U.S. Hospital Facilities Market Size and Trends

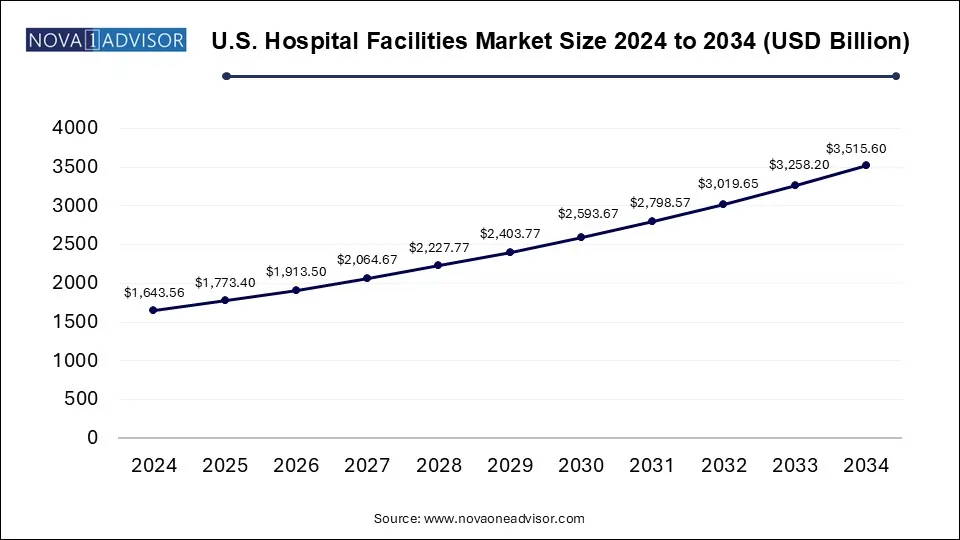

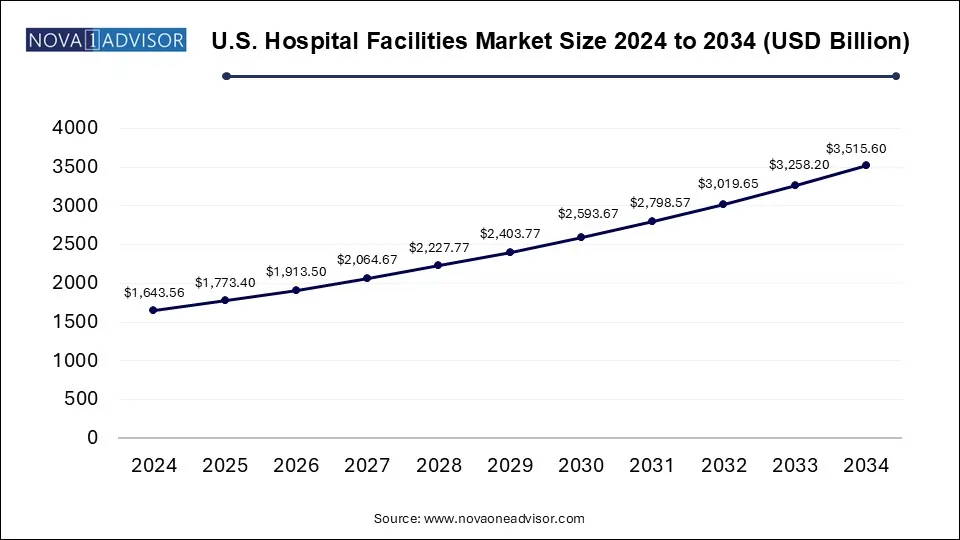

The U.S. hospital facilities market size was exhibited at USD 1643.56 billion in 2024 and is projected to hit around USD 3515.6 billion by 2034, growing at a CAGR of 7.9% during the forecast period 2025 to 2034.

U.S. Hospital Facilities Market Key Takeaways:

- The outpatient services segment dominated the market with a share of around 51% in 2024 and is additionally poised to be the fastest-growing segment with a CAGR of 9.0% over the forecast period.

- The inpatient services segment is projected to have moderate growth during the forecast period.

- The cardiovascular segment dominated the market, accounting for a share of around 20% in 2024.

