U.S. Healthcare Discount Plan Market Size and Growth

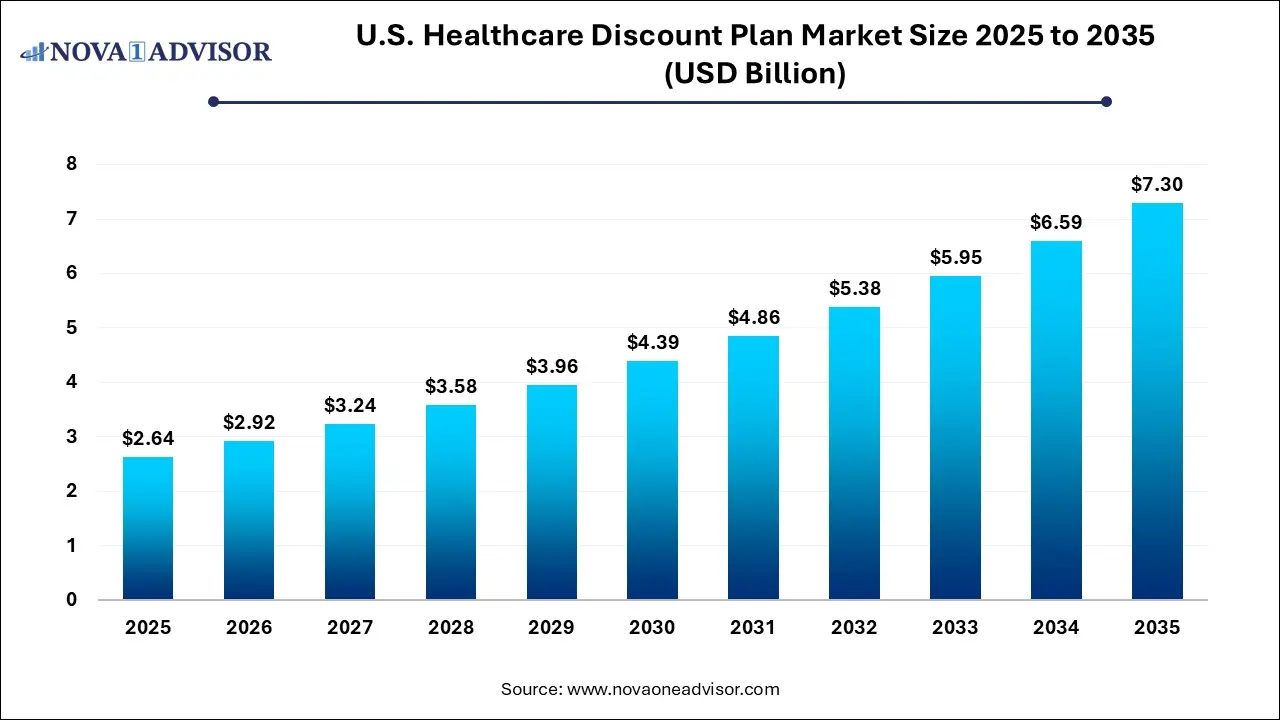

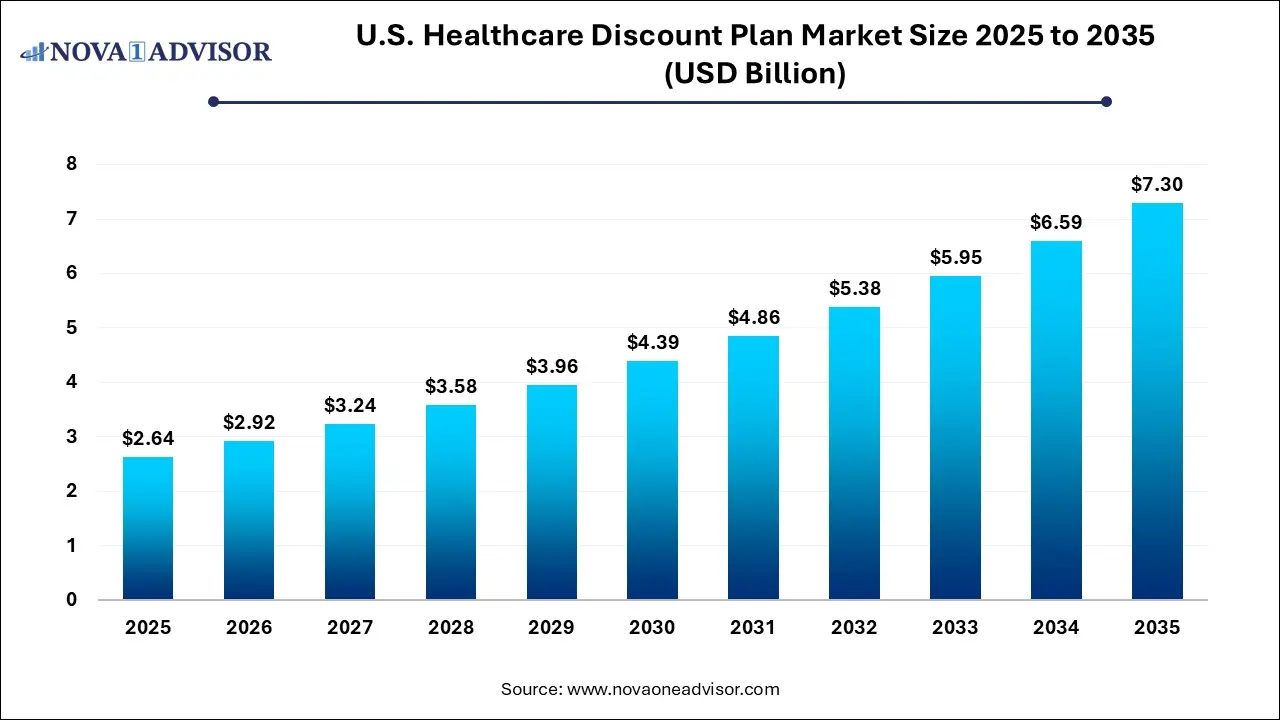

The U.S. healthcare discount plan market size was exhibited at USD 2.64 billion in 2025 and is projected to hit around USD 7.30 billion by 2035, growing at a CAGR of 10.7% during the forecast period 2026 to 2035.

U.S. Healthcare Discount Plan Market Key Takeaways:

- In terms of service, the others service segment dominated the market in 2025 with the largest revenue share of 19.6%.

- The virtual visits segment is estimated to register the fastest-growing CAGR of 13.1% over the forecast period.

Market Overview

The U.S. healthcare discount plan market is becoming an increasingly relevant component of the nation’s healthcare ecosystem, offering consumers an affordable and flexible alternative to traditional health insurance. Unlike insurance plans that reimburse medical expenses after meeting deductibles and co-pays, healthcare discount plans provide members with pre-negotiated discounts on a wide array of healthcare services, from dental and vision care to prescription medications, telehealth consultations, chiropractic services, and more. These plans are particularly attractive to the uninsured, underinsured, and those seeking supplemental savings on non-covered services.

