U.S. Flexible Packaging Market Size and Growth

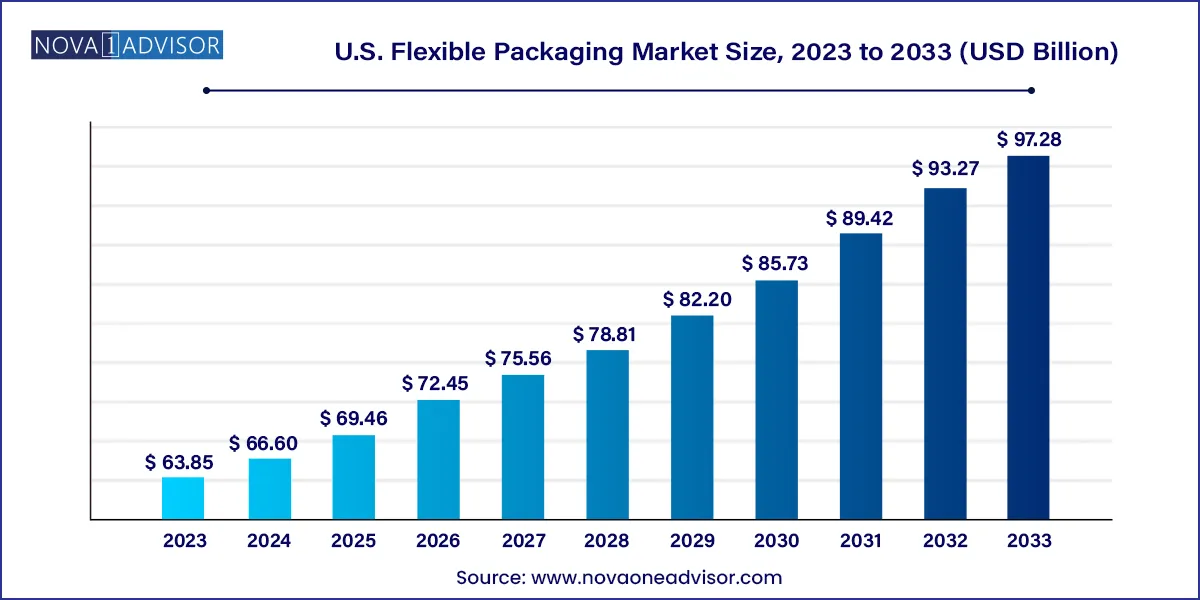

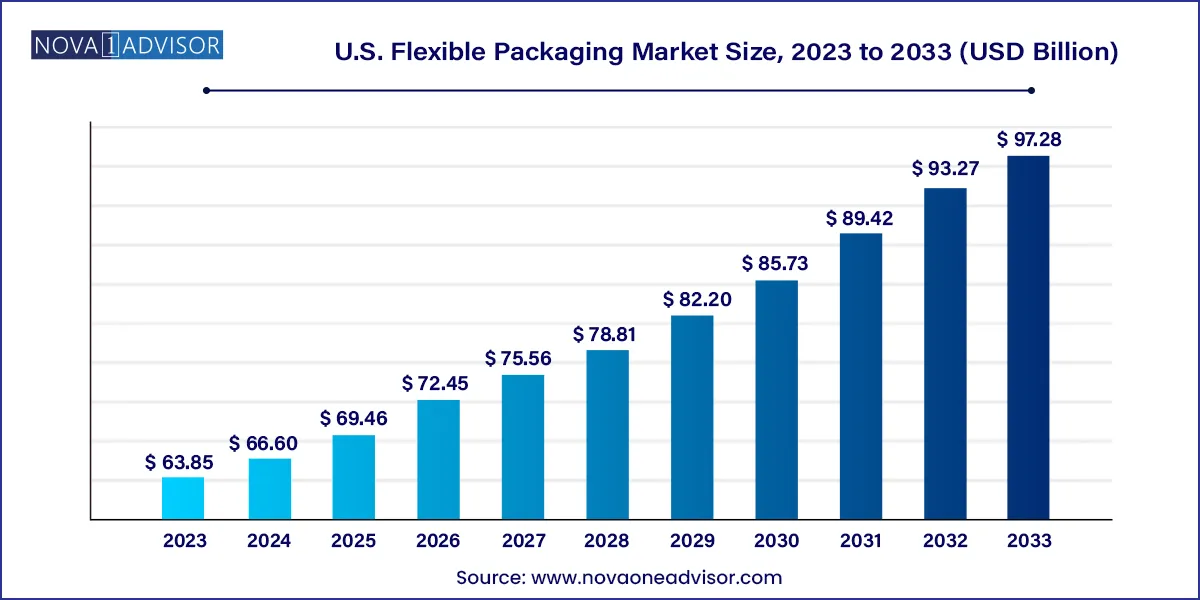

The U.S. flexible packaging market size was exhibited at USD 63.85 billion in 2023 and is projected to hit around USD 97.28 billion by 2033, growing at a CAGR of 4.3% during the forecast period 2024 to 2033.