- The public/community hospitals segment dominated the market with a share of over 53.0% in 2024.

- On the other hand, the private hospital segment is anticipated to witness lucrative expansion with a CAGR of 8.7% over the forecast period.

- The 0-99 segment dominated the market in 2024 with a revenue share of 53.2%.

- The 100-199 segment is anticipated to register the fastest CAGR of 8.13% over the forecast period.

Market Overview

The U.S. hospital facilities market forms the structural foundation of one of the world’s most sophisticated healthcare ecosystems. Comprising public, private, and state-owned institutions, hospital facilities in the United States serve as the core of acute care, chronic disease management, surgical interventions, emergency response, and specialized treatments. With approximately 6,000 hospitals operating nationwide including community, teaching, and government-run hospitals the market is a complex, high-stakes domain deeply influenced by public policy, technology adoption, demographic shifts, and evolving health burdens.

This market is characterized by rapid modernization of physical infrastructure, integration of smart technologies, expansion of specialized care units (e.g., oncology, cardiology, neurorehabilitation), and increased emphasis on outpatient services. Driven by aging populations, chronic disease prevalence, and pandemic-era lessons, U.S. hospitals are undergoing a transformation focused on enhancing operational efficiency, patient experience, and service delivery.

Despite these advancements, challenges persist. Workforce shortages, rising construction and maintenance costs, and regulatory hurdles have made hospital administration and expansion increasingly complex. As hospitals compete to deliver high-quality care while managing financial sustainability, the emphasis on service diversification, digital health integration, and value-based care has never been greater.

Major Trends in the Market

-

Surge in Outpatient and Ambulatory Service Expansion: Hospitals are increasingly shifting elective and minor procedures to outpatient departments to reduce costs and improve patient turnover.

-

Digital and Smart Hospital Infrastructure Development: Facilities are investing in automated systems, AI-powered diagnostics, robotics, and digital twin technologies to modernize hospital operations.

-

Green and Sustainable Facility Initiatives: Hospitals are prioritizing energy-efficient HVAC systems, renewable power sources, and sustainable construction to reduce environmental impact.

-

Post-COVID Infection Control Infrastructure Investments: Enhanced air filtration, contactless systems, and negative pressure rooms are now standard in facility upgrades.

-

Rise of Specialty Hospitals and Centers of Excellence: Demand for dedicated cancer, cardiovascular, and orthopedic hospitals is rising to provide targeted, high-quality care.

Report Scope of U.S. Hospital Facilities Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 1773.4 Billion |

| Market Size by 2034 |

USD 3515.6 Billion |

| Growth Rate From 2025 to 2034 |

CAGR of 7.9% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

Patient Service, Facility Type, Service Type, Bed Size |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Key Companies Profiled |

The Johns Hopkins Hospital; Mayo Clinic; Cleveland Clinic; Cedars-Sinai; Massachusetts General Hospital; UCSF Health; New York-Presbyterian Hospital; Brigham and Women's Hospital; Ronald Regan UCLA Medical Center; Northwestern Memorial Hospital |

Key Market Driver: Increasing Burden of Chronic Diseases and Aging Population

The U.S. hospital facilities market is heavily influenced by the growing prevalence of chronic diseases, particularly among the aging population. According to the CDC, nearly 60% of adults in the U.S. have at least one chronic condition such as heart disease, diabetes, cancer, or COPD. These conditions often require complex care, frequent hospitalizations, diagnostic services, and long-term management necessitating well-equipped and specialized hospital facilities.

Moreover, the baby boomer generation continues to push the proportion of Americans over 65 upward. This demographic trend is placing increased demand on hospitals for geriatric care, joint replacement surgeries, rehabilitation, and comorbidity management. Consequently, healthcare systems are investing in facility upgrades, adding beds in certain specialties, and enhancing long-term care infrastructure to meet rising patient acuity and demand.

Key Market Restraint: Rising Operational and Capital Expenditure

One of the most pressing challenges facing hospital facility administrators is the rising cost of operations and capital investments. Hospital infrastructure—whether new construction, renovation, or technology integration—demands substantial financial resources. Costs are further compounded by supply chain disruptions, labor shortages in skilled trades, and inflationary pressures on building materials.

