U.S. Fitness Apps Market Size and Research

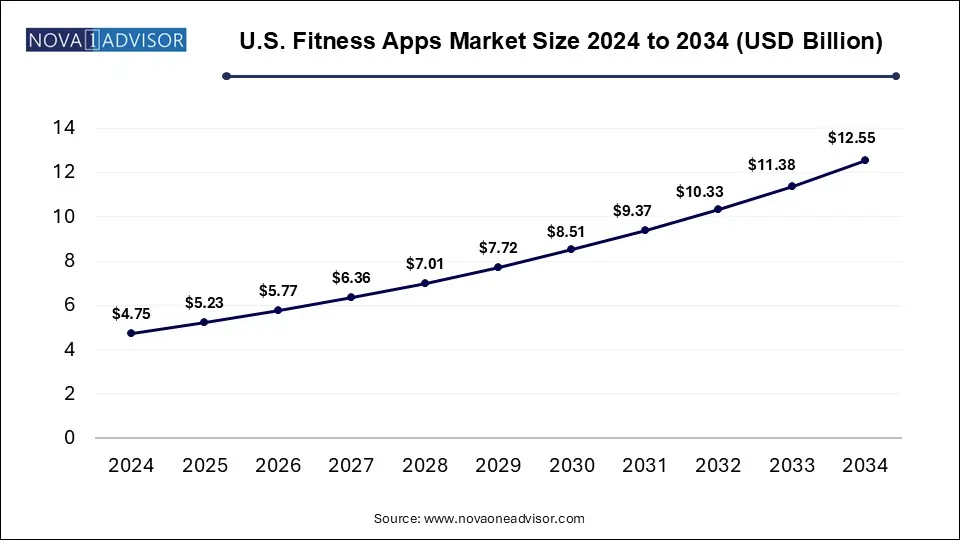

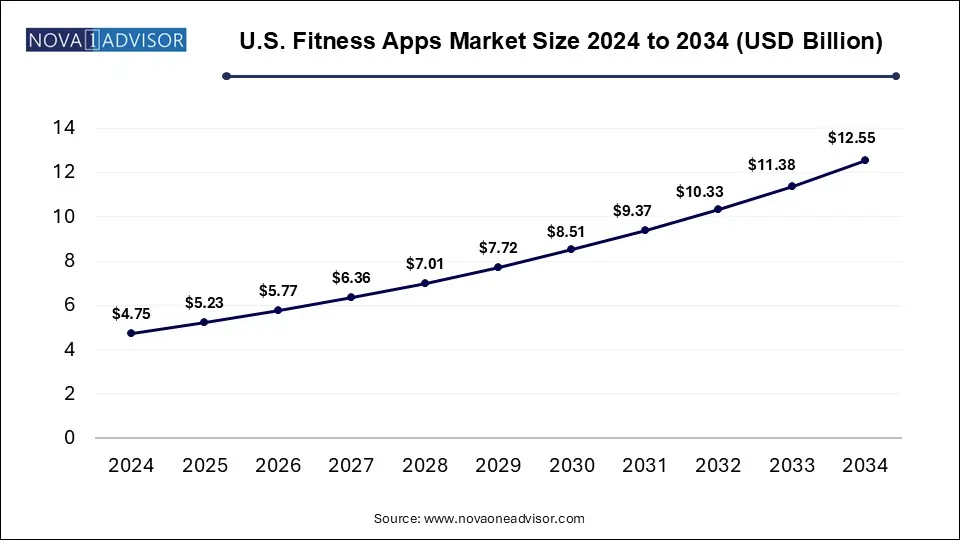

The U.S. Fitness Apps Market size was exhibited at USD 4.75 billion in 2024 and is projected to hit around USD 12.55 billion by 2034, growing at a CAGR of 10.2% during the forecast period 2025 to 2034.

Key Takeaways:

- The exercise & weight loss segment dominated the U.S. fitness app market with a revenue share of 54% in 2024.

- The iOS segment dominated the U.S. fitness app market with a revenue share of 53% in 2024.

- The smartphones segment held the largest market share of 67% in 2024.

