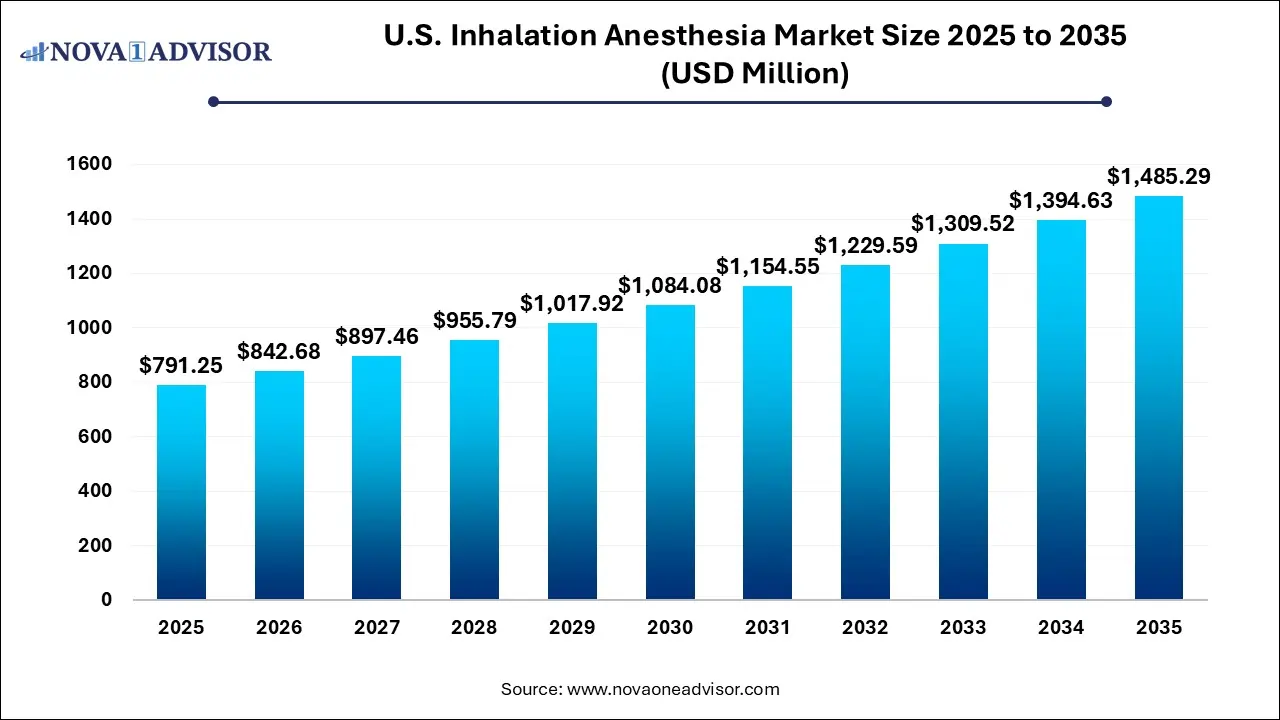

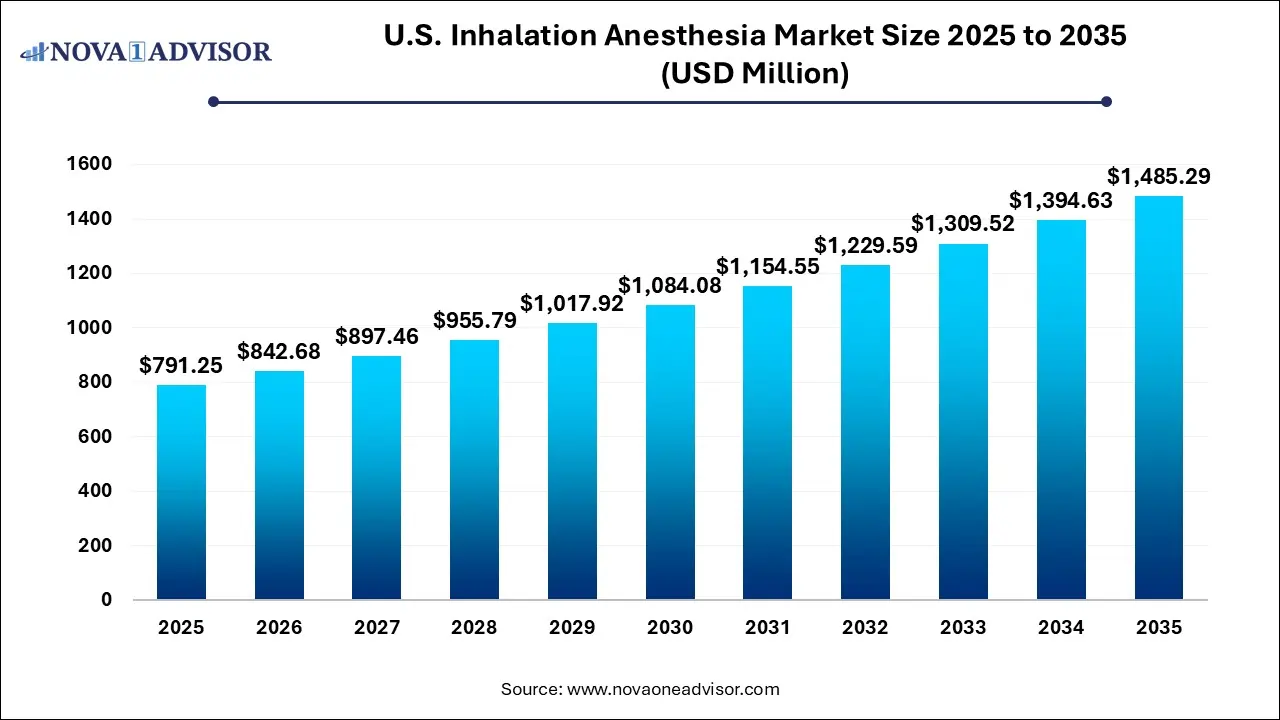

U.S. Inhalation Anesthesia Market Size and Growth

The U.S. inhalation anesthesia market size was exhibited at USD 791.25 million in 2025 and is projected to hit around USD 1,485.29 million by 2035, growing at a CAGR of 6.5% during the forecast period 2026 to 2035.

Key Takeaways:

- The sevoflurane drug dominated the U.S. inhalation anesthesia market, accounting for the largest revenue share of 76% in 2025.

- The isoflurane drug is expected to grow at a significant CAGR of 4.8% over the forecast period.

- The hospitals led the U.S. inhalation anesthesia industry with the largest revenue share Of 65% in 2025.

Market Overview

The U.S. inhalation anesthesia market has emerged as a vital component within the country’s broader healthcare infrastructure, particularly in surgical care and critical care settings. Inhalation anesthetics are primarily administered through a vaporizer connected to an anesthesia machine, delivering controlled doses of volatile anesthetic agents. These agents, including sevoflurane, desflurane, and isoflurane, are widely employed to induce and maintain general anesthesia during a broad range of surgical procedures.

The growing demand for minimally invasive surgeries, the increase in geriatric population requiring surgical interventions, and the advancement in anesthetic delivery systems are collectively fueling the market growth. Furthermore, innovations in anesthetic formulations have improved patient safety profiles, reduced recovery time, and decreased incidences of post-operative complications, adding to the adoption rate of these agents.

