U.S. Interventional Cardiology And Peripheral Market Size and Trends

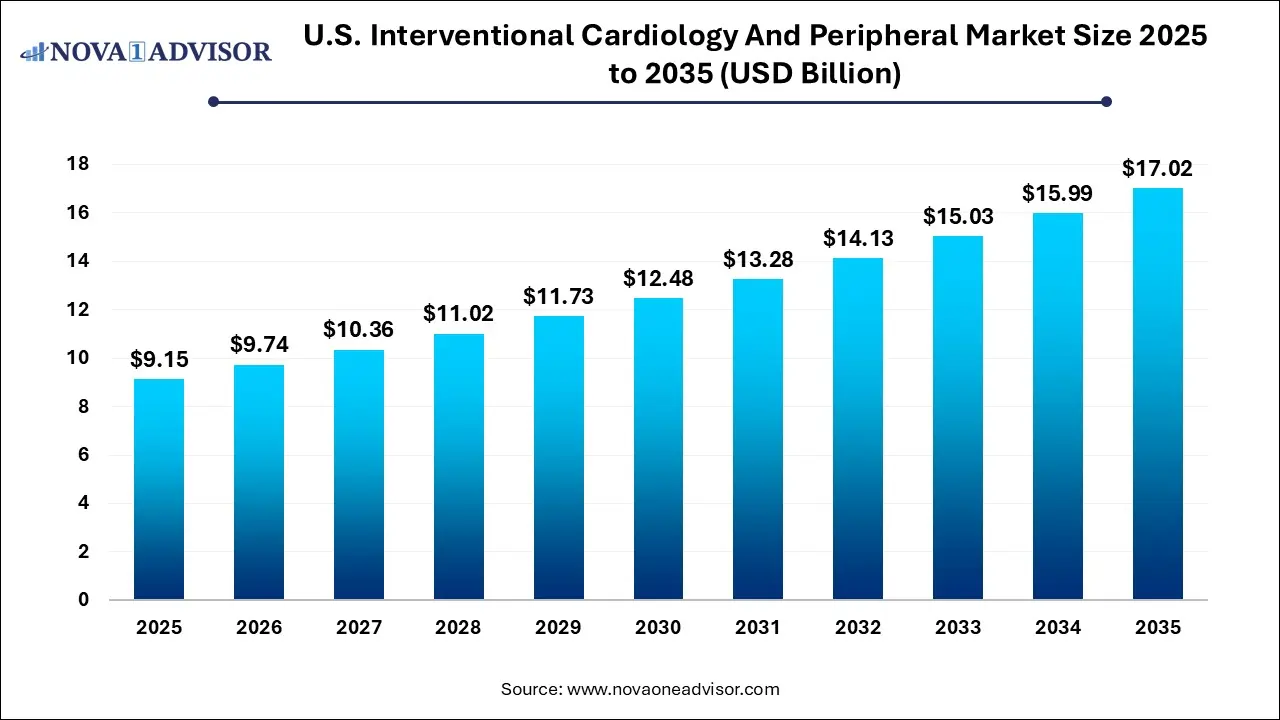

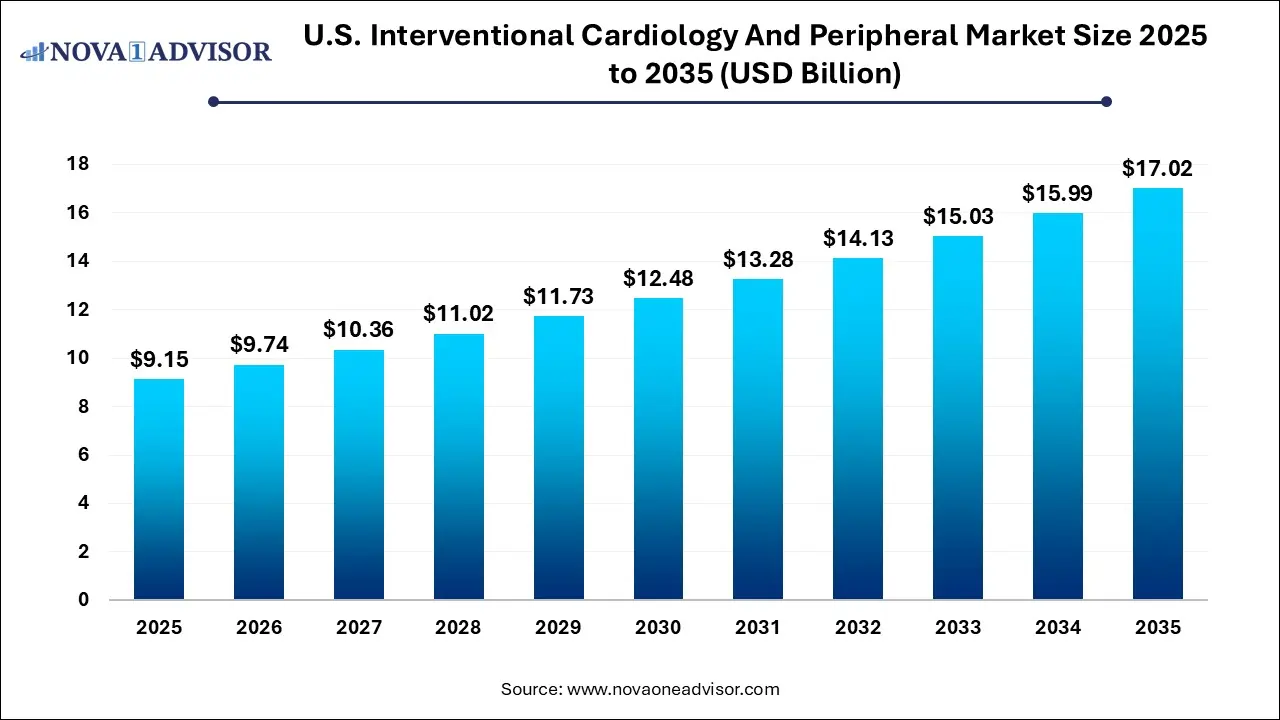

The U.S. interventional cardiology and peripheral market size was exhibited at USD 9.15 billion in 2025 and is projected to hit around USD 17.02 billion by 2035, growing at a CAGR of 6.4% during the forecast period 2026 to 2035.

Key Takeaways:

- Coronary stents led the U.S. interventional cardiology and peripheral market and accounted for a share of 42% in 2025

- Angioplasty dominated the U.S. interventional cardiology and peripheral industry and accounted for a share of 60% in 2025.

Market Overview

The U.S. interventional cardiology and peripheral market is a dynamic and rapidly evolving segment of the medical device industry, driven by the rising burden of cardiovascular diseases, aging demographics, and advancements in minimally invasive treatment technologies. Interventional cardiology focuses on catheter-based treatments for structural heart diseases, while peripheral interventions address blockages in blood vessels outside the heart, such as in the limbs.

Cardiovascular diseases remain the leading cause of death in the United States, accounting for over 800,000 deaths annually according to the CDC. The high prevalence of coronary artery disease (CAD), peripheral artery disease (PAD), and other vascular disorders necessitates efficient and innovative treatment options. This has resulted in growing utilization of interventional tools such as drug-eluting and bioabsorbable stents, atherectomy devices, and embolic protection systems.

