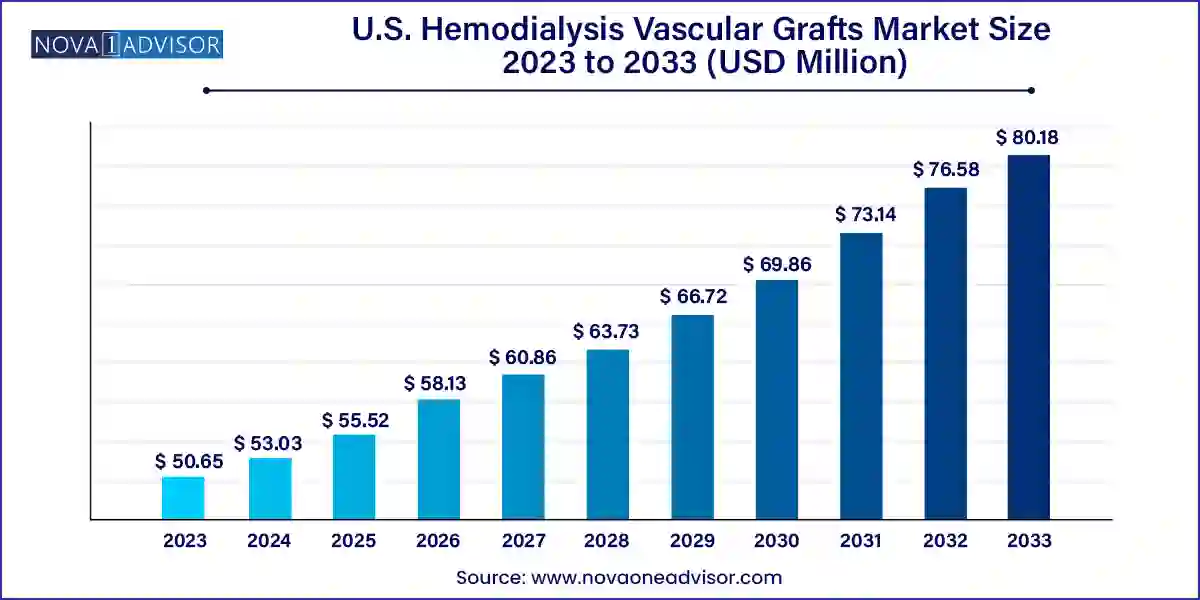

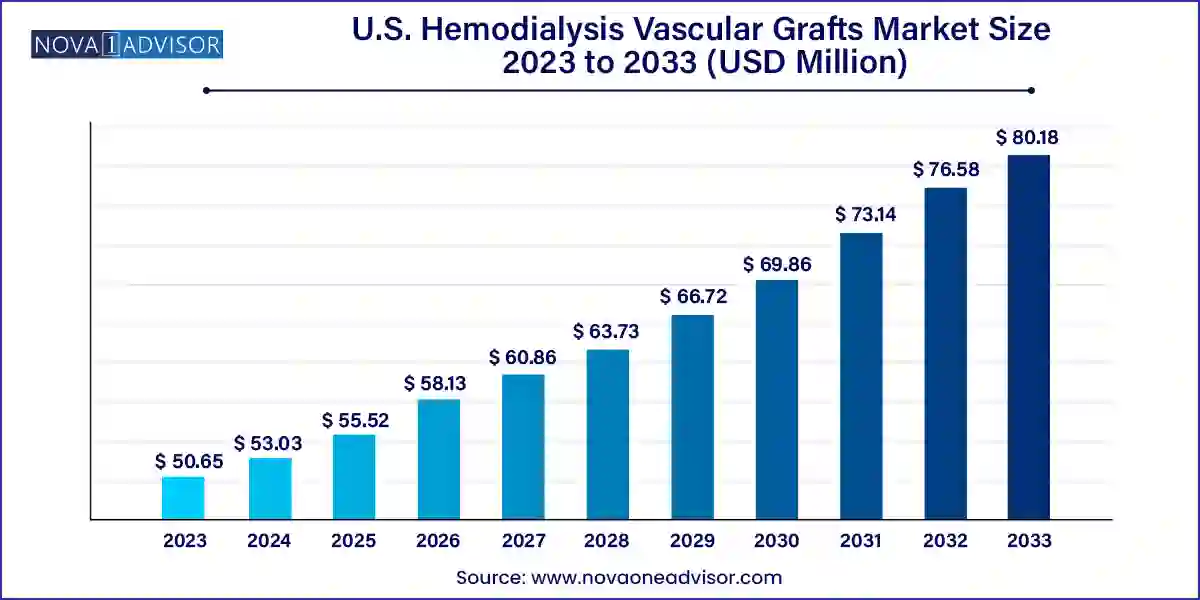

U.S. Hemodialysis Vascular Grafts Market Size and Growth

The U.S. hemodialysis vascular grafts market size was exhibited at USD 50.65 million in 2023 and is projected to hit around USD 80.18 million by 2033, growing at a CAGR of 4.7% during the forecast period 2024 to 2033.

