U.S. ENT Devices Market Size and Growth

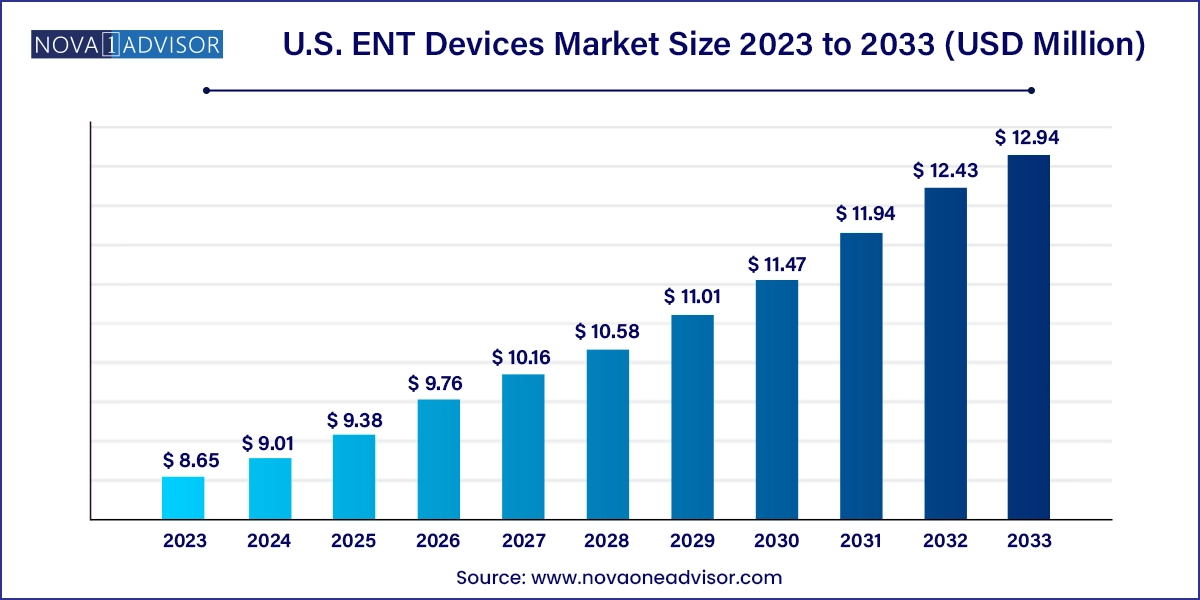

The U.S. ENT devices market size was exhibited at USD 8.65 billion in 2023 and is projected to hit around USD 12.94 billion by 2033, growing at a CAGR of 4.11% during the forecast period 2024 to 2033.This growth is attributable to the increasing prevalence of ear, nose, and throat disorders, rising demand for minimally invasive procedures, and technological advancements.

U.S. ENT Devices Market Key Takeaways:

- The surgical ENT devices segment led the market with the largest revenue share of 30.45% in 2023.

- The hearing implants segment is anticipated to grow at the fastest CAGR of 6.4% over the forecast period.

Market Overview

The U.S. ENT (Ear, Nose, and Throat) devices market represents a significant segment of the broader medical devices industry, owing to the rising prevalence of ENT-related disorders, increasing adoption of minimally invasive procedures, and technological advancements in diagnostic and surgical equipment. ENT disorders such as hearing loss, sinusitis, sleep apnea, and chronic ear infections are common across all age groups in the United States, particularly among children and the elderly. With healthcare spending per capita remaining among the highest globally, the U.S. has become a highly lucrative landscape for manufacturers and developers of ENT devices.

An aging population is particularly driving demand in this market. According to the U.S. Census Bureau, more than 77 million Americans will be aged 65 or older by 2034, surpassing the number of children for the first time in U.S. history. Since elderly individuals are more prone to ENT conditions such as presbycusis (age-related hearing loss), chronic rhinosinusitis, and laryngeal disorders, the market for devices aiding diagnosis and treatment is poised for sustained growth.

Technological convergence with fields like robotics, artificial intelligence, and 3D imaging has introduced a new paradigm in ENT diagnosis and treatment. Furthermore, ENT surgeries are increasingly being conducted using minimally invasive approaches that promise faster recovery, reduced complications, and greater procedural efficiency. Simultaneously, increased awareness, a favorable reimbursement environment, and expanding audiology services in both urban and semi-urban regions are opening up new avenues for growth.

