U.S. Hospital Emergency Department Market Size and Research

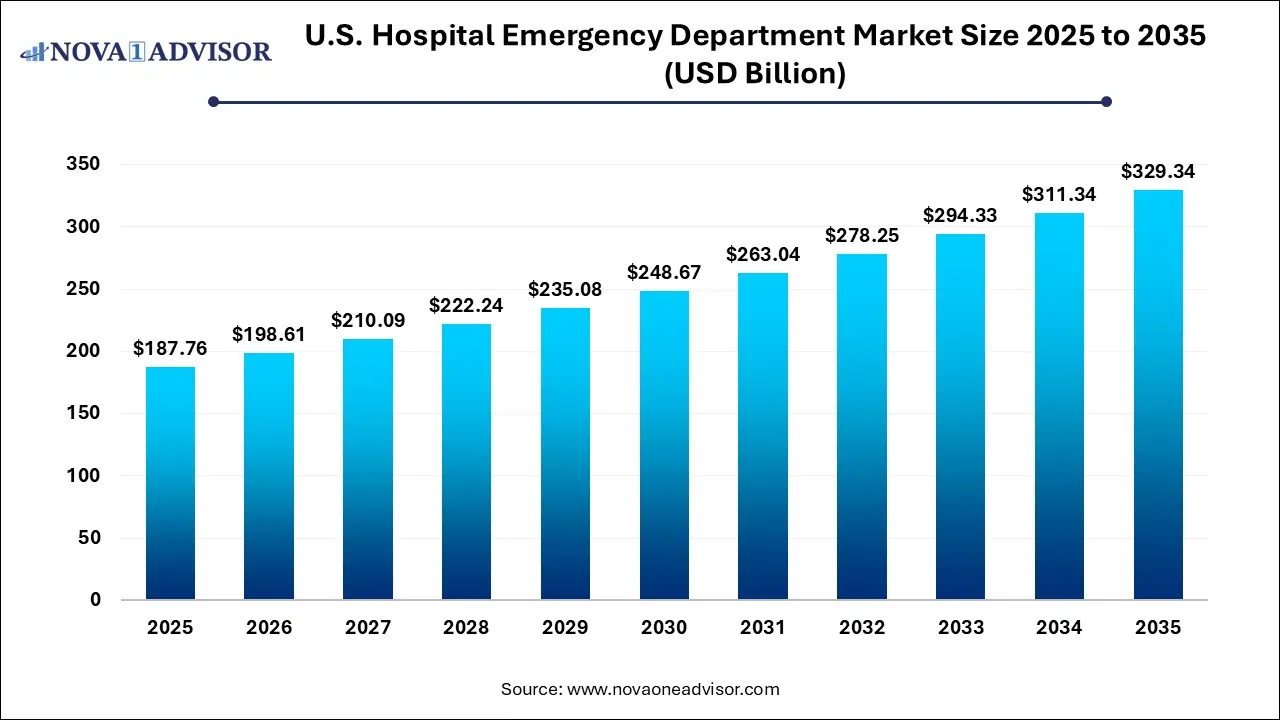

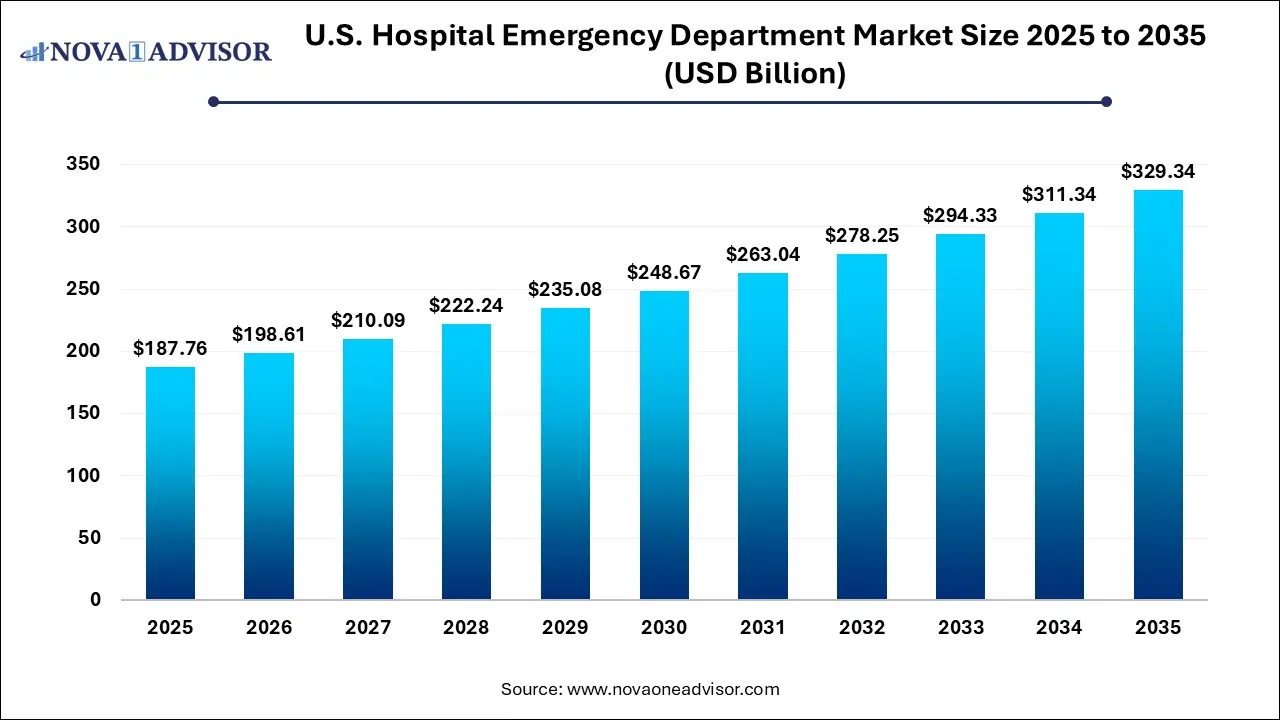

The U.S. hospital emergency department market size was exhibited at USD 187.76 billion in 2025 and is projected to hit around USD 329.34 billion by 2035, growing at a CAGR of 5.78% during the forecast period 2026 to 2035.

U.S. Hospital Emergency Department Market Key Takeaways:

- The private & others segment dominated the market with a revenue share of 46.4% in 2025 and is expected to witness the fastest growth rate over the forecast period.

- The infectious conditions segment dominated the market with the largest revenue share of 38.0% in 2025.

Market Overview

The U.S. hospital emergency department (ED) market forms a vital pillar of the country’s healthcare system, offering life-saving, immediate medical care for a wide range of acute conditions. With over 130 million annual visits recorded in recent years, emergency departments are often the first point of contact for patients experiencing trauma, stroke, cardiac arrest, severe infections, psychiatric episodes, and other emergent conditions. These departments function 24/7, serving both insured and uninsured patients regardless of their ability to pay—making them essential yet complex nodes of care delivery.

