U.S. Intravenous Solutions Market Size and Research

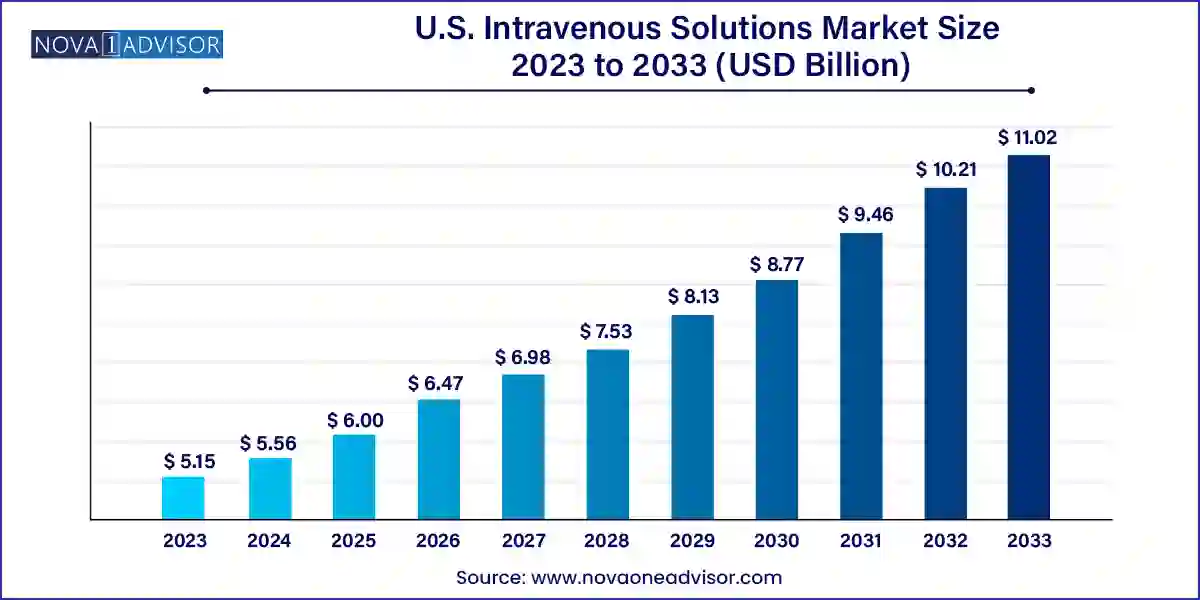

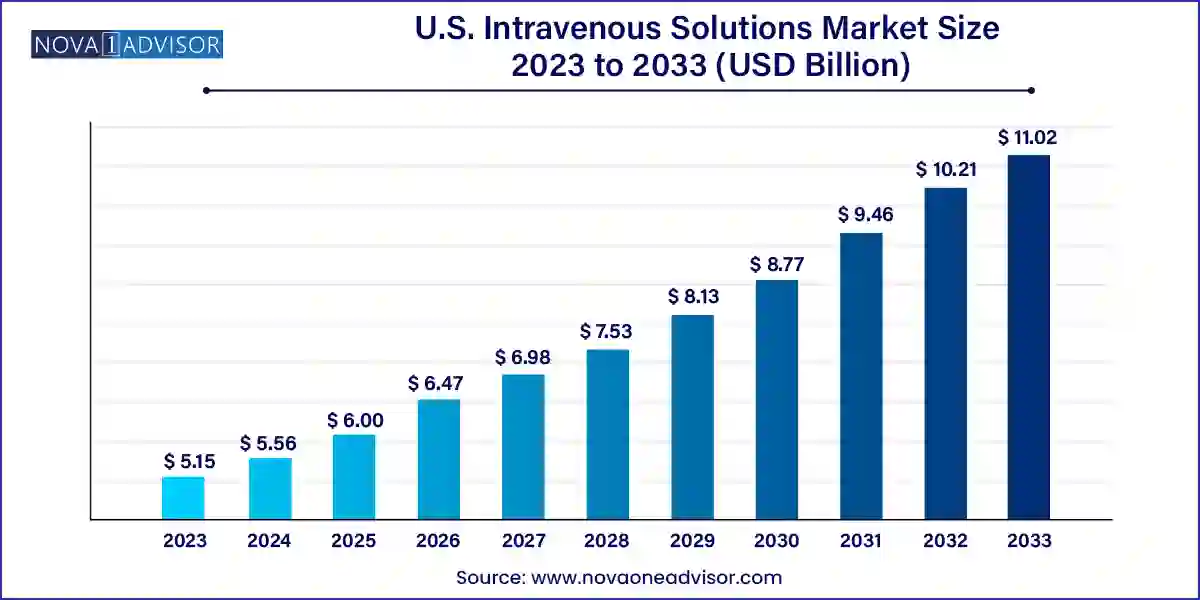

The U.S. intravenous solutions market size was exhibited at USD 5.15 billion in 2023 and is projected to hit around USD 11.02 billion by 2033, growing at a CAGR of 7.9% during the forecast period 2024 to 2033.

U.S. Intravenous Solutions Market By Key Takeaways:

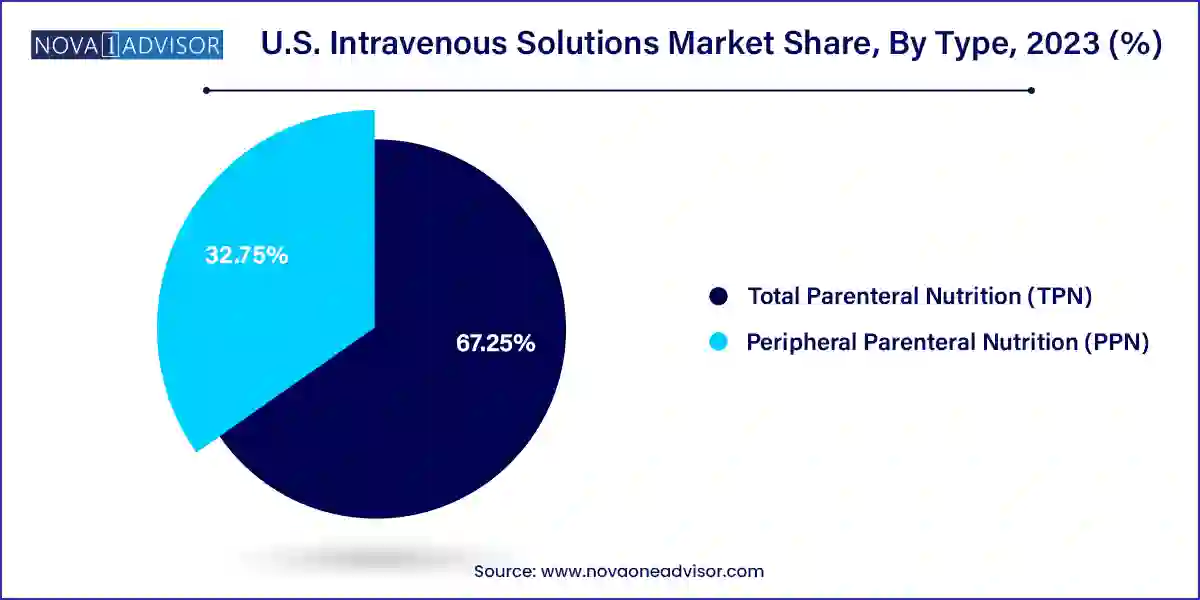

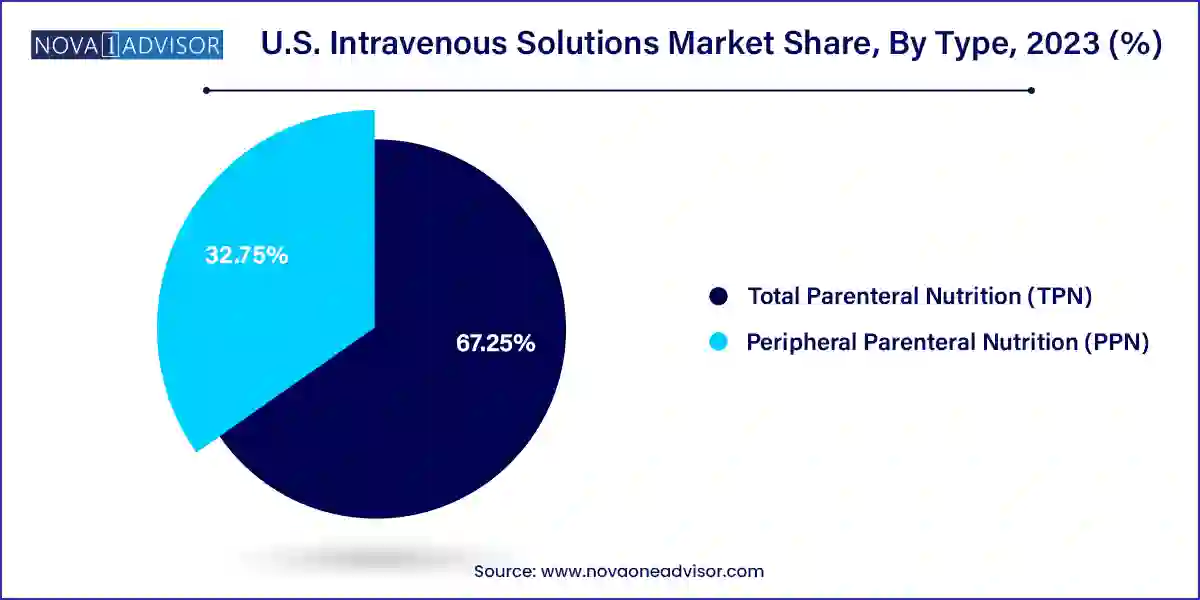

- The TPN segment led the market with the largest revenue share of 67.25% in 2023 and is expected to grow at the fastest CAGR of 8.0% over the forecast period.

- Based on nutrient, the single dose amino acid solution segment led the market with the largest revenue share of 31.35% in 2023.

Market Overview

The U.S. Intravenous (IV) Solutions Market stands as a fundamental segment of the broader healthcare infrastructure, supporting a wide range of clinical scenarios, from emergency medicine and intensive care to surgical recovery and chronic disease management. Intravenous solutions refer to fluids delivered directly into a patient’s venous system to provide hydration, nutrition, electrolytes, or medications. These solutions are critical in restoring and maintaining fluid balance, especially when oral intake is not possible or insufficient.

The U.S. healthcare system, with its expansive network of hospitals, clinics, ambulatory centers, and long-term care facilities, consumes massive volumes of IV solutions daily. The demand is driven by an aging population, rising incidence of chronic illnesses, increasing surgical procedures, and frequent use in outpatient settings. Additionally, advancements in compounding technologies and the growing prevalence of home infusion therapy have expanded the scope of IV therapy beyond traditional inpatient care.

The COVID-19 pandemic highlighted the indispensable role of IV solutions in acute care management. Hospitals faced unprecedented surges in ICU admissions, leading to shortages of IV fluids, especially for patients requiring prolonged ventilation or parenteral nutrition. Post-pandemic, the market has matured with improved supply chain protocols, increased domestic production, and strategic stockpiling practices to avoid future disruptions.

Major players in the market continue to invest in the development of advanced formulations, multi-chamber bags, and closed system transfer devices (CSTDs) that minimize contamination risks and improve administration efficiency. The rising focus on precision nutrition, antibiotic stewardship, and safe delivery mechanisms further supports the evolution of the IV solutions landscape in the U.S.

Major Trends in the Market

-

Rise in Home Infusion Therapy: More patients are receiving IV therapy at home for conditions like infections, cancer, and autoimmune diseases, supported by portable infusion pumps and nursing networks.

