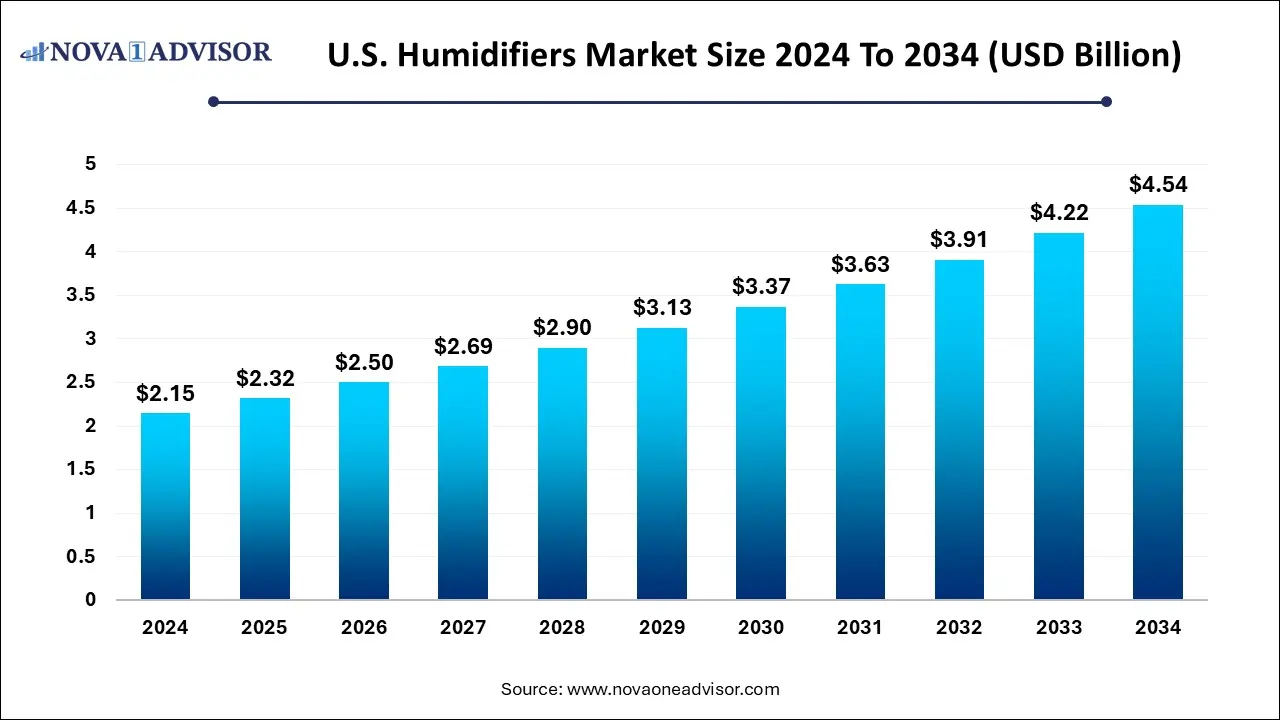

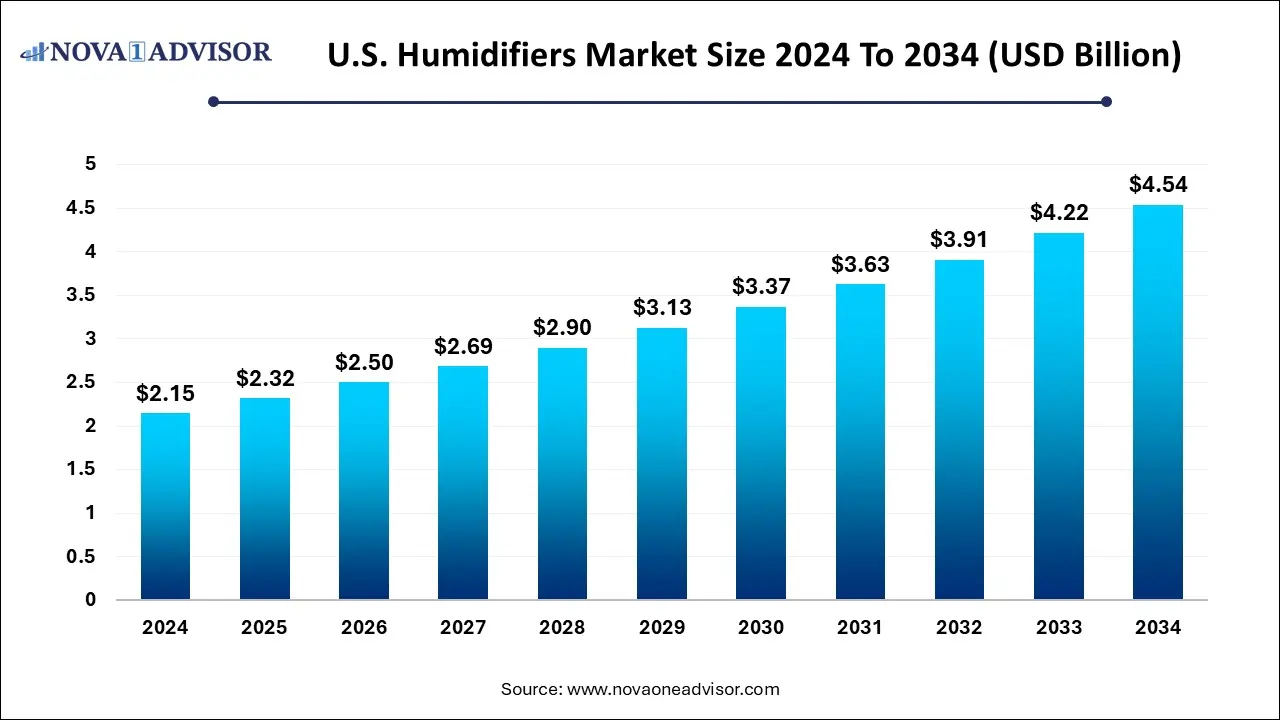

U.S. Humidifiers Market Size and Growth 2025 to 2034

The U.S. humidifiers market size was estimated at USD 2.15 billion in 2024 and is projected to reach USD 4.54 billion by 2034, growing at a CAGR of 7.77% from 2025 to 2034.

U.S. Humidifiers Market Key Takeaways

- By product, heated humidifiers dominated the market in 2024.

- By product, adiabatic humidifiers are seen to be the fastest growing segment.

- By installation type, portable humidifiers led the market as of this year.

- By installation type, fixed humidifiers are expected to grow at the fastest rate during the forecast years.

- By distribution channel, the offline segment dominated the market this year.

- By distribution channel, the online segment is seen to have the fastest growth rate.

- By end user, hospitals held the largest market share in 2024.

- By end user, the home based segment is estimated to have the fastest growth rate throughout the forecast period.

What are Humidifiers?

Humidifiers are appliances that help to maintain humidity levels in indoor spaces by improving air quality, alleviating airway irritation and providing comfort. They help to reduce dryness-related health issues such as sinus irritation, dry skin and other respiratory problems. In the US, factors such as increasing urbanization, rising disposable incomes and health consciousness are fueling humidifier adoption. The market includes various types of humidifiers that can cater to both, residential as well as commercial applications.

Key Market Trends