From large hospital chains to outpatient surgical centers, the demand for rapid-acting and highly controllable anesthetics continues to rise. The increasing incidence of chronic conditions such as cardiovascular disease, cancer, and orthopedic disorders, which often require surgical intervention, further accelerates the use of inhalation anesthesia across the United States.

Major Trends in the Market

-

Shift Toward Outpatient and Ambulatory Procedures: The growing preference for ambulatory surgical centers (ASCs) is reshaping the demand dynamics for inhalation anesthesia, favoring agents with quick onset and offset of action.

-

Preference for Sevoflurane: Due to its favorable pharmacokinetics and safety profile, sevoflurane remains the dominant drug used in various surgical procedures, especially in pediatric and outpatient surgeries.

-

Sustainability and Green Anesthesia Practices: Rising concerns regarding environmental emissions from inhaled anesthetics are prompting hospitals and surgical centers to adopt eco-friendly practices and invest in low-GWP (Global Warming Potential) agents and scavenging systems.

-

Technological Advancements in Delivery Systems: Development of advanced vaporizers and integrated monitoring systems is allowing precise control over anesthetic dosage, thereby enhancing safety and efficacy.

-

Increased Focus on Patient Safety: Regulatory bodies like the FDA and Joint Commission are emphasizing safe anesthesia practices, resulting in stringent adherence to quality standards and monitoring protocols in anesthesia administration.

-

Growing Pediatric Surgery Volumes: There is a noticeable uptick in pediatric surgical interventions, which typically require volatile agents like sevoflurane due to their gentle profile and ease of administration in children.

