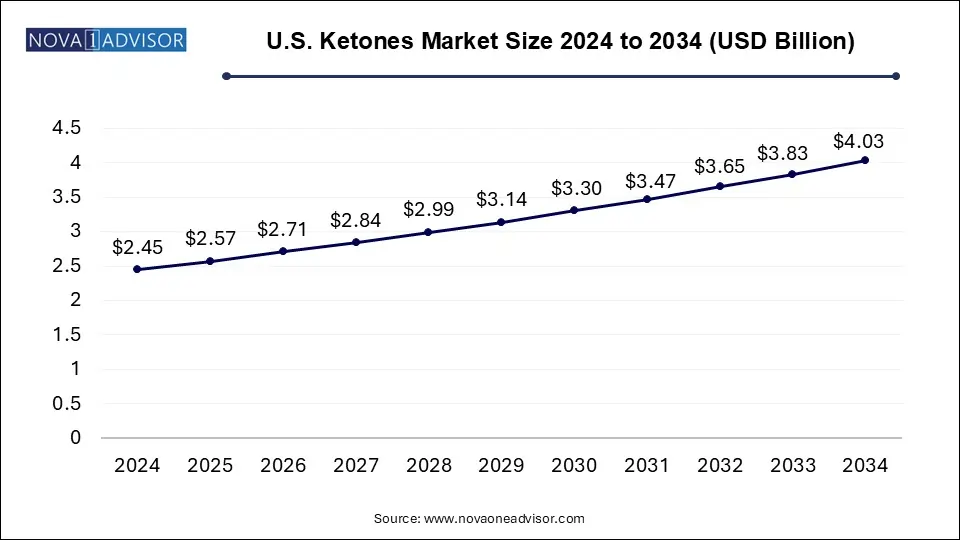

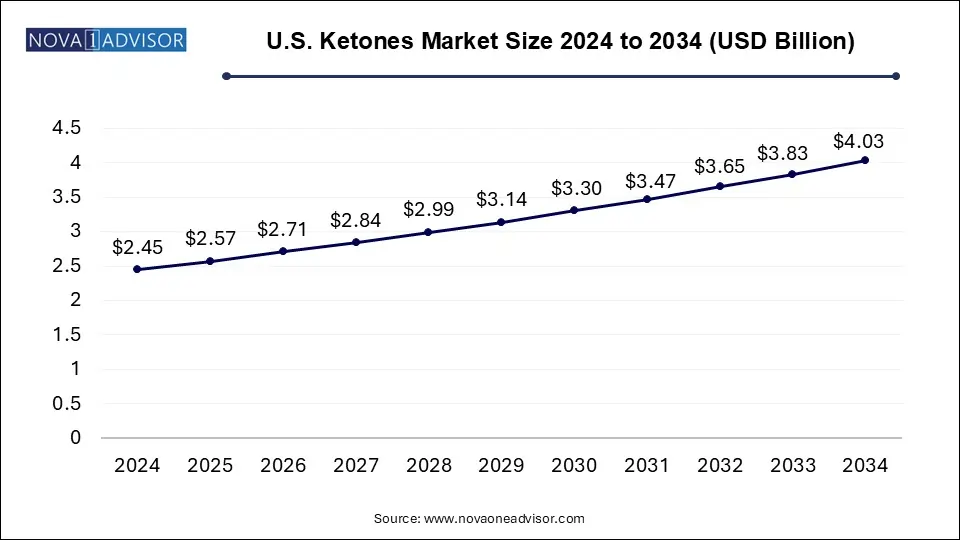

U.S. Ketones Market Size and Growth

The U.S. ketones market size was exhibited at USD 2.45 billion in 2024 and is projected to hit around USD 4.03 billion by 2034, growing at a CAGR of 5.1% during the forecast period 2025 to 2034.

U.S. Ketones Market Key Takeaways:

- The pharmaceuticals application segment dominated the U.S. Ketones market and accounted for the largest revenue share of 28.0% in 2024.

- The food & beverage segment is anticipated to register the fastest CAGR of more than 5.5% over the forecast period.

Market Overview

The U.S. ketones market is a dynamic and multi-faceted segment of the broader chemicals industry, characterized by the increasing utilization of ketones in various applications ranging from consumer products to industrial processes. Ketones, a class of organic compounds with a carbonyl group bonded to two hydrocarbon groups, are widely used as solvents, intermediates, and active ingredients. Acetone, methyl ethyl ketone (MEK), and diethyl ketone are among the most commonly used in commercial applications.

In the United States, ketones serve as essential chemicals in sectors such as cosmetics and personal care, pharmaceuticals, adhesives, food and beverages, and electroplating. Their roles range from acting as solvents in nail polish removers and paints to being used as metabolic supplements in nutritional and ketogenic products. The versatility of ketones, combined with the nation’s well-developed chemical manufacturing base and strong consumer demand for wellness and personal care products, makes the U.S. one of the most lucrative markets globally.

