U.S. Eye Care Market Size and Trends

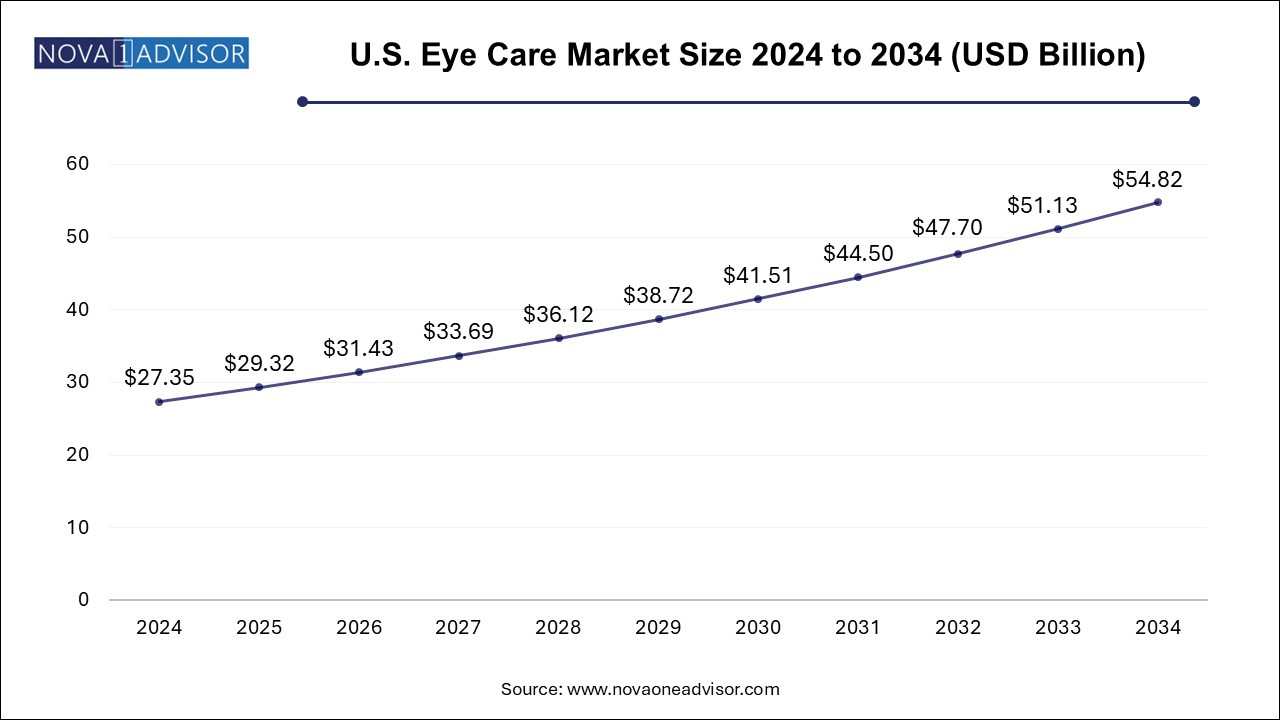

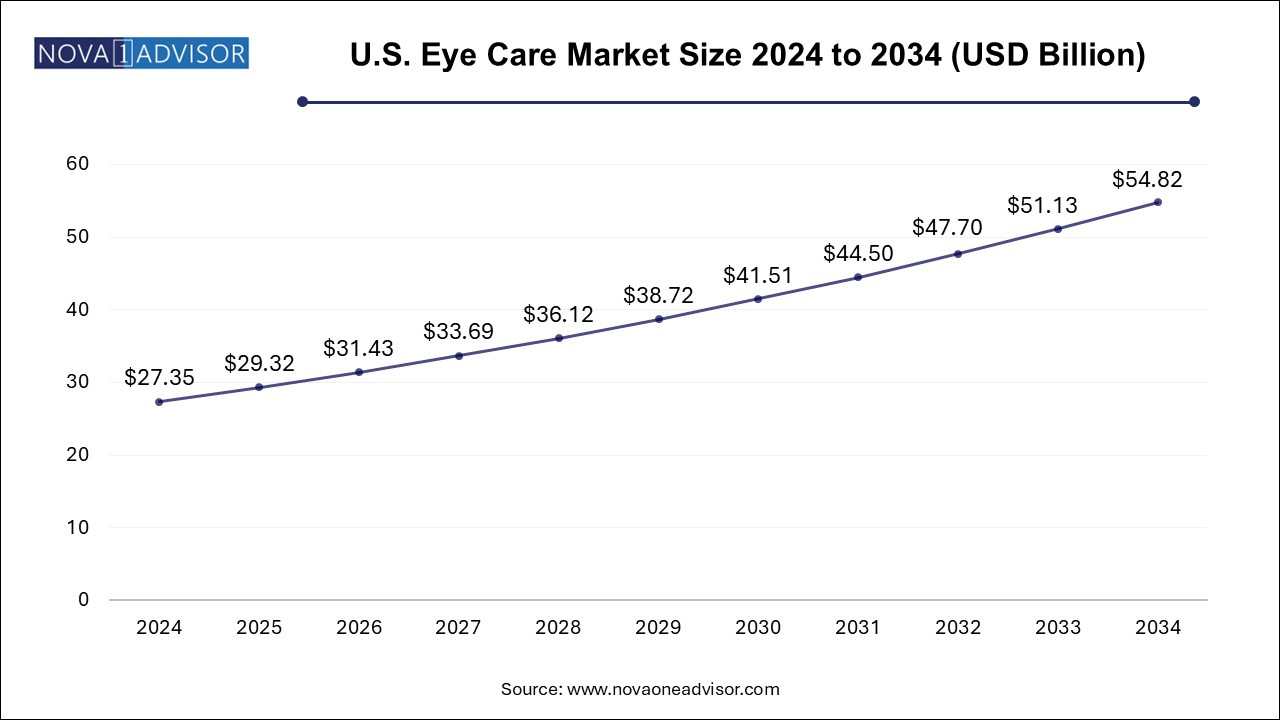

The U.S. eye care market size was exhibited at USD 27.35 billion in 2024 and is projected to hit around USD 54.82 billion by 2034, growing at a CAGR of 7.2% during the forecast period 2025 to 2034.

Market Overview

The U.S. eye care market has witnessed significant transformation in recent years, driven by technological advancements, evolving consumer behaviors, and a heightened focus on preventative healthcare. Eye care, a crucial component of the healthcare system, encompasses a wide array of products and services intended to preserve vision, treat ocular disorders, and enhance visual quality. From routine eye checkups and prescription glasses to complex ophthalmic surgeries and pharmaceutical interventions, the sector has grown into a diverse and dynamic landscape.

According to industry observations, the rising prevalence of age-related eye conditions, such as cataracts, macular degeneration, and glaucoma, is intensifying the demand for ophthalmic products and services. Additionally, the escalating screen time across all age groups has amplified the incidence of vision problems such as digital eye strain and myopia, pushing consumers toward proactive eye care.

The market's robust performance is further propelled by the increasing penetration of eye care products through retail and e-commerce platforms. While traditional hospital and clinic-based distribution remains critical, online stores have become a strong alternative due to convenience and accessibility, particularly among younger consumers. Furthermore, the market is witnessing a convergence of health and lifestyle trends, as evident in the rise of fashionable prescription eyewear and daily wear contact lenses.

With a maturing population, a growing middle class, and rising healthcare expenditures, the U.S. eye care market is poised for continued growth, offering opportunities for innovation and expansion across the value chain.

Major Trends in the Market

-

Increased Adoption of Daily Disposable Contact Lenses: Consumers are gravitating towards daily disposables due to hygiene benefits, comfort, and convenience.

-

Digital Eye Strain Awareness Campaigns: Rising awareness around screen-induced eye strain has led to increased sales of blue-light filtering glasses and lubricating eye drops.

-

Technological Integration in Eye Exams: Tele-optometry and AI-enabled diagnostic tools are increasingly being used for early detection of eye conditions.

