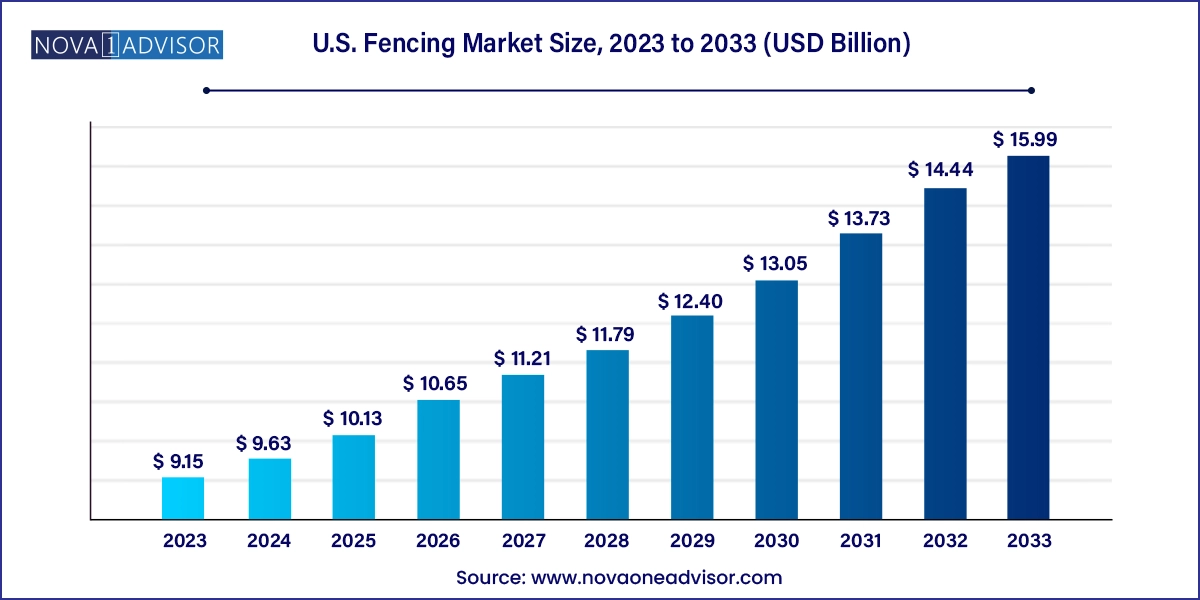

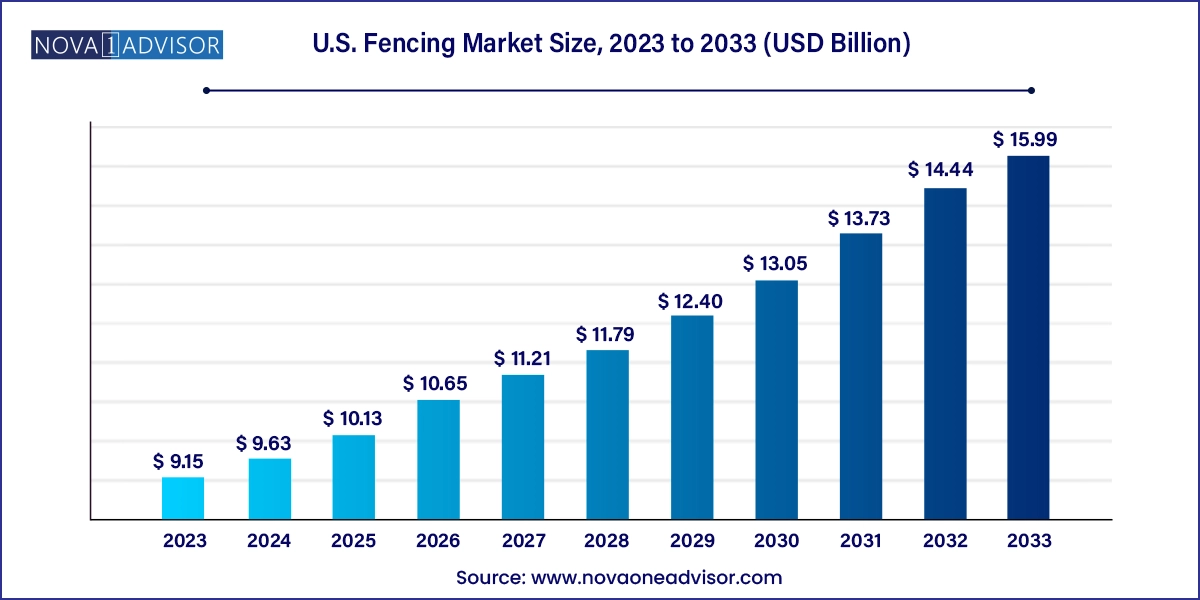

U.S. Fencing Market Size and Growth

The U.S. fencing market size was exhibited at USD 9.15 billion in 2023 and is projected to hit around USD 15.19 billion by 2033, growing at a CAGR of 5.2% during the forecast period 2024 to 2033.