Major Trends in the Market

-

Rise of AI and machine learning in audiology and ENT diagnostics, leading to smart hearing aids and diagnostic platforms that automatically adapt to environmental stimuli.

-

Growing adoption of robotic-assisted ENT surgeries, especially for complex laryngeal and sinus procedures that require high precision in narrow anatomical regions.

-

Miniaturization and digital integration in otoscopes and endoscopes, enabling real-time imaging and wireless data transfer to mobile devices or cloud platforms.

-

Rapid expansion of outpatient and ambulatory care centers, which are increasingly equipped with flexible and compact ENT diagnostic systems.

-

Shift toward minimally invasive sinus dilation techniques, such as balloon sinuplasty, replacing conventional surgical methods.

-

Integration of tele-audiology services, particularly in rural parts of the U.S., offering remote hearing assessments and device calibration.

-

Growing consumer preference for invisible and rechargeable hearing aids, driven by aesthetics and convenience.

-

Increased pediatric ENT screening initiatives, especially in schools, to detect hearing loss and speech disorders early.

Report Scope of U.S. ENT Devices Market

| Report Coverage |

Details |

| Market Size in 2024 |

USD 9.01 Billion |

| Market Size by 2033 |

USD 12.94 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 4.11% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Product, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

U.S. |

| Key Companies Profiled |

Ambu A/S; Cochlear Ltd.; Demant A/S; GN Store Nord A/S; KARL STORZ SE & Co. KG; Olympus Corporation; PENTAX Medical; Richard Wolf GmbH; RION Co., Ltd.; Smith & Nephew, Inc.; Sonova; Starkey Laboratories, Inc.; Stryker; Nico Corporation; Nemera |

Key Market Driver: Increasing Prevalence of Hearing Loss

Hearing loss is emerging as one of the most critical healthcare concerns in the United States, affecting individuals across all age groups but predominantly the elderly. According to the National Institute on Deafness and Other Communication Disorders (NIDCD), approximately 15% of American adults (37.5 million) aged 18 and over report some trouble hearing. Among adults aged 70 and older who could benefit from hearing aids, fewer than 30% have ever used them.

The growing number of individuals with untreated hearing loss has significant social, psychological, and economic implications, contributing to cognitive decline, social isolation, and reduced workforce productivity. This urgent public health concern is driving extensive investments in both hearing screening devices and advanced hearing aid technologies. Federal and state-level programs, including the expansion of Medicare and Medicaid coverage for hearing devices, have further accelerated adoption. In response, companies are developing next-gen hearing aids with AI-enabled background noise filtering, Bluetooth connectivity, and real-time speech enhancement features, significantly driving the U.S. ENT devices market forward.

Key Market Restraint: High Cost of Advanced ENT Devices

Despite technological advancements, the high upfront cost of several ENT devices, particularly robotic surgical systems, AI-enabled hearing aids, and 3D imaging equipment, poses a significant challenge for widespread adoption. Hospitals and clinics in rural or lower-income areas often lack the budgetary capacity to invest in such capital-intensive technologies. Moreover, hearing aids and implants are often only partially covered by insurance plans, with many individuals opting out of treatment due to the financial burden.

While leading manufacturers continue to launch premium-feature devices, their cost-effectiveness remains a concern among providers. The cost-related barrier is particularly evident in the market for hearing implants, where a single cochlear implant procedure can cost between $30,000 and $50,000, including preoperative evaluation, surgery, and post-implant therapy. Unless addressed through policy reform, insurance expansion, or pricing innovation, this financial restraint may limit the addressable market size in economically vulnerable demographics.

Key Market Opportunity: Expansion of Outpatient ENT Services

The growing demand for outpatient and ambulatory ENT procedures is creating a substantial opportunity for manufacturers to develop portable, affordable, and efficient devices tailored for these settings. With the U.S. healthcare system increasingly shifting toward value-based care and cost containment, outpatient facilities are favored due to their lower procedural costs, reduced hospital stay, and faster patient turnaround.

