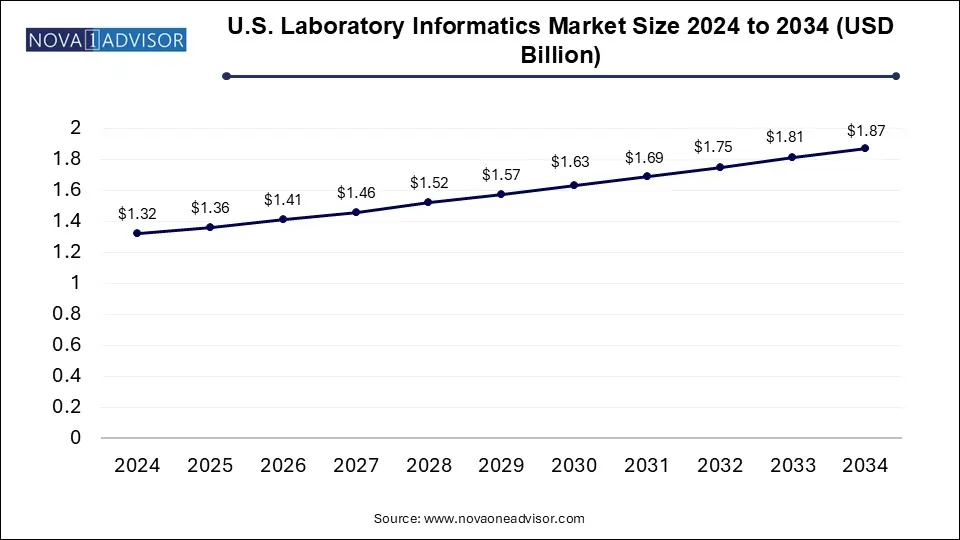

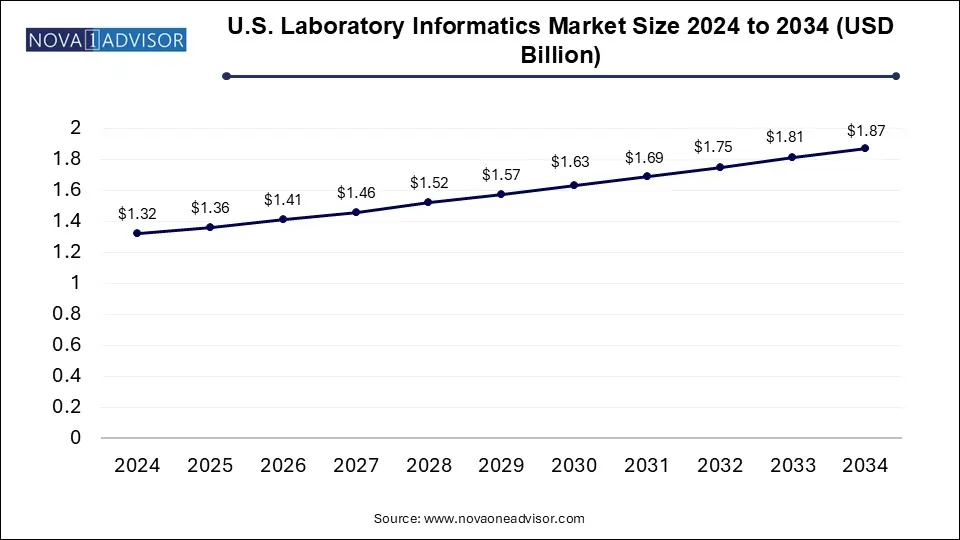

The U.S. laboratory informatics market size was exhibited at USD 1.32 billion in 2024 and is projected to hit around USD 1.87 billion by 2034, growing at a CAGR of 3.6% during the forecast period 2025 to 2034.

- The LIMS segment accounted for the largest revenue share of more than 45.0% in 2024 and is expected to witness lucrative growth over the forecast period.

- Enterprise Content Management (ECM) is anticipated to exhibit noteworthy growth over the forecast period.

- The cloud-based solutions segment accounted for the largest revenue share of more than 40.00% in 2024

- The services segment dominated the market in 2024.

- The life sciences end-use segment accounted for the largest share of more than 28.0% in 2024.

Market Overview

The U.S. laboratory informatics market has emerged as a critical pillar in the digital transformation of laboratory operations across the country. As laboratories across industries such as life sciences, healthcare, petrochemicals, food and agriculture, and environmental testing face mounting pressure to improve efficiency, ensure regulatory compliance, and enhance data integrity, the demand for advanced informatics solutions has surged. Laboratory informatics refers to the integration of platforms and tools that streamline data collection, analysis, storage, sharing, and reporting in lab environments, including Laboratory Information Management Systems (LIMS), Electronic Lab Notebooks (ELN), Scientific Data Management Systems (SDMS), and more.

