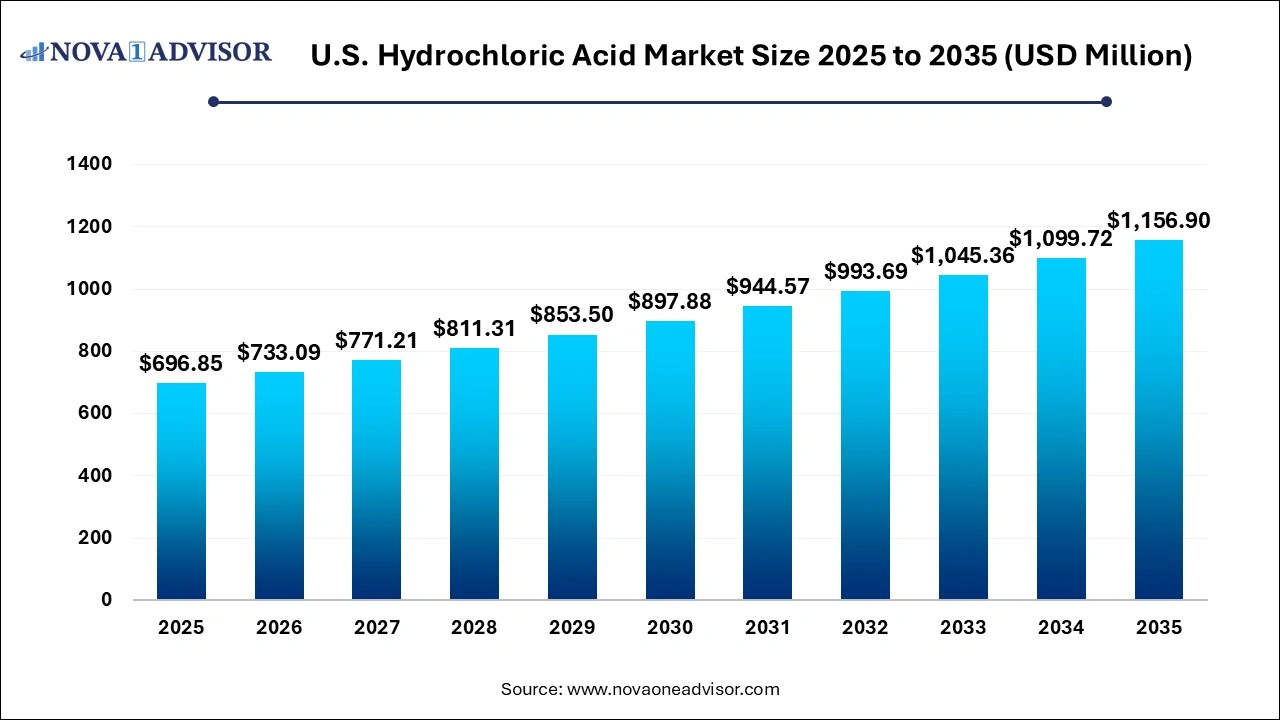

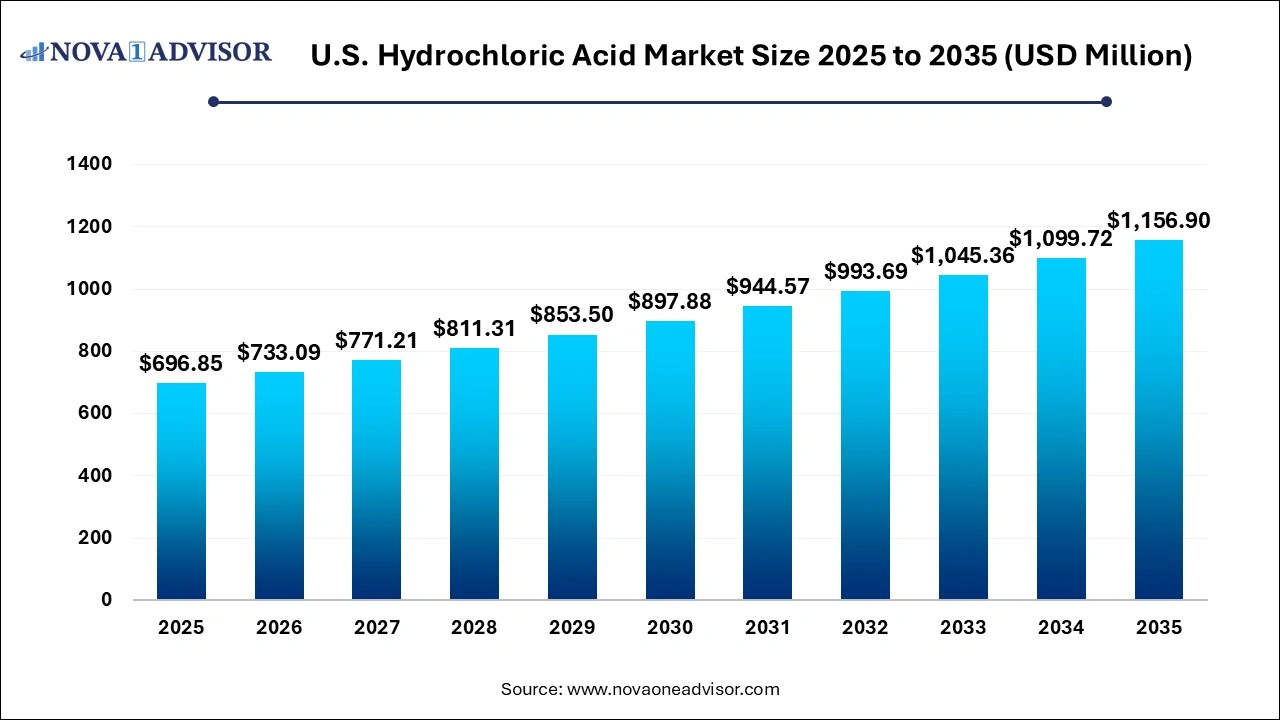

U.S. Hydrochloric Acid Market Size and Growth 2026 to 2035

The U.S. hydrochloric acid market size was exhibited at USD 696.85 million in 2025 and is projected to hit around USD 1,156.90 million by 2035, growing at a CAGR of 5.2% during the forecast period 2026 to 2035.

U.S. Hydrochloric Acid Market Key Takeaways:

- The food processing application segment dominated the U.S. hydrochloric acid industry and accounted for the largest revenue share of 29.7% in 2025.

- The California hydrochloric acid market dominated the U.S. market and accounted for the largest revenue share of 61.0% in 2025.

- The hydrochloric acid market in New Mexico is expected to grow at a CAGR of 5.8% over the forecast period

U.S. Hydrochloric Acid Market Overview

The U.S. hydrochloric acid market plays a foundational role across numerous industrial and manufacturing sectors. Hydrochloric acid (HCl), a highly corrosive and strong mineral acid, is widely used due to its versatility, cost-efficiency, and reactivity. From chemical synthesis to oil well stimulation, steel pickling to food processing, HCl is a staple chemical in many American industries. The market in the United States benefits from well-established downstream applications, robust demand in the oil and gas sector, and a growing inclination toward wastewater treatment and metallurgy.

The market is shaped by both captive consumption—where producers use HCl internally—and merchant sales to third-party consumers. Key producers, often part of integrated chemical and petrochemical companies, supply hydrochloric acid as a byproduct of chlorination reactions or via direct synthesis. Demand tends to be highly dependent on the overall health of industries like oil and gas, steel, automotive, and construction, which are major consumers of related downstream products.

In recent years, heightened drilling activity in the Permian Basin and the resurgence of domestic oil production have fueled hydrochloric acid consumption, particularly in oil well acidizing processes. Simultaneously, environmental considerations and regulatory oversight from agencies such as the EPA have spurred innovation in safe handling, storage, and transport of HCl. Furthermore, an increasing emphasis on technological improvements and sustainability has led manufacturers to optimize their production cycles to minimize waste and emissions, fostering a more circular approach to chemical processing.

Major Trends in the U.S. Hydrochloric Acid Market

-

Increased Demand from the Oil & Gas Sector: Shale gas exploration and hydraulic fracturing activities in the U.S. drive a steady demand for hydrochloric acid in well stimulation applications.

-

Shift Toward On-Site Regeneration and Recycling: To improve environmental sustainability, companies are investing in technologies for HCl recovery and reuse, especially in steel and semiconductor sectors.

-

Growth in Food-Grade Hydrochloric Acid: The food processing industry is seeing increased adoption of HCl for pH control, gelatin production, and beverage acidification.

-

Emphasis on Corrosion-Resistant Storage Infrastructure: The handling of HCl requires improved tank materials and coatings, leading to demand for specialized logistics and warehousing solutions.

