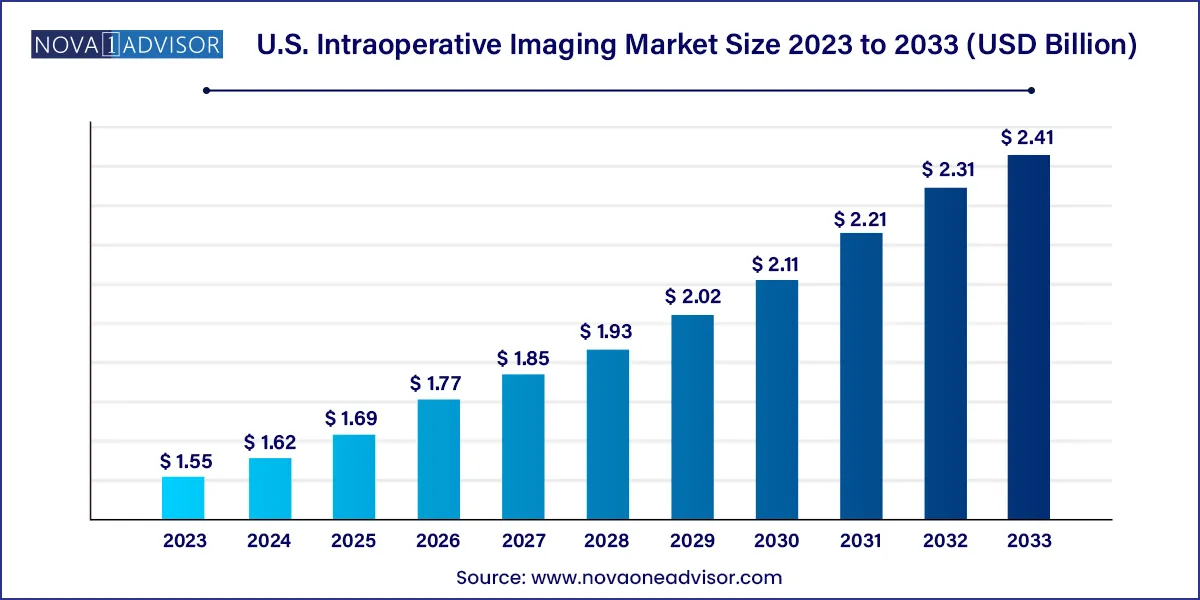

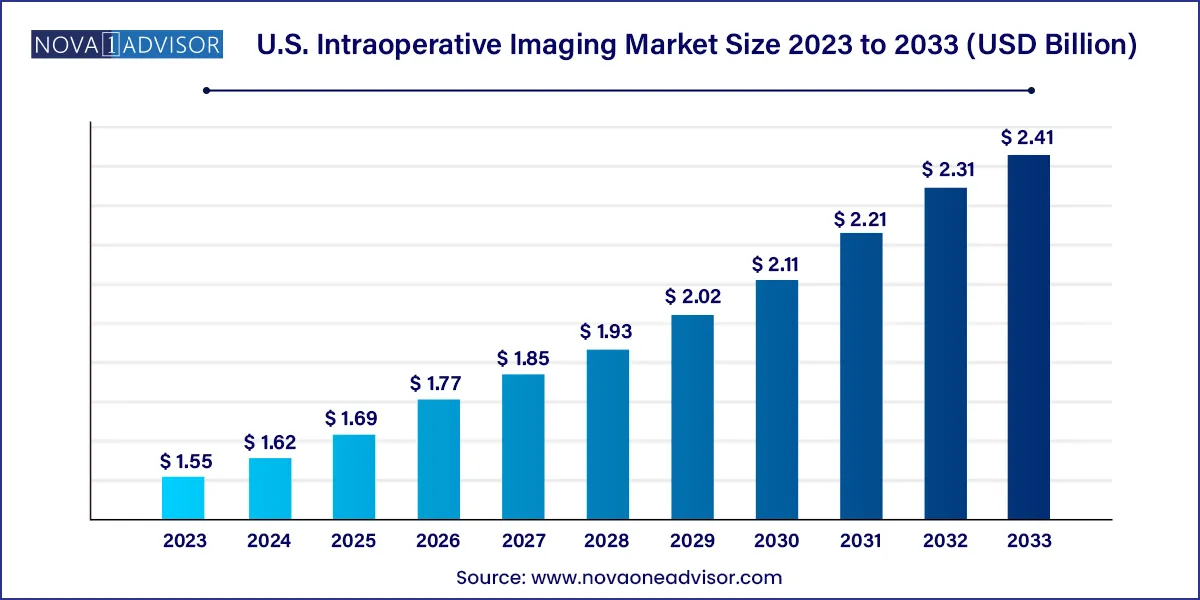

U.S. Intraoperative Imaging Market Size and Growth

The U.S. intraoperative imaging market size was valued at USD 1.55 billion in 2023 and is projected to surpass around USD 2.41 billion by 2033, registering a CAGR of 4.51% over the forecast period of 2024 to 2033.

U.S. Intraoperative Imaging Market Key Takeaways

- C-arms dominated the market and accounted for 30.93% of the revenue share in 2023.

- The increasing demand for iMRI systems is estimated to make it the fastest-growing segment over the forecast period.

- Neurosurgery application has dominated the intraoperative imaging market in 2023 by capturing 31.97% revenue share.

- The orthopedic surgery segment is projected to experience the highest growth rate during the forecast period