Emergency departments in the U.S. are characterized by their dual role in providing critical treatment and managing patient triage for hospital admissions. They also operate as crucial touchpoints for underserved populations, particularly those who lack regular access to primary care. This has led to a rise in non-emergent visits, contributing to overcrowding and longer wait times, but also emphasizing the centrality of EDs in public health strategy.

Hospital systems are responding to this growing demand through infrastructure expansion, digital triage tools, and care coordination models that bridge emergency, inpatient, and outpatient services. Reimbursement frameworks—especially Medicare, Medicaid, and private insurance contracts—significantly influence ED workflows, staffing, and clinical resource allocation. As healthcare delivery continues to evolve post-COVID-19, emergency departments are adapting by adopting telemedicine, advanced diagnostics, and value-based care pathways.

Major Trends in the Market

-

Rising Use of Emergency Departments for Behavioral Health Crises: A surge in psychiatric-related ED visits has led hospitals to expand mental health resources and crisis stabilization units.

-

Integration of Telehealth for Low-Acuity Conditions: Virtual emergency consultations are reducing overcrowding and enabling better triage for non-urgent cases.

-

Value-Based Care Models in Emergency Services: Hospitals are adopting accountable care and bundled payment models that incentivize efficient ED-to-inpatient transitions and readmission prevention.

-

AI-Based Patient Flow and Triage Optimization: Predictive analytics are being used to manage ED bottlenecks and prioritize critical care interventions.

