U.S. Human Primary Cell Culture Market Size and Trends

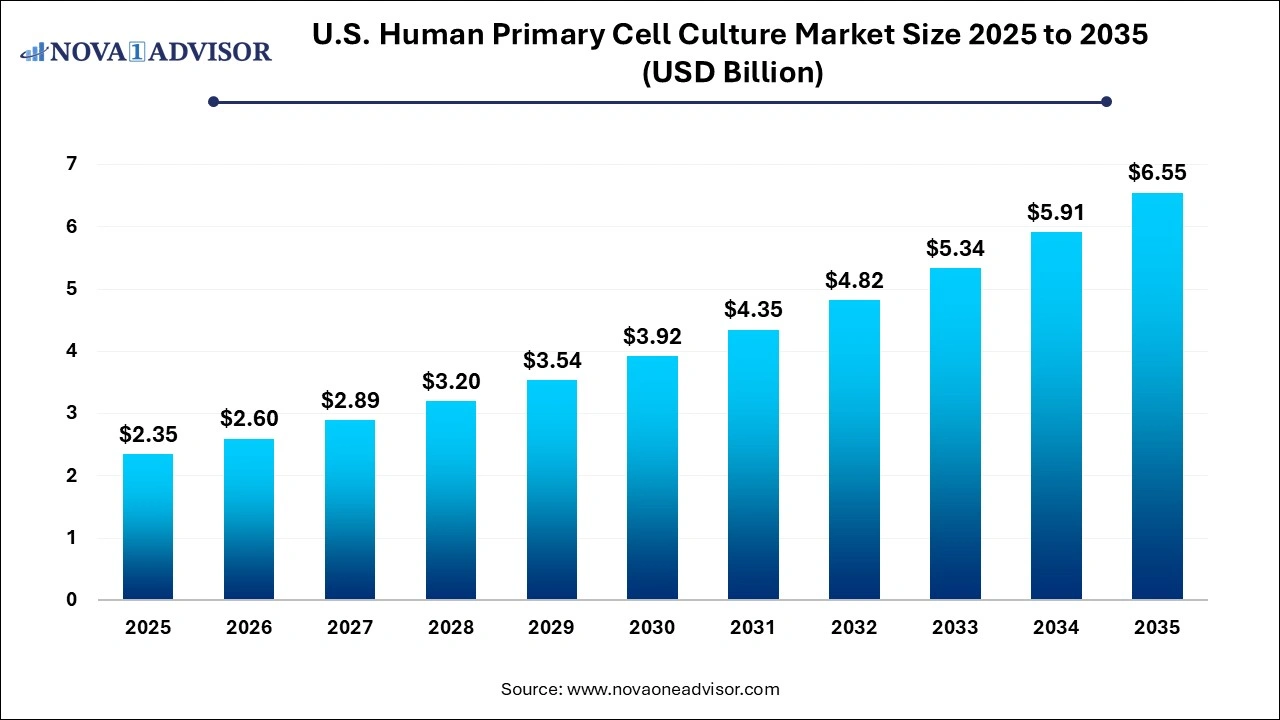

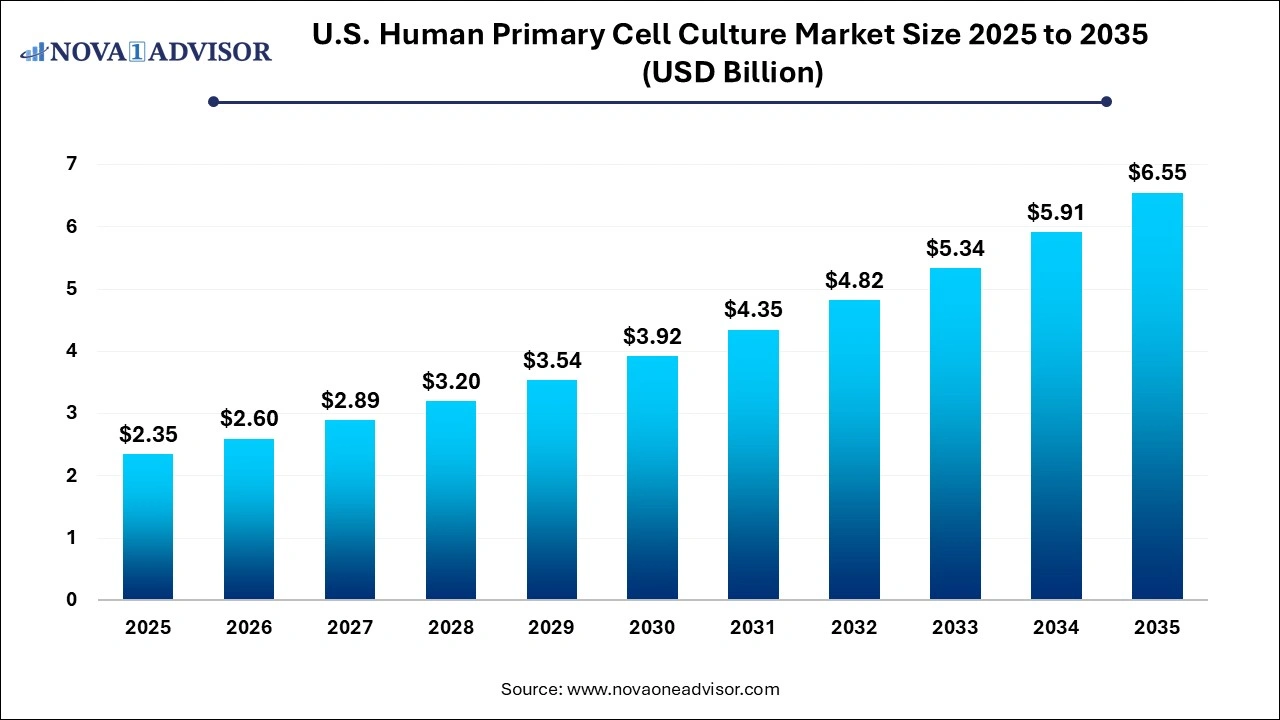

The U.S. human primary cell culture market size was exhibited at USD 2.35 billion in 2025 and is projected to hit around USD 6.55 billion by 2035, growing at a CAGR of 10.8% during the forecast period 2026 to 2035.

Market Overview

The U.S. human primary cell culture market is at the forefront of biomedical innovation, playing a critical role in advancing drug discovery, regenerative medicine, and cell-based research. Unlike immortalized cell lines, primary cells are directly derived from living tissues and retain the physiological relevance, genetic markers, and functional characteristics of their tissue of origin. As such, they serve as gold-standard models for studying cellular biology, drug efficacy, toxicology, and disease mechanisms in a more clinically relevant context.

This market is seeing strong momentum driven by heightened demand from the pharmaceutical and biotechnology sectors, which rely on primary cells for predictive toxicology and pharmacokinetics studies. With increasing pressure to reduce late-stage clinical failures, primary cells provide more accurate in vitro systems to assess drug responses. Additionally, they are widely used in 3D cultures, organ-on-chip platforms, and tissue engineering for more physiologically accurate disease modeling and therapy development.

The U.S., home to some of the world’s most prominent academic institutions, biotech clusters, and research consortia, dominates the global market for human primary cell culture. A combination of robust federal funding, public-private partnerships, and a strong intellectual property framework has allowed U.S.