U.S. In Vitro Fertilization Market Trends

The U.S. in vitro fertilization market size was exhibited at USD 5.56 billion in 2023 and is projected to hit around USD 8.63 billion by 2033, growing at a CAGR of 4.5% during the forecast period 2024 to 2033.

Key Takeaways:

- The culture media segment dominated the market and accounted for a share of around 40% in 2023.

- Disposable devices are expected to grow at the fastest CAGR over the forecast period.

- The fresh non-donor segment accounted for the largest market share in 2023.

- Frozen donors are expected to register the fastest CAGR during the forecast period.

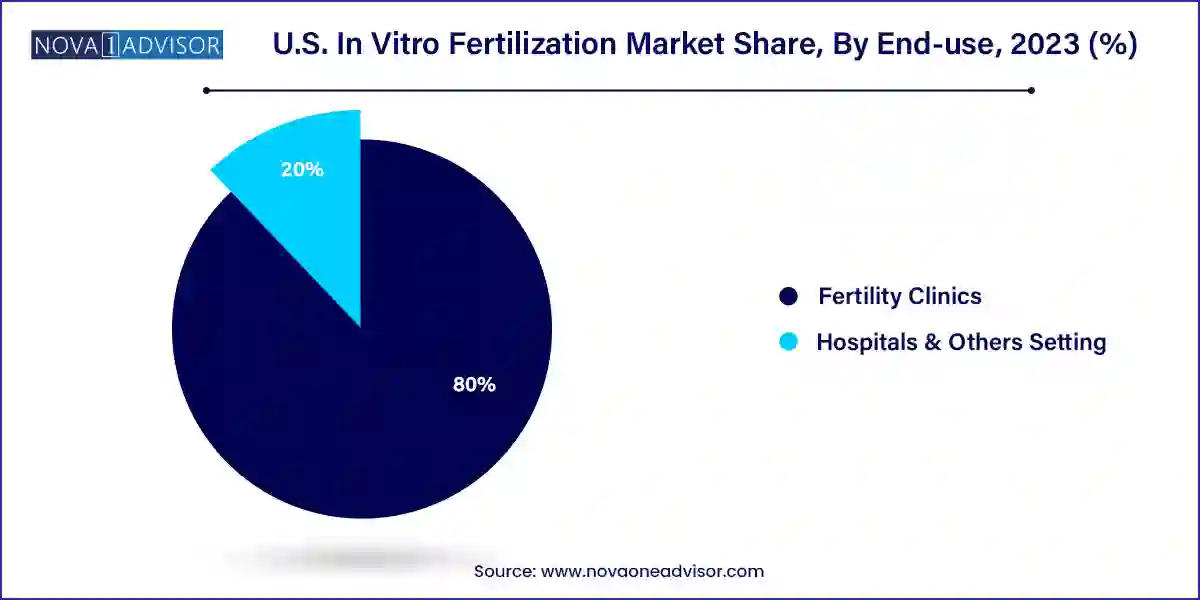

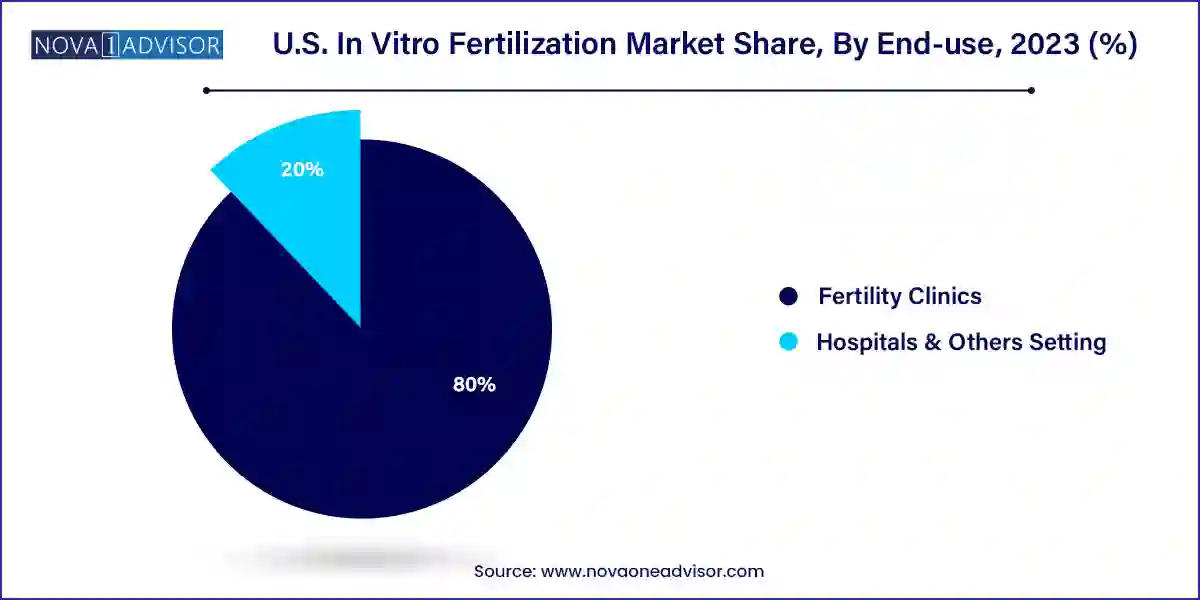

- The fertility clinics segment dominated the market in 2023 and is expected to grow at the fastest CAGR over the forecast period.

- Hospitals and other settings segments are expected to grow at a significant CAGR over the forecast period.

Market Overview

The U.S. In Vitro Fertilization (IVF) market represents a dynamic and evolving sector within reproductive healthcare, driven by a confluence of technological advancements, rising infertility rates, shifting societal norms, and increasing demand for assisted reproductive technologies (ARTs). IVF is a complex series of procedures that assist with fertility, prevent genetic problems, and aid in the conception of a child. Since its introduction in the late 1970s, IVF has undergone significant scientific evolution and has grown into a mainstream option for individuals and couples seeking parenthood.

In the U.S., a substantial portion of the adult population experiences infertility issues estimates suggest that approximately 1 in 8 couples struggle with conception. Factors contributing to this include delayed childbearing due to career aspirations, rising incidences of lifestyle-related diseases, and environmental factors. The growing acceptance of same-sex parenthood and single parenting has also broadened the demographic base requiring fertility services. In parallel, increasing insurance coverage for fertility treatments in several U.S. states and the emergence of financing programs have made IVF services more accessible.

Moreover, the integration of artificial intelligence (AI), time-lapse imaging, and genetic screening in IVF clinics has enhanced the success rate of procedures. These innovations are encouraging broader adoption of IVF not only for infertility but also for genetic screening and fertility preservation purposes.

Major Trends in the Market

-