U.S. Flexible Packaging Market Key Takeaways:

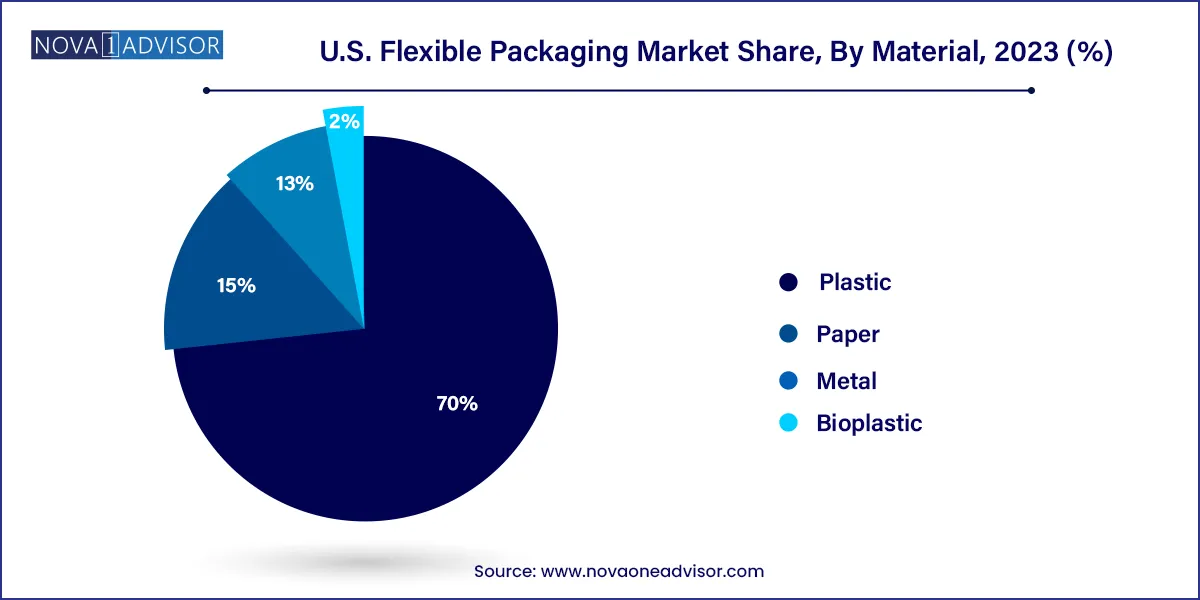

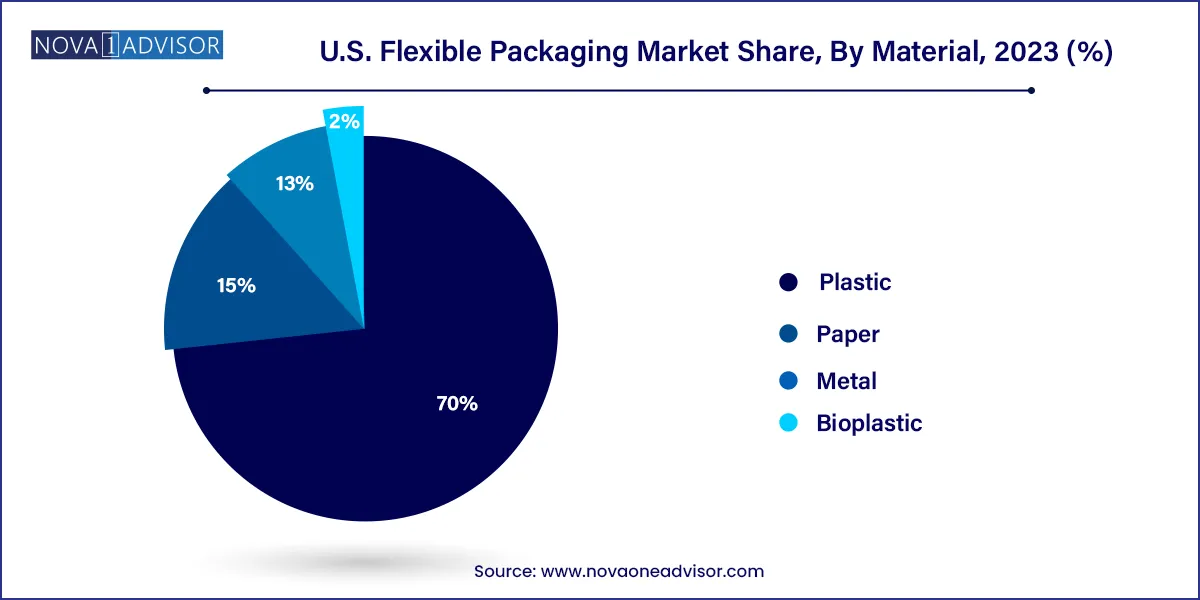

- The plastics segment dominated the U.S. market in 2023 with more than 70.0% revenue share.

- Bioplastics represent the fastest-growing segment in the U.S. flexible packaging market, with a projected CAGR of 5.4% from 2024 to 2033.

- The pouches dominated the U.S. market in 2023 with more than 60.0% revenue share.

- The films and wraps segment is the fastest-growing product segment in the U.S. flexible packaging market with a CAGR of 4.9% from 2024 to 2033.

- The food & beverage segment dominated the U.S. market in 2023 with more than 24.0% revenue share.

- The pharmaceutical segment is projected to experience the fastest growth in the U.S. flexible packaging market, with a projected CAGR of 4.9% from 2024 to 2033.

Market Overview

The U.S. flexible packaging market represents one of the most dynamic sectors in the country’s broader packaging industry. Characterized by its versatility, cost-efficiency, and sustainability potential, flexible packaging encompasses any packaging made from non-rigid materials such as plastic films, paper, aluminum foil, or bioplastics, which can be molded or reshaped based on application requirements.

Flexible packaging serves a multitude of industries most notably food & beverage, pharmaceuticals, personal care, and industrial products and is favored for its lightweight structure, extended shelf life capabilities, portability, and consumer convenience. As of 2025, flexible packaging has moved well beyond traditional wraps and pouches to encompass advanced structures such as retort pouches, shrink films, stretch labels, and sustainable rollstocks.

