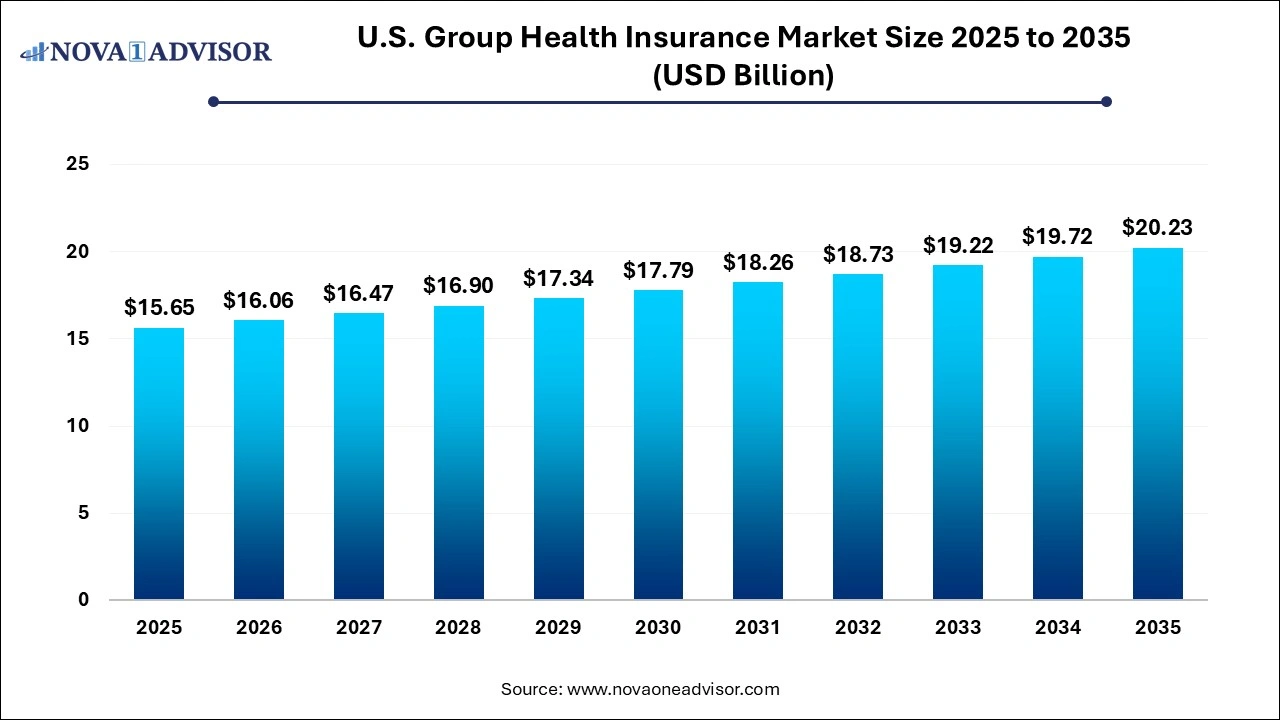

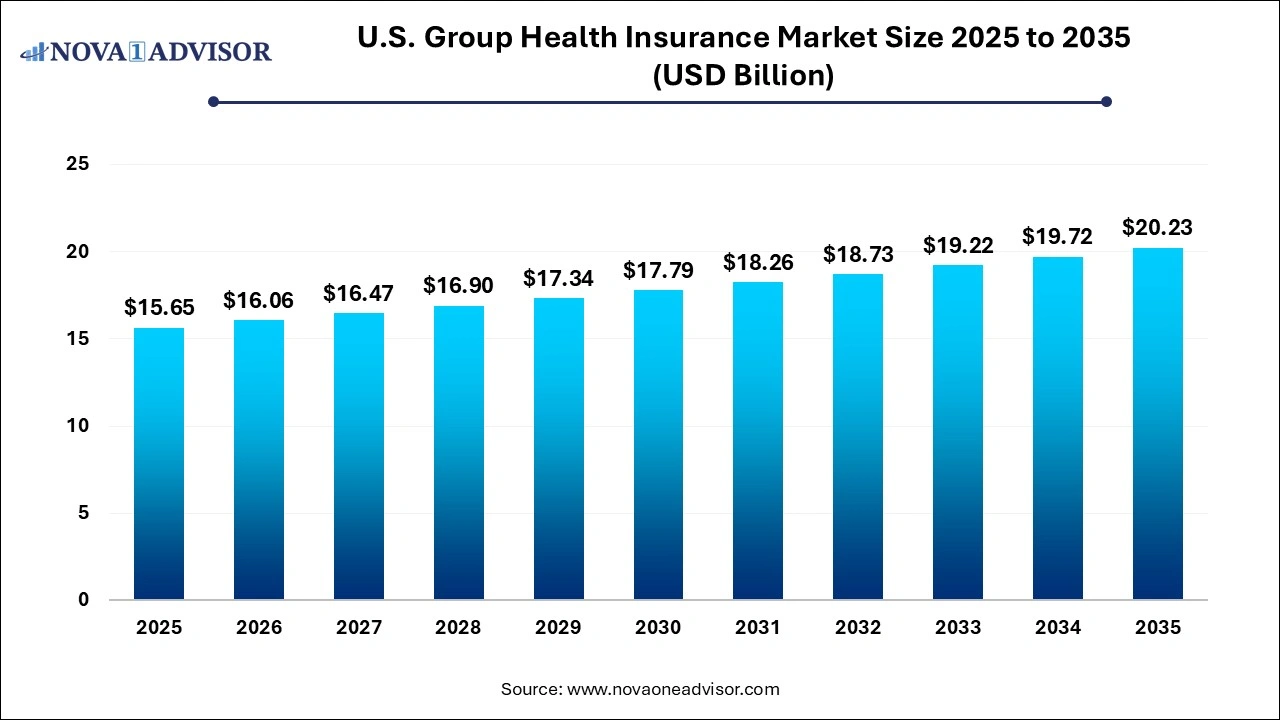

U.S. Group Health Insurance Market Size and Growth 2026 to 2035

The U.S. group health insurance market size was exhibited at USD 15.65 billion in 2025 and is projected to hit around USD 20.23 billion by 2035, growing at a CAGR of 2.6% during the forecast period 2026 to 2035.

Key Takeaways:

- In 2025, the PPO plan's revenue share was over 45%, which was the highest.