Growing Trend of Delayed Parenthood: There is a marked increase in women choosing to have children later in life due to educational and career goals, leading to increased demand for IVF services and fertility preservation options.

-

Rise in Fertility Preservation Among Cancer Patients: With advancements in oncology improving survival rates, fertility preservation through cryopreservation is gaining popularity among patients undergoing chemotherapy or radiation.

-

Technological Integration in IVF Labs: Technologies such as AI-powered embryo selection, time-lapse microscopy, and robotic systems are being adopted to improve outcomes and reduce error margins.

-

Increasing Popularity of Egg Freezing: Elective egg freezing is being increasingly adopted by women who wish to postpone childbearing, contributing to increased utilization of cryopreservation media and systems.

-

Expansion of Insurance Coverage: More states in the U.S. are mandating insurance providers to cover fertility treatments, driving broader access and growth in demand.

-

Outsourcing and Franchise Models in IVF Clinics: Fertility chains are expanding through franchise-based models and acquisition of standalone clinics to scale operations and brand recognition.

-

Sustainability and Ethical Concerns: Growing awareness around the ethical considerations of embryo disposal, surrogacy laws, and genetic manipulation are shaping policy and procedural transparency in clinics.

Report Scope of U.S. In Vitro Fertilization Market

| Report Coverage |

Details |

| Market Size in 2024 |

USD 5.81 Billion |

| Market Size by 2033 |

USD 8.63 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 4.5% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Instruments, Procedure Type, and End-use |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

U.S. |

| Key Companies Profiled |

Bayer AG; Cook Medical LLC; EMD Serono, Inc.; Ferring B.V.; FUJIFILM Irvine Scientific (FUJIFILM Holdings Corporation); Genea Biomedx; EMD Serono, Inc. (Merck KGaA); Merck & Co., Inc.; The Cooper Companies, Inc.; Thermo Fisher Scientific, Inc.; Vitrolife |

Key Market Driver: Technological Advancements Enhancing IVF Success Rates

One of the most significant drivers of the U.S. IVF market is the continuous technological advancement in IVF procedures and equipment. Over the last decade, integration of cutting-edge tools such as artificial intelligence for embryo grading, time-lapse imaging for monitoring embryo development, and preimplantation genetic testing (PGT) has substantially improved success rates of IVF cycles. According to recent studies, AI-based embryo selection can enhance the prediction of live birth outcomes more accurately than traditional morphological assessments.

