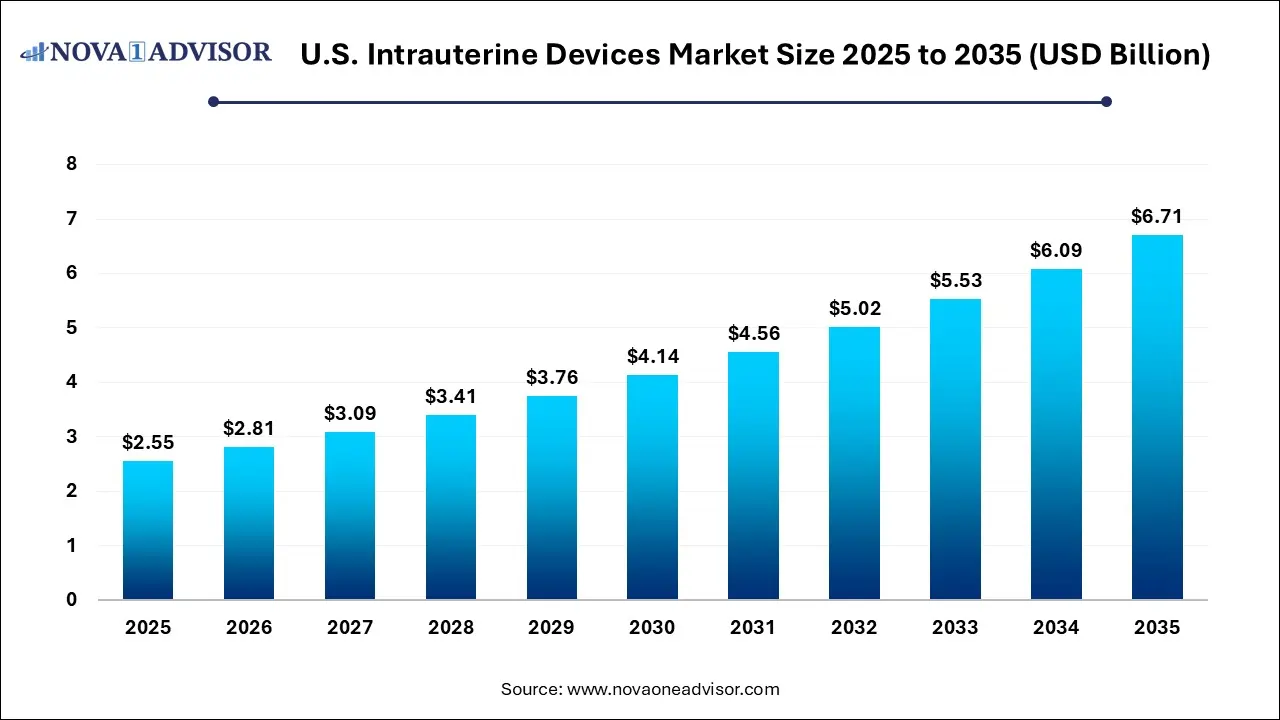

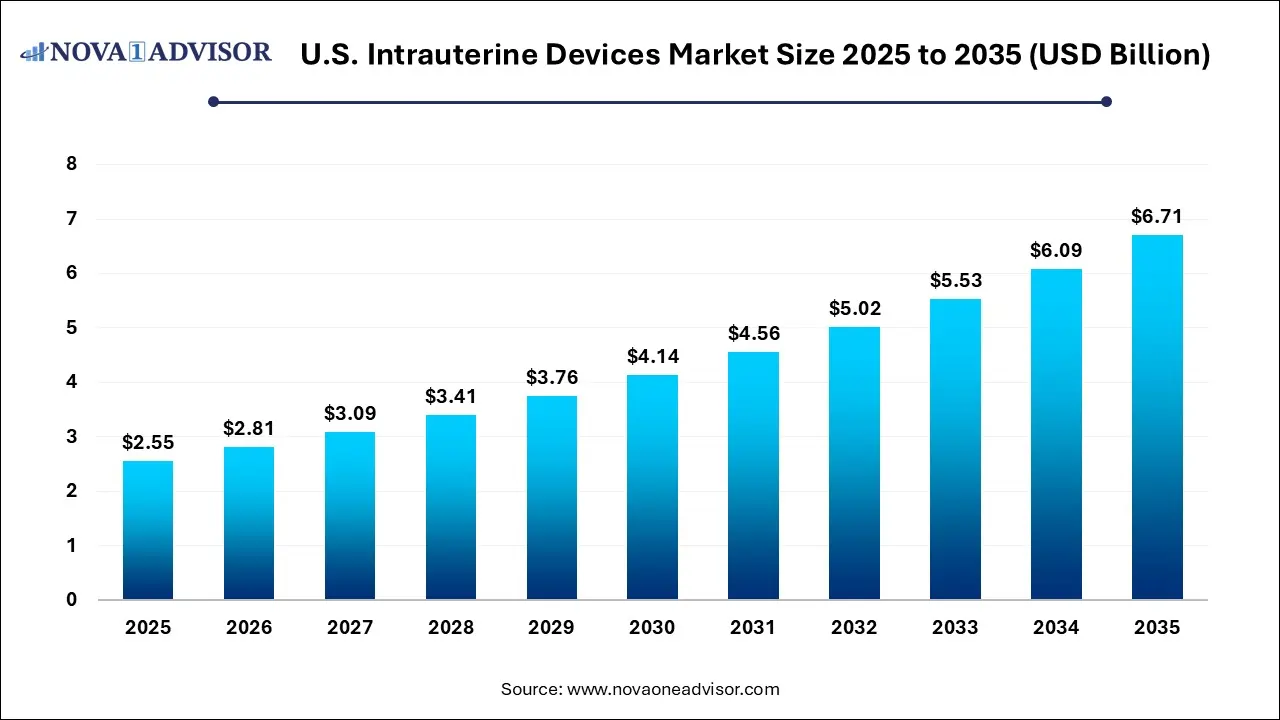

U.S. Intrauterine Devices Market Size and Growth 2026 to 2035

The U.S. intrauterine devices market size was exhibited at USD 2.55 billion in 2025 and is projected to hit around USD 6.71 billion by 2035, growing at a CAGR of 10.16% during the forecast period 2026 to 2035.

U.S. Intrauterine Devices Market Takeaways

- The hormonal IUD segment was valued at USD 1.1 Billion in 2025.

- The 25-29 age group segment was valued at around USD 319 million in 2025.

Market Overview:

The U.S. intrauterine devices (IUDs) market encompasses the production, distribution, and use of small, T-shaped devices inserted into the uterus for long-term, reversible contraception. These devices, available in hormonal and copper types, offer benefits such as over 99% efficacy in preventing pregnancy, long-lasting protection for 3 to 10 years, and low maintenance requirements compared to daily birth control methods. IUDs are used in various applications, including general contraception, emergency contraception (copper IUD), and management of heavy menstrual bleeding (hormonal IUD) within hospitals and gynecology clinics.

Market Outlook

- Market Growth Overview: The U.S. intrauterine devices market is expected to grow significantly between 2025 and 2034, driven by the rising rate of unwanted pregnancy, more convenience and efficacy, and rising demand for reliable contraception.

- Sustainability Trends: Sustainability trends involve eco-conscious materials, enhanced product efficacy and duration, and improved patient experience and accessibility.

- Major Investors: Major investors in the market include Bayer AG, AbbVie (Allergan), Merck & Co., and CooperSurgical.

Artificial Intelligence: The Next Growth Catalyst in U.S. Intrauterine Devices

AI is impacting the U.S. intrauterine device (IUD) industry by enabling more personalized medicine and improving patient care through data analytics and remote monitoring. AI algorithms analyze individual health data, such as medical history and hormone levels, to recommend the most suitable IUD type, which helps reduce the trial-and-error process and potential side effects. Mobile health apps integrated with AI facilitate virtual consultations and continuous monitoring, thereby increasing access to reproductive healthcare and enhancing patient engagement.