Devices such as flexible endoscopes, portable otoscopes, and hearing screening tools are being optimized for non-hospital environments. Manufacturers are launching compact units with wireless connectivity, app integration, and user-friendly interfaces designed for primary care providers and audiologists. Additionally, regulatory bodies like the FDA have fast-tracked the approval process for such devices, especially those targeting hearing loss, chronic sinusitis, and sleep-disordered breathing. As more patients seek ENT care through outpatient models, this trend will continue to unlock growth opportunities for companies targeting smaller practices and community health settings.

U.S. ENT Devices Market By Product Insights

Diagnostic ENT Devices dominated the U.S. ENT devices market in 2023, owing to their indispensable role in identifying ENT disorders before they escalate into chronic conditions. Among diagnostic tools, rigid endoscopes, sinuscopes, and otoscopes remain the most widely used in clinical practice. Otoscopes, in particular, are essential in pediatric care, where ear infections are a common complaint. The increased demand for early and precise diagnosis, coupled with the availability of digital and video-enabled otoscopes, has bolstered their market position. Similarly, sinuscopes have gained traction due to their critical role in diagnosing chronic sinusitis—a condition affecting nearly 30 million Americans annually.

.webp)

Flexible endoscopes represent the fastest-growing sub-segment within diagnostic devices. This growth is driven by their ability to access anatomically complex areas such as the nasopharynx, larynx, and bronchi with minimal discomfort. The integration of high-definition imaging and video recording capabilities into these devices has further enhanced diagnostic accuracy and documentation. Robot-assisted endoscopes, although currently in the nascent phase, are gaining interest for their use in minimally invasive laryngeal surgeries, setting the stage for future expansion. Hearing screening devices are also experiencing a surge in demand due to government mandates for neonatal hearing tests and growing awareness among adults regarding early detection of hearing impairment.

Surgical ENT Devices are projected to witness substantial growth over the forecast period due to increasing procedural volumes and the shift towards office-based surgeries. Radiofrequency handpieces and sinus dilation devices are particularly notable, as they enable minimally invasive treatments with reduced recovery time. Balloon sinuplasty, which uses sinus dilation devices, is becoming a popular alternative to traditional sinus surgery. ENT hand instruments and otological drill burrs are also experiencing rising demand, especially in otologic surgeries and tympanoplasty procedures. Manufacturers are focusing on ergonomic designs and reusable instrument models to cater to budget-conscious outpatient settings, further contributing to growth.

Country-Level Analysis

The U.S. market is characterized by a high concentration of ENT specialists, a robust healthcare infrastructure, and supportive reimbursement policies. States such as California, Texas, New York, and Florida host some of the largest ENT hospitals and clinics, contributing significantly to the overall market share. In particular, academic medical centers like Mayo Clinic (Minnesota), Cleveland Clinic (Ohio), and Johns Hopkins (Maryland) are actively involved in ENT research, innovation, and clinical trials, acting as incubators for new device development.

Private insurance penetration is also high in the U.S., with many plans now offering partial or full coverage for ENT diagnostics, surgeries, and hearing aids. The Veterans Health Administration and Medicare programs provide a steady patient base for audiological services, further supporting device uptake. Regulatory bodies like the FDA have also taken steps to accelerate device approvals, especially in hearing-related domains. For example, in October 2022, the FDA approved the sale of over-the-counter (OTC) hearing aids, enabling wider accessibility and consumer choice—an important development for market expansion.

Some of the prominent players in the U.S. ENT devices market include:

- Ambu A/S

- Cochlear Ltd.

- Demant A/S

- GN Store Nord A/S

- KARL STORZ SE & Co. KG

- Olympus Corporation

- PENTAX Medical

- Richard Wolf GmbH

- RION Co., Ltd.

- Smith & Nephew, Inc.

- Sonova

- Starkey Laboratories, Inc.

- Stryker

- Nico Corporation

- Nemera

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. ENT devices market

Product

-

-

- Sinuscopes

- Otoscopes

- Laryngoscopes

-

-

- Bronchoscopes

- Laryngoscopes

- Nasopharyngoscopes

-

- Robot Assisted Endoscope

- Hearing Screening Device

-

- Radiofrequency handpieces

- Otological Drill Burrs

- ENT Hand Instruments

- Sinus Dilation Devices

- Nasal Packing Devices

- Others

- Hearing Aids

- Hearing Implants

- Nasal Splints

Regional

- West

- Midwest

- Northeast

- Southwest

- Southeast

.webp)