The post-pandemic recovery and the return of manufacturing to domestic soil have created new momentum in the chemical sector, including ketone production. Additionally, innovations in bio-based ketones and the rising popularity of ketogenic diets have opened new frontiers in the health and nutrition space. Government regulations under the U.S. EPA and FDA guide the safe usage of ketones in food, pharmaceuticals, and cosmetics, ensuring consumer and environmental safety.

With continuous research into sustainable ketone synthesis, improved supply chain capabilities, and an expanding number of applications, the U.S. ketones market is poised for sustained growth in the coming decade.

Major Trends in the Market

-

Growing Demand for Bio-Based Ketones: The push toward sustainability has encouraged manufacturers to invest in plant-derived ketones as an eco-friendly alternative to petrochemical sources.

-

Rising Use of Ketones in Ketogenic Supplements: Health-conscious consumers are increasingly turning to ketone esters and salts for energy, weight loss, and cognitive enhancement.

-

Expansion of Ketones in Personal Care Formulations: Ketones like acetone are key ingredients in skincare, nail products, and perfumes, fueling growth in the beauty sector.

-

Increased Industrial Use in Adhesives and Coatings: MEK and similar compounds are widely used in the production of industrial adhesives, lacquers, and paints.

-

Growth of Clean Label Food Additives: Food-grade ketones are being used in flavoring and preservation, aligning with clean-label movement trends in the U.S. food industry.

-

Advancements in Green Chemistry for Ketone Production: Research institutions and manufacturers are developing catalytic processes to synthesize ketones with reduced emissions.

-

Electroplating and Semiconductor Demand for High-Purity Ketones: Precision manufacturing sectors such as electronics require high-purity ketones for surface treatments and solvents.

Report Scope of U.S. Ketones Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 2.57 Billion |

| Market Size by 2034 |

USD 4.03 Billion |

| Growth Rate From 2025 to 2034 |

CAGR of 5.1% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

Application |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Key Companies Profiled |

BASF SE; Ineos; KetoLogic; Perfect Keto; KetoneAid; Sapien Products LLC; Boli LLC; Zenwise; Limitless Venture Group, Inc. |

Market Driver – Rising Adoption of Ketogenic Diets and Nutritional Supplements

One of the most prominent drivers in the U.S. ketones market is the booming demand from the health and wellness sector, particularly the rise of ketogenic diets and associated nutritional supplements. Ketones, especially exogenous variants like ketone esters and ketone salts, are consumed as dietary supplements to promote fat metabolism, enhance cognitive performance, and improve athletic endurance. The ketogenic diet, which emphasizes high fat and very low carbohydrate intake, triggers the body to produce ketones naturally creating a market for synthetic supplementation.

U.S. consumers, driven by a growing focus on fitness, longevity, and metabolic health, have shown strong interest in products that help achieve or maintain ketosis. This trend has catalyzed the growth of food and beverage manufacturers producing keto-friendly drinks, snacks, and supplements. Companies like HVMN, Prüvit, and KetoneAid are tapping into this consumer base by offering exogenous ketone-based beverages and capsules, often supported by lifestyle influencers and digital marketing. As more clinical studies validate the health benefits of ketones, demand is likely to accelerate further.

Market Restraint – Regulatory and Safety Challenges in Industrial Ketone Use

Despite its strong market potential, the U.S. ketones industry faces notable challenges, particularly in the regulation and safe handling of industrial ketones like MEK, acetone, and cyclohexanone. These substances are classified as volatile organic compounds (VOCs) and flammable solvents, posing risks during production, storage, and transportation. MEK, for instance, is regulated under the Clean Air Act due to its ozone-forming potential and requires strict air emission controls.

Additionally, worker exposure to high concentrations of industrial ketones can lead to health complications, including skin and respiratory irritation. The Occupational Safety and Health Administration (OSHA) and the Environmental Protection Agency (EPA) enforce stringent workplace exposure limits and chemical disposal protocols, which raise compliance costs and create operational complexities for manufacturers and end-users alike. These regulatory pressures can slow the adoption of ketones in new applications and limit the number of market entrants.

Market Opportunity – Expansion of Ketones in Sustainable Chemical Manufacturing

A significant opportunity in the U.S. ketones market lies in the development and commercialization of sustainable, bio-based ketones for use in green chemistry applications. As regulatory scrutiny over petrochemicals intensifies, and as industries aim to lower their carbon footprint, bio-derived ketones offer a viable and attractive alternative. These ketones are produced using fermentation or catalytic conversion of renewable biomass sources, offering lower environmental impact.