Market Overview

The U.S. Hemodialysis Vascular Grafts Market represents a critical component in the larger renal care ecosystem, facilitating long-term vascular access for patients undergoing hemodialysis due to end-stage renal disease (ESRD). With rising incidences of chronic kidney disease (CKD), the demand for reliable and safe vascular access solutions has surged across the country. Vascular grafts are especially vital in situations where arteriovenous fistulas are not viable or effective, making them a necessary alternative for both short-term and long-term hemodialysis care.

In the United States, approximately 786,000 individuals are living with ESRD, with over 70% receiving hemodialysis as their primary treatment modality. These figures are expected to climb as the aging population, lifestyle-related illnesses such as diabetes and hypertension, and other comorbidities increase. Given this scenario, the market for hemodialysis vascular grafts has evolved significantly over the last decade moving beyond conventional synthetic grafts toward biologically engineered, hybrid, and innovative material-based solutions.

Technological advancements, regulatory approvals, and the entry of new graft products designed for improved patency rates, fewer infections, and enhanced compatibility are shaping the future landscape. The U.S. remains one of the largest and most progressive markets globally for vascular access devices, backed by a robust healthcare infrastructure, dedicated renal care programs (e.g., Medicare’s ESRD program), and an active base of specialized vascular surgeons and nephrologists.

As hospital networks and outpatient dialysis centers expand their footprint and partnerships with device manufacturers, the commercial potential for vascular graft innovations is vast. Market participants continue to invest in clinical trials and biocompatible technologies to reduce intervention frequency and post-operative complications, thereby meeting both clinical and economic goals in the healthcare system.

Major Trends in the Market

-

Shift Toward Biologically Engineered Grafts: Tissue-engineered and human-derived vascular grafts are gaining preference for their compatibility and long-term viability.

-

Increased Prevalence of Home Hemodialysis: Rise in home-based dialysis procedures is indirectly influencing demand for more durable and user-friendly vascular grafts.

-

Technological Advancements in Hybrid Grafts: Innovation in combining synthetic and biological materials to create high-performance hybrid vascular grafts is accelerating.

-

Focus on Antimicrobial-Coated Grafts: To reduce infection risks, companies are introducing grafts coated with antimicrobial agents.

-

Outpatient Dialysis Center Expansion: Growth of private and outpatient dialysis clinics is creating new procurement avenues for graft manufacturers.

-

Value-Based Reimbursement Models: CMS and private payers are increasingly incentivizing reduced hospitalization rates and improved vascular access outcomes.

-

Customizable and Size-Specific Grafts: Patient-specific grafts based on anatomy and previous treatment history are being developed with AI and 3D modeling.

-

Collaborations Between Device Firms and Dialysis Networks: Strategic partnerships aim to develop integrated solutions from access creation to maintenance.

Report Scope of U.S. Hemodialysis Vascular Grafts Market

| Report Coverage |

Details |

| Market Size in 2024 |

USD 53.03 Million |

| Market Size by 2033 |

USD 80.18 Million |

| Growth Rate From 2024 to 2033 |

CAGR of 4.7% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Raw material, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

U.S. |

| Key Companies Profiled |

Getinge; Medtronic; W. L. Gore & Associates; LeMaitre Vascular; CryoLife; Merit Medical Systems; C.R. Bard, Inc.; Vascudyne Inc. |

Market Driver: Rising ESRD and CKD Prevalence in the U.S.

The most powerful driver for the U.S. hemodialysis vascular grafts market is the continuous rise in chronic kidney disease and end-stage renal disease cases across all demographics. According to the National Kidney Foundation, over 37 million adults in the U.S. are estimated to have kidney disease, and a significant percentage will progress to the point where hemodialysis becomes essential. ESRD, characterized by the irreversible loss of kidney function, demands recurring dialysis for survival.

The increasing burden of diabetes (a leading cause of CKD), obesity, and hypertension especially among aging and minority populations has directly amplified the demand for durable and safe vascular access options. As arteriovenous fistulas are not suitable for all patients due to vein quality or other anatomical limitations, vascular grafts become the go-to solution, particularly for elderly patients and those with prior failed access. This growing patient base provides a consistent and expanding market opportunity for graft manufacturers and healthcare providers.

Despite their effectiveness, synthetic vascular grafts carry a notable risk of complications such as thrombosis, stenosis, and infection. These issues often necessitate repeated interventions, which can be costly, time-consuming, and physically taxing for patients. Particularly, polytetrafluoroethylene (PTFE)-based grafts, while widely used for their durability and patency, have been associated with higher infection rates when compared to autologous grafts or native fistulas.

Such risks contribute to long-term patient morbidity, increased hospitalizations, and higher total cost of care. This has led some nephrologists and vascular surgeons to remain cautious or delay graft use in favor of attempting fistula placement even if initial outcomes are uncertain. Furthermore, medical malpractice risks associated with graft-related complications can deter certain facilities from actively pushing their use unless clinically warranted. These dynamics create a challenging environment for broader graft adoption and necessitate more innovation and robust long-term data to drive confidence.

