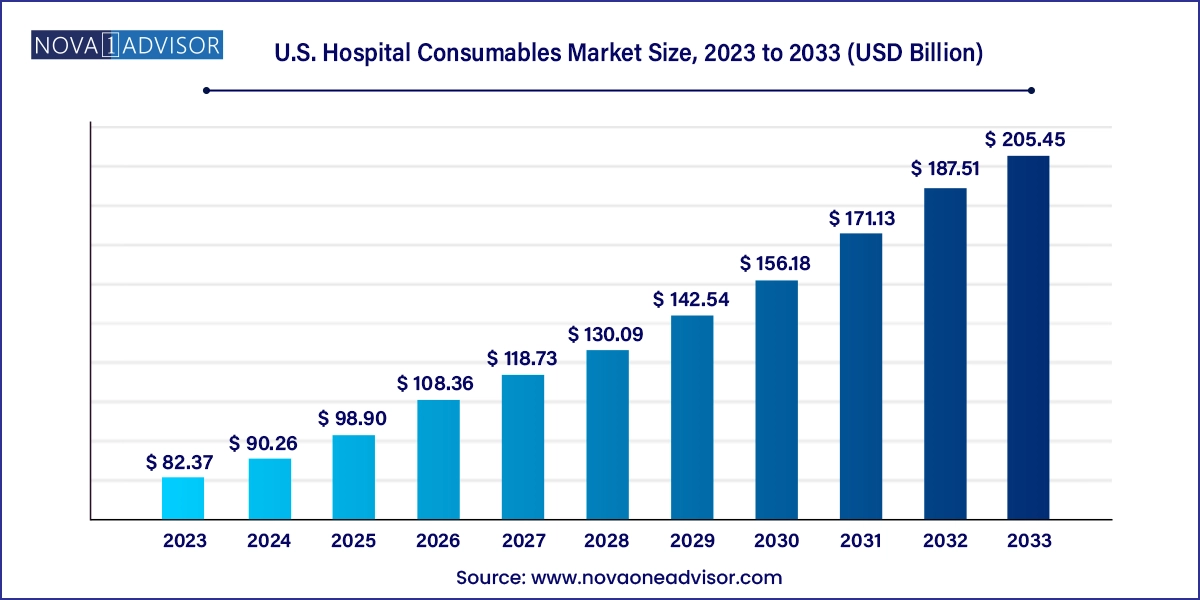

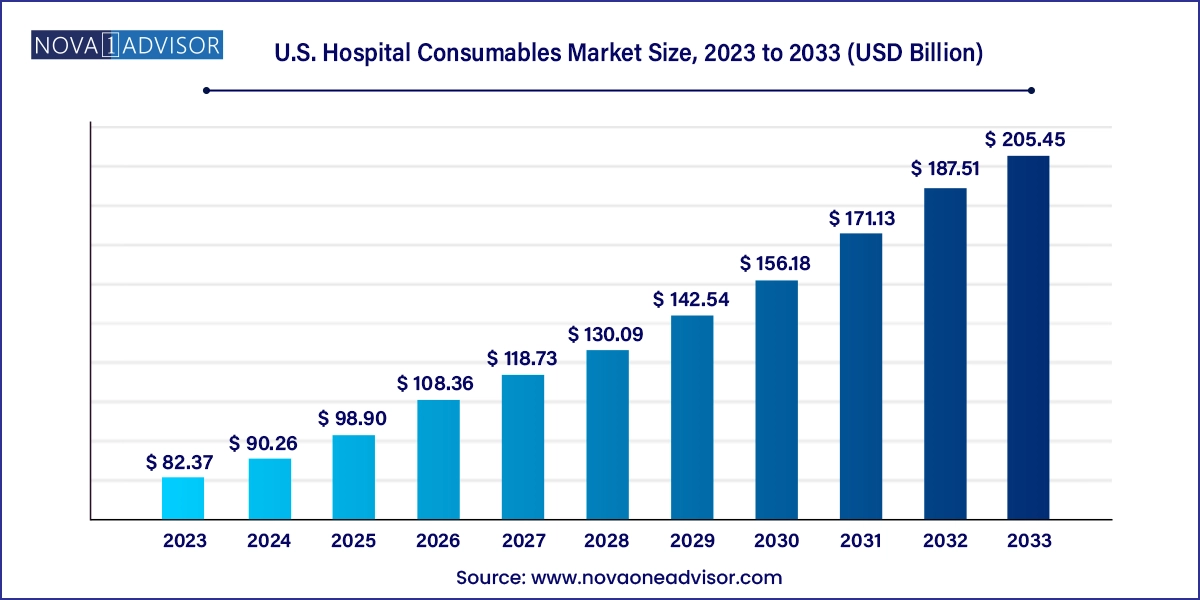

U.S. Hospital Consumables Market Size and Growth

The U.S. hospital consumables market size was exhibited at USD 82.37 billion in 2023 and is projected to hit around USD 205.45 billion by 2033, growing at a CAGR of 9.57% during the forecast period 2024 to 2033.