In the U.S., where packaging innovation intersects with evolving consumer preferences and corporate sustainability commitments, flexible packaging is thriving. The market benefits from increasing demand for on-the-go consumption formats, single-serve packaging, and eco-conscious alternatives that align with regulatory guidelines and ESG goals. Furthermore, the COVID-19 pandemic has accelerated interest in tamper-evident, resealable, and hygienic packaging solutions, boosting investment in new formats and barrier technologies.

Companies are investing in digital printing, smart labeling, antimicrobial films, and recyclable mono-material structures, all of which underscore flexible packaging’s centrality in the packaging transformation currently reshaping the U.S. manufacturing and retail landscapes.

Major Trends in the Market

-

Rapid Growth of Sustainable and Recyclable Flexible Packaging: Increased adoption of mono-material packaging, compostable films, and bio-based plastics across food and pharma applications.

-

Rise in E-commerce and Direct-to-Consumer (DTC) Brands: Flexible packaging is increasingly used in compact, protective, and brand-enhancing formats for DTC shipping and subscription boxes.

-

Technology Integration with Smart Labels and QR Codes: Consumers are engaging with digitally interactive packaging for traceability, authentication, and product information.

-

Increased Investment in Retort and High-Barrier Pouches: Shelf-stable, heat-resistant, and leak-proof pouches are gaining popularity in ready-to-eat meals and pet food.

-

Demand Surge for Healthcare and Pharmaceutical Pouches: Driven by over-the-counter medications, wellness products, and diagnostics that require sterile and easy-to-carry packaging formats.

-

Growth in In-Store Refill Solutions and Lightweighting: Retailers and brands are promoting refillable pouches to reduce single-use plastic and optimize transportation logistics.

-

Consumer Preference for Convenient, Resealable Formats: Features such as zip locks, spouts, and tear notches are boosting the attractiveness of flexible packaging formats for busy consumers.