Market Overview

The U.S. Fitness Apps Market has witnessed unprecedented growth over the past decade, driven by rising health consciousness, increasing smartphone penetration, and a surge in demand for personalized fitness solutions. Fitness apps today are no longer limited to step-counting tools; they have evolved into sophisticated platforms offering holistic health management, including workout planning, diet tracking, and integration with wearable devices. According to industry estimates, the market is poised to maintain robust growth due to the synergistic effects of technological advancements, consumer behavioral shifts, and supportive healthcare initiatives.

The COVID-19 pandemic accelerated the digital transformation of the fitness industry, as gym closures and social distancing norms prompted consumers to explore home-based fitness solutions. This created a lasting preference for hybrid fitness models, where users integrate in-person workouts with virtual guidance. Fitness apps like MyFitnessPal, Fitbit, Peloton, and Nike Training Club are capitalizing on this trend, offering adaptive and AI-powered recommendations to users.

Major Trends in the Market

-

AI and Machine Learning Integration: Fitness apps are leveraging AI for personalized workout plans, diet recommendations, and predictive analytics based on user behavior.

-

Gamification of Fitness: Apps are incorporating gaming elements such as rewards, leaderboards, and challenges to drive user engagement and retention.

-

Increased Focus on Mental Health: Meditation and mindfulness have become integral parts of fitness apps, with platforms like Calm and Headspace gaining popularity.

-

Cross-Platform Integration: Fitness apps now seamlessly integrate with wearables, smart TVs, and IoT devices to deliver a connected fitness ecosystem.

-

Subscription-based Premium Models: Freemium offerings are giving way to tiered subscription models offering advanced analytics, coaching, and content libraries.

-

Corporate Wellness Programs: Employers are partnering with app developers to provide wellness tools as part of employee benefits programs.

Report Scope of U.S. Fitness App Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 5.23 Billion |

| Market Size by 2034 |

USD 12.55 Billion |

| Growth Rate From 2025 to 2034 |

CAGR of 10.2% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

Type, Platform, and Devices |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Key Companies Profiled |

Apple Inc.; Google LLC (Alphabet Inc.); Peloton Interactive, Inc.; Azumio, Inc.; MyFitnessPal, Inc.; Nike, Inc.; Under Armour, Inc.; Zwift Inc.; Strava, Inc.; Calm.com, Inc. |

Market Driver: Rising Adoption of Wearables and Smartphones

The widespread adoption of smartphones and wearable devices in the U.S. has created a fertile ground for the growth of fitness apps. According to industry data, over 85% of Americans own a smartphone, and nearly 1 in 5 owns a fitness tracker or smartwatch. Fitness apps leverage these devices’ built-in sensors to deliver real-time data on physical activity, heart rate, sleep patterns, and more. For instance, Apple Health integrates seamlessly with third-party fitness apps, enabling users to centralize their wellness data. This growing interconnected ecosystem encourages consumers to use multiple apps, leading to higher market penetration and sustained revenue growth.

Market Restraint: Data Privacy and Security Concerns

Despite robust market growth, data privacy and security remain significant challenges for fitness app developers. These platforms collect sensitive user information, including biometric data, location, and health metrics. Breaches and misuse of such data can lead to loss of user trust and regulatory scrutiny. For example, in 2022, a major fitness app was criticized for sharing anonymized location data with third parties, raising alarms about potential misuse. In response, the U.S. Federal Trade Commission (FTC) has heightened oversight, pushing for stricter compliance with data protection laws like the Health Insurance Portability and Accountability Act (HIPAA). This regulatory landscape adds complexity and cost for app developers.

Market Opportunity: Personalized Fitness and AI-Driven Coaching

Personalized fitness solutions present a substantial opportunity in the U.S. market. Consumers increasingly demand tailored experiences that reflect their unique goals, preferences, and health conditions. AI-driven coaching is emerging as a key differentiator, where apps use machine learning algorithms to analyze user data and deliver hyper-personalized recommendations. For instance, apps like Freeletics offer AI coaches that adapt workout routines in real-time based on user feedback and progress. This trend aligns with the broader movement toward preventive healthcare, where fitness apps act as proactive wellness companions.