These innovations have increased patient confidence and clinic efficiency, which, in turn, has boosted the demand for advanced capital equipment such as incubators, micromanipulators, imaging systems, and embryo culture media. Clinics are increasingly investing in smart laboratory infrastructure, including anti-vibration tables, IVF cabinets, and witness systems, to ensure precision and minimize human error. As technology continues to evolve, it is expected that the success rates, affordability, and availability of IVF will improve further, expanding the market reach.

Key Market Restraint: High Treatment Costs and Limited Insurance Coverage

Despite technological advancements and a growing societal acceptance of IVF, the high cost of treatment remains a significant barrier for many prospective parents in the U.S. A single cycle of IVF can range from $12,000 to $17,000, excluding the cost of medications, which can add several thousand dollars. Multiple cycles are often required, further escalating the financial burden.

Although some states have mandated fertility treatment coverage, the inconsistency in insurance policies across the U.S. means that many individuals pay out-of-pocket. This economic burden often discourages lower- and middle-income couples from pursuing IVF, thereby restraining market growth. Moreover, ancillary procedures like preimplantation genetic diagnosis (PGD) and cryopreservation incur additional expenses, further limiting affordability. Thus, unless there is a broader national policy push or cost optimization through innovation, the high cost barrier will remain a challenge.

Key Market Opportunity: Rising Demand from Same-sex Couples and Single Parents

A notable opportunity in the U.S. IVF market is the growing demand from non-traditional family structures, including same-sex couples and single individuals seeking biological parenthood. According to the Pew Research Center, there has been a steady rise in LGBTQ+ families and individuals pursuing parenthood, supported by progressive legislation and societal acceptance. IVF, particularly through donor eggs or sperm and gestational surrogacy, offers a viable solution for these groups.

Several IVF clinics are now tailoring their services and marketing efforts to cater specifically to the LGBTQ+ community, offering inclusive care models and personalized treatment paths. This trend is expected to drive demand for frozen donor and fresh donor procedures, as well as ancillary services such as sperm separation devices and cryosystems. The expanding definition of families in America represents a promising, under-penetrated market segment that IVF providers can actively engage with to drive future growth.

U.S. In Vitro Fertilization Market By Instruments Insights

In 2024, the capital equipment segment dominated the U.S. IVF instrument market, driven by the necessity for high-precision tools in IVF laboratories. Equipment like sperm analyzer systems, imaging systems, incubators, and micromanipulator systems are indispensable in ensuring procedural accuracy and enhancing embryo viability. IVF clinics increasingly invest in advanced systems such as anti-vibration tables and laser systems to support delicate embryology tasks. For example, micromanipulator systems are vital for intracytoplasmic sperm injection (ICSI), a commonly used IVF technique. These systems offer reproducibility and minimize contamination risks, which are crucial in improving clinical success rates.

On the other hand, the cryopreservation media segment is poised to register the fastest growth during the forecast period. The growing demand for egg and embryo freezing services is a key factor driving this growth. Women are increasingly opting to preserve fertility due to medical or social reasons, including cancer treatments, endometriosis, or postponement of motherhood. Cryopreservation media enables long-term storage of gametes and embryos without compromising viability, making it a critical component in IVF protocols. Technological improvements in vitrification techniques and media formulation are enhancing survival rates of thawed embryos, further propelling this segment.

U.S. In Vitro Fertilization Market By Procedure Type Insights

Among procedure types, the frozen non-donor segment holds the largest share in the U.S. IVF market. This dominance is attributed to the increasing success rates and cost-effectiveness associated with frozen embryo transfers (FET). Clinicians often recommend freezing embryos and transferring them in subsequent cycles rather than fresh transfers, which allows the woman’s body to recover post-ovarian stimulation and creates a more natural uterine environment. Furthermore, advancements in cryopreservation have significantly improved the survival and implantation rates of frozen embryos, making this approach preferable for both physicians and patients.