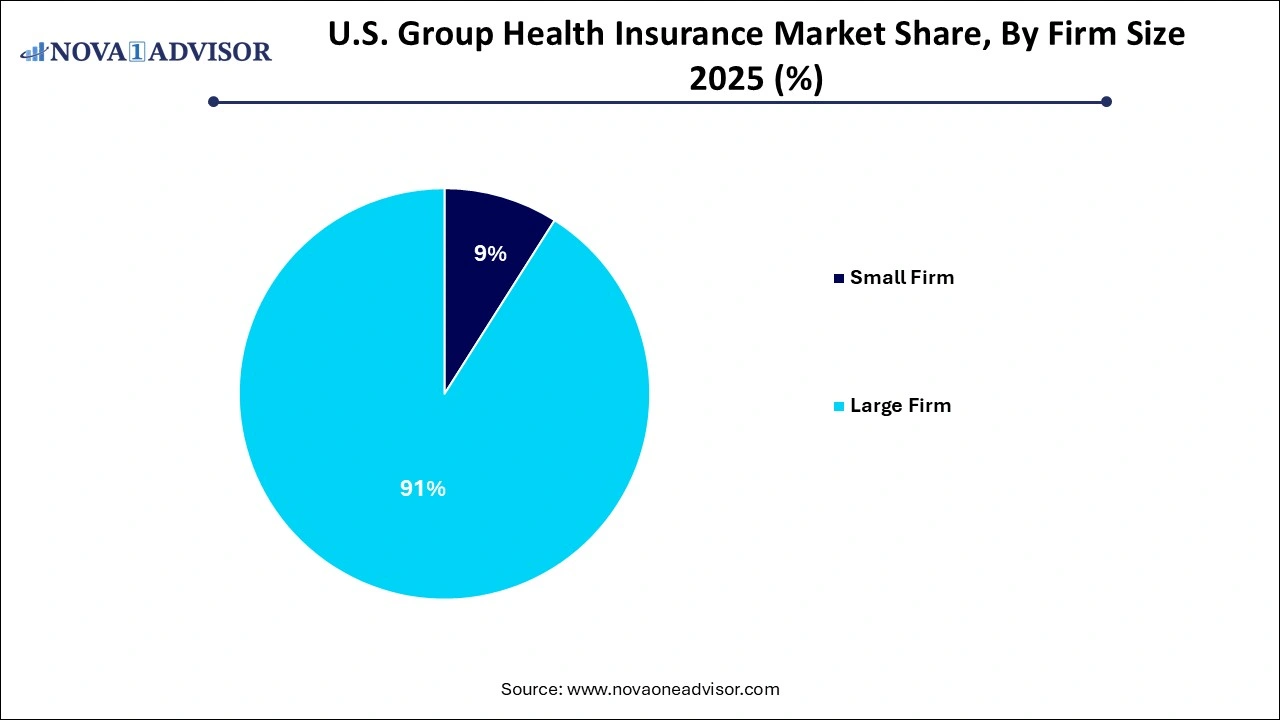

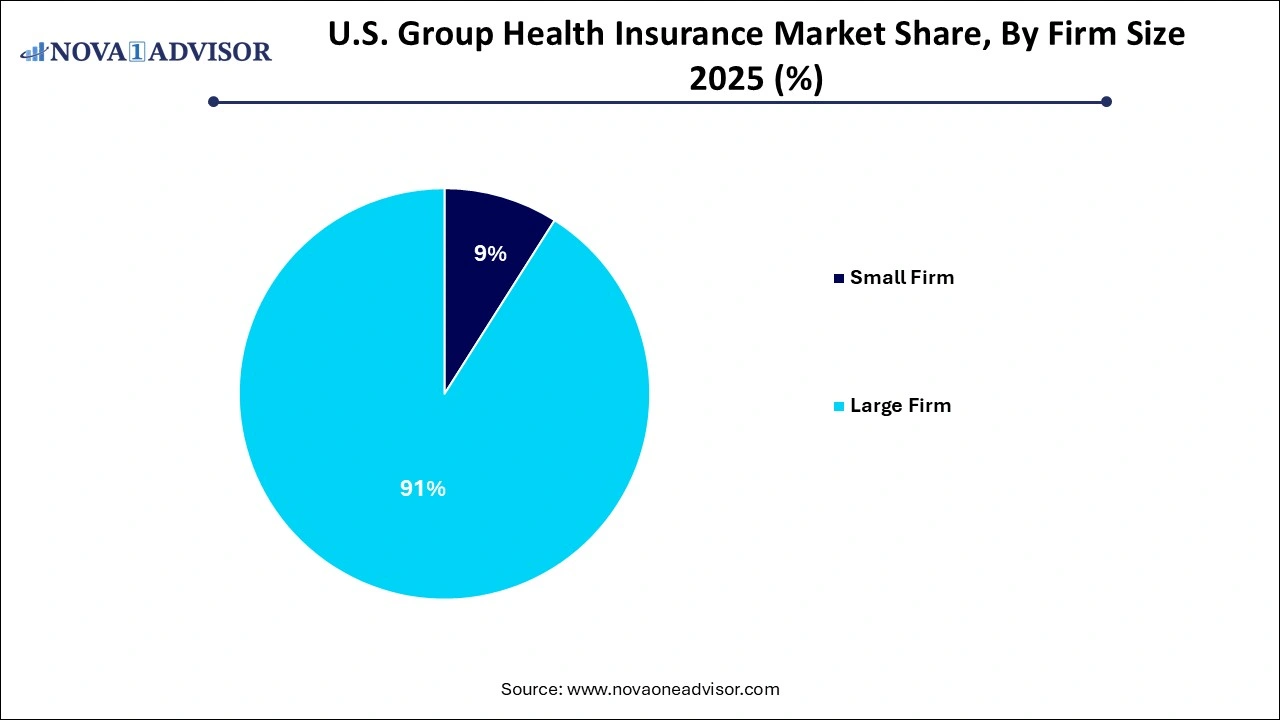

- The large firm segment dominated the market in 2025 and is expected to maintain its dominance throughout the forecast period.