-

Increase in Geriatric Emergency Medicine Programs: With the aging population, EDs are developing senior-friendly care models with specialized geriatric protocols.

Report Scope of U.S. Hospital Emergency Department Market

| Report Coverage |

Details |

| Market Size in 2026 |

USD 198.61 Billion |

| Market Size by 2035 |

USD 329.34 Billion |

| Growth Rate From 2026 to 2035 |

CAGR of 5.76% |

| Base Year |

2025 |

| Forecast Period |

2026-2035 |

| Segments Covered |

Insurance type, Condition |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Key Companies Profiled |

Parkland Health; Lakeland Regional Health; St. Joseph’s Health; Natchitoches Regional Medical Center; Schoolcraft Memorial Hospital; Clarion Hospital; USA Health; Baptist Health South Florida; Montefiore Medical Center; LAC+USC Medical Center |

Key Market Driver: High Burden of Chronic and Acute Health Conditions

The primary driver of growth in the U.S. hospital emergency department market is the persistently high burden of acute medical events and chronic disease exacerbations. According to the CDC, cardiovascular disease remains the leading cause of death in the U.S., and emergency departments are the first responders for heart attacks, strokes, and hypertensive crises. Similarly, diabetes-related complications, respiratory distress from COPD, and acute kidney injury episodes often culminate in emergency room visits.

Moreover, infectious disease outbreaks—such as the seasonal flu, COVID-19, and emerging threats like RSV—create surges in ED utilization. Trauma from car accidents, workplace injuries, and violence further amplify the load. Hospitals must remain equipped to handle this broad and unpredictable spectrum of cases around the clock. The critical role that EDs play in responding to such diverse medical needs ensures their continued demand, particularly in regions with aging populations or inadequate access to primary care.

Key Market Restraint: Overcrowding and Resource Strain

One of the most significant restraints in the U.S. hospital emergency department market is persistent overcrowding, which leads to longer wait times, delays in care, and poor patient outcomes. Studies show that a large percentage of ED visits are non-emergent in nature conditions that could be treated in urgent care centers or primary care settings. This inappropriate utilization stretches already limited resources, resulting in ED staff burnout and capacity issues.

Additionally, a shortage of emergency medicine physicians and specialized nursing staff exacerbates operational stress. Rural and underfunded hospitals, in particular, face challenges in retaining qualified personnel. Overcrowding also contributes to “boarding,” where admitted patients remain in the ED while awaiting inpatient beds, which diminishes the ED's ability to serve incoming emergencies. Although various policies and technological interventions are being trialed, systemic inefficiencies continue to hinder optimal emergency care delivery.

Key Market Opportunity: Integration of Emergency Care with Population Health Initiatives

An emerging opportunity in the U.S. hospital emergency department market is the integration of emergency services with broader population health strategies. Traditionally focused on acute care, EDs are now playing an increasingly central role in chronic disease identification, social determinant screening, and care coordination. Many hospital systems are deploying patient navigators, case managers, and care transition teams within the ED to connect patients with follow-up services, medication management, and community health resources.

This shift is particularly impactful for high-risk, high-utilizer patients—such as those with multiple comorbidities or behavioral health conditions—who frequently cycle through the emergency department. By leveraging the ED as a point of intervention for preventive health, hospitals can improve patient outcomes, reduce unnecessary readmissions, and qualify for value-based reimbursement incentives. As CMS and private payers continue to reward outcomes over volume, this expanded ED function is likely to gain traction.

U.S. Hospital Emergency Department Market By Insurance Type Insights

Medicare & Medicaid dominated the insurance-type segment in the U.S. hospital emergency department market. This is due to the high percentage of emergency department users who are either elderly, disabled, or low-income—all populations heavily reliant on public insurance programs. Medicare covers acute events in the elderly population, including falls, strokes, and infections, while Medicaid services are frequently used by low-income individuals and families, particularly for pediatric emergencies and maternal complications. Publicly insured patients also represent a substantial share of ED visits for behavioral health and substance use crises. Hospitals often receive disproportionate share hospital (DSH) payments to offset losses from uncompensated care, further highlighting the importance of Medicare and Medicaid in this sector.

