U.S. Integrated Operating Rooms Market Size, Share, Growth, Report 2026 to 2035

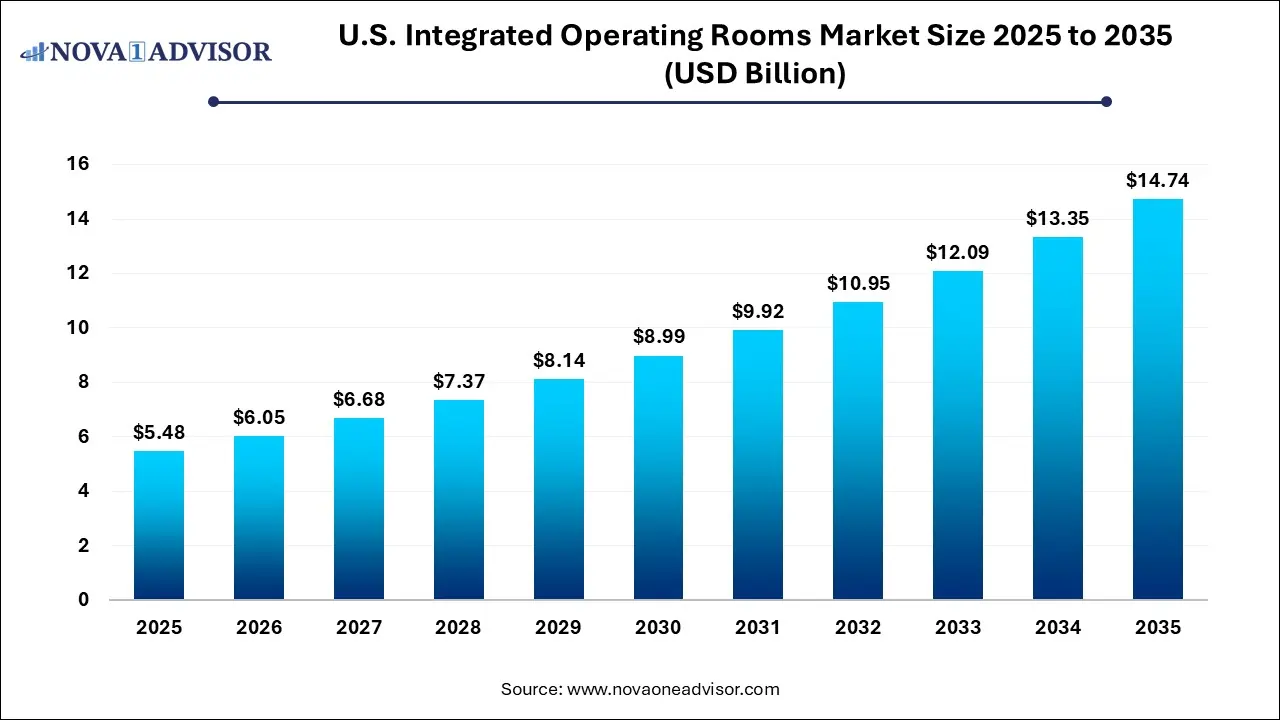

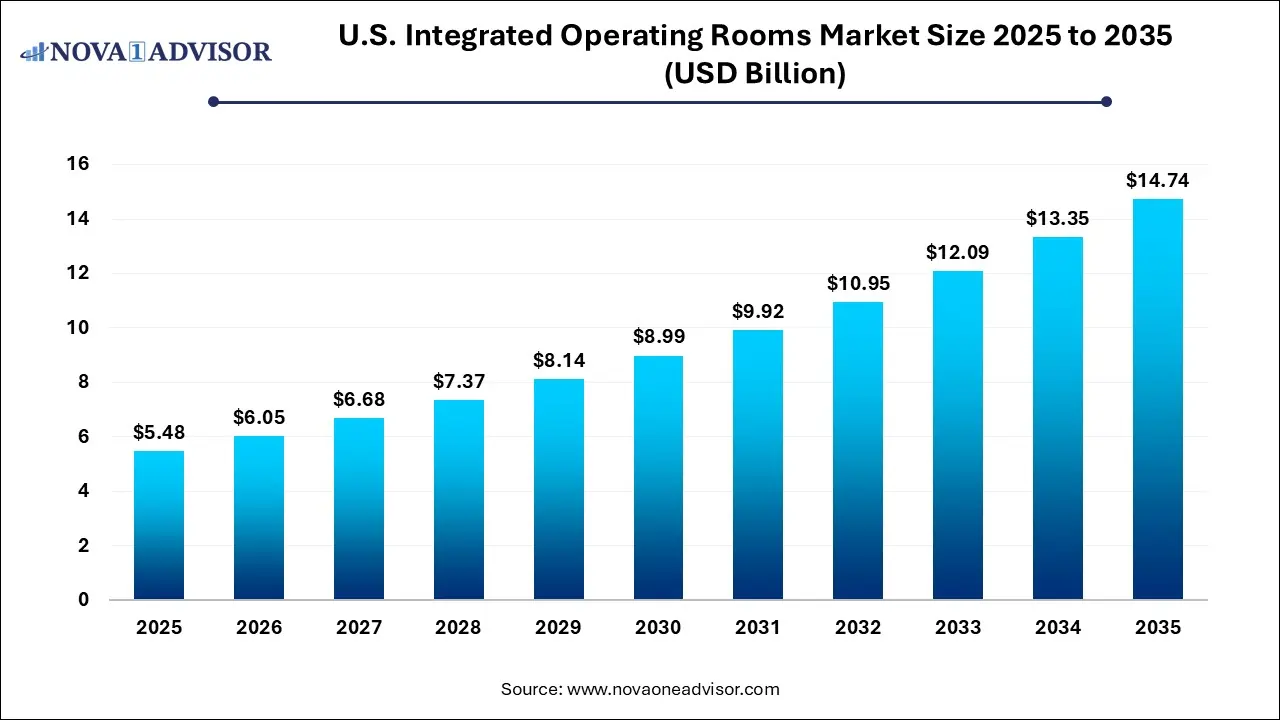

The U.S. integrated operating rooms market size was estimated at USD 5.48 billion in 2025 and is expected to surpass around USD 14.74 billion by 2035 and poised to grow at a compound annual growth rate (CAGR) of 10.4% during the forecast period 2026 to 2035.

Key Takeaways:

- Increasing demand for minimally invasive & image-guided procedures and the growing popularity of integrated ORs is expected to boost the market growth

- The hospital-based outpatient department segment led the market in 2025 owing to its increasing demand by these end-users

- On the other hand, high costs associated with integrated ORs is estimated to hinder the market growth

Market Overview

The U.S. integrated operating rooms (ORs) market is undergoing a dynamic transformation as hospitals and surgical facilities embrace the convergence of advanced imaging, digital connectivity, and ergonomic design to optimize surgical workflows. An integrated operating room is a digitally connected surgical environment in which audio, video, medical imaging, surgical lighting, and documentation systems are centrally controlled and seamlessly connected through a unified digital interface. These rooms enable real-time communication, minimally invasive procedures, efficient data management, and enhanced surgical precision.