In parallel, operational expenditures such as energy usage, waste management, equipment maintenance, and labor represent significant recurring costs. Hospitals are also under pressure to comply with evolving safety and accreditation standards, which adds to compliance-related spending. These financial constraints may lead to delayed infrastructure upgrades, limited bed expansions, or downsizing of non-essential services in underperforming facilities.

Key Market Opportunity: Integration of Digital Health and Smart Infrastructure

An exciting opportunity lies in the integration of digital health technologies and smart infrastructure into hospital facilities. From AI-based diagnostics to real-time patient monitoring, hospitals are beginning to leverage advanced technology to improve care outcomes and operational efficiency. Smart rooms equipped with voice assistants, patient-controlled interfaces, and remote vitals monitoring are redefining the hospital experience.

On the backend, hospitals are implementing intelligent building management systems to optimize lighting, HVAC, water, and power usage. Predictive maintenance of medical and structural equipment using IoT sensors is gaining momentum. As federal and private investment in healthtech accelerates, hospital systems that embrace smart infrastructure will likely improve patient satisfaction, safety, and long-term ROI.

U.S. Hospital Facilities Market By Patient Service Insights

Inpatient services dominated the U.S. hospital facilities market, accounting for a substantial portion of hospital revenue and physical infrastructure demand. Inpatient facilities are critical for surgeries, childbirth, severe infection management, and post-operative rehabilitation. These services require extensive physical space, medical equipment, and dedicated staff—including operating rooms, ICUs, and surgical recovery wards. Despite a growing emphasis on outpatient care, hospitals continue to rely on inpatient services for complex, high-revenue treatments such as orthopedic surgery, cardiothoracic procedures, and intensive trauma care.

Outpatient services are the fastest-growing segment, as hospitals shift lower-risk, short-duration procedures and consultations to more efficient, ambulatory care environments. From diagnostic imaging and minor surgeries to physical therapy and oncology infusions, outpatient facilities are helping hospitals decongest inpatient capacity, reduce overheads, and improve patient throughput. The popularity of outpatient services is bolstered by advancements in minimally invasive procedures, better post-discharge monitoring, and increased insurance reimbursements.

U.S. Hospital Facilities Market By Service Type Insights

The cardiovascular segment dominated the market, accounting for a share of around 20% in 2024. The segment is further expected to dominate the market over the forecast period. Growing adoption of sedentary lifestyle practices is leading to a rise in the incidence of obesity in the U.S., thus increasing the risk of heart diseases. Thus, an increasing number of patients suffering from CVDs is expected to propel segment growth.

The cancer care segment is also expected to account for a significant market share over the forecast period. Cancer is the second leading cause of death in the U.S. after CVDs. According to the HCUP, there were about 2.8 million cancer-related hospitalizations in 2017. Out of these, around 1.0 million hospitalizations had cancer as a principal diagnosis and 1.7 million had cancer as a secondary diagnosis.

According to the National Center for Biotechnology Information, in 2024, 609,360 cancer deaths and over 1.9 million new cancer cases were projected to occur in the U.S. which also includes 350 deaths approximately due to lung cancer, the leading cause of cancer deaths. The increasing costs of cancer treatment, the rising number of specialized oncology departments & oncologists, and the supportive reimbursement framework are among the key factors expected to propel segment growth.

Based on service type, the market is segmented into acute care; cardiovascular; cancer care; neurorehabilitation & psychiatry services; pathology lab, diagnostic, and imaging; obstetrics & gynecology; and others. The acute care segment is expected to witness the fastest CAGR of 8.78% from 2023 to 2030, owing to the rising demand for primary care services and the increasing prevalence of acute infections. For instance, as per a survey distributed by the CDC, a total of 523,000 emergency department visits for infectious and parasitic diseases led to hospital admissions in 2018.

U.S. Hospital Facilities Market By Facility Type Insights

Private hospitals held the dominant position in the market, driven by their ability to invest in high-end infrastructure, patient-centric designs, and service diversification. These facilities often operate in metropolitan areas with affluent populations and are known for offering premium services, short wait times, and specialized care. They also benefit from flexibility in administrative decisions, enabling faster adoption of innovation and expansion strategies.