-

Rise of Fashion-Driven Eyewear: Eyewear is evolving into a fashion accessory, influencing purchasing decisions especially among Millennials and Gen Z.

-

E-commerce as a Growing Distribution Channel: Online sales of contact lenses, prescription glasses, and ocular health products have grown significantly post-pandemic.

-

Sustainable Eye Care Products: Manufacturers are introducing biodegradable lenses and eco-friendly packaging in response to growing environmental concerns.

-

Preventative Eye Care Among Children: Increasing focus on early intervention in children’s vision problems has led to rising pediatric eye care services and products.

Report Scope of U.S. Eye Care Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 29.32 Billion |

| Market Size by 2034 |

USD 54.82 Billion |

| Growth Rate From 2025 to 2034 |

CAGR of 7.2% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

Product, Mode of Purchase, and Distribution Channel |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Key Companies Profiled |

Alcon, Inc.; Johnson and Johnson Eye Care, Inc.; Bausch & Lomb Incorporated; Carl Zeiss Meditec AG (ZEISS International); HOYA CORPORATION; Rayner; STAAR SURGICAL; Novartis AG |

A primary driver of the U.S. eye care market is the increasing incidence of age-related eye disorders. With a growing elderly population—projected to comprise over 20% of the U.S. population by 2030—conditions such as presbyopia, cataracts, macular degeneration, and glaucoma are becoming more prevalent. According to the National Eye Institute, by 2050, the number of Americans with cataracts is expected to double from 24.4 million to about 50 million. This demographic trend directly boosts demand for intraocular lenses, prescription eyewear, and frequent ophthalmologic checkups.

Furthermore, these conditions often require long-term management and surgical interventions, sustaining demand for both prescription and over-the-counter (OTC) ocular health products. The convergence of aging with improved access to eye care services and insurance coverage has also expanded the consumer base. Innovations in surgical techniques and optical devices—like premium intraocular lenses (IOLs) offering multifocal capabilities—further reinforce market expansion.

Market Restraint: High Cost of Advanced Eye Care Products and Services

Despite positive growth indicators, the high cost associated with advanced eye care products and treatments remains a substantial barrier. High-end prescription lenses, specialty contact lenses, and ophthalmic surgeries are often expensive, limiting access for uninsured or underinsured populations. For example, premium intraocular lenses used in cataract surgeries can cost significantly more than standard monofocal lenses, creating a price barrier for many.

Furthermore, while insurance may cover routine eye exams and basic corrective measures, it often falls short of covering cosmetic or technologically advanced vision correction options. This financial gap may deter patients from pursuing necessary treatments, especially in the case of elective procedures. The disparity in access to care—especially across rural or low-income urban areas—underscores the challenge of equitable service delivery in the U.S. eye care ecosystem.

Market Opportunity: Growth of Pediatric Vision Care

The pediatric segment presents a promising growth opportunity in the U.S. eye care market. With increasing digital device usage among children and mounting concerns over early-onset myopia, parents and schools are placing greater emphasis on children's eye health. The American Optometric Association now recommends comprehensive eye exams for children as early as six months old, followed by annual check-ups—further encouraging early detection and correction of vision issues.

In response, companies are introducing kid-friendly eyewear with durable materials, fun designs, and improved fit, as well as contact lenses designed specifically for pediatric use. Moreover, school-based vision screening programs and initiatives by nonprofit organizations are facilitating access to care for underserved children. These dynamics are fostering demand for both OTC and Rx products tailored to pediatric needs, making it a ripe area for investment and innovation.

U.S. Eye Care Market By Product Insights

Contact lenses dominated the product segment in the U.S. eye care market, accounting for a significant share due to their widespread use for both vision correction and cosmetic purposes. The popularity of daily disposable lenses, which offer convenience and hygiene, has propelled this segment. Brands such as Acuvue (Johnson & Johnson Vision) and Air Optix (Alcon) continue to dominate the market, offering options ranging from astigmatism correction to multifocal lenses. Technological advancements, such as silicone hydrogel materials and moisture-lock technology, have enhanced the comfort and oxygen permeability of contact lenses, making them the preferred choice for millions of Americans.

