U.S. Female External Catheter Market Size and Research

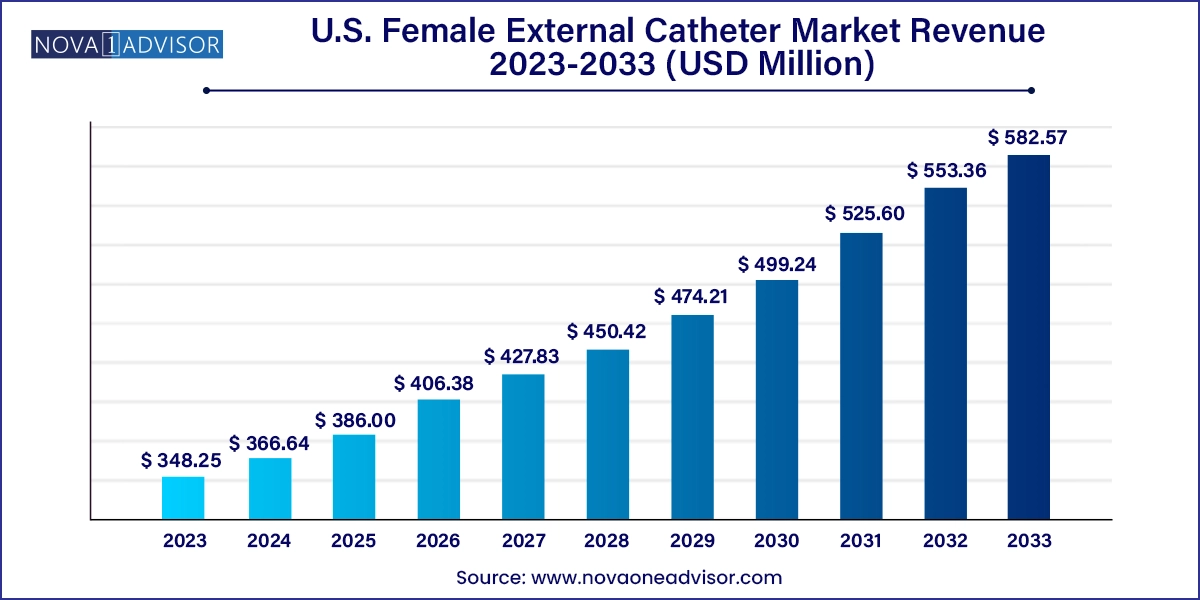

The U.S. female external catheter market size was exhibited at USD 348.25 million in 2023 and is projected to hit around USD 582.57 million by 2033, growing at a CAGR of 5.28% during the forecast period 2024 to 2033.

U.S. Female External Catheter Market Key Takeaways:

- The latex segment is expected to register the fastest CAGR of 5.59% during the forecast period.

- The segment is also expected to register the fastest CAGR of 5.98% during the forecast period.