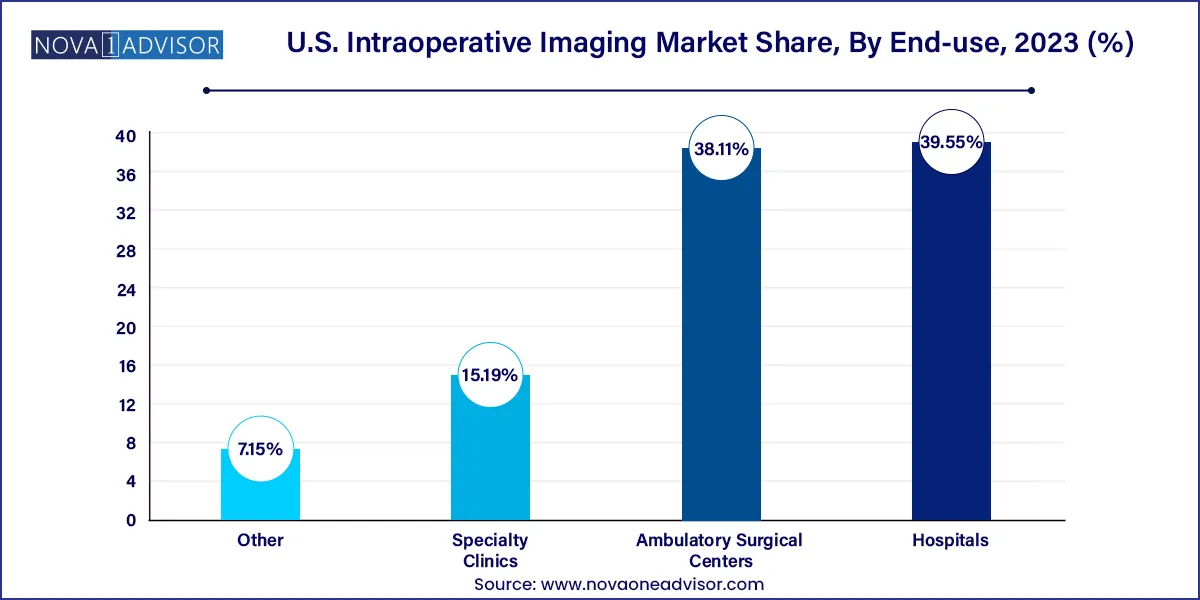

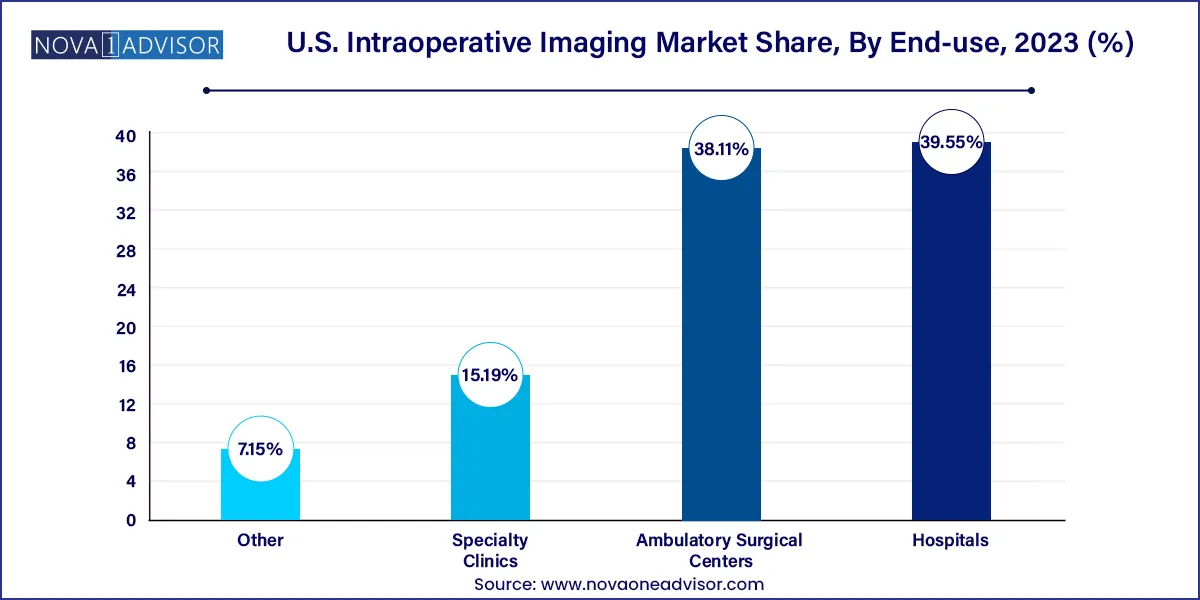

- Hospital segment have led the U.S. intraoperative imaging market on the basis of end-use by capturing 39.55% of the total revenue in 2023.

- Ambulatory surgical centers (ASCs) are expected to witness the highest CAGR from 2024 to 2033

Market Overview

The U.S. intraoperative imaging market is rapidly evolving, driven by the growing need for real-time imaging during complex surgeries. Intraoperative imaging refers to the use of imaging technologies such as intraoperative computed tomography (iCT), magnetic resonance imaging (iMRI), ultrasound, and C-arms during surgical procedures to guide the surgeon with live, high-resolution visuals. This enhances surgical precision, reduces risks, and improves patient outcomes.

Intraoperative imaging has transitioned from being a supplemental tool to a critical element in modern surgical protocols. It enables surgeons to assess anatomical structures, confirm tumor removal, manage bleeding, and reduce complications in real time. With surgical procedures becoming increasingly sophisticated—particularly in neurosurgery, orthopedic surgery, and cardiovascular interventions the demand for real-time intraoperative imaging continues to grow in the U.S.

The country's advanced healthcare infrastructure, high per capita health spending, and adoption of innovative surgical technologies create an ideal environment for market expansion. Additionally, an aging population with a rising incidence of chronic diseases such as cancer, cardiovascular disorders, and orthopedic conditions has increased the volume of complex surgeries requiring intraoperative imaging.

As hospitals and ambulatory surgical centers (ASCs) seek to reduce surgical error rates, minimize revision surgeries, and improve clinical efficiency, intraoperative imaging technologies are being rapidly integrated into operating rooms. These systems are increasingly connected with navigation tools, robotic systems, and artificial intelligence (AI) software, signaling a new era of image-guided surgeries.