U.S. Fencing Market Key Takeaways:

- The metal fencing product segment led the market and had a major share of the revenue with USD 4.55 billion in 2023.

- The concrete fencing segment is poised to advance at the highest CAGR of 6.9% during the forecast period of 2024-2033.

- Residential application contributes the largest share to the U.S. fencing market and accounted for 33.6% of revenue in 2023.

- The segment is expected to expand at a CAGR of around 5.3% during the forecast period.

- The south U.S. regional segment accounted for the highest revenue share of USD 3.2 billion and is poised to advance at a CAGR of around 5.8% during the forecast period.

Market Overview

The U.S. fencing market has evolved significantly over the past decade, shaped by rising investments in residential development, urban infrastructure, and a growing emphasis on property aesthetics and security. Fencing plays a vital role in demarcating boundaries, enhancing security, ensuring privacy, and adding aesthetic value to residential, commercial, and institutional properties. Demand is further bolstered by the increase in remodeling projects and urban beautification initiatives across U.S. cities.

Fencing solutions in the U.S. are no longer limited to conventional barriers. Today, smart fences integrated with surveillance systems and automation tools are gaining popularity, particularly in high-end residential and industrial areas. Additionally, shifting preferences toward durable, low-maintenance materials such as vinyl, composite, and powder-coated steel are influencing the competitive landscape. Amid this dynamic evolution, technological innovation, environmental sustainability, and customization are becoming key differentiators among market players.

Major Trends in the Market

-

Increased use of low-maintenance and eco-friendly materials such as composite fencing and recycled plastic.

-

Rising demand for smart fencing systems, integrated with alarms, sensors, and remote control features.

-

Growing popularity of privacy fences in suburban and urban residential areas.

-

Expansion of decorative and ornamental fencing as part of landscape architecture.

-

Strong emphasis on perimeter security in commercial and governmental properties.

-

Surging DIY installations supported by easy-to-assemble fencing kits and online tutorials.

-

Growth in fencing-as-a-service (FaaS) offered by specialized contractors for temporary event setups and construction zones.

-

Urban policy shifts emphasizing green perimeters and noise-reducing fencing in city planning.

Report Scope of U.S. Fencing Market

| Report Coverage |

Details |

| Market Size in 2024 |

USD 9.63 Billion |

| Market Size by 2033 |

USD 15.19 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 5.2% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Material, Application, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

U.S. (Northeast, Midwest, South, West) |

| Key Companies Profiled |

Allied Tube & Conduit; Ameristar Fence Products Incorporated; Associated Materials LLC; Bekaert; CERTAINTEED; Gregory Industries; Jerith Manufacturing; Long Fence Company Inc.; Ply Gem Residential Solutions; Poly Vinyl Creations |

Market Driver: Rising Residential Construction and Home Improvement Projects

One of the major drivers propelling the U.S. fencing market is the steady rise in residential construction and home improvement initiatives. Fueled by a growing housing demand, low-interest mortgage environments, and increased consumer spending on home aesthetics and privacy, fencing installation has become a default part of many residential developments. Suburban growth across states like Texas, Florida, and Arizona has especially contributed to new fence installations, particularly wood and vinyl fences that offer an optimal balance between aesthetics and functionality.

The COVID-19 pandemic also redefined residential needs, with more homeowners investing in outdoor spaces and private enclosures. Backyard renovations, pool fencing, garden fencing, and pet containment zones are increasingly viewed as essential features, further boosting demand. Moreover, the emergence of home improvement influencers and online content has significantly inspired DIY installations, creating opportunities across traditional and e-commerce retail channels.

Market Restraint: Fluctuating Raw Material Costs

A notable restraint in the U.S. fencing market is the volatile pricing of raw materials such as lumber, steel, aluminum, and plastics. These fluctuations, influenced by factors like trade policies, inflation, global supply disruptions, and climate-induced shortages, impact both manufacturing costs and final retail prices. For example, during the 2021-2022 period, lumber prices spiked drastically due to supply chain challenges and increased home renovation activity, making wooden fences significantly more expensive for both consumers and contractors.

These price shifts can deter customers from proceeding with planned installations or force a switch to less preferred materials, impacting brand loyalty and contractor margins. Furthermore, manufacturers are often compelled to absorb a portion of the increased costs to remain competitive, which affects their profitability. Supply constraints also delay construction timelines, leading to inefficiencies across the value chain.

Market Opportunity: Innovation in Modular and Smart Fencing Systems

The growing interest in smart and modular fencing systems represents a high-potential opportunity within the U.S. market. Modular fencing allows for faster, more flexible installation, and easier replacements or upgrades. These systems are especially relevant for temporary or semi-permanent applications such as construction sites, public events, and rental properties.

