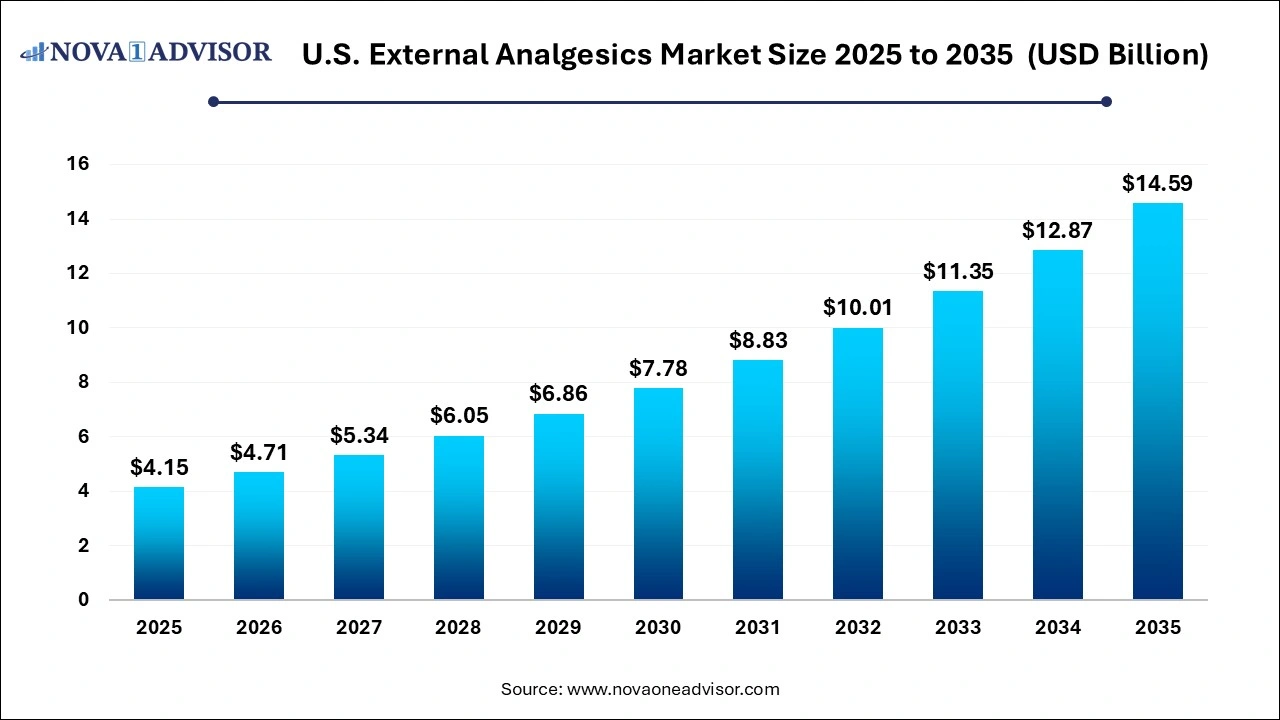

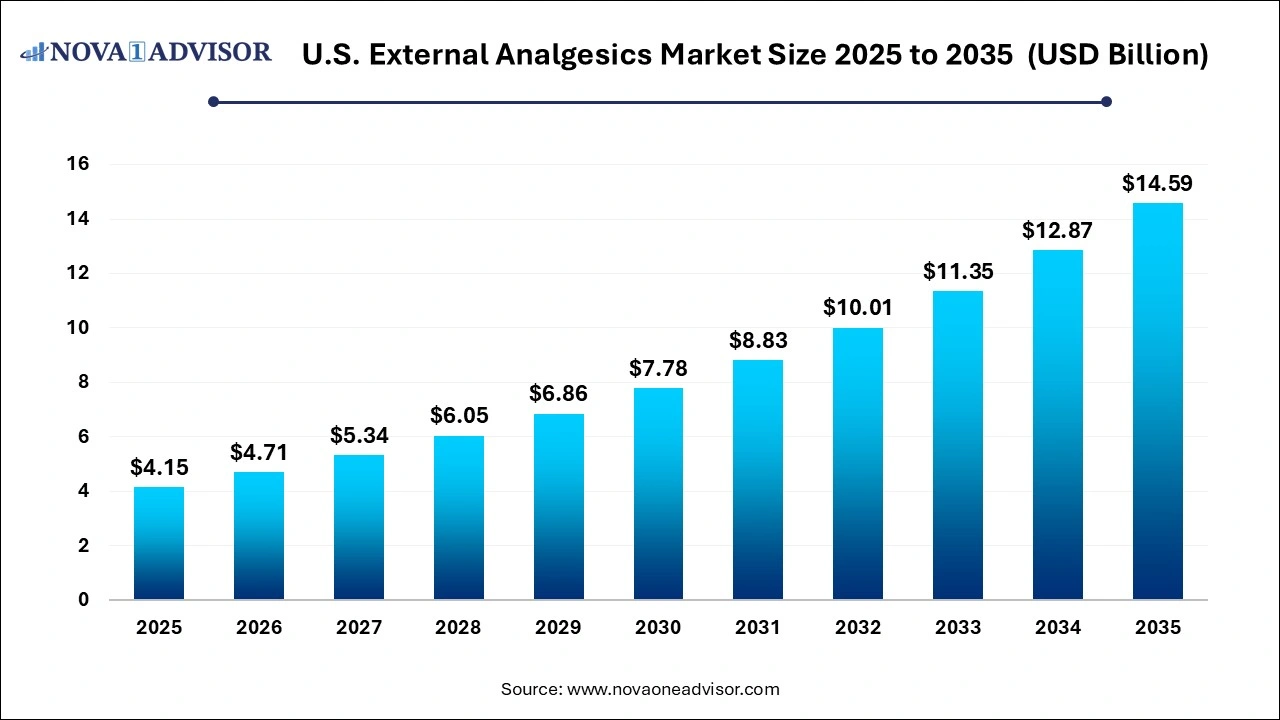

U.S. External Analgesics Market Size and Trends 2026 to 2035

The U.S. external analgesics market size was exhibited at USD 4.15 billion in 2025 and is projected to hit around USD 14.59 billion by 2035, growing at a CAGR of 13.4% during the forecast period 2026 to 2035.

U.S. External Analgesics Market Key Takeaways:

- The hot/cold products segment led the market with the largest revenue share of 58.3% in 2025.

- The kinesiology tape (KT) segment is anticipated to grow at a significant CAGR over the forecast period.

- Based on distribution channel, the retail/ brick & mortar segment led the market with the largest revenue share of 72.0% in 2025.

- The e-commerce segment is anticipated to grow at the fastest CAGR over the forecast period.

Market Overview

The external analgesics market in the United States is experiencing consistent growth as consumers increasingly seek non-invasive, over-the-counter (OTC) pain relief solutions for various musculoskeletal and soft tissue conditions. External analgesics include a range of products applied directly to the skin such as topical creams, sprays, heating pads, TENS devices, kinesiology tape, and red light therapy solutions that provide localized pain relief without systemic side effects. Their appeal lies in ease of use, reduced risk of addiction compared to opioids, and versatility in managing acute and chronic pain.

The demand for these products has expanded beyond athletic and elderly populations to include broader consumer groups managing joint stiffness, postural pain, menstrual cramps, and injury rehabilitation. The increasing prevalence of lifestyle-related ailments like back pain, arthritis, and repetitive strain injuries, alongside the aging population in the U.S., is further accelerating adoption. Moreover, the COVID-19 pandemic shifted consumer preference toward self-managed care and e-commerce-based purchasing, providing a tailwind to the external analgesics segment.

The market is characterized by a diverse product portfolio, ranging from conventional menthol and capsaicin-based topicals to advanced modalities like red light therapy and wearable electrical stimulation devices. Innovation is evident in multifunctional and smart products, including Bluetooth-enabled TENS units and wearable heating patches with auto shut-off and adjustable settings.

Major Trends in the Market

-

Surging Demand for Drug-Free Pain Relief: Consumers are increasingly seeking non-pharmaceutical alternatives to manage chronic and post-exercise pain.