U.S. Intraoperative Imaging Market Trends

- Technological Advancements: Continuous advancements in imaging technologies, such as intraoperative MRI (iMRI), intraoperative CT (iCT), and intraoperative ultrasound (iUS), are driving market growth. These technologies enable real-time visualization during surgical procedures, enhancing precision and reducing the need for follow-up surgeries.

- Minimally Invasive Procedures: There's a growing preference for minimally invasive surgeries due to reduced postoperative complications, faster recovery times, and shorter hospital stays. Intraoperative imaging plays a crucial role in guiding surgeons during minimally invasive procedures, leading to increased adoption of intraoperative imaging systems.

- Increasing Demand for Orthopedic Surgeries: The rising prevalence of orthopedic disorders, such as osteoarthritis and fractures, coupled with the aging population, is fueling the demand for intraoperative imaging systems in orthopedic surgeries. These systems aid in accurate implant placement and alignment, resulting in improved patient outcomes.

- Integration of Artificial Intelligence (AI): Integration of AI algorithms into intraoperative imaging systems is enabling automated image analysis, surgical planning, and intraoperative guidance. AI-powered imaging solutions offer real-time feedback to surgeons, assisting in decision-making and enhancing surgical accuracy.

- Expanding Applications in Neurosurgery: Intraoperative imaging systems are extensively used in neurosurgical procedures, including brain tumor resection, epilepsy surgery, and deep brain stimulation. The growing incidence of neurological disorders and the increasing adoption of image-guided neurosurgery techniques are driving the demand for intraoperative imaging solutions.

- Collaborations and Partnerships: Key players in the market are engaging in strategic collaborations and partnerships to enhance their product portfolios and expand their market presence. These collaborations facilitate technology transfer, research and development initiatives, and market penetration strategies.

- Regulatory Landscape: Stringent regulatory requirements for medical devices, including intraoperative imaging systems, influence market dynamics. Compliance with regulatory standards and obtaining approvals from regulatory authorities are critical for market players to launch and commercialize their products.

- Shift Towards Outpatient Settings: There's a growing trend towards performing surgeries in outpatient settings, driven by factors such as cost-effectiveness, convenience, and advancements in surgical techniques. Intraoperative imaging systems that are compact, portable, and suitable for outpatient settings are witnessing increased demand.

U.S. Intraoperative Imaging Market Report Scope

| Report Attribute |

Details |

| Market Size in 2024 |

USD 1.62 Billion |

| Market Size by 2033 |

USD 2.41 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 4.51% |

| Base Year |

2023 |

| Forecast Period |

2024 to 2033 |

| Segments Covered |

Product, application, end-use |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled |

GE HealthCare; Siemens Healthcare GmbH; Medtronic plc; Royal Philips; Shimadzu Corporation (Medical Systems); Brainlab AG; IMRIS; Canon Medical USA, INC; Shenzhen Anke High-tech Co.; Mindray Ltd. |

Market Driver: Rise in Complex Surgical Procedures and Patient Safety Demands

One of the strongest drivers of the U.S. intraoperative imaging market is the rising demand for complex, minimally invasive surgeries and the growing emphasis on patient safety. As surgical techniques evolve, particularly in areas like neurosurgery, spine, orthopedic trauma, and cardiovascular interventions, the margin for error continues to narrow. Surgeons now require live, intraoperative imaging to confirm real-time anatomical positioning, ensure complete lesion resection, or verify implant placement.

For instance, intraoperative MRI has become a standard in high-end neurosurgical procedures, allowing surgeons to check for residual tumor tissue without closing the skull. Similarly, mobile C-arms with 3D imaging are invaluable in orthopedic procedures, helping prevent misaligned bone fixation or implant misplacement.