-

Custom and Multi-Chamber Bags: Hospitals are adopting pre-mixed, multi-chamber IV bags to streamline preparation, reduce compounding errors, and enhance sterility.

-

Increased Demand for TPN in Critical Care: The use of Total Parenteral Nutrition (TPN) is growing in intensive care units (ICUs) and surgical recovery units for patients with gastrointestinal dysfunction.

-

Sterility and Contamination Prevention: Emphasis on closed system IV delivery and single-use containers to minimize risks of infection and exposure.

-

Nutrient-Rich IV Formulations: Demand for formulations that deliver complete macronutrient and micronutrient profiles is increasing, especially in oncology and long-term nutrition therapy.

-

Technological Integration with Pumps: Smart infusion pumps and connected devices are being used to monitor flow rates, dosage, and alert clinicians in real time.

-

Focus on Pediatric and Geriatric Needs: Tailored IV formulations for age-specific requirements are being developed, reflecting a growing need for personalized treatment protocols.

-

Sustainability in Packaging: Manufacturers are shifting toward recyclable, lightweight packaging solutions to reduce medical waste and align with environmental goals.

Report Scope of U.S. Intravenous Solutions Market

| Report Coverage |

Details |

| Market Size in 2024 |

USD 5.56 Billion |

| Market Size by 2033 |

USD 11.02 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 7.9% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Type, Nutrients |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

U.S. |

| Key Companies Profiled |

Fresenius Kabi AG; Pfizer Inc.; Baxter; ICU Medical; Option Care Health Inc.; B. Braun Medical Inc |

Market Driver: Increasing Hospitalization and Surgical Procedures

A prominent driver for the U.S. intravenous solutions market is the rising number of hospitalizations and surgical procedures, both elective and emergency. As the U.S. population ages and comorbidities like diabetes, cardiovascular disease, and cancer become more prevalent, the demand for surgical and intensive care services has escalated. IV solutions are a cornerstone in these settings used to manage fluid and electrolyte imbalances, administer medications, support nutritional needs, and stabilize hemodynamic status.

Postoperative recovery and critical care units, in particular, rely heavily on parenteral fluids to maintain patient hydration, correct acid-base imbalances, and provide nutrition when gastrointestinal function is impaired. According to the CDC, over 50 million surgical procedures are performed annually in the U.S., and a substantial percentage of these cases require pre- and post-operative IV therapy. This steady volume, combined with increasing acuity in patient care, ensures sustained growth in demand for various IV formulations.

Market Restraint: Supply Chain Vulnerability and Product Recalls

Despite strong demand, the U.S. intravenous solutions market faces a significant restraint in the form of supply chain disruptions and periodic product recalls. The manufacturing and distribution of IV fluids depend on a complex, tightly regulated supply chain involving sterile production, rigorous quality testing, and cold chain logistics. Events such as natural disasters, regulatory shutdowns, or international raw material shortages can significantly impact product availability.

During the early phases of the COVID-19 pandemic, the country faced critical shortages of IV fluids, particularly saline and dextrose solutions. Even outside of crisis periods, several manufacturers have issued product recalls due to contamination risks, particulate matter, or incorrect labeling leading to disruptions in hospital workflows and patient care. These risks necessitate continuous investment in redundancy, quality control, and localized production capabilities, raising the overall cost of market participation.

Market Opportunity: Expansion of Personalized Parenteral Nutrition

A compelling opportunity in the U.S. IV solutions market lies in the expansion of personalized parenteral nutrition (PN), particularly for patients with chronic illnesses, gastrointestinal disorders, and oncology. Patients who are unable to tolerate enteral nutrition due to conditions like short bowel syndrome, Crohn’s disease, or cancer-related gastrointestinal dysfunction often require long-term PN therapy. The ability to tailor macronutrient ratios (carbohydrates, lipids, amino acids) and micronutrient content (vitamins and minerals) to a patient's metabolic status creates highly individualized treatment pathways.