-based companies and institutions to pioneer innovations in cell sourcing, culture media formulation, and cryopreservation. Further, the increasing adoption of ethically sourced, consent-driven primary tissues, along with the push toward personalized medicine, is transforming the landscape of cell-based research in the country.

With healthcare moving towards patient-specific therapies and the pharmaceutical industry embracing human-relevant preclinical models, the human primary cell culture market in the U.S. is poised for significant growth in the coming decade.

Major Trends in the Market

-

Rise of 3D and Organoid Cultures: Researchers are shifting from 2D to 3D primary cell culture models to better replicate in vivo environments.

-

Ethical and Traceable Sourcing of Human Tissues: Increased emphasis on tissue traceability, consent protocols, and ethical sourcing is shaping procurement strategies.

-

Adoption of Serum-Free and Chemically Defined Media: Researchers are moving away from animal-derived components to reduce variability and improve reproducibility.

-

Integration with Lab-on-Chip and Microfluidics: Primary cells are being used in microphysiological systems for drug screening and disease modeling.

-

Rising Demand from Immuno-oncology Research: Tumor-infiltrating lymphocytes and other primary immune cells are increasingly used to study cancer-immune interactions.

-

Advances in Cryopreservation and Biobanking: New protocols are extending the shelf life and viability of primary cells, aiding distribution and repeat experimentation.

-

Partnerships Between CROs and Biotech Firms: Contract research organizations are increasingly incorporating primary cells into their assay platforms for custom research projects.