U.S. Hospital Consumables Market Key Takeaways:

- The non-woven disposable products segment accounted for a significant revenue share of approximately 24.2% in 2023.

- The disposable medical gloves segment is expected to advance at the fastest CAGR of 14.4% over the forecast period.

Market Overview

The U.S. Hospital Consumables Market represents a foundational segment of the healthcare industry, comprising essential items used across various medical procedures and patient care activities. These products range from disposable gloves, syringes, and gauze to more technical items such as IV kits, catheters, and guidewires. Their frequent use, disposability, and crucial role in maintaining hygiene and operational efficiency make them indispensable in hospital settings. As the U.S. healthcare system continues to expand, fueled by a growing elderly population, rising chronic disease burden, and advancing medical technologies, the demand for hospital consumables is increasing exponentially.

Additionally, the COVID-19 pandemic underscored the critical importance of hospital consumables, spotlighting supply chain vulnerabilities and catalyzing efforts to localize production and ensure stockpile readiness. Government mandates and policy revisions have also emphasized the role of safety and quality in consumable manufacturing. Innovations in materials, focus on environmentally sustainable disposable products, and growing adoption of single-use medical supplies are reshaping this market into a technologically advanced and strategically vital healthcare component.

Major Trends in the Market

-

Rising Shift Toward Single-Use Consumables: To prevent cross-contamination and hospital-acquired infections, healthcare facilities are increasingly adopting single-use, disposable products.

-

Smart Monitoring Integration: Devices like digital thermometers and glucometer strips are being incorporated with smart monitoring systems and EHR platforms.

-

Eco-friendly Product Development: Hospitals are seeking biodegradable and recyclable alternatives to conventional plastic-based disposables.

-

Miniaturization and Portability: BP monitors and other diagnostic tools are becoming more compact and portable to enhance point-of-care testing.

-

Increase in Chronic Disease Management Kits: Customized kits like IV solutions and procedure trays tailored to chronic care are gaining traction.

-

Public-Private Collaboration: Government agencies are collaborating with manufacturers to maintain emergency consumables reserves post-COVID.

-

Automation in Supply Chain Management: Inventory management systems using AI are being employed to reduce wastage and forecast consumable needs more accurately.

Report Scope of U.S. Hospital Consumables Market

| Report Coverage |

Details |

| Market Size in 2024 |

USD 90.26 Billion |

| Market Size by 2033 |

USD 205.45 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 9.57% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Product |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Country scope |

U.S. |

| Key Companies Profiled |

McKesson Medical-Surgical Inc.; Medline Industries, Inc.; B. Braun SE; Terumo Medical Corporation; Owens & Minor; Smith+Nephew; Cardinal Health; 3M |

Market Driver

Escalating Hospitalization Rates Due to Chronic Diseases:

The growing burden of chronic diseases in the U.S., such as diabetes, cardiovascular disorders, and respiratory ailments, is a major driver propelling the hospital consumables market. As the prevalence of these conditions continues to rise, so too does the need for long-term treatment and regular hospital visits. This scenario boosts the consumption of essential supplies like catheters, IV kits, syringes, and glucometer strips. According to the CDC, over 60% of American adults live with at least one chronic disease, many of which require frequent hospitalizations or outpatient care. This trend is significantly increasing the recurring demand for consumables, making them a core expenditure for healthcare facilities.

Market Restraint

Environmental Waste and Disposal Regulations:

One of the pressing challenges in the U.S. hospital consumables market is managing the environmental impact of disposable medical supplies. As hospitals move toward single-use items for infection control, the volume of medical waste has surged. Managing and disposing of this waste is regulated under strict federal and state-level guidelines, including those from OSHA and the EPA. Non-compliance can result in hefty fines and reputational damage. Furthermore, the cost of waste segregation, transportation, and incineration adds to operational burdens for healthcare providers. These environmental and regulatory pressures are compelling manufacturers to innovate, but they also create hurdles in market expansion.

Market Opportunity

Growth of Ambulatory Surgical Centers (ASCs):

The expanding footprint of Ambulatory Surgical Centers (ASCs) across the U.S. offers a significant opportunity for the hospital consumables market. ASCs are known for performing outpatient surgeries in a cost-effective and efficient manner, contributing to rising procedural volumes. These centers require consumables just like traditional hospitals, often in higher turnover rates due to faster patient cycles. From surgical gloves and procedure trays to catheters and gauze, ASCs represent a lucrative and growing channel for medical consumables. With healthcare policy increasingly favoring outpatient care for cost containment, this trend is expected to drive long-term market expansion.