In the U.S., integrated ORs are becoming a cornerstone of surgical modernization, particularly in large urban hospitals and teaching institutions. As patient outcomes become increasingly dependent on precision, safety, and efficiency, healthcare systems are investing in smart operating rooms to reduce intraoperative errors, shorten surgical times, and improve post-operative recovery. Technologies such as high-definition (HD) and 4K imaging, artificial intelligence-assisted navigation, and real-time data analytics are no longer optional they are vital tools enhancing surgeon performance and patient care.

Major healthcare providers such as the Cleveland Clinic and Mayo Clinic have implemented fully integrated surgical suites that allow for smoother procedures, interdisciplinary collaboration, and rapid conversion of operating spaces for different specialties. The push toward value-based care in the U.S., combined with the increasing volume of complex surgeries, particularly robotic-assisted and minimally invasive surgeries, has further propelled the adoption of integrated OR solutions. Additionally, the shift toward outpatient procedures and the growth of Ambulatory Surgery Centers (ASCs) are reinforcing the need for scalable and cost-effective integrated solutions across care settings.

Major Trends in the Market

-

Widespread adoption of 4K and 8K surgical displays and ultra-HD imaging systems.

-

Integration of artificial intelligence (AI) for real-time decision support and anomaly detection.

-

Rising utilization of telemedicine features for remote surgical collaboration and education.

-

Implementation of touchless and voice-activated control systems to minimize contamination.

-

Use of integrated ORs in outpatient and same-day surgery centers.

-

Growing preference for modular and mobile integrated OR systems.