Simultaneously, the frozen donor segment is experiencing the fastest growth. A growing number of women who are unable to produce viable eggs due to age or medical conditions are turning to frozen donor eggs. Egg banks across the U.S. now offer diverse donor profiles with ready-to-ship frozen oocytes, making the IVF process quicker and more flexible. Single women and same-sex male couples also contribute to the rising demand for donor gametes. As the legal and ethical frameworks around gamete donation become clearer, this segment is expected to grow steadily in the coming years.

U.S. In Vitro Fertilization Market By End-use Insights

The fertility clinics segment is the most dominant end-use segment within the U.S. IVF market. Specialized IVF centers offer tailored services, state-of-the-art labs, and personalized treatment plans that ensure higher success rates. These clinics also tend to be more affordable compared to hospital settings due to their focused business models. Many fertility clinics operate in urban and suburban areas with advanced diagnostic and therapeutic infrastructure. For instance, large fertility networks like CCRM and Kindbody have multiple branches across the country, leveraging economies of scale to offer comprehensive services from consultation to embryo transfer.

Conversely, the hospitals and other settings segment is expected to witness the fastest growth rate. Many hospitals are expanding their reproductive health departments to include IVF and related services, thereby integrating fertility care with general health services. This integration helps cater to patients who prefer continuity of care within a single medical institution. Additionally, rural and semi-urban hospitals are partnering with IVF experts to offer telehealth consultations and satellite clinics, thus extending the reach of fertility care to underserved regions. Such diversification of service delivery models is contributing to segment growth.

Country-Level Analysis

Within the U.S., IVF services are predominantly concentrated in high-density population regions like California, New York, Florida, and Texas. California leads the market due to a large number of IVF clinics, a tech-savvy population, and liberal legislation supporting reproductive rights. New York and Massachusetts also show strong demand, bolstered by state mandates requiring insurers to cover IVF treatments. Meanwhile, Southern states such as Georgia and North Carolina are seeing a rise in fertility clinics due to increased awareness and reduced stigma.

However, access to IVF services is still uneven across the country. Rural areas and certain conservative states may have limited availability of ART services due to lack of specialized facilities and sociocultural barriers. Nonetheless, increased telemedicine penetration and mobile clinics are helping to bridge this gap. Over the next decade, the expansion of fertility networks and improvements in affordability are expected to create a more uniform distribution of IVF services nationwide.

Recent Developments

-

June 2024: Kindbody announced the opening of its flagship fertility clinic in Miami, expanding its national footprint and increasing access to IVF and egg-freezing services in Southern Florida.

-

February 2024: CooperSurgical partnered with Generate Life Sciences to launch new cryopreservation solutions targeting higher embryo survival rates in IVF labs.

-

October 2023: Prelude Fertility and Inception Fertility merged operations to create one of the largest fertility networks in the U.S., aiming to streamline care across 100+ clinics.

-

August 2023: Boston IVF introduced a proprietary AI-based embryo selection software across all its clinics, aimed at improving implantation rates and reducing time to pregnancy.

Some of the prominent players in the U.S. in vitro fertilization market include:

- Bayer AG

- Cook Medical LLC

- EMD Serono, Inc.

- Ferring B.V.

- FUJIFILM Irvine Scientific (FUJIFILM Holdings Corporation)

- Genea Biomedx

- EMD Serono, Inc. (Merck KGaA)

- Merck & Co., Inc.

- The Cooper Companies, Inc.

- Thermo Fisher Scientific, Inc.

- Vitrolife

- Nova IVF

- RMA Network (Reproductive Medicine Associates)

- U.S. Fertility

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. in vitro fertilization market

Instrument

- Disposable Devices

- Culture Media

-

- Cryopreservation Media

- Embryo Culture Media

- Ovum Processing Media

- Sperm Processing Media

-

- Sperm Analyzer Systems

- Imaging Systems

- Ovum Aspiration Pumps

- Micromanipulator Systems

- Incubators

- Gas Analyzers

- Laser Systems

- Cryosystems

- Sperm Separation Devices

- IVF Cabinets

- Anti-vibration Tables

- Witness Systems

- Other

Procedure Type

- Fresh Donor

- Frozen Donor

- Fresh Non-Donor

- Frozen Non-Donor

End-use

- Fertility Clinics

- Hospitals & Others Setting