Report Scope of U.S. Human Primary Cell Culture Market

| Report Coverage |

Details |

| Market Size in 2026 |

USD 2.6 Billion |

| Market Size by 2035 |

USD 6.55 Billion |

| Growth Rate From 2026 to 2035 |

CAGR of 10.8% |

| Base Year |

2025 |

| Forecast Period |

2026-2035 |

| Segments Covered |

Product, Application, End-use |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Key Companies Profiled |

Thermo Fisher Scientific, Inc.; Merck KGaA; Lonza Group; Corning Incorporated; Danaher Corporation; QIAGEN N.V.; STEMCELL Technologies; Becton, Dickinson and Company (BD); Bio-Techne Corporation; Charles River Laboratories |

Key Market Driver: Increased Adoption of Physiologically Relevant Drug Screening Models

The most critical driver of the U.S. human primary cell culture market is the increased reliance on physiologically relevant models in drug discovery and toxicology. Traditional cell lines, while convenient and inexpensive, often fail to replicate in vivo cellular environments due to extensive genetic and epigenetic drift. In contrast, primary cells more closely mimic the structure, function, and response of human tissues, thereby reducing false positives or negatives in early-stage testing.

This is particularly crucial in assessing drug-induced liver injury (DILI), cardiotoxicity, and nephrotoxicity—areas where primary hepatocytes, cardiomyocytes, and renal epithelial cells offer unmatched predictive accuracy. Regulatory bodies such as the FDA now encourage the use of human-relevant models in preclinical testing. Consequently, pharmaceutical companies are shifting budgets toward high-fidelity in vitro platforms, driving demand for robust primary cell lines, culture media, and reagents that can ensure high viability and consistency. This shift is transforming early-phase R&D and significantly reducing drug attrition rates in clinical trials.

Key Market Restraint: Limited Proliferation and Variability in Primary Cell Cultures

Despite their advantages, primary cells come with notable technical and biological limitations that challenge their widespread adoption. One of the primary concerns is their limited proliferation capacity—most primary cells undergo senescence after a few passages, making long-term experimentation and scalability difficult. Unlike immortalized lines, primary cells do not divide indefinitely, and their functional properties can degrade over time.

Additionally, donor-to-donor variability introduces significant heterogeneity, especially in studies involving multiple tissue sources. This variability can compromise reproducibility and data interpretation unless well-controlled or validated with large sample sets. The handling of primary cells also requires specialized training, optimized protocols, and high-quality reagents—factors that increase costs and limit use in low-resource academic labs. These challenges, while addressable, create entry barriers for many institutions and research teams seeking to transition from traditional models to primary cell systems.

Key Market Opportunity: Expansion of Personalized Medicine and Cell-Based Therapies

A powerful growth opportunity for the U.S. human primary cell culture market lies in the rising focus on personalized medicine and autologous cell-based therapies. As the healthcare system moves toward tailoring treatments based on individual patient profiles, primary cells derived from patient-specific tissues (e.g., tumor biopsies, blood samples, skin cells) are emerging as key enablers of customized therapeutic approaches.

For instance, in oncology, researchers are culturing patient-derived tumor cells to screen drugs ex vivo and determine the most effective chemotherapy or immunotherapy combination. In regenerative medicine, autologous cells are being expanded for transplant into injured tissues or organs. This personalized approach demands highly controlled and efficient primary cell culture systems capable of preserving the native characteristics of cells. Companies offering customizable culture media, GMP-compliant reagents, and clinical-grade primary cells are well-positioned to tap into this emerging segment, which could redefine how diseases are diagnosed and treated in the next decade.

U.S. Human Primary Cell Culture Market By Application Insights

Drug discovery dominated the application segment in the U.S. human primary cell culture market, largely due to the intensive use of primary cells in early-phase pharmacological screening and toxicity testing. Primary hepatocytes, cardiomyocytes, and renal cells are essential tools for preclinical safety evaluation of novel compounds. In cancer drug development, tumor-derived primary cultures are increasingly used to assess therapeutic efficacy across genetically diverse tumor subtypes. The ability of primary cells to mimic patient-specific responses is driving adoption in both high-throughput screening platforms and precision oncology initiatives.

Meanwhile, regenerative medicine is the fastest-growing application, buoyed by advancements in tissue engineering and cell therapy. Primary skin cells are being expanded for burn treatment, while myoblasts and cardiac cells are used in musculoskeletal and cardiovascular repair. The use of autologous and allogeneic primary cells as starting materials for clinical-grade therapeutic development has opened new revenue streams. With the FDA approving more cell-based therapies and the establishment of specialized GMP manufacturing facilities across the U.S., this application is expected to see exponential growth over the next decade.

U.S. Human Primary Cell Culture Market By Product Insights

Based on The Primary cells were the dominant product segment in 2025, capturing the largest revenue share due to their direct relevance in research and therapeutic applications. Among subtypes, hepatocytes, hematopoietic cells, and skin cells are the most in-demand due to their extensive use in toxicology, immunology, and wound healing research. Hepatocytes, in particular, are essential for liver toxicity studies, given their central role in drug metabolism. Similarly, hematopoietic cells, derived from bone marrow or peripheral blood, are widely used in immuno-oncology, stem cell biology, and hematologic disease modeling.