- The level-funded plan segment would expand rapidly, with a CAGR of around 4.9%

- The South region held the largest share of the U.S. market in 2025.

U.S. Group Health Insurance Market Overview

The U.S. Group Health Insurance Market serves as the backbone of employer-sponsored healthcare coverage, providing millions of Americans with access to medical services through their workplace. Group health insurance refers to health plans offered by employers to a group of employees (and often their dependents) under a single contract. These plans are often more affordable and offer broader coverage than individual insurance, thanks to risk pooling and negotiated provider rates.

As of 2025, nearly 155 million people in the United States are covered by employer-sponsored insurance, making it the largest health coverage source in the country. This coverage spans small businesses offering fully insured policies to large corporations managing self-funded or level-funded plans. The market encompasses a variety of plan types including HMOs (Health Maintenance Organizations), PPOs (Preferred Provider Organizations), POS (Point of Service), HDHPs (High Deductible Health Plans), and conventional indemnity models.

The landscape is shaped by regulatory changes, rising healthcare costs, innovation in digital health, and evolving workforce expectations—especially in a post-pandemic world. Employers are increasingly shifting toward value-based care models, virtual care integrations, and mental health coverage. Meanwhile, insurers are adopting more technology-driven services such as virtual-first health plans and AI-powered health navigation tools.

While large firms dominate in terms of volume and spend, small and mid-sized firms are seeing steady adoption, particularly with the help of level-funded solutions that offer cost transparency and partial self-insurance without full risk exposure. The group health insurance market in the U.S. remains complex, competitive, and critically important for economic stability and employee wellbeing.

Major Trends in the U.S. Group Health Insurance Market

-

Rising Popularity of Virtual-First Plans: Insurers are launching digital-first options that offer virtual primary care as the main access point, reducing costs and improving convenience.

-

Mental Health as a Core Benefit: Employer plans increasingly integrate therapy, counseling, and stress-management tools into standard coverage.

-

Level-Funding for Small Businesses: Hybrid models that offer predictability of fully insured plans with savings potential of self-funding are gaining traction.

-

Shift Toward High-Deductible Plans Paired with HSAs: HDHP/SO plans continue to rise, offering tax advantages and premium savings for both employers and employees.

-

Regulatory Focus on Transparency: Rules requiring price transparency and employer reporting are reshaping how group plans are administered.

-

Personalized Wellness Programs: Plans are integrating personalized health incentives, wearables, and digital coaching to improve population health outcomes.

-

Integration of Pharmacy Benefit Management (PBM): Employers are reevaluating how prescription drug benefits are structured to manage soaring medication costs.

-

Expansion of Value-Based Care Contracts: Insurers and employers are embracing provider contracts based on outcomes rather than service volume.

Report Scope of The U.S. Group Health Insurance Market

| Report Coverage |

Details |

| Market Size in 2026 |

USD 16.06 Billion |

| Market Size by 2035 |

USD 20.23 Billion |

| Growth Rate From 2026 to 2035 |

CAGR of 2.6% |

| Base Year |

2025 |

| Forecast Period |

2026-2035 |

| Segments Covered |

Plan Type, Firm Size, Region |

| Market Analysis (Terms Used) |

Value (USD Million/Billion) or (Volume/Units) |

| Regional Scope |

Northeast, Midwest, South, West |

| Key Companies Profiled |

Health Care Service Corporation; Unitedhealth Group; Kaiser Foundation Health Plan, Inc.; Blue Cross Blue Shield Association; Anthem, Inc. (Now Elevance Health); The IHC Group; Health Partners Group Ltd; Mississippi Insurance Group, LLC; Providence Health Plan; Harvard Pilgrim Health Care, Inc. |

Market Driver: Employer Demand for Competitive Benefits to Attract and Retain Talent

One of the most significant drivers of growth in the U.S. group health insurance market is employers’ increasing reliance on health benefits as a tool for talent acquisition and retention. In a labor market where skilled professionals have more choices, comprehensive health coverage has become a crucial differentiator for employers seeking to attract top talent. According to a 2024 survey by the Kaiser Family Foundation, over 80% of employees consider health insurance one of the most important job benefits.