-

Rising Investments in Green Chemistry: Driven by regulatory pressure, manufacturers are exploring alternatives and improvements in production processes to reduce environmental impact.

-

Expansion of Chemical Derivatives Production: Hydrochloric acid is increasingly used as a reagent in producing inorganic and organic chemicals such as ferric chloride and vinyl chloride monomer.

-

Focus on Regional Supply Chain Stability: Due to logistics and hazard considerations, there's a shift towards more localized production and short-distance transport of hydrochloric acid.

Report Scope of U.S. Hydrochloric Acid Market

| Report Coverage |

Details |

| Market Size in 2026 |

USD 733.09 Million |

| Market Size by 2035 |

USD 1080.36 Million |

| Growth Rate From 2026 to 2035 |

CAGR of 5.2% |

| Base Year |

2025 |

| Forecast Period |

2026-2035 |

| Segments Covered |

Application |

| Market Analysis (Terms Used) |

Value (USD Million/Billion) or (Volume/Units) |

| Key Companies Profiled |

Thermo Fisher Scientific Inc.; Westlake Chemical Corporation; ERCO Worldwide; Continental Chemical Company; Miles Chemical Company Inc.; Tronox Holdings plc; Jones-Hamilton Co.; Olin Corporation; Spectrum Chemical Manufacturing Corp.; Detrex Corporation; TRInternational; Formosa Plastics Corporation, U.S.A. |

Market Driver – Booming Oil Well Acidizing Activity in Shale Basins

A significant driver propelling the U.S. hydrochloric acid market is the robust demand from the oil well acidizing segment, particularly in shale plays like the Permian Basin and Bakken Formation. Hydrochloric acid plays an essential role in the acidizing process a well stimulation technique used to improve flow within oil and gas reservoirs. By dissolving carbonate rocks and removing scale and other formation debris, HCl enhances permeability and boosts extraction efficiency.

The revival of domestic energy independence initiatives and the lifting of restrictions on oil exports have revitalized upstream drilling operations in the U.S. Consequently, oilfield service providers are requiring larger volumes of industrial-grade hydrochloric acid. With hundreds of new wells being drilled annually, and given the relatively low cost of HCl compared to other stimulation chemicals, its use in acidizing remains both technically and economically favorable. According to recent reports, over 60% of new shale wells utilize acidizing processes, underlining its criticality.

Market Restraint – Environmental and Safety Regulations

While hydrochloric acid is a vital industrial chemical, it is also a hazardous substance that presents significant environmental and health risks. Stringent federal and state-level regulations concerning the storage, transport, and disposal of HCl pose operational challenges for both manufacturers and end-users. The Environmental Protection Agency (EPA) and the Occupational Safety and Health Administration (OSHA) impose strict compliance protocols related to emissions, exposure limits, and handling procedures.

Companies face high costs in establishing and maintaining HCl-compatible infrastructure, including acid-resistant tanks, fume control systems, and neutralization units. Additionally, frequent safety inspections and the need for specialized workforce training can hinder market fluidity. Concerns around accidental spills, groundwater contamination, and respiratory hazards also limit HCl usage in certain sensitive regions or industries unless robust mitigation plans are in place.

Market Opportunity – Growing Application in Food Processing and Water Treatment

An emerging opportunity in the U.S. hydrochloric acid market lies in the food and beverage industry, as well as municipal and industrial water treatment applications. Food-grade hydrochloric acid is used for acidifying products, adjusting pH, and processing ingredients like gelatin and corn syrup. As consumers demand clean-label food products and better quality control, manufacturers are leaning on food-safe acidifiers like HCl to maintain consistency and safety.

Similarly, hydrochloric acid is increasingly being adopted in water treatment facilities for pH regulation, scale removal, and disinfection. The rising emphasis on safe drinking water, driven by initiatives like the Safe Drinking Water Act and concerns surrounding PFAS contamination, is leading municipalities to rely more on versatile chemicals like HCl. Additionally, industries such as power generation and paper manufacturing use HCl for resin regeneration in water softening processes. These applications, combined with a push for sustainable and efficient treatment solutions, present a promising growth avenue.