-

Technological Advancements in Pain Devices: New launches in TENS and red light therapy are integrating IoT and smart features.

-

Rising Popularity of E-Commerce Channels: Online sales are expanding, offering subscription-based models and greater consumer education through direct-to-consumer platforms.

-

Growth of Preventive Wellness Culture: External analgesics are being used proactively for recovery and muscle health, especially in fitness-conscious demographics.

-

Sports Rehabilitation and Recovery: The use of kinesiology tape and hot/cold products in athletic training and physical therapy is on the rise.

-

Hybrid Therapy Devices: Multi-modal products that combine heat, vibration, and light therapy are entering the consumer market.

-

Customization and Ergonomic Design: Products are becoming more targeted, with options shaped for joints, lower back, and cervical areas for enhanced comfort and effectiveness.

Report Scope of U.S. External Analgesics Market

| Report Coverage |

Details |

| Market Size in 2026 |

USD 4.71 Billion |

| Market Size by 2035 |

USD 14.59 Billion |

| Growth Rate From 2026 to 2035 |

CAGR of 13.4% |

| Base Year |

2025 |

| Forecast Period |

2026-2035 |

| Segments Covered |

Product, Distribution Channel |

| Market Analysis (Terms Used) |

Value (USD Million/Billion) or (Volume/Units) |

| Key Companies Profiled |

Baxter; Boston Scientific Corporation; Enovis; Medtronic; ICU Medical Inc.; Abbott; Stryker; Nevro Corp.; OMRON Healthcare, Inc. |

Market Driver: Increasing Prevalence of Chronic Musculoskeletal Conditions

One of the core drivers for the U.S. external analgesics market is the growing incidence of chronic musculoskeletal disorders, particularly arthritis, lower back pain, and joint degeneration. According to the CDC, nearly 60 million U.S. adults are living with arthritis, and back pain is a leading cause of disability and workplace absenteeism. These conditions often require long-term pain management strategies that are safe, convenient, and accessible.

External analgesics offer localized pain relief without the gastrointestinal or systemic effects associated with oral NSAIDs or the dependency risk of opioids. Products like TENS devices, heating pads, and topical creams have become go-to solutions for managing daily pain episodes. Additionally, elderly populations are especially drawn to these solutions due to the need to minimize polypharmacy and drug interactions. This chronic condition burden, paired with increasing awareness of non-invasive therapies, is significantly boosting product demand.

Market Restraint: Limited Clinical Evidence for Some Modalities

A key challenge in the external analgesics market is insufficient clinical validation and standardization for certain product categories—particularly newer entrants like red light therapy devices and kinesiology tape. While many consumers report subjective relief, the lack of robust, peer-reviewed clinical trials validating their long-term efficacy and mechanism of action limits widespread adoption by medical professionals and insurers.

This skepticism extends to regulatory hurdles. Devices like TENS or infrared light therapy units must gain FDA clearance, and while many receive Class II designations, they are often marketed with disclaimers. Moreover, a fragmented product quality landscape—ranging from FDA-registered units to unregulated imports—creates consumer confusion and variable effectiveness. As a result, professional endorsement remains tepid for some products, especially in clinical rehabilitation settings.

Market Opportunity: Integration of Smart Technology and Remote Monitoring

An emerging opportunity in the U.S. external analgesics market lies in smart and connected therapeutic devices that provide real-time feedback, usage tracking, and integration with mobile apps. Consumers today demand personalization, control, and data transparency in wellness solutions. Companies are responding with Bluetooth-enabled TENS devices, heating pads with programmable temperature cycles, and light therapy units that log usage and suggest treatment plans.

These features not only improve user experience but also pave the way for integration into remote patient monitoring systems. For example, physiotherapists can monitor device usage in patients undergoing home rehabilitation post-surgery or injury. This aligns with broader trends in digital therapeutics and telehealth, where wearable or smart pain management tools can become part of larger health management ecosystems. In the near future, AI-driven analytics may even predict flare-ups or recommend usage schedules based on biometric inputs.