- Health and Wellness Awareness: Consumers are becoming increasingly aware about the importance of maintaining optimal indoor humidity levels. Dry air is the culprit for respiratory conditions, sleep disturbances and skin irritation, which is encouraging people to purchase humidifiers.

- Urbanization and Lifestyle Changes: Rapid urbanization is also contributing to drier indoor environments due to extensive use of air conditioning and heating systems. Households are actively seeking solutions that improve indoor comfort, thus enabling consumers to invest in appliances such as humidifiers.

- Adoption of Smart Humidifiers: Smart and connected humidifiers are gaining traction in the market due to a rapidly growing smart home ecosystem. These devices offer features like app-based controls, remote monitoring, and automated humidity adjustments. Integration with voice assistants such as Alexa and Google Home is also seen to enhance consumer convenience.

- Eco-Friendly Designs: Sustainability is on the rise, shaping consumer choices for eco-friendly models using biodegradable materials and energy-saving systems. Filter less ultrasonic humidifiers are on the rise as they reduce maintenance costs and waste.

What is the impact of AI in this field?

The US humidifier market is rapidly evolving due to the rise of AI integration. AI is transforming these devices from simple home appliances into intelligent and smart wellness systems. With efficient protocol adoption, enhanced connectivity and personalized air quality management, these smart devices are set to form an integral aspect of ourw household ecosystem.