On the other hand, primary cell culture media is the fastest-growing segment, with serum-free and chemically defined media gaining rapid traction. Researchers are increasingly opting for media formulations that exclude animal-derived components to reduce variability and align with regulatory standards. Serum-free media also improves reproducibility across labs, supporting the expansion of clinical and translational applications. The growing need for specialized media that supports the survival and function of niche primary cells—like lung or gastrointestinal cells—is also fueling innovation in this segment, making it one of the most dynamic areas of the market.

U.S. Human Primary Cell Culture Market By End-use Insights

The Pharmaceutical and biotechnology companies are the primary end-users, accounting for the largest share of the U.S. human primary cell culture market. These organizations are increasingly using primary cells for compound validation, toxicity profiling, and efficacy testing. With the high costs associated with late-stage clinical trial failures, these companies prioritize predictive in vitro models to reduce risk. They also invest heavily in customized primary cell culture protocols to align with their therapeutic pipelinesespecially in oncology, neurology, and immunology.

At the same time, Contract Manufacturing and Research Organizations (CMOs and CROs) are the fastest-growing end-user segment, driven by the outsourcing trend in drug discovery and preclinical testing. Many pharma and biotech firms collaborate with CROs for specialized services such as primary cell assay development, screening campaigns, and toxicology evaluations. These organizations maintain dedicated cell culture teams and labs, offering flexible and cost-effective solutions. Their ability to scale and customize assays for specific projects makes them invaluable partners in the development lifecycle, accelerating market growth within this segment.

Country-Level Analysis – United States

The United States stands as the most mature and dominant market for human primary cell culture globally, thanks to its comprehensive biomedical infrastructure, highly advanced regulatory framework, and strong academic-industrial collaboration. Home to major NIH-funded research centers, Ivy League institutions, and biotech hubs such as Boston, San Diego, and San Francisco, the country fosters a continuous demand for innovative cell-based tools.

Federal initiatives such as the Cancer Moonshot, NIH Human Biomolecular Atlas Program, and the 21st Century Cures Act have catalyzed investment in cell culture technologies, tissue biobanking, and personalized medicine. Additionally, the U.S. FDA's emphasis on reducing animal testing has further incentivized the development and adoption of human-relevant primary cell models. The presence of major life sciences firms, from Thermo Fisher Scientific to Lonza and ATCC, reinforces the country's leadership in product development, distribution, and quality assurance.

Moreover, U.S.-based cell culture companies often serve as global exporters of ethically sourced and certified human primary cells, as well as culture reagents and custom media formulations. With favorable IP laws, strong biotech venture funding, and a vibrant innovation ecosystem, the U.S. is expected to maintain its dominance in this market through 2034.

Some of the prominent players in the U.S. human primary cell culture market include:

U.S. Human Primary Cell Culture Market Recent Developments

-

In March 2025, Lonza launched a new line of cryopreserved primary human hepatocytes with extended viability, targeting high-throughput toxicology applications in pharma R&D.

-

Thermo Fisher Scientific, in January 2025, unveiled its latest Gibco™ Human Primary Cell Culture Kits, optimized for regenerative medicine workflows, including cardiac and musculoskeletal repair.

-

Cell Applications, Inc., in February 2025, partnered with a major CRO to offer custom assay development services using human primary fibroblasts and endothelial cells.

-

In December 2024, ATCC expanded its cell repository by adding over 30 new donor-derived primary cell lines with documented genomic profiles, enhancing personalized research capabilities.

-

PromoCell GmbH, in collaboration with U.S. academic labs, launched a chemically defined serum-free media product line for skin and epithelial primary cells in November 2024.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2035. For this study, Nova one advisor, Inc. has segmented the U.S. human primary cell culture market

By Product

-

- Hematopoietic Cells

- Skin Cells

- Hepatocytes

- Gastrointestinal Cells

- Lung Cells

- Renal Cells

- Heart Cells

- Skeletal and Muscle Cells

- Other Primary Cells

- Primary Cell Culture Media

-

- Serum-free Media

- Serum-containing Media

- Others

-

- Attachment Solutions

- Buffers and Salts

- Sera

- Growth Factors and Cytokines

- Others

By Application

- Drug Discovery

- Therapy Development

- Regenerative Medicine

- Others

By End-use

- Pharmaceutical & Biotechnology Companies

- CMOs & CROs

- Academic Research Institutes