Amid rising healthcare costs, millions of Americans are turning to discount plans to manage out-of-pocket expenses. According to the National Association of Dental Plans (NADP), more than 10 million people in the U.S. utilize dental discount plans alone, and this number is expected to grow as consumers seek immediate, cost-effective access to healthcare providers without the red tape associated with insurance claims. The market is supported by a range of providers, from stand-alone discount networks to healthtech companies bundling wellness programs and telemedicine into their offerings.

Another major appeal of discount plans is their simplicity—no deductibles, no exclusions for pre-existing conditions, and fast enrollment. Especially in the post-pandemic landscape, where healthcare access and affordability are more scrutinized than ever, discount healthcare programs are proving to be a vital bridge for millions of Americans navigating fragmented care and high premiums. Their continued expansion is enabled by growing partnerships with healthcare providers, pharmacies, and digital platforms offering bundled, subscription-based services.

Major Trends in the Market

-

Rise of Virtual Visits and Telehealth Integration: Telemedicine services bundled within discount plans are gaining popularity, offering 24/7 access to general practitioners and specialists without wait times.

-

Expansion of Non-Traditional Healthcare Services: Alternative medicine (e.g., acupuncture, naturopathy) and wellness programs are increasingly being included in discount plans as holistic health gains traction.

-

Growth of Employer-Sponsored Discount Programs: Small businesses are offering discount plans as low-cost employee benefits, especially in sectors with part-time or gig workers.