Hospitals and ASCs are under increasing pressure to improve surgical outcomes, reduce post-operative complications, and meet reimbursement criteria linked to quality metrics. This has led to a surge in demand for advanced intraoperative imaging solutions, which help reduce repeat surgeries, shorten hospital stays, and enhance overall surgical accuracy.

Market Restraint: High Equipment Cost and Operational Complexity

Despite its clinical benefits, one of the most significant restraints on market growth is the high cost of intraoperative imaging equipment and the complexity involved in operating it. Capital investment for advanced imaging systems especially iMRI or hybrid OR-compatible CT scanners can run into millions of dollars. These systems often require infrastructure upgrades, such as room shielding, cooling systems, and dedicated operating room configurations.

In addition to the capital investment, hospitals must bear ongoing maintenance costs, staff training, and potential disruptions to surgical workflow during initial implementation. Not all facilities, particularly small- to mid-sized hospitals and ASCs, have the financial resources or personnel to adopt and maintain such systems effectively.

Moreover, seamless integration of intraoperative imaging with other OR technologies such as robotics and navigation platforms requires interoperability and software alignment, which adds further complexity. These barriers may delay or deter adoption in cost-sensitive or resource-constrained environments, even in the presence of clinical need.

Market Opportunity: Expansion into Outpatient and Ambulatory Surgical Centers

An emerging and substantial opportunity for the U.S. intraoperative imaging market is the growing adoption of imaging systems in ambulatory surgical centers (ASCs) and outpatient clinics. These facilities are seeing rapid growth due to their cost efficiency, shorter patient recovery times, and preference among payers and patients for non-hospital care.

Historically, intraoperative imaging systems were confined to large hospital ORs due to their size and complexity. However, technological advances have made it possible to offer compact, mobile, and relatively affordable imaging solutions—particularly mobile C-arms and ultrasound devices—that are ideal for ASCs. As procedures like joint arthroscopy, spine injections, and minimally invasive cardiovascular surgeries migrate to outpatient settings, the need for real-time imaging during these interventions is growing.

Manufacturers that can offer scalable, modular imaging systems tailored for smaller settings with high performance at a lower cost point are well-positioned to capture this segment. Additionally, cloud-based data storage and remote access capabilities support the ASC model by enhancing image-sharing and post-operative follow-up.

U.S. Intraoperative Imaging Market By End-use Insights

Hospitals are the largest end-users, accounting for the majority of intraoperative imaging installations in the U.S. These facilities have the infrastructure, budget, and patient volume to invest in advanced imaging technologies, including high-end CT, MRI, and hybrid OR systems. Academic hospitals and Level 1 trauma centers often use intraoperative imaging as a standard practice in neurosurgical, cardiac, and complex trauma cases. Moreover, hospitals benefit from multidisciplinary collaboration and research funding, which accelerates the deployment of cutting-edge imaging tools.

Ambulatory surgical centers (ASCs) are the fastest-growing end-user segment, reflecting broader trends in the decentralization of surgical care. Increasing numbers of orthopedic and minimally invasive procedures are being performed in outpatient settings, driving demand for compact and mobile imaging solutions. Vendors are responding with lightweight, intuitive systems that meet regulatory standards for imaging but don’t require the complex setup or spatial footprint of traditional hospital installations. As reimbursement models shift in favor of outpatient procedures, ASCs are expected to become a major customer base for intraoperative imaging technologies.

U.S. Intraoperative Imaging Market By Product Insights

C-arms are the dominant product segment in the U.S. intraoperative imaging market, owing to their versatility, cost-efficiency, and widespread adoption across multiple surgical disciplines. Mobile C-arms are routinely used in orthopedic, cardiovascular, and general surgeries to provide fluoroscopic imaging during procedures such as spinal fusions, fracture reductions, and catheter placements. Their portability and relatively lower cost compared to CT or MRI make them particularly attractive for both hospitals and ASCs.