Market Opportunity: Advancements in Tissue-Engineered Vascular Grafts (TEVGs)

A transformative opportunity in the U.S. hemodialysis vascular grafts market lies in the development and commercialization of tissue-engineered vascular grafts (TEVGs). These grafts, often developed using scaffold-based systems and seeded with a patient’s own cells or using biodegradable materials, aim to replicate the biological functionality and healing response of natural blood vessels. TEVGs promise superior biocompatibility, reduced thrombogenicity, and minimal immunological response compared to synthetic grafts.

Leading companies and research institutions are in various phases of clinical trials evaluating the long-term safety and efficacy of these grafts. For instance, bioengineered human acellular vessels (HAVs), under development by companies like Humacyte, are showing potential in early trials for hemodialysis patients. TEVGs not only have the potential to enhance patient outcomes but could also significantly reduce the burden on healthcare systems by minimizing graft failure and complications, making them a game-changing innovation in this field.

U.S. Hemodialysis Vascular Grafts Market By Raw Material Insights

Polytetrafluoroethylene (PTFE) vascular grafts dominate the U.S. market due to their strong track record, widespread availability, and mechanical reliability. PTFE grafts have been used for decades in hemodialysis and are favored for their durability, tensile strength, and ease of handling during surgery. Their porous nature supports tissue ingrowth, while newer versions incorporate heparin-bonding or antimicrobial coatings to mitigate infection and clotting risks. PTFE-based grafts are especially preferred for patients with poor vein quality or failed fistulas, offering consistent outcomes in both hospital and outpatient dialysis settings.

However, the fastest-growing raw material segment is tissue-engineered and biological grafts, including human saphenous and umbilical vein-based products. These materials offer superior biological integration and minimal foreign body response, which is critical in patients with a long dialysis prognosis. Innovations in decellularized human and porcine tissues, combined with breakthroughs in cell-seeding and scaffold design, are allowing for more natural healing and remodeling of the graft within the patient’s body. As these grafts receive FDA approval and demonstrate long-term effectiveness, their market share is expected to expand rapidly, especially in younger and high-risk patient groups.

Country-Level Analysis

Within the U.S., several regional dynamics shape the landscape of vascular graft demand. The Northeast region stands out as a dominant market due to its dense population, high concentration of specialized renal care centers, and academic medical institutions actively involved in clinical research. States like New York and Massachusetts host top-tier nephrology practices and tertiary care hospitals that are early adopters of advanced medical devices, including biologically engineered vascular grafts. Additionally, the region benefits from strong insurance coverage networks and federal healthcare programs supporting chronic disease management.

Meanwhile, the Southeast emerges as the fastest-growing region due to its high incidence of diabetes, hypertension, and obesity—key risk factors for CKD and ESRD. States such as Georgia, Florida, and Alabama show disproportionately high rates of kidney failure, particularly among African American communities. Federal programs, including the ESRD Network 6 and 7 initiatives, are targeting improved vascular access outcomes in these areas. The rapid growth of outpatient dialysis centers and adoption of percutaneous AV grafts are expected to drive significant demand in this region over the next decade.

U.S. Hemodialysis Vascular Grafts Market By Recent Developments

-

March 2025 – Humacyte Inc. announced successful completion of a Phase III trial evaluating its human acellular vessel (HAV) for vascular access in hemodialysis. The company plans to submit a Biologics License Application (BLA) to the FDA in Q3 2025.

-

January 2025 – W. L. Gore & Associates, the manufacturer of GORE® PROPATEN® vascular grafts, introduced a new iteration of its PTFE graft featuring a heparin-bonded surface with improved anti-thrombogenic properties.

-

October 2024 – Getinge AB partnered with a U.S. academic institution to develop polyurethane-based hybrid grafts intended to combine mechanical strength with biological integration for dialysis patients.

-

August 2024 – Becton, Dickinson and Company (BD) entered a strategic distribution agreement to market bioengineered umbilical vein grafts for vascular access in select U.S. states.

-

June 2024 – LeMaitre Vascular expanded its manufacturing facility in Burlington, Massachusetts, to increase production of biologic vascular grafts, anticipating demand from U.S. dialysis centers.

Some of the prominent players in the U.S. hemodialysis vascular grafts market include:

- Getinge

- Medtronic

- W. L. Gore & Associates

- LeMaitre

- CryoLife

- Merit Medical Systems

- C. R. Bard, Inc.

- Vascudyne, Inc.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. hemodialysis vascular grafts market

Raw Material

- Polyester

- Polytetrafluoroethylene

- Polyurethane

- Biological Materials

-

- Human Saphenous & Umbilical Veins

- Tissue Engineered Materials

Regional

- West

- Midwest

- Northeast

- Southwest

- Southeast