-

Personalized and Modular Plan Structures: Consumers now demand customized plans that allow them to pick services they use regularly, such as vision or dental, instead of one-size-fits-all coverage.

-

Digital Enrollment and Mobile App Platforms: Seamless access to discount cards, provider directories, and benefit usage tracking via smartphone apps is becoming a standard feature.

Report Scope of U.S. Healthcare Discount Plan Market

| Report Coverage |

Details |

| Market Size in 2026 |

USD 2.92 Billion |

| Market Size by 2035 |

USD 7.30 Billion |

| Growth Rate From 2026 to 2035 |

CAGR of 10.7% |

| Base Year |

2025 |

| Forecast Period |

2026-2035 |

| Segments Covered |

Service |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Key Companies Profiled |

New Benefits, Ltd.; AmeriPlan; CARRINGTON International Corporation; Florida Health Solution Corp.; Avia Dental Plan; Inc.; Best Care Medical Plan, Inc.; True Dental Discounts; United Health Group; Sam's Club; Cigna; Freshbenies; Humana; Xpress Healthcare |

Key Market Driver: Increasing Healthcare Costs and Insurance Gaps

A core driver of the U.S. healthcare discount plan market is the rising cost of medical services and insurance premiums, which are placing a growing financial strain on individuals and families. According to data from the Kaiser Family Foundation, the average premium for employer-sponsored family health coverage surpassed $22,000 in 2023, with out-of-pocket deductibles and copays continuing to rise. This creates a financial gap even for insured patients, particularly when it comes to services not fully covered under traditional plans, such as dental, vision, or certain medications.

Healthcare discount plans fill this void by offering pre-negotiated savings across a wide spectrum of services without the complexity or financial commitment of insurance. For uninsured or underinsured individuals—including freelancers, gig workers, retirees, or small business employees—these plans provide affordable access to essential care. By aligning with consumer needs for transparency and cost control, discount plans are emerging as a powerful alternative to traditional coverage, especially for those navigating high-deductible health plans (HDHPs).

Key Market Restraint: Misunderstanding and Regulatory Ambiguity

One of the primary restraints facing the healthcare discount plan market in the U.S. is the public’s confusion around what these plans do—and do not—offer. Unlike insurance, discount plans do not cover or reimburse costs; they merely provide access to a network of providers offering reduced rates. Consumers unfamiliar with the distinction may assume their plan covers services in full or functions like insurance, only to be surprised by out-of-pocket requirements at the point of care.

This confusion has prompted scrutiny from consumer protection groups and regulators. Although the plans are generally governed under state commerce laws rather than federal insurance regulations, their marketing practices and clarity of terms remain under review in several states. Misuse or misrepresentation of discount plans can erode public trust, and without consistent national standards or regulatory oversight, the market risks reputational setbacks that could slow adoption.

Key Market Opportunity: Integration with Subscription-Based Wellness Ecosystems

A compelling opportunity within the U.S. healthcare discount plan market is its integration into subscription-based wellness ecosystems. As health-conscious consumers increasingly seek holistic care solutions—encompassing fitness, nutrition, stress management, and preventive screenings—discount plan providers can enhance their value proposition by bundling medical savings with wellness-focused offerings. Monthly or annual plans that combine chiropractic care, teletherapy, gym access, and discount supplements are especially appealing to Millennials and Gen Z consumers who prioritize wellness as a lifestyle.

This approach also aligns with trends in digital health, where apps are being used to track benefits usage, schedule virtual consults, and receive customized health tips. By positioning discount plans as part of a broader health and wellness journey—rather than just a cost-saving tool—providers can tap into new market segments and improve member engagement. Partnerships with digital health platforms, fitness brands, and behavioral health services are expected to drive this expansion forward.

U.S. Healthcare Discount Plan Market By Service Insights

Dental care dominated the U.S. healthcare discount plan market owing to the persistently high out-of-pocket costs associated with dental services and the limited dental coverage under most insurance plans. Many Americans, particularly adults, lack comprehensive dental insurance, making discount dental plans an attractive alternative. These plans offer substantial savings on routine exams, cleanings, X-rays, fillings, and even orthodontics or cosmetic procedures not typically covered by insurance. Providers such as Aetna Dental Access and Careington have developed extensive national networks of participating dentists, boosting accessibility and convenience for enrollees.