Healthcare providers are increasingly adopting catheter-based therapies over open surgeries due to benefits like reduced hospital stays, lower complication rates, and quicker patient recovery. Technological advancements, including image-guided navigation systems, smart stents, and robotic-assisted interventions, are further propelling the market.

Hospitals, ambulatory surgical centers, and specialty cardiovascular clinics across the U.S. are expanding their interventional cardiology departments, bolstered by supportive reimbursement policies and ongoing clinical research. As patient awareness and preventive screening rates improve, early diagnosis is enhancing patient inflow for elective and semi-urgent procedures, boosting demand for interventional cardiology and peripheral products.

Major Trends in the Market

-

Shift from Surgical to Minimally Invasive Interventions: Surgeons are increasingly opting for catheter-based techniques due to improved safety profiles and patient outcomes.

-

Surge in Drug-Eluting and Bioabsorbable Stents: Demand for stents that offer drug release or complete absorption post-deployment is on the rise due to lower restenosis and thrombosis risks.

-

Integration of Robotics and AI: Robotic-assisted interventions are growing in the cardiology space, providing enhanced precision and control.

-

Expansion of Outpatient Cardiac Procedures: Ambulatory surgical centers are performing a growing number of interventional cardiology procedures, enabled by advances in balloon catheters and rapid recovery protocols.