On the technological front, smart fences integrated with motion detectors, surveillance cameras, and alarm systems are gaining traction among security-conscious consumers. Startups and established security solution providers are exploring the convergence of fencing with IoT and AI, offering smart perimeters that notify homeowners or facility managers of breaches in real time. These innovations appeal particularly to high-net-worth residential properties, gated communities, and logistics facilities seeking layered security measures.

U.S. Fencing Market By Material Insights

Metal fencing dominated the material segment in 2024, owing to its superior durability, resistance to weather elements, and high security features. Steel and aluminum fences are widely used in both residential and commercial applications for perimeter protection, especially in urban settings. Wrought iron fencing remains a popular choice for decorative appeal in premium properties. Furthermore, powder-coated metal fencing offers corrosion resistance and longer lifespans, making them ideal for regions with heavy rainfall or snow.

Plastic & composite fencing is the fastest growing segment, driven by rising demand for low-maintenance, eco-friendly solutions. Vinyl and composite materials resist rot, fading, and insect damage, making them attractive alternatives to traditional wood. Their aesthetic flexibility, with options mimicking natural textures, appeals to design-conscious homeowners. Additionally, the increasing availability of recycled composite fencing aligns with green building codes and sustainability goals, making this segment highly promising for future expansion.

U.S. Fencing Market By Application Insights

The residential sector was the dominant application segment, reflecting homeowners' increasing investment in privacy, safety, and outdoor aesthetics. Fences are commonly used to enclose backyards, pools, gardens, and driveways, often dictated by municipal codes and homeowner preferences. Popular materials in residential installations include wood, vinyl, and ornamental metal, with custom designs gaining favor in upscale neighborhoods. The growth of suburban housing projects and rising homeownership rates continue to support this segment.

The 'Others' category, encompassing commercial, industrial, and institutional uses, is growing rapidly, particularly in high-security environments like warehouses, schools, government buildings, and data centers. Here, fencing serves as a physical deterrent, compliance requirement, and privacy enhancer. Chain-link and high-security metal fencing dominate this category, while electrified and barbed-wire fences are prevalent in remote utility installations. Increased focus on commercial property security and perimeter management is fueling investments in this segment.

U.S. Fencing Market By Regional Insights

The South U.S. region led the fencing market, due to expansive residential construction and favorable climate conditions for year-round outdoor projects. States like Texas, Florida, and Georgia have seen a surge in housing developments and population growth, driving up fencing demand. Cultural preferences for defined property boundaries and pet safety further augment market size. Moreover, storm-related insurance regulations in coastal regions often mandate fencing, creating sustained demand.

The West U.S. is the fastest growing region, fueled by high-value real estate markets in California, Arizona, and Nevada. Wildfire management strategies have also influenced fencing practices, with homeowners investing in fire-resistant materials and clearance perimeters. The region's affinity for modern, minimalist designs has driven uptake in metal and composite fencing. As eco-conscious architecture trends rise, demand for sustainable and modular fencing solutions continues to grow.

Country-Level Analysis

Within the United States, fencing market dynamics vary significantly by state, reflecting differences in climate, housing patterns, urbanization rates, and consumer preferences. In California, demand for privacy and aesthetic fencing remains high in urban and suburban locales, with increased emphasis on fire-resistant materials due to recurring wildfires. Texas, on the other hand, leads in total fence installations, driven by vast residential developments and ranch-style property fencing needs.

Florida presents a unique case due to hurricane-prone zones requiring resilient fencing solutions like reinforced vinyl and aluminum. Fences around pools are also heavily regulated by state codes, further boosting demand. Meanwhile, New York and other Northeastern states show consistent demand for ornamental and security fencing in both urban brownstones and suburban townships. Across the Midwest, chain-link and wood fences remain staples due to affordability and practicality.

Some of the prominent players in the U.S. fencing market include:

- Allied Tube & Conduit

- Ameristar Fence Products Incorporated

- Associated Materials LLC

- Bekaert

- CERTAINTEED

- Gregory Industries

- Jerith Manufacturing

- Long Fence Company Inc.

- Ply Gem Residential Solutions

- Poly Vinyl Creations

Recent Developments

-

In March 2024, Ameristar Perimeter Security launched a new line of anti-ram crash-rated fencing systems targeted at federal and commercial infrastructure.

-

In February 2024, Master Halco announced a partnership with a tech startup to integrate IoT sensors into its residential fencing lines.

-

In January 2024, ActiveYards introduced a modular aluminum fencing system with tool-free assembly targeted at the DIY segment.

-

In December 2023, Fortress Building Products expanded its vinyl fencing product range to include new woodgrain finishes and improved UV resistance.

-

In November 2023, CertainTeed unveiled its "EcoGuard" composite fencing line made from 95% recycled materials, aimed at LEED-certified housing projects.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2023 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. fencing market

Material

- Metal

- Wood

- Plastic & Composites

- Concrete

Application

Regional

- Northeast U.S.

- Midwest U.S.

- South U.S.

- West U.S.