-

Use in Geriatric Surgeries: The aging U.S. population, prone to comorbidities, demands safer and efficient anesthesia options, increasing the need for inhaled agents with better tolerability and faster emergence.

-

COVID-19 Aftermath: Post-pandemic surgical backlogs and the return of elective surgeries have boosted the need for high-throughput anesthetic solutions, reinvigorating demand across healthcare settings.

Report Scope of U.S. Inhalation Anesthesia Market

| Report Coverage |

Details |

| Market Size in 2026 |

USD 842.68 Million |

| Market Size by 2035 |

USD 1,485.29 Million |

| Growth Rate From 2026 to 2035 |

CAGR of 6.5% |

| Base Year |

2025 |

| Forecast Period |

2026-2035 |

| Segments Covered |

Drug, Application, End use |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Key Companies Profiled |

Baxter; AbbVie Inc.; Piramal Enterprises Ltd.; Hikma Pharmaceuticals PLC; Halocarbon, LLC; Sandoz Group AG; Fresenius Kabi AG |

Key Market Driver: Growth in Surgical Procedures

The growing volume of surgeries in the U.S. serves as a major driver for the inhalation anesthesia market. According to the American Hospital Association, over 35 million surgeries are conducted annually in the U.S., with a steady rise in elective and non-elective procedures. The increase is driven by the expanding geriatric population and rising prevalence of lifestyle-related diseases such as obesity, cardiovascular diseases, and cancer. These conditions often require surgical interventions, thereby fueling the use of anesthesia. Inhalation anesthetics, known for their rapid action and easy reversibility, are particularly well-suited for both induction and maintenance phases of anesthesia. As hospitals and ambulatory centers continue to optimize throughput, fast-acting agents like sevoflurane and desflurane are gaining popularity, bolstering market demand.

Key Market Restraint: Environmental Concerns

A significant challenge restraining the U.S. inhalation anesthesia market is environmental sustainability. Volatile anesthetics like desflurane and isoflurane contribute to greenhouse gas emissions when exhaled by patients and released into the atmosphere. Desflurane, for example, has a Global Warming Potential (GWP) more than 2,500 times that of carbon dioxide. As the healthcare industry comes under increasing pressure to lower its environmental footprint, anesthesiologists and hospital administrators are being urged to reduce the usage of high-GWP agents. Additionally, compliance with evolving environmental regulations and the implementation of scavenging systems introduce cost and operational challenges. These concerns are prompting some institutions to limit the use of specific agents, indirectly impacting overall market expansion.

Key Opportunity: Rise in Ambulatory Surgical Centers (ASCs)

The growth of ambulatory surgical centers (ASCs) presents a lucrative opportunity for the inhalation anesthesia market in the U.S. These centers offer same-day surgical care, which is more cost-effective and patient-friendly compared to traditional hospital settings. Inhalation anesthetics like sevoflurane and desflurane, known for rapid induction and recovery, align perfectly with the operational model of ASCs. Moreover, with the Centers for Medicare & Medicaid Services (CMS) expanding coverage for more procedures in ASCs, these facilities are increasingly performing complex surgeries that previously required hospitalization. This shift enhances the demand for efficient anesthetic agents that enable quick patient turnover while ensuring safety. Vendors that cater to ASCs with compact delivery systems and cost-effective solutions stand to gain significantly in the coming years.

Segmental Analysis

Drug Outlook

Sevoflurane dominated the U.S. inhalation anesthesia market by drug type in 2025, and it is expected to maintain its lead due to its favorable safety and pharmacodynamic profile. Sevoflurane is especially effective in pediatric and geriatric populations where rapid onset and minimal airway irritation are critical. Additionally, its low solubility in blood allows for faster recovery times, reducing the post-anesthetic care unit (PACU) burden. Hospitals and ASCs favor sevoflurane for outpatient surgeries and short-duration procedures due to its smooth induction and quick awakening, enabling efficient patient throughput. The ease of titration and minimal pungency make it an anesthesiologist’s preferred choice in a wide range of cases.

Desflurane is projected to be the fastest-growing drug segment during the forecast period. Its ultra-low blood-gas partition coefficient allows for rapid changes in anesthetic depth and faster recovery. This is particularly valuable in long or complex procedures where swift emergence is desirable. Although environmental concerns have affected its usage, technological advances in gas scavenging and sustainability practices are mitigating its drawbacks. Desflurane is especially beneficial in obese patients due to its rapid elimination, making it a key agent in bariatric surgeries—an area witnessing rising volumes in the U.S. healthcare system.

