a CAGR of 9.9% during the forecast period 2026 to 2035.

Key Takeaways:

- The life support & emergency resuscitation segment dominated the market with the largest revenue share of 34.2% in 2025.

- The hospitals and trauma centers segment dominated the market with the largest revenue share of 51.0% in 2025.

Market Overview

The U.S. Emergency Medical Services (EMS) Products Market plays a vital role in safeguarding public health by equipping first responders and healthcare providers with tools necessary to stabilize, treat, and transport patients in critical situations. EMS products are the backbone of pre-hospital care and immediate life support in settings ranging from urban trauma incidents to rural roadside emergencies. These products encompass a wide array of medical equipment, devices, and supplies that enable rapid diagnosis, patient stabilization, infection control, and efficient handling in emergencies.

Driven by a combination of rising emergency room visits, natural disasters, mass casualty incidents, increasing accident rates, and chronic disease emergencies, the demand for advanced and reliable EMS products has grown considerably in the U.S. over the past decade. Notably, the COVID-19 pandemic also demonstrated the critical importance of well-equipped EMS teams in managing surges in emergency response calls and transporting infectious patients safely. Government and private investments in upgrading emergency medical infrastructure have surged in response, creating momentum across all EMS product categories.

Technological innovation is another central pillar of the market. Devices such as automated external defibrillators (AEDs), smart ventilators, and advanced patient monitoring systems are increasingly embedded with IoT and AI technologies to enhance usability and real-time responsiveness. Simultaneously, increased training and education among paramedics and EMTs have raised awareness and expectations regarding equipment performance, portability, and durability, prompting suppliers to focus on product quality, versatility, and compliance with FDA standards.

Major Trends in the Market

-

Integration of IoT and Smart Monitoring in EMS Equipment: Devices with real-time data transmission capabilities are enabling remote tracking of patient vitals en route to hospitals.

-

Miniaturization and Portability of Life-Saving Devices: Compact, lightweight equipment such as AEDs and portable ventilators are becoming standard in ambulances and public areas.

-

Focus on Infection Control and PPE Expansion: Post-pandemic demand has pushed for sustained investment in protective equipment, disinfectants, and sanitation protocols in ambulatory settings.

-

Increased Federal and State-Level EMS Funding: Grants and stimulus packages are empowering municipalities to upgrade EMS fleets and onboard cutting-edge medical supplies.

-

Tele-EMS and Connected Ambulances: Integration of telemedicine tools in ambulances to connect EMTs with specialists during transport is gaining popularity.

-

Specialty EMS Product Lines: Customized solutions for pediatric, bariatric, and elderly patient handling are driving product innovation in mobility and resuscitation devices.

-

Private Sector Partnerships with EMS Agencies: Collaborations between suppliers and EMS service providers for long-term contracts are shaping supply chain models and product R&D.

-

Eco-Friendly and Sustainable Supplies: Environmentally conscious consumables and recyclable packaging for EMS kits are becoming a purchasing criterion for institutions.

U.S. Emergency Medical Services Products Market Report Scope

| Report Coverage |

Details |

| Market Size in 2026 |

USD 15.99 Billion |

| Market Size by 2035 |

USD 37.40 Billion |

| Growth Rate From 2026 to 2035 |

CAGR of 9.9% |

| Base Year |

2025 |

| Forecast Period |

2026-2035 |

| Segments Covered |

Product, End-use |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Key Companies Profiled |

Bound Tree Medical; McKesson Medical-Surgical Inc.; Henry Schein, Inc.; Medline Industries, Inc.; Emergency Medical Products; Stryker; Smiths Group plc; Cardinal Health; Life-Assist; Penn Care Inc. |

Market Driver: Rising Incidence of Emergency Health Situations and Accidents

A key driver of the U.S. EMS Products Market is the rising number of medical emergencies, particularly related to trauma, cardiac arrests, respiratory distress, and road traffic accidents. According to the CDC, approximately 36 million emergency room visits are trauma-related annually in the U.S., with significant portions requiring immediate pre-hospital care. The increase in geriatric populations, opioid overdoses, heart disease-related emergencies, and chronic illnesses has contributed to this growing volume of emergency cases.