Technological advancements such as computerized compounding, barcode verification, and automated nutrient calculators are making it easier for hospital pharmacies and compounding centers to prepare customized solutions with greater safety and precision. As healthcare providers increasingly shift toward nutrition as a core element of therapeutic care, especially in ICU and oncology, companies that offer modular, mix-on-demand, and patient-specific IV formulations will gain a competitive edge.

U.S. Intravenous Solutions Market By Type Insights

Total Parenteral Nutrition (TPN) dominated the U.S. intravenous solutions market due to its comprehensive application in supporting patients who require complete nutrition intravenously. TPN solutions contain all essential nutrients—carbohydrates, amino acids, lipids, electrolytes, vitamins, and trace elements—making them vital for individuals who cannot receive adequate nutrition via the gastrointestinal route. In the U.S., TPN is extensively used in critical care units, post-surgical care, oncology departments, and neonatal ICUs. It is also crucial for managing long-term conditions such as gastrointestinal failure, sepsis, and severe burns, where enteral nutrition is either insufficient or contraindicated.

In contrast, Peripheral Parenteral Nutrition (PPN) is emerging as the fastest-growing segment due to its use in short-term and less intensive nutritional interventions. PPN is often administered through peripheral veins and is suitable for patients with temporary dietary restrictions or mild gastrointestinal dysfunction. With the rise of outpatient and home care programs, especially for post-operative recovery and geriatric patients, PPN offers a flexible, cost-effective, and less invasive alternative to central-line TPN. Manufacturers are responding with ready-to-administer, low-osmolarity formulations ideal for ambulatory use, further accelerating growth.

U.S. Intravenous Solutions Market By Nutrients Insights

Carbohydrates are the dominant nutrient segment within IV solutions, primarily in the form of dextrose, which is widely used to provide energy in parenteral nutrition. Dextrose solutions are the backbone of fluid resuscitation, perioperative support, and critical care. In hospitals, 5% and 10% dextrose solutions are among the most frequently administered IV fluids due to their compatibility with various medications and their role in managing hypoglycemia, dehydration, and caloric supplementation.

Single-dose amino acids, however, represent the fastest-growing nutrient segment. As the role of protein in wound healing, immune function, and muscle preservation gains clinical recognition, the demand for parenteral amino acid formulations has surged, especially in ICUs and post-surgical care. Specialized amino acid mixtures are now used for patients with renal or hepatic impairment, where standard protein metabolism is altered. This niche but expanding demand for condition-specific amino acid infusions is fostering innovation and market differentiation in the nutrient segment.

Country-Level Analysis

In the U.S., the intravenous solutions market is robust and mature, characterized by extensive hospital utilization, strong regulatory oversight, and continuous innovation. Hospitals are the largest consumers, with IV fluids being a standard of care across emergency rooms, surgical wards, intensive care units, and oncology departments. Ambulatory infusion centers and home health agencies are also major drivers of demand, especially in managing chronic infections, nutritional deficiencies, and immune disorders.

The presence of major players like Baxter, ICU Medical, and B. Braun, coupled with FDA-enforced quality standards, ensures a high degree of product reliability and availability. State-level health programs and federal initiatives such as Medicare and Medicaid support broad access to IV therapies, albeit with price sensitivity. Growing investments in domestic manufacturing facilities and strategic distribution partnerships reflect the market’s focus on self-reliance and continuity of care, particularly in post-pandemic recovery and preparedness planning.

Some of the prominent players in the U.S. intravenous solutions market include:

- Fresenius Kabi AG

- Pfizer Inc.

- Baxter

- ICU Medical

- Option Care Health Inc.

- B. Braun Medical Inc

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. intravenous solutions market

Type

- Total Parenteral Nutrition (TPN)

- Peripheral Parenteral Nutrition (PPN)

Nutrients

- Carbohydrates

- Vitamins & Minerals

- Single-dose Amino Acids

- Parenteral Lipid Emulsion

- Others