In contrast, iMRI is the fastest-growing segment, largely due to its increasing application in neurosurgery. Unlike pre-operative MRIs, iMRI allows surgeons to visualize brain tissue in real-time during surgery, enabling better outcomes in tumor resection and deep-brain stimulation procedures. The ability to re-image before wound closure significantly improves surgical precision. Although iMRI adoption is currently limited to larger academic or tertiary care centers due to cost, its clinical impact is spurring long-term investments and grant-funded implementations in high-volume surgical programs.

U.S. Intraoperative Imaging Market By Application Insights

Neurosurgery dominates the application segment, given the complexity and precision required in brain and spine surgeries. Intraoperative MRI and CT imaging are extensively used in neurosurgical procedures to ensure complete tumor excision, minimize neurological damage, and confirm implant placements. Technologies such as stereotactic navigation integrated with imaging provide enhanced visualization of critical brain regions, which is crucial for improving patient outcomes and minimizing reoperation risks.

Meanwhile, orthopedic surgery is the fastest-growing application, supported by the increasing incidence of sports injuries, age-related joint degeneration, and the expansion of robotic-assisted orthopedic surgeries. Real-time imaging during orthopedic procedures, such as spinal fusions and joint replacements, helps surgeons align bones and implants more accurately, thereby improving postoperative function and reducing complications. The growing availability of mobile C-arms and 3D navigation-compatible systems is facilitating the adoption of intraoperative imaging in this field, particularly in ASCs and orthopedic specialty clinics.

Country-Level Analysis

The United States stands at the forefront of intraoperative imaging technology adoption, owing to its strong medical infrastructure, early technology uptake, and a high volume of complex surgeries. With over 50 million surgical procedures performed annually, the need for precision and intraoperative decision-making tools is higher than ever.

The U.S. is home to world-leading academic and research institutions such as Johns Hopkins Hospital, Mayo Clinic, and Cleveland Clinic, which actively deploy and evaluate advanced imaging systems. Government and private funding support continuous innovation, particularly in areas like AI integration and robotics-assisted surgery.

U.S. healthcare regulations, including FDA approvals and CMS reimbursement policies, influence global standards for intraoperative imaging adoption. Furthermore, as value-based care models become more prominent, hospitals and surgical centers are investing in technologies that can improve surgical outcomes and reduce re-admissions—a key strength of intraoperative imaging solutions.

U.S. Intraoperative Imaging Market Recent Developments

-

March 2025: GE HealthCare introduced its next-generation OmniView C-arm system, featuring AI-assisted fluoroscopy to reduce radiation exposure and enhance image clarity in orthopedic and cardiovascular surgeries.

-

February 2025: Siemens Healthineers announced the launch of MAGNETOM iOR 1.5T, a compact intraoperative MRI system designed specifically for integration in hybrid neurosurgical suites.

-

January 2025: Medtronic partnered with Philips to co-develop an integrated surgical navigation and intraoperative imaging system tailored for spine surgeries, aiming to reduce instrumentation errors.

-

December 2024: Ziehm Imaging expanded its North American operations with a new manufacturing and training facility in Texas to meet growing U.S. demand for mobile C-arms.

-

November 2024: Canon Medical Systems received FDA clearance for its Alphenix Sky+ system, combining interventional radiology with surgical imaging in a hybrid operating environment.

U.S. Intraoperative Imaging Market Top Key Companies:

- GE HealthCare

- Siemens Healthcare GmbH

- Medtronic plc

- Royal Philips

- Shimadzu Corporation (Medical Systems)

- Brainlab AG

- IMRIS

- Canon Medical USA, INC.

- Shenzhen Anke High-tech Co.

- Mindray Ltd.

U.S. Intraoperative Imaging Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. Intraoperative Imaging market.

By Product

- iCT

- Intraoperative Ultrasound

- iMRI

- C-arms

By Application

- Neurosurgery

- Cardiovascular Surgery

- Orthopedic Surgery

- Trauma /Emergency Room Surgery

- ENT Surgery

- Oncology Surgery

- Other Applications

By End-use

- Hospitals

- Specialty Clinics

- Ambulatory Surgical Centers

- Other End-users