The key features of AI are predictive maintenance, personalized settings based on individual health profiles, integration with wellness ecosystems and autonomous operation. These tools and systems are now able to respond to changing environmental conditions without any user intervention. These devices can leverage advanced algorithms and understand patterns in air quality, user behavior and environmental conditions. This insight allows them to operate proactively, dealing with air quality issues way before they impact health and comfort.

Another key aspect is the shift towards autonomous operation. Future air purifiers and humidifiers are expected to adapt more effectively to changing conditions, learning from patterns and preferences to create optimal environments automatically. This autonomous capability represents the potential of AI integration, where devices not only respond to commands but takes decisions based on learned behaviors and environmental factors. This will result in a seamless experience where optimal air quality becomes effortless and a norm for every household.

Report Scope of U.S. Humidifiers Market

| Report Coverage |

Details |

| |

USD 2.32 Billion |

| Market Size by 2034 |

USD 4.54 Billion |

| Growth Rate From 2025 to 2034 |

CAGR of 7.77% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

By Product, By Installation Type, By Distribution Channel, By End User |

| Market Analysis (Terms Used)Market Size in 2025 |

Value (US$ Million/Billion) or (Volume/Units) |

| Country scope |

U.S. |

| Key Companies Profiled |

Medtronic; Fisher & Paykel Healthcare Limited; ResMed; Drive DeVilbiss International; Koninklijke Philips N.V.; Teleflex Incorporated; Vapotherm; Precision Medical, Inc.; Hamilton Medical; Ace-medical; CAREL INDUSTRIES S.p.A.; Condair Group |

Market Dynamics

Driver

Rising Awareness about Health and Air Quality

One of the key drivers that is fueling the US humidifier market is the increasing public awareness regarding the importance of maintaining the optimum indoor air quality and ensuring good health. More and more individuals are now understanding the drawbacks of dry air and how it causes health issues such as allergic reactions, irritated sinuses and dehydration. Thus, humidifiers have become a mandatory aspect in every household.

Moisture can help with problems such dry skin, nasal congestion and can even help with difficulty in breathing. We can see a high adoption of humidifiers especially in places that experience cold winters or severe pollution, such as Minnesota or Maine. They are now considered indispensable household appliances necessary for shaping a healthy and comfortable living environment.

Restraint

Maintenance and Operational Expenses

Despite various growth prospects, the US humidifiers market does have its fair share of challenges. The market can pose to be a challenge when it comes to maintenance and operational expenses, especially within larger infrastructures, such as hospitals, laboratories or care centers. Devices such as heated humidifiers require regular cleaning, disinfection and water refilling in order to prevent microbial contamination and maintain optimal performance. Any slack in its maintenance can lead to complications such as waterborne infections or circuit occlusions in ventilator systems.

In addition to that, components such as humidification chambers, filters, and sterile water add to the recurring costs, creating financial challenges for small scale clinics facilities. This can prevent market entry and slow down growth and development.

Opportunity

Technological Advancements and Urbanization

Technological advancements are bringing in multiple opportunities in the US Humidifier Market. The introduction of smart humidifiers, which can be controlled via mobile applications is reshaping consumer demand. These devices feature sensors that monitor humidity levels and adjust accordingly, thus enhancing user convenience and efficiency. The market is also witnessing a surge in demand for ultrasonic and evaporative humidifiers, which are known for their energy efficiency and effectiveness. As consumers increasingly seek products that can seamlessly integrate with their smart home systems, the market for technologically advanced humidifiers is expected to expand even more.

Rising urbanization is another significant opportunity in the market. As more individuals shift to urban areas, pure indoor air is becoming a concern. Urban environments often face higher levels of pollution and lower levels of humidity, which leads to discomfort and other health issues. The market is expected to benefit from this, as consumers are seen actively seeking solutions that are able to combat the adverse effects of urban living, thus boosting market growth.

Segmental Analysis

By Product Insights

Which product segment dominated the market in 2024?

Heated humidifiers dominated the U.S. humidifiers market in 2024, due to their widespread use in both hospital and home respiratory care. Heated humidifiers are effective in preventing airway drying. These types of humidifiers are popular in both, hospitals as well as home based settings. These systems also offer features like controlled temperature and humidity, improving comfort and reducing health complications, thus making them a popular choice.