Startups and chemical giants alike are investing in pilot plants and R&D focused on bio-acetone, bio-MEK, and other renewable ketone variants. These compounds can serve as solvents, intermediates, or active ingredients in environmentally friendly adhesives, inks, and coatings. Furthermore, consumer brands are increasingly interested in sourcing ingredients from sustainable supply chains—creating incentives for upstream manufacturers to innovate. With government incentives supporting bio-based manufacturing, this opportunity holds transformative potential for the U.S. ketones industry.

U.S. Ketones Market By Application Insights

The cosmetics and personal care segment dominated the U.S. ketones market, fueled by widespread use of acetone, diacetyl, and other aromatic ketones in product formulations. Acetone remains a key ingredient in nail polish removers, while aromatic ketones like benzophenone are commonly used as UV filters and fragrance enhancers in sunscreens, perfumes, and lotions. The U.S. beauty and personal care industry, valued at over $100 billion annually, continues to expand, creating robust demand for ketone-based raw materials. Moreover, consumer preference for quick-drying, non-greasy cosmetic formulations makes ketones essential as high-performance solvents.

Food and beverages represent one of the fastest-growing application segments, particularly due to the rise in clean-label flavoring agents and ketogenic dietary products. Certain ketones like diacetyl are used as flavor enhancers in dairy and snack items, while exogenous ketone supplements are increasingly found in health drinks and energy bars. U.S. consumers seeking cognitive health and weight management support have driven growth in ketone-infused beverages. Additionally, the focus on natural, non-synthetic food ingredients has led to innovation in fermentation-derived ketones for safe consumption.

Pharmaceuticals also represent a critical application area, with ketones used as intermediates in the synthesis of various drugs, especially antibiotics and steroids. Acetone is a common solvent in pharmaceutical-grade preparations, while ketone bodies are being researched for therapeutic use in neurodegenerative diseases like Alzheimer's and epilepsy. The strength of the U.S. pharma industry ensures continued demand for high-purity ketones, especially with growing emphasis on domestic API (active pharmaceutical ingredient) production.

Adhesives and chemical manufacturing are strong industrial segments, using ketones like MEK for their excellent solvency and evaporation rates. MEK-based adhesives are employed in construction, automotive assembly, and furniture, where fast bonding and clean finishes are necessary. With the push for environmentally safe and high-performance adhesives, ketones remain relevant due to their compatibility with various resins and polymers.

Electroplating applications are witnessing niche but growing demand, especially in precision industries like electronics and automotive, where ketones are used in surface cleaning and metal treatment processes. As advanced manufacturing grows, this segment is expected to steadily expand.

Country-Level Analysis – United States

Within the U.S., the ketones market reflects a well-distributed industrial landscape, supported by advanced research capabilities, high consumer awareness, and a regulatory environment that encourages product innovation while enforcing safety. States like Texas and Louisiana play a major role in ketone production due to their petrochemical complexes. Meanwhile, California and New York are leading consumers due to their strong personal care, nutrition, and biotech markets.

The U.S. also stands at the forefront of ketogenic dietary innovation, with hundreds of startups and wellness companies promoting ketone-infused products. Educational institutions like MIT and Stanford are conducting groundbreaking research into therapeutic applications of ketones. The interplay between industrial-scale production and health-focused consumer demand makes the U.S. market both complex and highly lucrative.

Further, U.S. legislation supporting biobased chemical manufacturing—such as the BioPreferred Program and tax incentives under the Inflation Reduction Act is encouraging the development of renewable ketones, particularly in states like Iowa and Minnesota with access to biomass.

Some of the prominent players in the U.S. ketones market include:

U.S. Ketones Market Recent Developments

-

April 2025 – HVMN Inc. launched its next-generation ketone drink “Ketone-IQ Pro” targeting endurance athletes and military personnel. The product is based on improved ketone ester technology and is manufactured in California.

-

February 2025 – ExxonMobil Chemical announced a partnership with a Midwest bio-manufacturer to develop a pilot facility for bio-MEK production using corn stover, highlighting a shift toward sustainable ketones.

-

January 2025 – Eastman Chemical Company expanded its Tennessee plant to increase acetone production capacity by 12%, driven by rising demand from personal care and pharmaceuticals.

-

November 2024 – KetoneAid entered the functional beverage retail market with its ketone-based drinks placed in Whole Foods stores across the U.S., capitalizing on consumer interest in metabolic health.

-

September 2024 – BASF Corporation developed a new high-purity methyl isobutyl ketone (MIBK) grade for electronics and specialty coatings, targeting the U.S. semiconductor sector.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the U.S. ketones market

By Application

- Cosmetics & Personal Care

- Food & Beverages

- Pharmaceuticals

- Adhesives

- Chemical Manufacturing

- Electroplating

- Others