U.S. Hospital Consumables Market By Product Insights

Disposable medical gloves dominated the market due to their ubiquitous use across all patient interactions and procedures. These gloves serve as the first line of defense against contamination and infection, making them essential in every medical setting. They are used not only by surgeons and nurses but also by administrative and sanitation staff, thereby contributing to massive volume demand. The pandemic significantly heightened glove usage, with hospitals stockpiling large quantities. In parallel, companies have developed nitrile and latex-free alternatives to reduce allergy risks, further enhancing adoption. Gloves also face relatively fewer price fluctuations, stabilizing supply contracts.

Disposable syringes are projected to be the fastest-growing segment due to increasing vaccination programs, insulin administration for diabetes, and widespread use in diagnostic testing. With growing patient engagement in home healthcare and the expansion of immunization initiatives, the need for sterile, single-use syringes is escalating. Moreover, auto-disable syringes and safety-engineered variants are being adopted to prevent needle-stick injuries, enhancing safety and compliance. Companies are focusing on mass manufacturing with minimal defect rates, using automation and robotic assembly lines to meet this rising demand.

IV Kits and Catheters

IV kits held a significant market share, especially in emergency and inpatient care settings. These kits streamline fluid and drug administration, improving care delivery efficiency. The availability of preassembled kits tailored for specific therapies (e.g., chemotherapy, rehydration, pain management) makes them an indispensable tool. Hospitals also benefit from reduced setup times and inventory complexity. As patient expectations for fast and accurate care rise, these standardized kits have become a central feature in both urban and rural hospitals.

Catheters, on the other hand, are the fastest-growing product within this category, primarily driven by the surge in urological disorders, aging population, and critical care needs. Foley and central venous catheters see high usage in ICUs, while intermittent and suprapubic catheters are increasingly used in long-term care. Biocompatible materials and anti-infection coatings are helping reduce catheter-associated complications, thereby encouraging adoption. Technological improvements such as antimicrobial impregnations and silicon-based tubing are further promoting the use of high-end variants in specialized departments.

Thermometers, Stethoscopes, and BP Monitors

Thermometers dominated the diagnostic tools category owing to their role in routine patient assessments and infection monitoring. The shift from traditional mercury-based thermometers to digital and infrared variants has boosted hygiene and speed. During the COVID-19 pandemic, non-contact infrared thermometers became critical in screening efforts, leading to widespread distribution across public and private healthcare facilities. Hospitals continue to maintain high procurement rates for thermometers due to their frequent use and relatively low cost.

BP monitors are among the fastest-growing diagnostic consumables due to the increasing prevalence of hypertension and heart-related disorders. Portable and automated BP monitors are now a staple in outpatient departments and home healthcare setups. Enhanced accuracy, wireless connectivity, and integration with EHR systems are driving preference for advanced models. Public awareness campaigns and preventive screenings further elevate demand, positioning this product category for continued growth.

IV Solutions and Procedure Trays

500 ml IV solutions were the most commonly used sub-segment, balancing adequate fluid volume for rehydration and drug dilution without the waste associated with larger volumes. Hospitals often rely on 500 ml units for patients requiring mild to moderate fluid management, especially in medical-surgical wards. Their high turnover rate and compatibility with various drugs make them indispensable.

100 ml IV solutions are the fastest-growing due to their specific use in pediatric care and short-duration treatments. Smaller volumes minimize the risk of fluid overload, especially in sensitive patient populations. With the rise of tailored drug delivery protocols, particularly in oncology and pain management, demand for precision dosing in 100 ml formats is escalating. The industry is responding with improved packaging and compatibility features.

Laceration trays led the procedure trays segment as hospitals prefer ready-to-use, sterile kits for wound closure, particularly in emergency departments. These kits reduce procedural errors, enhance time efficiency, and standardize care delivery. Their use is particularly high in trauma centers, urgent care clinics, and disaster response units.

Customized surgical trays are growing rapidly, especially in orthopedic, ophthalmic, and cardiovascular surgeries. These trays are tailored with instruments and consumables needed for specific procedures, reducing OR time and post-operative complications. Hospitals appreciate the streamlined inventory and reduced need for in-house sterilization.

Some of the prominent players in the U.S. hospital consumables market include:

- McKesson Medical-Surgical Inc.

- Medline Industries, Inc.

- B. Braun SE

- Terumo Medical Corporation

- Owens & Minor

- Smith+Nephew

- Cardinal Health

- 3M

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. hospital consumables market

Product

- Disposable Medical Gloves

- IV Kits

- Medical Gauze & Tapes

- Disposable Syringes

- Sharps Disposable Containers

- Catheters

- Non-woven Disposable Products

- Surgical Blades

- Medicine Cups

- Cannula

- Guidewires

- Thermometer

- Stethoscope

- Glucometer Strips

- IV Solutions

-

- 50 ml

- 100 ml

- 250 ml

- 500 ml

- 1000 ml

- BP Monitors

- Procedure Trays