Segmental Analysis

By Type Outlook

The exercise and weight loss segment continues to dominate the U.S. fitness apps market, accounting for a significant revenue share. The popularity of structured workout programs, on-demand video classes, and AI-driven trainers contributes to its dominance. Apps like Peloton and Nike Training Club lead this segment by offering diverse workout libraries and live-streaming options. Consumers appreciate the convenience of accessing professional-grade fitness guidance from their homes, which has become an essential feature post-pandemic. The demand for personalized workout regimes and virtual group fitness sessions also supports this segment's growth.

The diet and nutrition segment is poised to witness the fastest growth during the forecast period. Increasing awareness of the role of nutrition in overall wellness and chronic disease prevention drives the uptake of apps like MyFitnessPal and Noom. These platforms not only track calorie intake but also offer AI-driven meal recommendations, barcode scanning for grocery items, and integration with wearable devices to provide holistic health insights. Moreover, growing interest in specialized diets such as keto, vegan, and intermittent fasting has led to the development of niche apps catering to these trends.

iOS-based fitness apps have historically dominated the U.S. market, driven by the high penetration of Apple devices and strong user loyalty in the U.S. market. The Apple ecosystem supports seamless integration between iPhones, Apple Watches, and other connected devices, which enhances the user experience and encourages the adoption of iOS-exclusive fitness apps.

While iOS leads, the Android segment is anticipated to register a higher CAGR, driven by the affordability and widespread availability of Android devices. Developers are increasingly focusing on delivering feature parity between iOS and Android apps to capture the broader Android user base.

By Devices Outlook

Smartphones remain the primary device for accessing fitness apps due to their ubiquity and advanced hardware capabilities. The high-resolution displays, built-in GPS, and powerful processors of modern smartphones enable rich multimedia experiences, including live video streaming and AR-based workouts.

Wearable devices are the fastest-growing segment in this category. With the rise of smartwatches and fitness trackers from brands like Fitbit, Garmin, and Apple, consumers are increasingly relying on wearables for real-time activity monitoring and goal tracking. These devices often serve as companions to fitness apps, offering continuous health insights even when users are away from their phones.

Country-Level Analysis: United States

In the U.S., fitness apps are experiencing rapid adoption across various demographic groups. Urban areas, in particular, are witnessing higher uptake due to greater health awareness and access to high-speed internet. Millennials and Gen Z users form the largest user base, attracted by interactive features, social sharing capabilities, and gamified experiences. Moreover, partnerships between insurance companies and fitness app developers are encouraging older populations to engage with these platforms as part of wellness programs.

Government initiatives to promote digital health and preventive care also indirectly support the market. For instance, some states have integrated fitness app-based activity tracking into Medicaid incentive programs. The U.S. market is characterized by high competition, with both global giants and emerging startups vying for user engagement.

Some of The Prominent Players in The U.S. Fitness Apps Market Include:

- Apple Inc.

- Google LLC (Alphabet Inc.)

- Peloton Interactive, Inc.

- Azumio, Inc.

- MyFitnessPal, Inc.

- Nike, Inc.

- Under Armour, Inc.

- Zwift Inc.

- Strava, Inc.

- Calm.com, Inc.

Recent Developments

-

March 2025 – Peloton introduced “Peloton Outdoor,” a new app feature targeting runners and walkers with real-time coaching and route mapping capabilities.

-

February 2025 – MyFitnessPal partnered with Walmart to launch a barcode-scanning feature for in-store nutritional insights, making grocery shopping healthier.

-

January 2025 – Fitbit (owned by Google) announced a major update integrating advanced stress management tools and menstrual health tracking into its app ecosystem.

-

December 2024 – Nike Training Club unveiled live interactive classes with certified trainers, enhancing its premium subscription offerings.

-

October 2024 – Calm partnered with Amazon Alexa to integrate guided meditation sessions into smart home environments.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the U.S. Fitness Apps Market.

By Type

- Exercise & Weight Loss

- Diet & Nutrition

- Activity Tracking

By Platform

By Devices

- Smartphones

- Tablets

- Wearable Devices