Application Outlook

Maintenance accounted for the largest share in the application segment of the U.S. inhalation anesthesia market. Maintenance of anesthesia during surgical procedures requires consistent and controllable delivery of anesthetic agents. Inhalation anesthetics offer anesthesiologists the ability to finely adjust the depth of anesthesia, ensuring optimal surgical conditions and patient safety. Agents like isoflurane and sevoflurane provide hemodynamic stability, making them ideal for prolonged surgeries. Moreover, the increasing complexity of surgeries being conducted at both hospitals and ASCs necessitates effective maintenance strategies, reinforcing the segment's dominance.

Induction is the fastest-growing application segment as inhalation-based induction gains traction, particularly in pediatric and uncooperative patients. While intravenous agents are commonly used, inhalation induction offers a less invasive option, improving the patient experience. Sevoflurane, in particular, has gained widespread adoption in pediatric practices for this purpose. With technological improvements in vaporizer systems and patient monitoring, anesthesiologists are more confident in employing inhalation induction, especially where intravenous access is difficult or distressing.

End Use Outlook

Hospitals remained the dominant end-user segment in 2025 due to the high volume of surgeries performed and the availability of advanced anesthetic equipment and monitoring tools. Hospitals also handle more complex and emergency procedures, requiring robust anesthesia management protocols and high-quality agents. Most tertiary care hospitals maintain a steady demand for inhalation anesthetics for general surgeries, cardiac procedures, and neurological interventions. Additionally, their ability to invest in infrastructure and comply with regulatory norms ensures consistent adoption of new-generation anesthetic solutions.

Ambulatory Surgical Centers (ASCs) are expected to witness the fastest growth in the coming years. The expanding scope of surgeries being performed at ASCs, coupled with their focus on efficiency and patient satisfaction, makes them a lucrative segment. Inhalation anesthetics that offer quick induction, minimal side effects, and faster recovery times are highly valued in this setting. As insurers and healthcare policies increasingly favor outpatient care for cost-saving purposes, ASCs are set to play a more prominent role, fueling demand for innovative anesthetic agents and systems.

Country-Level Analysis: United States

Within the United States, several states such as California, Texas, New York, and Florida are leading contributors to market revenue due to their high surgical volumes and concentration of tertiary care hospitals. Urban regions, with their advanced healthcare facilities and higher population densities, show greater adoption of inhalation anesthetics. Furthermore, teaching hospitals and specialized surgical centers in these states are early adopters of new anesthetic technologies and practices. In contrast, rural healthcare settings are gradually embracing inhalation anesthesia, driven by telemedicine consultation, federal funding, and the rise of regional surgical hubs.

Regulatory developments by bodies like the FDA and the Joint Commission also play a significant role in shaping the market landscape. For instance, the enforcement of guidelines on anesthetic gas emissions and safety monitoring has pushed providers toward adopting compliant and eco-friendly solutions, particularly in high-regulation states like California.

Some of The Prominent Players in The U.S. inhalation anesthesia market Include:

- Baxter

- AbbVie Inc.

- Piramal Enterprises Ltd.

- Hikma Pharmaceuticals PLC

- Halocarbon, LLC

- Sandoz Group AG

- Fresenius Kabi AG

Recent Developments

-

April 2025: Baxter International announced a new partnership with a network of ASCs to provide integrated anesthesia solutions including inhalation agents, vaporizers, and monitoring systems tailored to outpatient settings.

-

March 2025: AbbVie expanded its manufacturing capacity for sevoflurane at its Illinois plant, citing rising demand from U.S. hospitals and ASCs post-COVID-19.

-

February 2025: Piramal Pharma Solutions unveiled a sustainability initiative to reduce greenhouse emissions from inhaled anesthetics, including improvements in scavenging systems used in their distribution kits.

-

December 2024: Hikma Pharmaceuticals received FDA approval for a generic formulation of isoflurane, aimed at improving access to cost-effective anesthetic agents.

-

October 2024: Fresenius Kabi announced a clinical trial in collaboration with leading U.S. hospitals to test the efficacy of low-flow anesthesia using desflurane to balance patient outcomes and environmental impact.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2035. For this study, Nova one advisor, Inc. has segmented the U.S. inhalation anesthesia market

By Drug

- Sevoflurane

- Desflurane

- Isoflurane

- Others

By Application

By End Use

- Hospitals

- Ambulatory Surgical Centers (ASC)

- Others