U.S. External Analgesics Market By Product Insights

Hot and cold products including disposable and non-disposable hot/cold packs currently dominate the U.S. external analgesics market due to their simplicity, affordability, and broad use cases. These products are recommended by doctors, physical therapists, and sports trainers for a range of conditions from sprains to post-surgical recovery. Non-disposable gel-based packs are especially popular in household first-aid and sports kits, while disposable variants cater to travel and work environments. The category benefits from strong retail presence and decades of consumer familiarity.

Red light and infrared therapy products are the fastest-growing segment, driven by rising consumer interest in non-contact, deep tissue stimulation for pain relief and inflammation management. These devices previously used only in dermatology or sports medicine clinics are now available for home use. Companies such as Joovv and Sunbeam have introduced portable red light panels and wearables targeting specific joints or muscle groups. The growth is fueled by social media testimonials, fitness influencer endorsements, and consumer willingness to invest in holistic recovery tools.

U.S. External Analgesics Market By Distribution Channel Insights

Retail and brick & mortar outlets, including pharmacies (e.g., CVS, Walgreens), big box retailers (e.g., Walmart), and specialty stores (e.g., GNC), dominate the external analgesics market. These channels benefit from consumer trust, immediate access, and the ability to offer bundled health products. Products like menthol creams, hot packs, and elastic tapes are often purchased as part of broader wellness or recovery baskets. In-store visibility, pharmacist recommendations, and on-shelf promotions further boost sales.

However, e-commerce is the fastest-growing distribution channel. Amazon, brand-owned D2C websites, and online health platforms have reshaped how consumers discover and purchase external analgesics. The convenience of home delivery, wider product variety, access to user reviews, and subscription-based models (for consumables like hot packs or creams) have boosted online sales. Moreover, digital-native brands are leveraging influencer marketing, instructional content, and telehealth tie-ins to drive traffic to their platforms.

Country-Level Analysis

The U.S. external analgesics market reflects strong national demand for drug-free pain solutions across diverse demographic groups. The aging population, with its higher incidence of arthritis and mobility issues, continues to be the primary consumer base for hot/cold packs, heating pads, and TENS units. At the same time, younger consumers especially fitness enthusiasts and remote workers are adopting kinesiology tapes, muscle recovery devices, and wearable therapy solutions to address posture-related strain and exercise recovery.

Healthcare providers increasingly recommend external analgesics as part of conservative care plans to reduce reliance on opioids. This aligns with CDC guidelines encouraging non-pharmacological pain management. Meanwhile, workplace injury management, veterans’ rehabilitation programs, and post-orthopedic surgical care all integrate external therapies. Additionally, consumer preference for wellness and self-care is fueling innovation, especially in smart devices and reusable products. Regulatory oversight ensures that products like TENS and light therapy devices meet safety standards, creating a trusted marketplace for innovation and growth.

Some of the prominent players in the U.S. external analgesics market include:

U.S. External Analgesics Market Recent Developments

-

March 2025: Therabody launched its new smart TENS and heat therapy belt, integrated with app-based tracking and pain mapping, targeting users with chronic lower back pain.

-

February 2025: Biofreeze announced its redesigned pain relief gel patch, combining cold therapy with vibration pads for enhanced effect, launched nationwide in partnership with Walgreens.

-

January 2025: Sunbeam (a division of Newell Brands) introduced a flexible red light therapy wrap designed for targeted knee and elbow relief, integrating flexible LED mesh for deeper penetration.

-

December 2024: KT Tape expanded its kinesiology tape portfolio with eco-friendly, biodegradable fabric tapes and collaborated with fitness influencers for a “Recovery Matters” campaign.

-

November 2024: Amazon Health added a new Pain Relief & Recovery category, highlighting top-rated hot/cold therapy and red light devices curated with physiotherapists and chiropractors.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2035. For this study, Nova one advisor, Inc. has segmented the U.S. external analgesics market

By Product

-

- Disposable

- Non-Disposable

- Kinesiology Tape

- Heating Pads

- TENS Devices

- Red Light Therapy/ Infrared Therapy Products

By Distribution Channel

- Retail/Brick & Mortar

- E-Commerce

- Others