-

Development of Nitinol-Based Devices: The use of nickel-titanium alloys is increasing due to their flexibility, durability, and biocompatibility.

-

Emphasis on Preventive Cardiology: There is a rising focus on early screening for PAD and CAD, driven by patient education initiatives and risk-based diagnostics.

-

Strategic Collaborations and M&A: Large medtech companies are acquiring niche players to diversify their product portfolios and enhance geographic reach.

Report Scope of U.S. Interventional Cardiology And Peripheral Market

| Report Coverage |

Details |

| Market Size in 2026 |

USD 9.74 Billion |

| Market Size by 2035 |

USD 17.02 Billion |

| Growth Rate From 2026 to 2035 |

CAGR of 6.4% |

| Base Year |

2025 |

| Forecast Period |

2026-2035 |

| Segments Covered |

Product, Application |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled |

B. Braun SE; BD; Cardinal Health; Medtronic; Teleflex Incorporated; W. L. Gore & Associates Inc.; Cook; Boston Scientific Corporation; AngioDynamics; Abbott; OrbusNeich Medical Group Holdings Limited |

Key Market Driver

High Prevalence of Cardiovascular Diseases and Aging Population

One of the most powerful drivers of the U.S. interventional cardiology and peripheral market is the high and steadily increasing prevalence of cardiovascular disorders, exacerbated by lifestyle-related risk factors and demographic shifts. According to the American Heart Association, more than 120 million Americans are affected by cardiovascular diseases. This includes more than 20 million adults diagnosed with PAD.

The aging U.S. population is a critical contributor. As individuals age, vascular elasticity decreases, and comorbidities such as diabetes, hypertension, and high cholesterol become more common—conditions closely linked to arterial plaque buildup. The increasing number of elderly individuals seeking less invasive treatments with shorter recovery periods has significantly accelerated the use of interventional devices like drug-eluting stents, microcatheters, and atherectomy tools. This demand is expected to continue rising as preventive cardiology gains prominence across healthcare settings.

Key Market Restraint

High Device and Procedural Costs

Despite the undeniable clinical benefits of interventional cardiology procedures, their high cost remains a considerable barrier to widespread access and adoption. Devices such as drug-eluting stents, embolic protection devices, and robotic-assisted catheters can be prohibitively expensive, especially for hospitals and outpatient centers with limited budgets. Furthermore, the cost of procedures including preoperative imaging, physician fees, and post-procedure monitoring adds to the financial burden.

While Medicare and private insurers cover many of these procedures, disparities in reimbursement rates and administrative hurdles often limit their accessibility. This is particularly problematic for rural hospitals and community clinics that may lack the capital to maintain updated interventional equipment. Additionally, cost concerns impact patient decisions, especially among the underinsured or those facing high out-of-pocket expenses.

Key Market Opportunity

Emergence of Next-Generation Bioabsorbable and Drug-Coated Devices

A transformative opportunity in the U.S. market lies in the development and commercialization of next-generation interventional cardiology products such as fully bioabsorbable stents and drug-coated balloons. These technologies represent the future of vascular intervention, offering promising benefits including reduced long-term inflammation, elimination of permanent implants, and lower reintervention rates.

Clinical trials have demonstrated positive outcomes using these devices in both coronary and peripheral applications. As regulatory approvals progress and longer-term safety data accumulates, hospitals are expected to gradually transition to these advanced devices. Companies investing in R&D for novel coating agents, customized polymer degradation timelines, and real-time imaging compatibility stand to gain a significant competitive advantage. Educational initiatives aimed at interventional cardiologists and cardiovascular surgeons will further support the adoption of these technologies.

Segmental Analysis

Product Outlook

Interventional catheters dominated the product segment in 2025, accounting for the highest revenue share. Their dominance stems from widespread use in diagnostic and therapeutic interventions, including angioplasty and lesion crossing. Interventional catheters are essential in virtually every vascular procedure, offering precise navigation, drug delivery, and thrombus removal. Innovations in material design, hydrophilic coatings, and tip flexibility have made these devices safer and more efficient. Many hospitals and ASCs maintain a broad inventory of interventional catheters due to their versatility and cross-application utility in both cardiac and peripheral settings.