Prescription drugs are the fastest-growing service segment, accelerated by rising medication prices and the increased burden of chronic disease management. Discount drug cards, often included as part of bundled healthcare plans or offered independently, provide significant savings on both generic and brand-name medications. Major retail chains like Walgreens and CVS participate in these networks, enhancing consumer access. With inflationary pressures on pharmaceutical pricing and gaps in insurance drug formularies, many patients are turning to discount programs to reduce medication costs—especially those managing long-term conditions such as diabetes, hypertension, and asthma.

Virtual visits and telemedicine are also growing rapidly, particularly in the aftermath of COVID-19, which normalized remote consultations. These services provide round-the-clock access to healthcare professionals, improving outcomes and reducing emergency room visits for minor conditions. As telehealth becomes more integrated into mainstream healthcare delivery, discount plan providers are enhancing their offerings with mental health services, dermatology, and chronic care management via virtual platforms.

Other Noteworthy Segments

Vision care is another prominent service, with plans offering discounts on eye exams, contact lenses, and corrective surgery like LASIK. This appeals particularly to middle-aged and older adults who experience age-related vision decline.

Alternative medicines and chiropractic care, traditionally outside the scope of insurance, are gaining ground among health-conscious consumers seeking holistic wellness solutions. Discount plans offer savings on acupuncture, massage therapy, and spinal adjustments, attracting users looking for drug-free pain relief and stress management.

Country-Level Analysis: United States

The healthcare discount plan market in the United States reflects the country’s fragmented and high-cost healthcare infrastructure. With approximately 30 million Americans uninsured and tens of millions more underinsured, there is growing demand for solutions that offer affordability and flexibility. Discount plans appeal not only to the uninsured, but also to those with high-deductible health plans (HDHPs), retirees on fixed incomes, and independent contractors lacking employer-sponsored coverage.

The rise of gig economy platforms such as Uber, DoorDash, and Instacart has further accelerated demand, with many of these workers seeking out-of-pocket care solutions that don’t require employer ties. At the same time, a large population of older adults is using discount plans to fill gaps in Medicare—especially for services like dental, hearing, and vision, which are often excluded from traditional Medicare.

States have taken varied approaches to regulating these plans. While some have imposed strict transparency and disclosure laws, others have allowed broader marketing freedom. However, federal oversight remains minimal, which both enables market flexibility and introduces potential risks. As awareness grows and transparency improves, healthcare discount plans are poised to play a more visible role in supplementing the U.S. healthcare experience.

Some of the prominent players in the U.S. healthcare discount plan market include:

- Discount Medical Plan Organizations (DMPOs)

Coverdell

- Access One Consumer Health, Inc.

- New Benefits, Ltd.

- Alliance Healthcare of Florida, Inc.

- Ameriplan

- CARRINGTON International Corp.

Marketer

- Cigna

- Sam’s West, Inc.

- United Health Group

- DentalPlans.com, Inc.

- American Dental Care Partners, Inc.

- Humana, Inc.

- Blue Cross and BlueShield Association

- Xpress Healthcare

- Discounts by Design

- Freshbenies

Recent Developments

-

Careington International (March 2025) announced a new partnership with a major telehealth provider to integrate 24/7 virtual primary care into all core discount packages, improving accessibility for rural and underserved populations.

-

New Benefits (February 2025) launched a bundled mental health discount service with virtual therapy and self-care app subscriptions aimed at Gen Z and Millennial users.

-

WellCard Health (January 2025) expanded its prescription discount network to include over 70,000 pharmacies nationwide, with new digital features allowing real-time price comparison across pharmacy locations.

-

Discount Dental Plans USA (December 2024) introduced a bilingual mobile app for managing dental plan usage, provider directories, and appointment scheduling, targeting Hispanic populations in urban areas.

-

Simple HealthPlans (November 2024) unveiled a modular “Build-Your-Plan” feature that allows consumers to select specific services—such as dental, vision, or alternative therapy—for custom monthly pricing.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2035. For this study, Nova one advisor, Inc. has segmented the U.S. healthcare discount plan market

By Service

- Health Advocate

- Virtual Visits

- Alternative Medicines

- Prescription Drugs

- Dental Care

- Vision Care

- Hearing Aids

- Chiropractic Care

- Nurse Services

- Vitamins & Supplements

- Wellness Plans

- Podiatry Plans

- Others