EMS responders are expected to reach scenes faster and deliver advanced interventions before hospital admission. To meet this expectation, they rely on a wide range of products—from automated defibrillators to ventilators and trauma kits that must be both technologically advanced and field-tested for rugged use. These life-saving interventions require continuous investment by hospitals, ambulance service providers, and government bodies in high-performance EMS tools. The market is further stimulated by state mandates requiring AEDs in public buildings and training in CPR and emergency resuscitation.

Market Restraint: Budget Constraints and High Cost of Advanced EMS Equipment

Despite the market’s promising growth, a major constraint is the high cost associated with acquiring, maintaining, and replacing advanced EMS equipment. High-performance devices such as mechanical ventilators, mobile patient monitors, and smart resuscitation systems come with significant capital investment requirements. Smaller EMS providers, particularly in rural or underserved regions, often face financial hurdles in acquiring state-of-the-art equipment or replacing outdated inventories.

Furthermore, public EMS agencies frequently operate under tight municipal or state budgets, limiting their ability to invest in newer technologies or expand their equipment inventory to meet surging demand. The cost factor also affects training needs, as advanced equipment often requires certified operators and continual skill updates. Combined with variable insurance reimbursement rates for EMS transport services, these budgetary limitations pose significant operational challenges for broad and equitable adoption of modern EMS products across the country.

Market Opportunity: Expansion of EMS Capabilities into Community-Based and Non-Trauma Care

A growing opportunity in the U.S. EMS Products Market lies in the expansion of EMS roles beyond trauma response to include chronic care support, community paramedicine, and preventive intervention. Programs such as Community Paramedicine (CP) and Mobile Integrated Healthcare (MIH) are reshaping how EMS teams are deployed, enabling them to handle non-emergency but time-sensitive care, such as medication compliance checks, wound monitoring, and remote vitals management for patients with limited mobility or access to primary care.

This evolution in EMS scope is driving demand for a new class of products wearable monitoring systems, compact diagnostic tools, chronic wound care supplies, and mobile health kits tailored for in-home visits. Vendors that develop product lines specific to these emerging needs such as lightweight ventilators or infection control travel kits stand to gain significantly. The federal government’s interest in reducing ER overcrowding and lowering healthcare costs via pre-emptive care models is fueling grant-funded CP program expansions in multiple states, creating a new frontier for EMS product manufacturers and distributors.

Segments Insights:

By Product

Life Support & Emergency Resuscitation equipment dominated the EMS product segment, owing to their critical role in managing cardiac, respiratory, and trauma emergencies. Devices such as defibrillators, ventilators, and endotracheal tubes are integral to pre-hospital care, often making the difference between life and death. AEDs, in particular, have become widely used in ambulances, public facilities, and first-responder kits. Ventilators are essential for managing respiratory failure and post-COVID complications. Portable versions are now being adopted for field use in both ambulance and air-transport environments. Additionally, laryngoscopes and resuscitators have seen rising demand in pediatric and elderly care applications where airway management requires additional precision.

Infection Control Supplies are the fastest-growing product category, a trend catalyzed by the COVID-19 pandemic and maintained by a broader shift toward biosecurity in emergency response. EMS teams increasingly rely on PPE kits, disinfectant agents, and isolation equipment to handle suspected infectious patients without risking cross-contamination. Demand for reusable face shields, N95 respirators, portable decontamination systems, and disposable patient drapes has risen in parallel with awareness of occupational exposure risks. This category is also expected to evolve with innovation in antimicrobial materials, sustainability (biodegradable PPE), and packaging that enables rapid access and minimal waste in high-pressure environments.

By End-use

Hospitals & Trauma Centers dominated the EMS product end-use segment, reflecting their central role in emergency response networks and their budgetary ability to maintain high-capacity EMS product inventories. Emergency departments often coordinate with EMS providers for patient triage, stabilization, and handover, requiring compatible and high-performance equipment at both ends. Hospitals typically procure resuscitation kits, patient monitoring devices, and infection control materials in bulk to serve both in-hospital needs and EMS deployment vehicles. Teaching hospitals and trauma centers are also early adopters of smart EMS technologies such as real-time telemetry, cloud-based vitals tracking, and remote patient management platforms.