In contrast, drug-eluting stents are the fastest-growing product segment, driven by their ability to reduce restenosis and improve long-term vessel patency. In recent years, improvements in polymer design and drug combinations (e.g., everolimus, sirolimus) have dramatically enhanced clinical outcomes. Bioabsorbable drug-eluting stents, in particular, are gaining interest for their capacity to provide temporary scaffolding and disappear after vessel healing. Their use is expanding from coronary arteries to peripheral applications, especially in patients with diabetes or small vessel disease. As FDA approvals continue and physician awareness grows, this segment is expected to show exponential growth through 2035.

Application Outlook

Angioplasty was the dominant application segment in 2025, owing to its widespread use in treating both coronary and peripheral artery blockages. This minimally invasive procedure has become the gold standard for revascularization, particularly for acute myocardial infarction and PAD. The growing availability of drug-coated balloons and precision delivery systems is making angioplasty safer and more effective. The expansion of same-day discharge protocols and enhanced recovery pathways has further supported this application’s uptake across healthcare facilities.

Meanwhile, percutaneous valve repair is anticipated to be the fastest-growing application, fueled by rising cases of valvular heart diseases and the increasing adoption of transcatheter techniques. With the introduction of devices like MitraClip and the evolution of transcatheter aortic valve replacement (TAVR), interventional cardiology has extended its reach beyond traditional stent procedures. The U.S. FDA has approved multiple percutaneous valve devices, and ongoing clinical trials are expected to broaden their indications. As patient demand for non-surgical options rises and physician training expands, the application of percutaneous valve repair will likely see significant growth.

Country-Level Analysis: United States

In the United States, the interventional cardiology and peripheral market exhibits significant geographical disparities in terms of access, technology adoption, and patient outcomes. Major urban and academic hospitals in states like California, New York, and Texas have pioneered the adoption of robotic-assisted interventional procedures, advanced imaging platforms, and hybrid catheter labs. These centers often serve as clinical trial sites and early adopters of next-gen devices.

Conversely, rural and underserved regions in states such as Mississippi, Arkansas, and West Virginia continue to face challenges in accessing interventional services due to infrastructure gaps and limited specialist availability. Initiatives like mobile cath labs and tele-intervention consultations are slowly addressing this divide. Moreover, Medicare reforms targeting value-based care have encouraged hospitals across the U.S. to invest in interventional equipment that supports faster recovery and better long-term outcomes.

The U.S. market is also shaped by its payer ecosystem. Private insurance companies, Medicare, and Medicaid play pivotal roles in procedure coverage, device adoption, and provider incentives. The ongoing shift toward bundled payments and outcome-based reimbursement models has accelerated the use of high-quality, durable interventional products.

Some of The Prominent Players in The U.S. interventional cardiology and peripheral market Include:

Recent Developments

-

May 2025 – Abbott Laboratories launched a new generation of drug-coated balloon catheters for peripheral artery disease under its Lutonix brand, promising improved drug transfer efficiency and reduced restenosis.

-

March 2025 – Boston Scientific Corporation received expanded FDA approval for its Ranger Drug-Coated Balloon to treat below-the-knee PAD, following positive clinical trial results.

-

January 2025 – Medtronic plc announced the commercial launch of its Onyx Frontier Drug-Eluting Stent System in the U.S., an evolution of the Resolute Onyx platform with enhanced deliverability.

-

December 2024 – Cardiovascular Systems, Inc. (CSI) partnered with a U.S.-based AI startup to integrate real-time lesion mapping and image-guided navigation in its next generation orbital atherectomy devices.

-

October 2024 – Terumo Medical Corporation introduced the R2P MISAGO RX self-expanding stent system, designed specifically for above-the-knee peripheral interventions in the U.S. market.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2035. For this study, Nova one advisor, Inc. has segmented the Operating room equipment market

By Product

- Interventional Catheters

- Microcatheters

-

- Support Microcatheters

- Delivery Microcatheters

- Others

- Guidewires

- Peripheral Stents

-

- Self-expanding

- Balloon-expandable

- Drug-eluting Stents

-

- Bioabsorbable Stents

- Drug Eluting Stents

- Bare Metal Stents

- PTCA Balloon Catheters

- Atherectomy Devices

- Chronic Total Occlusion Devices

- Synthetic Surgical Grafts

- Embolic Protection Devices

- IVC Filters

- PTA Balloon Catheters

- Thrombectomy Devices

By Application

- Angioplasty

- Congenital Heart Defect Correction

- Thrombectomy

- Valvuloplasty

- Percutaneous Valve Repair

- Others