Meanwhile, ocular health products are emerging as the fastest-growing product segment. With increased awareness of eye health maintenance, especially in relation to screen fatigue and aging, there is a growing demand for artificial tears, antihistamine drops, and supplements promoting retinal health. Companies are expanding their portfolios to include preservative-free formulations and combination therapies that address both dry eyes and allergies. The accessibility of these products over the counter and via online platforms is also fueling their rapid growth, positioning ocular health products as a key area of expansion in the coming years.

U.S. Eye Care Market By Mode of Purchase Insights

Prescribed (Rx) products currently dominate the U.S. eye care market by mode of purchase. Prescription items such as corrective contact lenses, medicated eye drops, and intraocular lenses for cataract treatment are essential for treating a broad range of chronic and acute eye conditions. These products require medical diagnosis and oversight, ensuring consistent demand through ophthalmologist and optometrist channels. The reliance on medical expertise also supports product quality and safety, reinforcing consumer trust in Rx-based solutions.

On the other hand, Over-the-Counter (OTC) products are the fastest-growing category. As health-conscious consumers seek proactive solutions to common problems like dry eyes, irritation, and digital eye strain, demand for OTC products such as lubricating drops, antihistamines, and blue-light blocking glasses has surged. The convenience of purchasing these items without a prescription, combined with extensive retail and online availability, makes OTC products particularly attractive. Marketing efforts emphasizing natural ingredients and wellness benefits have further enhanced their appeal across diverse age groups.

U.S. Eye Care Market By Distribution Channel Insights

Retail stores remain the dominant distribution channel in the U.S. eye care market, driven by the longstanding presence of optical retail chains and pharmacies. Retailers such as LensCrafters, Walmart Vision Centers, and Walgreens provide immediate access to a wide range of eye care products and services, including in-store optometrist consultations. The tactile shopping experience, combined with real-time product trials (especially for eyewear), supports consumer engagement and loyalty, making this channel indispensable.

Nevertheless, online stores have emerged as the fastest-growing distribution channel, especially post-COVID-19. Platforms such as Warby Parker, 1-800 Contacts, and Amazon have capitalized on digital convenience, offering subscription models, virtual try-on features, and seamless prescription fulfillment. Consumers appreciate the flexibility and time savings offered by e-commerce, along with periodic discounts and home delivery. As digital health literacy improves and regulations around online vision care evolve, this segment is expected to gain even more traction, particularly among tech-savvy and younger consumers.

Some of the prominent players in the U.S. eye care market include:

U.S. Eye Care Market Recent Developments

-

March 2025: Johnson & Johnson Vision launched the Acuvue Oasys MAX 1-Day contact lenses across the U.S., featuring TearStable Technology™ aimed at reducing digital eye fatigue—a key move amid increasing screen time.

-

January 2025: Bausch + Lomb acquired Dry Eye Relief Inc., a startup specializing in preservative-free artificial tears, to strengthen its ocular health portfolio and respond to the surging demand for natural eye care solutions.

-

November 2024: Warby Parker announced a partnership with UnitedHealthcare to expand access to affordable prescription eyewear for insured customers. This strategic alliance aims to bridge the affordability gap in the Rx eyewear market.

-

October 2024: Alcon introduced a smart contact lens prototype embedded with biosensors to monitor intraocular pressure in glaucoma patients, signaling the integration of diagnostics and therapeutics in wearable eye care devices.

-

August 2024: EssilorLuxottica opened a new distribution center in Texas, designed to streamline its North American supply chain and improve delivery timelines for both retail and e-commerce orders.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the U.S. eye care market

By Product

- Contact Lenses

- Intraocular Lenses

- Ocular Health Products

- Others

By Mode Of Purchase

- Prescribed (Rx) Products

- Over The Counter (OTC) Products

By Distribution Channel

- Hospitals & Clinics

- Retail Stores

- Online Stores

- Others