Ambulatory Surgical Centers (ASCs) are among the fastest-growing end-use environments, especially as they expand their operational scope to include more complex procedures and urgent care functions. ASCs now require emergency preparedness protocols and corresponding product inventories ranging from defibrillators and oxygen masks to stretchers and emergency kits to manage intraoperative complications or respond to patient collapses. Given their leaner staffing and space constraints compared to hospitals, ASCs demand compact, efficient, and easy-to-use EMS tools. Vendors that tailor emergency resuscitation and infection control kits for these facilities are well positioned to tap into this niche, which continues to grow with the shift toward outpatient care models.

Country-Level Analysis: United States

The United States commands one of the most dynamic and technologically advanced EMS systems globally. The U.S. EMS infrastructure includes over 21,000 local and regional agencies, encompassing municipal fire departments, private ambulance companies, hospital-based EMS teams, and air ambulance services. As a country with one of the highest rates of road traffic, trauma-related injuries, cardiac arrests, and natural disasters, the need for high-performance EMS products is both immediate and ongoing.

Federal agencies such as the Department of Homeland Security (DHS) and the Department of Health and Human Services (HHS) allocate substantial funding annually toward emergency preparedness and EMS modernization initiatives. Additionally, the Centers for Medicare & Medicaid Services (CMS) continue to adjust reimbursement policies for EMS transports and treatment-in-place protocols, encouraging agencies to modernize their product inventories. Cities such as New York, Chicago, and Los Angeles have deployed advanced EMS fleets with smart ambulances, AI-assisted resuscitation tools, and remote consultation setups that signal broader adoption trends.

The private sector also plays a major role, with corporate EMS services (e.g., AMR) entering into long-term supply agreements with leading vendors. These partnerships are streamlining procurement and boosting innovation cycles. Moreover, EMS training programs across the U.S. now incorporate equipment handling modules for the latest devices, ensuring faster adoption and operator competency. As EMS expands into preventive and chronic care services under new care delivery models, the scope of EMS product usage in the U.S. will only widen.

Some of the prominent players in the U.S. emergency medical services products market include:

- Bound Tree Medical

- Henry Schein, Inc.

- Medline Industries, Inc.

- Emergency Medical Products

- Stryker

- Cardinal Health

- Life-Assist

- McKesson Medical-Surgical Inc.

- Smiths Group plc

- Penn Care Inc.

Recent Developments

-

March 2025 – Philips Healthcare launched a next-generation automated external defibrillator (AED) with cloud connectivity for EMS teams, enabling real-time ECG streaming during pre-hospital care.

-

February 2025 – Stryker Corporation announced the acquisition of a mobility solutions company to enhance its patient handling product line with smart stretchers and automated loading systems for ambulances.

-

November 2024 – ZOLL Medical expanded its ventilator product range with a lightweight portable model optimized for disaster response and field operations.

-

September 2024 – 3M Health Care introduced a new line of antimicrobial PPE kits specifically designed for EMS professionals handling suspected infectious patients during mass casualty events.

-

July 2024 – Medline Industries partnered with several EMS training centers to provide preassembled trauma kits and portable wound care units for live training and field deployment.

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2035. For this study, Nova one advisor, Inc. has segmented the global U.S. emergency medical services products market.

Product

- Life Support & Emergency Resuscitation

-

- Defibrillators

- Endotracheal Tubes

- Ventilators

- Resuscitators

- Laryngoscopes

- Patient Monitoring Systems

- Wound Care Consumables

-

- Dressings & Bandages

- Sutures & Staples

- Others

- Patient Handling Equipment

-

- Medical Beds

- Wheelchairs & Scooters

- Other Equipment

- Infection Control Supplies

-

- Disinfectant & Cleaning Agents

- Personal Protection Equipment

- Others

End-use

- Hospitals & Trauma Centers

- Ambulatory Surgical Centers

- Others