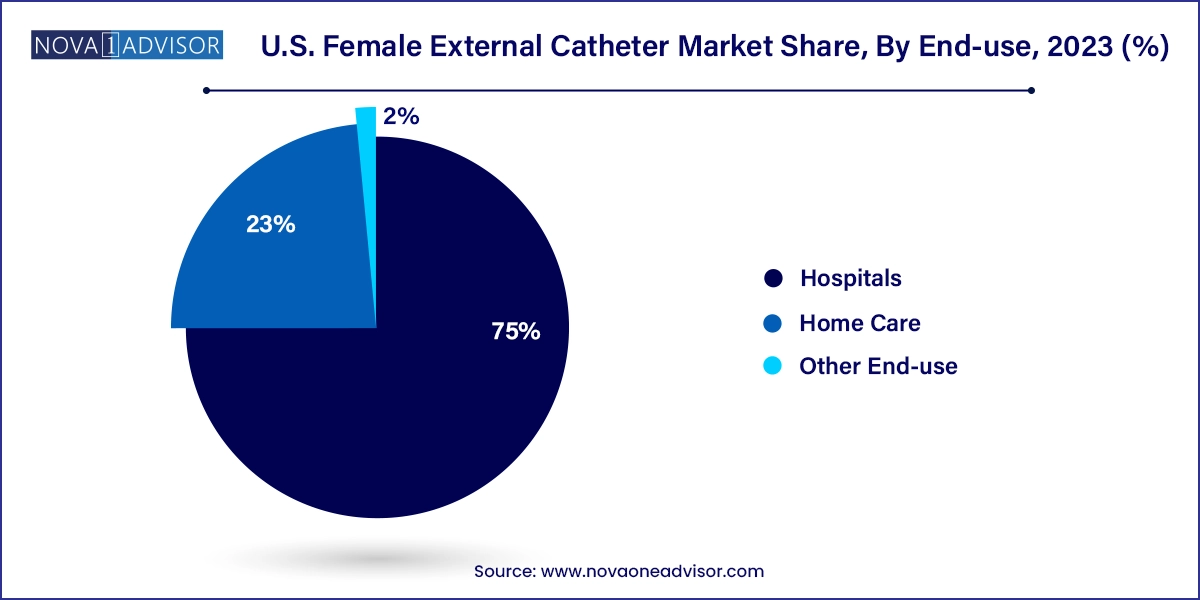

- Hospitals dominated the market share 75.0% in 2023.

- Further, home care segment is expected to register the fastest CAGR of 7.41% during the forecast period

Market Overview

The U.S. female external catheter market has experienced notable evolution over the past few years, driven by changing healthcare delivery models, rising prevalence of urinary incontinence among women, and innovations in non-invasive urological devices. Unlike indwelling or intermittent catheters, female external catheters (FECs) are designed for non-invasive management of urinary incontinence. These devices provide an alternative to traditional catheterization by collecting urine externally without penetrating the urethra, thereby reducing the risk of catheter-associated urinary tract infections (CAUTIs).

This market addresses a critical clinical and caregiving gap, especially among older women and those suffering from neurological disorders, immobility, or chronic illnesses. Female external catheters are gaining prominence in both hospital and home care settings due to their ease of application, improved patient comfort, and reduced infection risk. The growing emphasis on dignified, safe, and effective continence care for women is encouraging healthcare providers to adopt these devices as a standard of care.

Additionally, the shift toward value-based healthcare models has increased demand for cost-effective and complication-free solutions in urology. Female external catheters align with this trend by minimizing hospital-acquired infections, decreasing nursing burden, and enhancing patient satisfaction. In the U.S., where urinary incontinence affects an estimated 25 million adults—predominantly women—these devices are poised to become essential tools for managing continence in various clinical and non-clinical environments.

Major Trends in the Market

-

Growth in Non-invasive Continence Management Solutions: Increased focus on patient comfort and CAUTI reduction is driving demand for external catheter devices.

-

Rising Preference for Home-based Urology Care: The aging population and post-acute care model are fueling demand for user-friendly home-use catheters.

-

Improved Designs and Anatomical Fit: Manufacturers are enhancing product fit and material flexibility to improve adhesion and reduce leakage.

-

Expansion in Female-focused Urology Products: More companies are entering the female-specific external catheter space, traditionally dominated by male products.

-

Sustainability in Medical Devices: Growing interest in reusable external components and eco-friendly materials to reduce clinical waste.

-

Digital Health Integration: Smart sensors and moisture detection systems are being explored to monitor urine output in real time.

-

Rising Awareness through Advocacy Groups: Women’s health organizations are helping reduce stigma around incontinence, increasing openness to new continence management solutions.

-

Greater Involvement of Telehealth Providers: Telemedicine-driven urology consultations are recommending FECs as non-invasive solutions suitable for remote patient care.