-

Increased demand for cyber-secure, cloud-based data and video storage for surgical documentation.

-

Convergence of robotic-assisted surgery systems with integrated room technologies.

U.S. Integrated Operating Rooms Market Report Scope

| Report Attribute |

Details |

| Market Size in 2026 |

USD 6.05 Billion |

| Market Size by 2035 |

USD 14.74 Billion |

| Growth Rate From 2026 to 2035 |

CAGR of 10.4% |

| Base Year |

2025 |

| Forecast Period |

2026 to 2035 |

| Segments Covered |

End-Use |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled |

Stryker; Brainlab AG; Barco; Steris Plc; Arthrex, Inc.; Karl Storz; Olympus Corp.; Getinge AB; Skytron, LLC; Caresyntax; Sony |

Market Driver: Surge in Minimally Invasive and Image-Guided Surgeries

The most significant driver in the U.S. integrated ORs market is the rapid increase in minimally invasive and image-guided surgical procedures. These surgical modalities require the use of advanced visual aids, precise instruments, and real-time feedback systems. Integrated ORs bring all of these components together into one interconnected ecosystem, ensuring that the surgeon, anesthesiologist, and nursing staff can operate cohesively with immediate access to essential data.

For instance, a neurosurgical procedure that incorporates intraoperative MRI, robotic assistance, and AI-powered navigation becomes exponentially more efficient and safer within an integrated operating suite. Hospitals like Massachusetts General have equipped hybrid ORs that support multiple disciplines—neurosurgery, orthopedics, cardiovascular, and urology—through flexible configuration and digital control. These setups improve surgical accuracy, reduce transition times between procedures, and enhance safety by minimizing manual adjustments and equipment clutter.

Market Restraint: High Capital Investment and Infrastructure Challenges

Despite its advantages, one of the foremost restraints in the U.S. market is the high cost of installation and infrastructure adaptation. Designing and constructing an integrated OR can involve a multimillion-dollar investment, especially for legacy hospitals that must retrofit existing surgical spaces. The costs include equipment procurement, software integration, construction, training, and ongoing technical maintenance.

This high upfront expenditure is particularly challenging for smaller community hospitals and standalone ASCs. Moreover, the complexity of integrating legacy imaging systems, surgical lights, audio-visual equipment, and hospital information systems can lead to interoperability issues. Managing these intricacies requires skilled project managers, biomedical engineers, and IT support, further increasing the operational burden. Consequently, some healthcare systems may delay full-scale integration or settle for semi-integrated solutions due to cost constraints.

Market Opportunity: Integration with Robotic Surgery and Smart Analytics

An emerging opportunity lies in further integration of robotic-assisted surgery systems and surgical analytics platforms into integrated ORs. Robotic systems, such as Intuitive’s da Vinci Surgical System or Medtronic’s Hugo, are increasingly becoming standard for complex procedures in urology, gynecology, and general surgery. As these systems generate massive volumes of data and video content, integrated ORs can serve as centralized platforms for managing and analyzing this data in real-time.

For example, new platforms are being developed that allow surgeons to overlay 3D imaging on live operative views, enhancing anatomical visualization. These AI-augmented systems not only improve intraoperative decision-making but also feed into surgical data analytics platforms that assess performance metrics, complication rates, and instrument usage. Hospitals that can harness this data are better positioned to meet value-based care goals, improve efficiency, and train the next generation of surgeons more effectively. This integration of robotics, AI, and analytics within ORs offers strong growth potential for the U.S. market.

Segmental Analysis

By End-use

Hospitals dominate the U.S. integrated operating rooms market, accounting for the largest share of installations and upgrades. Large academic medical centers and urban hospitals are at the forefront of adopting fully integrated OR suites. These institutions are equipped to handle complex surgeries, multi-specialty collaborations, and robotic-assisted procedures. For instance, NewYork-Presbyterian Hospital implemented a series of next-generation operating suites that combine surgical navigation systems, HD displays, and smart OR controls, improving surgical accuracy and interdisciplinary coordination.

Hospitals benefit from integrated ORs by reducing equipment clutter, improving sterile field access, and enhancing patient safety. Additionally, integrated rooms allow hospitals to convert ORs into hybrid environments, supporting both diagnostic and interventional procedures without relocating the patient. With rising surgical caseloads and demand for precision medicine, hospitals continue to invest in scalable and flexible OR integration platforms that can evolve with future surgical technologies.