Report Scope of the U.S. Intrauterine Devices Market

|

Report Coverage

|

Details

|

|

Market Size in 2026

|

USD 2.81 Billion

|

|

Market Size by 2035

|

USD 6.71 Billion

|

|

Growth Rate from 2026 to 2035

|

CAGR of 10.16%

|

|

Base Year

|

2025

|

|

Forecast Period

|

2026 to 2035

|

|

Segments Covered

|

Product, Age Group

|

|

Key companies profiled

|

Bayer AG, CooperSurgical Inc. (CooperCompanies) and Allergan (AbbVie Inc.).

|

Segmental analysis:

By Product

The copper IUD segment dominates the U.S. intrauterine devices market, primarily due to its long-standing clinical use, hormone-free nature, and extended duration of effectiveness. Copper IUDs are widely preferred by women seeking reliable, non-hormonal contraception and are suitable across a broad age range. Their cost-effectiveness, minimal maintenance, and strong recommendation by healthcare providers continue to support their leading market position.

The hormonal IUD segment is the fastest-growing in the U.S. market, driven by increasing awareness of its therapeutic benefits beyond contraception. These include reduced menstrual bleeding, lower pain associated with menstruation, and improved quality of life. Growing adoption among younger women, first-time users, and patients seeking menstrual management is accelerating demand for hormonal IUDs.

By Age Group

The 30–34 age group dominates the U.S. IUD market, as women in this demographic commonly adopt long-acting reversible contraception for family planning and birth spacing. High awareness of contraceptive options, stable healthcare access, and strong physician recommendations contribute to the significant uptake of IUDs within this age segment.

The 45+ age group represents the fastest-growing segment in the U.S. IUD market, supported by increasing use of IUDs for perimenopausal contraception and non-contraceptive benefits such as management of heavy menstrual bleeding. Rising acceptance of hormonal IUDs for therapeutic purposes and extended reproductive healthcare needs are key factors driving growth in this segment.

Value Chain Analysis of the U.S. Intrauterine Devices Market

- Research & Development (R&D) and Product Design

This foundational stage involves innovating new devices (such as new materials, smaller sizes, or different hormone dosages) and obtaining necessary regulatory approvals from the FDA.

Key Players: Bayer AG, Mirena, Skyla, Kyleena, Liletta, and CooperSurgical, Inc.

- Manufacturing and Assembly

This stage focuses on the mass production, assembly, and quality control of the IUDs, adhering to stringent medical device standards.

Key Players: Bayer AG, CooperSurgical, Inc., and AbbVie Inc.

- Distribution and Logistics

Finished IUDs are moved through the supply chain to end-users, including hospitals, gynecology clinics, and community healthcare centers.

Key Players: Bayer AG, CooperSurgical, and Merck & Co.

U.S. Intrauterine Devices Market Companies

- Bayer: Bayer is a leading force in the U.S. hormonal IUD market with a diverse portfolio that includes popular brands such as Mirena, Skyla, and Kyleena.

- AbbVie: AbbVie contributes by offering the hormonal IUD product Liletta, following its acquisition of Allergan, the original product owner.

- CooperSurgical: CooperSurgical is a key player in the non-hormonal segment of the market, primarily known for manufacturing and distributing the copper IUD Paragard.

- Medicines360: This non-profit pharmaceutical company increases access to women's health products by providing the hormonal IUD Liletta at a significantly reduced cost through the 340B drug discount program.

- DKT: DKT International, a non-profit organization, contributes to the IUD market primarily by focusing on making contraceptive products, including IUDs like SafeLoad and Silverline, more accessible and affordable, particularly in developing countries and through public health initiatives.

- Sebela Pharmaceuticals: Sebela Pharmaceuticals is recognized as one of the prominent companies in the overall U.S. IUD market landscape. While specific IUD product lines were not detailed in the search results, they are listed among key manufacturers competing for market share through potential product portfolio expansion and innovation.

U.S. Intrauterine Devices Market Segmentation

By product

By Age Group

- 15-19

- 20-24

- 25-29

- 30-34

- 35-39

- 40-44

- 45+