Private & other insurance providers are the fastest-growing segment, driven by broader commercial insurance penetration, employer-sponsored plans, and the proliferation of urgent/emergent coverage under high-deductible health plans. The expansion of employer wellness programs and health savings accounts has led to a shift in patient expectations for quick, accessible care. While privately insured patients traditionally prefer urgent care or primary clinics, complex or high-risk conditions still direct them toward hospital EDs. Moreover, value-based contracts between hospitals and private insurers now incentivize efficient ED throughput, encouraging hospitals to innovate within the private payer landscape.

U.S. Hospital Emergency Department Market By Condition Insights

Traumatic conditions represented the dominant category of ED visits in the U.S. market. These include motor vehicle accidents, falls, gunshot wounds, industrial injuries, and sports-related trauma. The severity and unpredictability of these cases require immediate attention and advanced trauma capabilities, including imaging, surgical consultation, and life support services. Emergency departments, especially those designated as Level I or II trauma centers, are equipped to manage such high-acuity cases around the clock. Public health data continues to show rising injury-related ED visits, particularly among children and older adults, reinforcing trauma’s dominance in emergency care.

Psychiatric emergencies are emerging as the fastest-growing condition segment, reflecting a national mental health crisis exacerbated by the COVID-19 pandemic. Emergency departments are often the first point of contact for individuals experiencing acute psychiatric symptoms, suicidal ideation, or substance withdrawal. However, many hospitals lack specialized behavioral health facilities or trained staff to manage such cases, leading to prolonged boarding and strained resources. In response, healthcare systems are establishing crisis stabilization units and embedding psychiatric nurse practitioners in EDs. Federal funding and state-level mental health reforms are accelerating the development of integrated emergency psychiatric care models, making this a rapidly expanding focus area.

Cardiac and neurologic emergencies such as strokes, heart attacks, and seizures also form critical components of ED utilization. The growing prevalence of lifestyle-related diseases such as hypertension, diabetes, and obesity has increased the frequency of acute cardiovascular and cerebrovascular events. EDs play a vital role in early detection, intervention, and triage for these time-sensitive conditions, often initiating protocols for rapid catheterization lab activation or stroke unit transfer.

Country-Level Analysis: United States

In the United States, the hospital emergency department market is intricately tied to national healthcare policy, social safety nets, and evolving care delivery models. Emergency departments serve as both clinical lifelines and social care points, responding not only to acute health needs but also to systemic gaps in primary care and mental health services. Public hospital systems, urban academic centers, and rural critical access hospitals all participate in this market with varying degrees of resources and specialization.

The U.S. has invested in the Emergency Medical Treatment and Labor Act (EMTALA), ensuring that all individuals, regardless of insurance status, receive emergency care. While this promotes universal access, it places financial pressure on hospitals, particularly safety-net institutions. Current policy debates focus on funding mechanisms, such as Medicaid expansion and 340B drug pricing, which directly affect ED operations. Additionally, the rise of alternative care settings like freestanding EDs and urgent care centers is reshaping patient pathways and forcing traditional hospitals to differentiate through quality, speed, and specialty care.

Some of the prominent players in the U.S. hospital emergency department market include:

Recent Developments

-

HCA Healthcare (March 2025) announced the launch of a centralized tele-triage platform in multiple U.S. hospitals to streamline emergency room wait times and guide non-urgent cases to alternative care.

-

CommonSpirit Health (February 2025) opened a new hybrid emergency and behavioral health stabilization unit in Phoenix, responding to the growing demand for integrated mental health emergency services.

-

Mass General Brigham (January 2025) launched a predictive AI tool for emergency departments aimed at forecasting patient volumes and optimizing bed management.

-

Tenet Healthcare (December 2024) expanded its Texas-based emergency care network by opening three new freestanding EDs designed for suburban and rural populations with limited access to full hospitals.

-

Providence Health (November 2024) introduced a geriatric emergency department program across its West Coast facilities, including specialized training for ED staff in managing older patients with cognitive impairment or complex chronic conditions.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2035. For this study, Nova one advisor, Inc. has segmented the U.S. hospital emergency department market

By Insurance Type

- Medicare & Medicaid

- Private & Others

By Condition

- Traumatic

- Infectious

- Gastrointestinal

- Psychiatric

- Cardiac

- Neurologic

- Others