Report Scope of U.S. Female External Catheter Market

| Report Coverage |

Details |

| Market Size in 2024 |

USD 366.64 Million |

| Market Size by 2033 |

USD 582.57 Million |

| Growth Rate From 2024 to 2033 |

CAGR of 5.28% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Material, Application, Area of Incontinence, End-use, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Country scope |

U.S. |

| Key Companies Profiled |

BD; Stryker; Boehringer Laboratories, LLC.; Consure Medical; Hollister Incorporated |

Key Market Driver – Increasing Prevalence of Female Urinary Incontinence

A major driver in the U.S. female external catheter market is the increasing prevalence of urinary incontinence among women, particularly in the aging and chronically ill populations. Urinary incontinence (UI) in women is often linked to childbirth, menopause, pelvic floor disorders, and chronic illnesses like diabetes or Parkinson’s disease. According to the Urology Care Foundation, one in three women over the age of 45 in the U.S. experiences some form of UI, with prevalence increasing with age.

This substantial patient base necessitates diverse continence care solutions, especially for women unwilling or unable to use invasive catheter types. Female external catheters provide a practical and comfortable option, especially in hospital environments, nursing homes, and post-surgical recovery. They minimize skin breakdown and avoid urethral trauma, making them ideal for long-term use in both clinical and home settings. With demographic trends indicating continued growth in elderly female populations, demand for safe and dignified continence care solutions is expected to rise sharply.

Key Market Restraint – Anatomical Challenges and Product Limitations

Despite their clinical advantages, female external catheters face inherent design and anatomical challenges that act as a significant market restraint. Unlike male external catheters, which are relatively straightforward to fit, female devices require a more complex design to adapt to varied anatomies. Ensuring proper adhesion, comfort, and urine channeling without leakage has historically been a major engineering hurdle.

Additionally, the relative novelty of female-specific external catheters means fewer product options, which can limit accessibility and affordability. Some patients and caregivers are also unfamiliar with the devices, resulting in misuse or reluctance to adopt. Current products still face limitations with regard to extended wear time, mobility, and skin sensitivity issues. These functional limitations must be addressed through design refinement, educational outreach, and improved material science before female external catheters can achieve mainstream adoption across all patient demographics.

Key Market Opportunity – Growth in Home Care and Post-Acute Settings

One of the most promising opportunities for the U.S. female external catheter market lies in the expansion of home care and post-acute care settings. As healthcare systems shift away from long hospital stays toward cost-effective, at-home recovery and chronic condition management, the need for self-administered or caregiver-assisted continence solutions is growing. Female external catheters offer a non-invasive, dignified, and easy-to-use alternative that fits well into the home care model.

This opportunity is amplified by the increasing use of wearable medical technologies and remote patient monitoring systems. Female external catheters can be integrated into digital health platforms that track output volume, hydration status, and skin integrity—adding value for clinicians managing patients remotely. Furthermore, as insurers begin to reimburse more home-based care, including incontinence supplies, the pathway for market expansion into the residential sector becomes increasingly clear.

U.S. Female External Catheter Market By Material Insights

The Silicone-based female external catheters dominated the U.S. market in 2023, owing to their superior biocompatibility, flexibility, and hypoallergenic properties. Silicone is widely favored in medical applications due to its inert nature, which reduces the risk of skin irritation and allergic reactions. In external catheter design, these characteristics translate into better patient comfort, longer wear time, and reduced risk of dermatitis. Silicone’s high permeability to gases like oxygen also makes it ideal for sensitive skin, which is a critical consideration for elderly users.

Latex catheters, while still present in the market, are declining in share, but continue to serve select healthcare settings due to lower manufacturing costs. Latex’s flexibility and ease of shaping make it useful for custom-fit applications; however, the material is prone to allergic reactions and less durable for extended wear. As patient preferences evolve toward safer and more comfortable options, the shift toward latex-free, silicone-based external devices is expected to accelerate, particularly in hospital protocols and home care settings.

U.S. Female External Catheter Market By Application Insights

Diabetes emerged as the leading application area, due to the strong correlation between diabetes and urinary incontinence, especially among aging women. Diabetic neuropathy often leads to impaired bladder control, making external catheters a viable solution for managing accidental urine leakage. With over 11 million U.S. women living with diabetes, the demand for safe, non-invasive continence solutions is significant. Healthcare providers increasingly prescribe female external catheters in both inpatient and outpatient diabetic care protocols to reduce the risk of infection and improve comfort.