Employers are investing in group plans not only to comply with the Affordable Care Act (ACA) requirements but to enhance employee satisfaction and reduce turnover. Especially in competitive sectors like tech, finance, and healthcare, companies are going beyond basic plans to offer fertility benefits, gender-affirming care, mental health coverage, and wellness incentives. These enhancements contribute to workforce productivity and loyalty, creating a virtuous cycle that further fuels demand for robust group health insurance solutions.

Market Restraint: Escalating Premium Costs and Financial Pressure on Employers

A key challenge restraining the market is the rising cost of premiums and overall health plan administration, which is squeezing employer budgets. According to a 2024 report by Modern Healthcare, the average employer contribution toward annual family premiums exceeded $16,000, with total plan costs expected to rise another 6.5% in 2025. For small businesses with limited financial reserves, this presents a significant burden.

This cost escalation is driven by multiple factors: increasing chronic disease prevalence, specialty drug inflation, hospital pricing disparities, and administrative complexity. Employers are often forced to shift more cost burden to employees through higher deductibles, narrower networks, or lower employer contribution rates potentially decreasing employee satisfaction. Additionally, regulatory requirements around transparency and compliance have increased administrative workloads and exposure to penalties, further complicating the financial viability of offering comprehensive group health plans.

Market Opportunity: Innovation in Personalized, Preventive, and Tech-Integrated Plans

A powerful opportunity in the U.S. group health insurance market lies in offering personalized, preventive, and tech-enhanced solutions that improve outcomes while controlling costs. The integration of digital tools such as wearable devices, mobile health apps, virtual care platforms, and AI-powered health coaching is enabling a transition from reactive to proactive care.

Employers and insurers are leveraging these tools to implement behavior-based wellness programs that offer incentives for exercise, healthy eating, medication adherence, and regular checkups. For instance, companies like UnitedHealthcare and Aetna are launching app-based platforms that track biometric data and award points for wellness activity completion. These programs not only reduce long-term healthcare utilization but also improve employee morale and engagement. As data analytics becomes more sophisticated, group health plans will be able to offer highly customized benefit experiences, boosting both health outcomes and ROI.

Segmental Insights

By Plan Type Insights

Preferred provider organization (PPO) plans dominate the U.S. group health insurance market, offering flexibility in provider choice, broad networks, and fewer referral requirements. Employers prefer PPOs because they strike a balance between employee satisfaction and cost control, especially in mid-to-large organizations. Employees value the ability to visit specialists without gatekeeping and the convenience of accessing out-of-network care when needed. In 2024, nearly 47% of covered workers in large firms were enrolled in PPO plans, underlining their market leadership. Insurers continue to refine PPO offerings by integrating virtual care and mental health networks to maintain competitiveness.

High-Deductible Health Plans with Savings Options (HDHP/SO) are the fastest growing segment, particularly among cost-conscious employers and younger employees. These plans typically feature lower premiums and pair with Health Savings Accounts (HSAs), offering triple tax advantages and greater financial autonomy. Many startups and tech companies now offer HDHP/SO plans as their default option, accompanied by employer HSA contributions. While critics note that high deductibles may deter low-income employees from seeking care, ongoing education and incentive structures are helping improve enrollment and utilization. As financial literacy improves and wellness engagement tools expand, HDHP/SO adoption is expected to continue rising.

By Firm Size Insights

Large firms dominate the group health insurance market, accounting for the majority of enrollees and premium spend. These companies often have the scale and resources to negotiate favorable terms, self-insure their health plans, and offer extensive benefit packages that include family coverage, dental/vision care, and wellness programs. They also benefit from sophisticated HR systems and benefits consultants who optimize plan design and compliance. Large employers are increasingly experimenting with direct-to-provider contracts, value-based reimbursement models, and internal health clinics to manage costs and improve care access.

Small firms adopting level-funded plans are the fastest growing segment, thanks to the hybrid model’s flexibility and affordability. Level funding allows small businesses to budget predictably while potentially benefiting from cost savings if claims run low. These plans often include stop-loss insurance and are exempt from certain ACA regulations, making them attractive to firms with fewer than 100 employees. In 2024, many insurance carriers introduced simplified underwriting and bundled solutions for level-funded plans, reducing the administrative burden for small firms. As awareness grows and more brokers promote these options, small business adoption is projected to accelerate.