Adiabatic humidifiers are the fastest-growing segment. These types of humidifiers generate fine mist using high-frequency vibrations, offering energy efficiency and silent operation. This is critical for patient rooms, sleep labs and even home use. The advantage of this segment lies in its versatility, low noise output and minimal maintenance requirements, thus driving adoption across various settings.

By Installation Type

Which installation type led the market as of this year?

Portable humidifiers led the market as of this year. This segment’s popularity stems from their affordability, ease of installation and the flexibility to humidify individual rooms or compact spaces. These humidifiers are widely used in bedrooms, offices, baby nurseries and can even be used during travel. With rising health consciousness and increasing urbanization, consumers are turning to portable models for improved sleep, sinus relief and hydration.

Fixed humidifiers are seen to grow at the fastest rate during the forecast period. These types of humidifiers offer long-term humidity control and are generally preferred in environments that require consistent air moisture. This segment is witnessing growing adoption due to global trends in air quality awareness and the need for respiratory comfort in dry indoor environments.

By Distribution Channel Insights

Which distribution channel was the most dominant this year?

The offline channel segment dominated the market as of this year, driven by consumer preference for inspecting products in person before purchase, specifically medical devices such as humidifiers. In addition to that, the immediate availability of products in offline sales channels, in-store demonstrations and personalized assistance further contributes to the segment's popularity and dominance.

The online channel segment is expected to grow at the fastest rate over the forecast period. This growth is driven by the rapid shift towards e-commerce platforms, due to factors such as competitive pricing and access to customer reviews. The surge in smartphone penetration, targeted digital marketing and subscription-based delivery models further contributes to this segment's growth.

By End-use Insights

Which end user held the largest market share in 2024?

Hospitals held the largest market share in 2024. This is because they rely heavily on humidifiers to support respiratory therapy, anesthesia delivery and mechanical ventilation. Various hospital departments require specialized humidification systems in order to support intubated patients or those who require high oxygen flow requirements. Additionally, hospitals often deploy centralized adiabatic humidification systems within HVAC setups in order to maintain optimal air quality and manage infection control standards.

Home care expected to be the fastest-growing end-user segment during the forecast period. This growth is driven by the increasing preference for outpatient management of chronic diseases and acute recovery. With the rise in CPAP and oxygen therapy as well as smart home systems, consumers are seen purchasing and even renting user-friendly humidifiers for continuous use at their home. Technological advancements such as auto-humidity control and mobile connectivity are seen boosting this segment’s popularity even more.

Some of the prominent players in the U.S. humidifiers market include:

- Medtronic

- Fisher & Paykel Healthcare Limited

- ResMed

- Drive DeVilbiss International

- Koninklijke Philips N.V.

- Teleflex Incorporated

- Vapotherm

- Precision Medical, Inc.

- Hamilton Medical

- Ace-medical

- CAREL INDUSTRIES S.p.A.

- Condair Group

Recent Developments

- In November 2024, Homedics launched the Natura humidifier, which is a 1.3-gallon top-fill ultrasonic model that delivers warm or cool mist for spaces up to 402 sq. ft. and runs up to 60 hours. It features Clean Tank Technology, auto-shutoff, programmable humidity, and even doubles up as a planter with a removable compartment for plants.

- In November 2025, Dyson recently unveiled two new additions to its Hot+Cool purifier range, which is the Dyson Purifier Hot+Cool HP2 De-NOx (HP12) and the Dyson Purifier Hot+Cool HP1. Designed to deliver cleaner air and all-year comfort, both these models introduce Dyson’s most sophisticated gas-capture system to date, engineered to combat worsening indoor air pollution during India’s high-pollution months.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the U.S. humidifiers market

By Product

-

- Integrated or Built in

- Standalone

- Adiabatic (High-pressure & Ultrasonic)

- Bubble Humidifiers

- Passover Humidifiers

By Installation Type

- Fixed Humidifiers

- Portable Humidifiers

By Distribution Channel

-

- Retail Stores

- Supermarkets & Hypermarkets

- Pharmacy & Health Stores

- Exclusive Brand Stores / Showrooms

-

- E-commerce Platforms

- Company-owned Online Stores

- Specialized Wellness & Home Appliance E-retailers

By End-use

- Hospitals

- Outpatient Facilities

- Home Care