Multiple sclerosis is the fastest-growing application segment, as more women are diagnosed and live longer with this chronic condition. MS often affects bladder function, leading to unpredictable and urgent episodes of urinary incontinence. External catheters allow these patients to maintain independence while reducing the embarrassment and inconvenience associated with frequent bathroom trips. As awareness of MS-related incontinence rises and patient advocacy groups emphasize non-invasive care, this segment is expected to show above-average CAGR through 2033.

U.S. Female External Catheter Market By Area of Incontinence Insights

Stress urinary incontinence (SUI) dominated the female external catheter market, as it is the most common form of incontinence among U.S. women. Triggered by physical activities like sneezing, laughing, or exercise, SUI is prevalent among postpartum women and those with pelvic floor weakness. Female external catheters provide a discrete and comfortable solution for managing SUI without resorting to invasive catheterization or absorbent undergarments. As women become more proactive in managing bladder leaks, demand for user-friendly external devices is steadily rising.

Functional incontinence is projected to be the fastest-growing segment, especially among older adults and neurologically impaired individuals who cannot reach the toilet in time. Functional limitations caused by stroke, dementia, or physical disability make traditional toileting difficult. Female external catheters offer an elegant solution by allowing passive urine management while preserving hygiene and skin health. As assisted living and nursing home populations expand, so will the need for functional incontinence solutions in the form of external urinary collection devices.

U.S. Female External Catheter Market By End-use Insights

Hospitals remained the largest end-use segment in 2023, driven by increased focus on infection prevention and patient-centered care. Female external catheters are being integrated into CAUTI-prevention bundles and used as first-line alternatives to indwelling catheters in non-critically ill patients. The ease of application, disposability, and non-invasive nature of these products make them suitable for postoperative recovery, neurology, urology, and geriatric wards. Large hospital networks are increasingly implementing standard protocols recommending external devices to improve patient outcomes and reduce costs.

Home care is the fastest-growing end-use segment, as more patients manage chronic conditions and postoperative recovery in non-institutional settings. With the growth of aging-in-place initiatives and the expansion of Medicare Advantage benefits for incontinence care, demand for convenient and discreet continence management solutions is surging. Female external catheters are being embraced by caregivers and patients alike for their simplicity, safety, and comfort. As awareness and availability increase, this segment is poised to become a key growth driver for the market.

Country-Level Analysis

In the U.S., the female external catheter market is shaped by a unique blend of aging demographics, healthcare innovation, and a strong emphasis on infection prevention. States with high elderly populations—such as Florida, California, and Pennsylvania—show the highest product adoption rates, especially in assisted living and skilled nursing facilities. Federal mandates to reduce hospital-acquired infections have further accelerated the use of external catheters in clinical settings nationwide.

Private insurance providers, Medicare, and the Veterans Health Administration are increasingly reimbursing external catheter devices as part of continence care kits. Urban centers like New York City and Chicago have seen a surge in telehealth-driven prescriptions for these devices, while rural healthcare systems are adopting them to improve outpatient and in-home care delivery. With growing patient awareness, changing caregiver attitudes, and favorable reimbursement shifts, the U.S. market is expected to witness steady expansion over the next decade.

Some of the prominent players in the U.S. female external catheter market include:

- BD

- Stryker

- Boehringer Laboratories, LLC.

- Consure Medical

- Hollister Incorporated

- Huons Global

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. female external catheter market

Material

Application

- Diabetes

- Strokes

- Alzheimer's disease

- Parkinson's disease

- Spinal Cord Injury

- Bladder Cancer

- Ovarian Cancer

- Multiple Sclerosis

- Others

Area of Incontinence

- Stress Urinary Incontinence

- Urge/OAB (Overactive Bladder)

- Overflow

- Functional

- Mixed

- Reflex

- Severe Incontinence

End-use

- Home Care

- Hospitals

- Other End-use