Small firms adopting level-funded plans are the fastest growing segment, thanks to the hybrid model’s flexibility and affordability. Level funding allows small businesses to budget predictably while potentially benefiting from cost savings if claims run low. These plans often include stop-loss insurance and are exempt from certain ACA regulations, making them attractive to firms with fewer than 100 employees. In 2024, many insurance carriers introduced simplified underwriting and bundled solutions for level-funded plans, reducing the administrative burden for small firms. As awareness grows and more brokers promote these options, small business adoption is projected to accelerate.

Country-Level Analysis – United States

The U.S. group health insurance market is deeply embedded in the nation's employer-employee relationship, serving as a de facto social safety net in the absence of universal healthcare. The market is highly dynamic and influenced by federal policies (e.g., ACA mandates, ERISA compliance, IRS tax rules), economic conditions, and workforce trends. State-level reforms such as Medicaid expansion or health benefit mandates also shape how plans are structured and priced.

In metropolitan hubs like New York, Los Angeles, and Chicago, competitive labor markets drive up demand for comprehensive group plans, while in rural or low-income regions, small businesses often struggle to afford employee coverage. The rise of remote work has introduced geographic flexibility, prompting employers to rethink network structures and virtual care offerings. Meanwhile, the federal government’s ongoing emphasis on price transparency, health equity, and digital modernization is influencing product development and administrative practices across the market.

Insurers are responding with multi-state licensed plans, virtual-first models, and vertically integrated services that combine insurance, care delivery, and pharmacy management. This holistic approach is positioning the U.S. as a global innovation leader in employer-sponsored health benefits.

Some of the prominent players in the U.S. group health insurance market include:

Recent Developments

-

February 2024 – UnitedHealthcare announced the expansion of its virtual-first employer health plan across multiple states, allowing members to choose virtual primary care as their default entry point. The plan includes unlimited virtual visits and integrated digital coaching tools.

-

January 2024 – Cigna launched a new group plan offering mental health support via 24/7 text therapy, guided meditation tools, and access to board-certified psychiatrists through its Evernorth platform.

-

December 2023 – Blue Cross Blue Shield Association unveiled a collaborative initiative with major employers to implement value-based contracts across PPO networks, aiming to reduce ER spending and incentivize preventive care.

-

October 2023 – Aetna introduced a level-funded solution for small businesses that includes predictive analytics, real-time claims tracking, and a refund feature for unused funds.

-

August 2023 – Kaiser Permanente partnered with several large tech firms to pilot AI-based chronic disease prevention programs bundled into group health plans, improving long-term cost efficiency.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2022 to 2035. For this study, Nova one advisor, Inc. has segmented the U.S. group health insurance market

Plan Type

- Health Maintenance Organization (HMO)

- Preferred Provider Organization (PPO)

- Point of Service (POS)

- High-Deductible Health Plans with a Savings Option (HDHP/SO)

- Conventional (Indemnity plans)

Firm Size

-

- Self-funded or Level-funded Plan

- Fully Insured

Region

- Northeast

- Midwest

- West Group

- South

Small firms adopting level-funded plans are the fastest growing segment, thanks to the hybrid model’s flexibility and affordability. Level funding allows small businesses to budget predictably while potentially benefiting from cost savings if claims run low. These plans often include stop-loss insurance and are exempt from certain ACA regulations, making them attractive to firms with fewer than 100 employees. In 2024, many insurance carriers introduced simplified underwriting and bundled solutions for level-funded plans, reducing the administrative burden for small firms. As awareness grows and more brokers promote these options, small business adoption is projected to accelerate.

Small firms adopting level-funded plans are the fastest growing segment, thanks to the hybrid model’s flexibility and affordability. Level funding allows small businesses to budget predictably while potentially benefiting from cost savings if claims run low. These plans often include stop-loss insurance and are exempt from certain ACA regulations, making them attractive to firms with fewer than 100 employees. In 2024, many insurance carriers introduced simplified underwriting and bundled solutions for level-funded plans, reducing the administrative burden for small firms. As awareness grows and more brokers promote these options, small business adoption is projected to accelerate.