On the other hand, Ambulatory Surgery Centers (ASCs) represent the fastest-growing segment in this market. As the healthcare landscape shifts toward outpatient care and cost containment, ASCs are increasingly adopting integrated ORs to maintain high clinical standards while improving throughput. These centers perform a significant volume of elective and same-day surgeries, and integration helps streamline pre-operative and intra-operative workflows.

For example, ASCs in California and Texas have installed integrated ORs equipped with mobile carts, cloud-based data transfer systems, and simplified control interfaces. These technologies enable efficient turnover, reduce procedural errors, and offer better documentation for insurance and compliance. Moreover, as insurers and Medicare incentivize outpatient care, the demand for compact, cost-effective, and user-friendly integrated OR setups in ASCs is expected to grow significantly over the next few years.

Hospital-Based Outpatient Departments (HOPDs) also play a vital role, offering specialized surgical services while maintaining hospital affiliation. These units often cater to high-risk or specialized cases not suitable for standalone ASCs. Integrated ORs in HOPDs facilitate better coordination between inpatient and outpatient care while maintaining a high level of technological sophistication. Facilities like these benefit from digital integration by maintaining seamless data flow with the main hospital information system.

Office-Based Labs (OBLs) are also gaining traction, particularly in vascular, orthopedic, and ophthalmic specialties. These facilities are smaller in scale but benefit from modular integrated OR designs. With tailored integration of lighting, imaging, and procedural tools, OBLs can perform high-value surgeries efficiently. Integrated OR solutions in OBLs focus on cost efficiency, compact design, and plug-and-play integration with minimal infrastructure disruption.

Country-Level Analysis: United States

The U.S. market for integrated operating rooms is uniquely positioned due to its advanced healthcare infrastructure, large volume of surgical procedures, and rapid adoption of digital health technologies. According to the Centers for Medicare & Medicaid Services (CMS), over 51 million surgeries are performed annually in the U.S., including outpatient and inpatient procedures. This substantial volume creates a compelling case for integrated ORs that enhance procedural safety, reduce surgical time, and improve patient outcomes.

Leading healthcare systems such as Kaiser Permanente, HCA Healthcare, and UPMC are investing heavily in digital surgical infrastructure. Additionally, the U.S. government's shift toward value-based care reimbursement models encourages health systems to adopt technologies that demonstrate cost savings and outcome improvement—further incentivizing the deployment of integrated ORs. States like California, Texas, and Florida have witnessed a surge in ASC development and integration investments, while academic hospitals in New York and Massachusetts are focusing on hybrid and AI-driven OR advancements.

Technology innovation hubs like Silicon Valley and Boston also contribute to rapid R&D and pilot implementation of integrated OR technologies. In addition, several federal grants and public-private partnerships have been established to support telemedicine and robotic surgery programs—accelerating integrated OR adoption across the country.

Key Companies & Market Share Insights

- Stryker

- Brainlab AG

- Barco

- Steris Plc

- Arthrex, Inc.

- Karl Storz

- Olympus Corporation

- Getinge AB

- Skytron, LLC

- Caresyntax

- Sony

Recent Developments

-

March 2025: Stryker Corporation launched its next-gen “iSuite Integrated OR” platform in collaboration with Microsoft’s Azure AI, enabling real-time surgical analytics and cloud documentation in U.S. hospitals.

-

January 2025: Getinge AB announced the expansion of its “Tegris OR Integration System” across 15 hospitals in the Midwest, offering touch-free control panels and multi-source video routing.

-

November 2024: Karl Storz introduced a compact, modular OR integration solution aimed at outpatient surgery centers and office-based surgical facilities, citing demand from smaller practices.

-

September 2024: Olympus Corporation of the Americas unveiled its "ORBEYE 8K 3D Visualization Platform" integrated with robotic arm control, piloted in advanced neurosurgical suites in New York.

-

July 2024: Skytron LLC partnered with a Florida-based ASC network to install 50+ integrated ORs featuring energy-efficient lighting, sterile field control, and digital scheduling.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2035. For this study, Nova one advisor, Inc. has segmented the U.S. Integrated Operating Rooms market.

By End-use

- Hospitals

- Hospital-Based Outpatient Department (HOPD)

- Ambulatory Surgery Centers (ASC)

- Office Based Labs (OBL)