U.S. Hydrochloric Acid Market By Application Insights

Oil Well Acidizing dominated the application segment, primarily due to its essential role in enhancing hydrocarbon flow within oil reservoirs. This method, especially prevalent in limestone and dolomite formations, requires high-purity HCl to dissolve minerals and improve well productivity. In the U.S., the proliferation of hydraulic fracturing and horizontal drilling techniques across shale plays—from Texas and New Mexico to North Dakota—has significantly amplified hydrochloric acid consumption. Oilfield services firms such as Halliburton and Schlumberger rely on large-scale acidizing treatments for reservoir stimulation. As such, demand for HCl remains strongly tied to energy production cycles and oil price stability.

Food Processing is emerging as one of the fastest-growing application areas, reflecting evolving food safety standards, clean processing mandates, and the expanding packaged food industry. HCl is instrumental in the production of food-grade additives, proteins, and flavoring agents. For example, it’s used in hydrolyzing proteins to create amino acids or in corn processing for fructose conversion. The Food and Drug Administration (FDA) allows hydrochloric acid for direct use in food, provided purity standards are met. With the increase in processed and shelf-stable food consumption post-pandemic, demand for food-grade acidifiers has risen, particularly among health-focused brands and manufacturers of ready-to-eat meals.

U.S. Hydrochloric Acid Market By States Insights

Texas stands as the epicenter of hydrochloric acid consumption in the U.S., driven by extensive oil and gas activity. The Permian Basin, the most productive oil basin in the country, sees significant demand for HCl due to its use in well stimulation and acid fracturing. The presence of chemical manufacturing hubs in Houston and Corpus Christi further bolsters demand, with many companies operating captive HCl units. The Gulf Coast’s petrochemical belt is home to companies like OxyChem and Dow, which produce hydrochloric acid both for internal use and for distribution across the southwestern United States.

California represents a fast-growing state market, particularly due to the diversity of application areas, including food processing, water treatment, and pool sanitation. With a large agricultural footprint and a leading food manufacturing base, the need for acidifiers, sterilizing agents, and cleaning solutions has grown. Furthermore, increasing population and urbanization are straining water infrastructure, prompting municipalities to enhance their treatment methods—many of which rely on hydrochloric acid for pH control and equipment descaling. The state's focus on sustainability has also prompted innovation in acid recycling and low-emission production techniques.

Country-Level Analysis – United States

The hydrochloric acid market in the United States reflects a unique combination of industrial maturity, environmental consciousness, and strategic oil and gas development. As the world’s largest producer and one of the leading consumers of HCl, the U.S. has developed an intricate supply chain connecting refineries, chemical plants, and end-user industries. Domestic production is dominated by companies with integrated operations, reducing dependence on imports.

Key states such as Texas, Louisiana, California, and Illinois have the highest concentration of production and consumption due to their heavy industrial presence. Regulatory oversight varies across the states, but federal laws ensure a baseline of environmental and safety compliance. The market also benefits from strong infrastructure for chemical logistics, including rail tankers, pipelines, and dedicated storage terminals. Future growth will be closely tied to how industries balance demand for efficiency with environmental responsibility.

Some of the prominent players in the U.S. hydrochloric acid market include:

U.S. Hydrochloric Acid Market Recent Developments

-

March 2025 – Occidental Petroleum Corporation (OxyChem) announced the expansion of its chlor-alkali facility in Texas, citing growing demand for hydrochloric acid in oilfield services. The upgrade will increase production capacity by 15%, aligning with new well stimulation contracts.

-

January 2025 – BASF Corporation revealed a partnership with an Arizona-based clean tech startup to develop sustainable HCl recovery units for semiconductor and electronics applications, aiming to reduce acid waste by up to 40%.

-

December 2024 – Univar Solutions launched a digital supply chain platform for real-time HCl inventory and delivery tracking across its U.S. logistics network, improving service reliability for industrial clients.

-

October 2024 – HASA Pool Products expanded its California-based packaging plant to meet the seasonal spike in demand for hydrochloric acid used in pool sanitation, targeting retail and commercial pool service providers.

-

August 2024 – INEOS Enterprises completed a $60 million refurbishment of its vinyl chloride and HCl production unit in Louisiana to enhance efficiency and reduce emissions by 20%.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2035 For this study, Nova one advisor, Inc. has segmented the U.S. hydrochloric acid market

By Application

- Oil Well Acidizing

- Food Processing

- Steel Pickling

- Ore Processing

- Pool Sanitation

- Calcium Chloride

- Others

By States

-

- Utah

- Idaho

- California

- Arizona

- Nevada

- Colorado

- Oregon

- Wyoming

- Montana

- New Mexico

- Rest of U.S.