Public and community hospitals are growing steadily, especially due to state-level investments in safety-net care and rural health expansion. These hospitals are essential for underserved populations, particularly in rural and low-income urban regions. Government stimulus programs, Medicaid funding, and infrastructure grants are facilitating improvements in community hospital capabilities, including digital infrastructure, ER expansions, and maternal health units.

U.S. Hospital Facilities Market By Bed Size Insights

Hospitals with 300+ beds dominate the U.S. hospital facilities landscape, primarily because they are often teaching hospitals, trauma centers, or regional hubs that offer comprehensive care across multiple specialties. These facilities serve large populations, handle high patient volumes, and are equipped for complex surgeries, critical care, and research-based medicine. Their scale allows for cost efficiencies in operations and significant investments in cutting-edge infrastructure and personnel.

Facilities with 100–199 beds are the fastest-growing in terms of expansion and modernization, particularly in suburban and semi-urban regions. These mid-size hospitals strike a balance between comprehensive care and operational flexibility. Their growth is driven by increasing local demand, cost containment strategies, and healthcare consolidation trends that push larger systems to establish mid-tier hospitals as satellites or affiliates. With the right investment, these facilities are being designed to offer high-quality care closer to patients’ homes, improving access and reducing transfer burdens on large urban centers.

Country-Level Analysis: United States

The U.S. hospital facilities market operates within a highly decentralized and mixed-delivery system, marked by public-private partnerships, non-profit hospital networks, for-profit hospital chains, and federally supported institutions like Veterans Affairs (VA) hospitals. Hospitals play a central role in both acute and chronic care delivery, often doubling as community health providers, teaching centers, and research institutions.

The federal government plays a key role through funding mechanisms like Medicare, Medicaid, and various infrastructure grants. Meanwhile, private investment is reshaping the competitive landscape, particularly through mergers and acquisitions that consolidate resources and enable network-wide modernization. Urban hospitals are focusing on specialty excellence and luxury patient experiences, while rural and community hospitals are struggling with funding but receiving support through the Biden Administration’s rural health and broadband access programs.

Technological integration, sustainability, and post-pandemic facility design are top priorities across the U.S. Efforts are also underway to improve hospital resiliency against future public health crises by investing in surge capacity, supply chain redundancy, and tele-triage models. The national focus is increasingly shifting from volume to value, with hospitals exploring ways to deliver cost-effective, high-quality care through modern infrastructure.

Some of the prominent players in the U.S. hospital facilities market include:

- The Johns Hopkins Hospital

- Mayo Clinic

- Cleveland Clinic

- Cedars-Sinai

- Massachusetts General Hospital

- UCSF Health

- NewYork-Presbyterian Hospital

- Brigham and Women's Hospital

- Ronald Regan UCLA Medical Center

- Northwestern Memorial Hospital

Recent Developments

-

HCA Healthcare (April 2025) announced plans to invest $4 billion in new hospital construction and renovation across Florida and Texas to expand bed capacity and specialized service units.

-

Kaiser Permanente (March 2025) began the construction of a smart hospital in San Diego, integrating AI-based triage tools, robotic pharmacy automation, and zero-emission architecture.

-

Cleveland Clinic (February 2025) unveiled a state-of-the-art neurological and musculoskeletal facility focused on advanced surgical procedures and interdisciplinary rehabilitation.

-

Ascension Health (January 2025) announced a green initiative across its hospital network to retrofit HVAC systems and lighting with energy-efficient solutions, targeting a 30% emissions reduction by 2030.

-

Mayo Clinic (December 2024) expanded its outpatient and virtual surgery capabilities at its Arizona campus, leveraging robotic-assisted surgery and post-discharge digital monitoring.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the U.S. hospital facilities market

By Patient Service

- Inpatient Services

- Outpatient Services

By Facility Type

- Private Hospitals

- State-owned & Federal Hospitals

- Public/Community Hospitals

By Service Type

- Acute Care

- Cardiovascular

- Cancer Care

- Neurorehabilitation & Psychiatry Services

- Pathology Lab, Diagnostics, and Imaging

- Obstetrics & Gynecology

- Others

By Bed Size

- 0-99

- 100-199

- 200-299

- 300-more