Report Scope of U.S. Flexible Packaging Market

| Report Coverage |

Details |

| Market Size in 2024 |

USD 66.60 Billion |

| Market Size by 2033 |

USD 97.28 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 4.3% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Material, Product, Application |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Key Companies Profiled |

Amcor plc; Berry Global Inc.; Mondi; Sonoco Products Company; Constantia Flexibles; Sealed Air; TC Transcontinental; WINPAK LTD; Bemis Company, Inc.; Coveris Holdings S.A. |

U.S. Flexible Packaging Market By Material Insights

Plastic dominated the material segment, due to its widespread use in multi-layer films, wraps, and pouches across food, beverage, personal care, and industrial applications. Plastics such as polyethylene (PE), polypropylene (PP), and polyethylene terephthalate (PET) are widely used for their flexibility, sealability, moisture barrier, and strength. These materials support both aesthetic branding and functional performance in vacuum pouches, frozen food packs, and medical-grade sachets.

Bioplastics are the fastest-growing segment, fueled by consumer demand for renewable and biodegradable packaging options. Brands are increasingly adopting bio-based PE and PLA films for organic food, baby care, and wellness product lines. While current adoption is limited due to cost and performance constraints, rapid R&D efforts and retail mandates (e.g., Walmart’s packaging scorecard) are expected to accelerate bioplastic use in the coming years.

U.S. Flexible Packaging Market By Product Insights

Pouches dominate the product landscape, owing to their versatility, resealability, and brandable surface area. Within this category, stand-up and retort pouches are gaining popularity for soups, ready meals, pet foods, and personal care products. These formats offer extended shelf life without refrigeration, reduced material usage, and enhanced consumer convenience.

Films and wraps are the fastest-growing segment, driven by food processors, meat packers, and e-commerce operators looking for lightweight, high-barrier, and printable packaging solutions. High-performance stretch and shrink films are also replacing rigid clamshells and trays in bakery, produce, and meal kit packaging. Rollstocks are increasingly used by brands seeking automated, high-speed packaging lines that minimize waste and enable custom printing.

U.S. Flexible Packaging Market By Application Insights

Food & beverage is the leading application, accounting for the largest share of the U.S. flexible packaging market. Flexible packaging formats such as pouches, wraps, and rollstock laminates are widely used for snacks, dairy, meat, frozen foods, and beverages. The sector’s need for high barrier protection, extended shelf life, and microwavable packaging supports continued adoption. Demand is especially strong for resealable single-serve packaging in snacks and beverages.

Pharmaceutical is the fastest-growing application, with flexible packaging used for pill packs, sachets, medical device wraps, diagnostic kits, and cold-chain shipments. The post-COVID-19 emphasis on sterility, hygiene, and consumer-friendly dosing is propelling innovation in child-resistant, tamper-evident, and oxygen/moisture-barrier flexible formats. Additionally, wellness and supplement brands are exploring zippered pouches and biodegradable sachets for pills and powders.

Country-Level Analysis

As the exclusive market under study, the United States leads in flexible packaging innovation, production, and consumption. The market’s growth is supported by a mature packaging infrastructure, widespread retail penetration, and strong consumer preference for portable, easy-to-use packaging formats.

The U.S. is home to numerous leading flexible packaging manufacturers and converters, with operations concentrated in states like Illinois, Texas, Georgia, and California. These firms cater to both domestic brands and multinational corporations across food, pharma, and consumer goods sectors.

The country also serves as a launchpad for smart packaging technologies, including NFC-enabled pouches, active oxygen scavenging layers, and antimicrobial coatings. With state-level mandates on waste reduction (e.g., California and Oregon) and federal support for recycling modernization, the U.S. flexible packaging industry is entering a phase of material and process reinvention.

Some of the prominent players in the U.S. flexible packaging market include:

- Amcor plc

- Berry Global Inc.

- Mondi

- Sonoco Products Company

- Constantia Flexibles

- Sealed Air

- TC Transcontinental

- WINPAK LTD

- Bemis Company, Inc.

- Coveris Holdings S.A.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. flexible packaging market

U.S. Flexible Packaging Material

- Plastic

- Paper

- Metal

- Bioplastic

U.S. Flexible Packaging Product

-

- Retort Pouches

- Refill Pouches

U.S. Flexible Packaging Application

- Food & Beverage

- Pharmaceutical

- Cosmetics

- Others