Digitalization in U.S. laboratories is no longer optional—it is a strategic imperative. Whether it’s a clinical laboratory managing large volumes of COVID-19 test data or a pharmaceutical R&D center managing proprietary drug discovery information, laboratory informatics platforms offer end-to-end visibility, real-time analytics, and process standardization. The U.S., with its globally leading biotechnology, healthcare, and research ecosystem, is at the forefront of this transformation, supported by robust investments in health IT, regulatory mandates from bodies like the FDA and EPA, and growing reliance on high-throughput technologies.

The pandemic further accelerated the shift to electronic workflows, remote access capabilities, and interoperability solutions, pushing institutions to adopt or upgrade their informatics infrastructure. Today, laboratory informatics platforms in the U.S. are expected to evolve from basic data management tools to AI-integrated, cloud-enabled solutions that support predictive modeling, compliance automation, and multi-location data harmonization.

Major Trends in the Market

-

Cloud-Based Deployment Surge: The shift from on-premise to cloud-hosted laboratory informatics systems is accelerating due to scalability, remote access, and cost-efficiency.

-

AI and Machine Learning Integration: Platforms are increasingly embedding AI tools for predictive analytics, anomaly detection, and automated quality control.

-

Data Interoperability and Integration: Demand is growing for informatics systems that integrate seamlessly with instruments, ERP systems, and electronic health records (EHRs).

-

Compliance-Driven Adoption: Regulatory compliance (21 CFR Part 11, CLIA, HIPAA) is pushing laboratories to upgrade to more robust, auditable systems.

-

Rise of Modular Informatics Solutions: Modular, customizable platforms are gaining popularity to meet specialized workflows across diverse lab environments.

-

Increasing Role of SaaS Models: Software-as-a-Service delivery models are reducing total cost of ownership and speeding up implementation timelines.

-

Expansion into Non-Traditional Sectors: Informatics adoption is increasing in industries like petrochemicals, food safety, and environmental science.

| Report Coverage |

Details |

| Market Size in 2025 |

USD 1.36 Billion |

| Market Size by 2034 |

USD 1.87 Billion |

| Growth Rate From 2025 to 2034 |

CAGR of 3.6% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

Product, Delivery Mode, Component, End-use |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Key Companies Profiled |

Thermo Fisher Scientific, Inc.; Waters; LabWare; Core Informatics; LabVantage Solutions, Inc.; LabLynx, Inc.; PerkinElmer Inc.; Abbott; Agilent Technologies, Inc.; IDBS |

Market Driver: Regulatory Pressure and Quality Assurance Mandates

A significant driver of the U.S. laboratory informatics market is the intensifying regulatory landscape that governs data integrity, traceability, and quality assurance in lab operations. Federal bodies such as the Food and Drug Administration (FDA), Environmental Protection Agency (EPA), Centers for Medicare & Medicaid Services (CMS), and the Department of Agriculture (USDA) enforce strict compliance standards that require detailed record-keeping, data security, and procedural consistency.

In life sciences and clinical research, regulations like 21 CFR Part 11 and GxP (Good Laboratory/Clinical/Manufacturing Practices) necessitate the use of validated informatics platforms that ensure audit trails, electronic signatures, and real-time monitoring. In environmental testing, EPA regulations such as SW-846 and NELAC standards mandate thorough documentation and quality control protocols.

As labs struggle with the volume and complexity of modern data, manual processes simply cannot meet these regulatory standards. Laboratory informatics solutions enable automated compliance reporting, real-time alerts for out-of-spec data, and centralized dashboards that make regulatory audits more transparent and efficient. This makes informatics not only a tool for productivity but a necessity for operational legitimacy in regulated sectors.

Market Restraint: High Implementation Costs and System Complexity

Despite the clear advantages, the adoption of laboratory informatics systems in the U.S. continues to face resistance due to the high initial investment and complexity of implementation. Advanced systems like LIMS or ELN often require significant customization to align with unique workflows, data formats, and compliance requirements of each lab. These customizations demand professional consulting, extended timelines, and IT infrastructure overhauls, all of which contribute to a high total cost of ownership.

Small and mid-sized labs, particularly those in academic institutions or standalone diagnostic centers, may find it difficult to justify these costs or manage the technical burden. Moreover, integrating informatics systems with legacy lab instruments, ERP solutions, or EHRs can be technically challenging and time-consuming. The lack of standardized APIs or data exchange formats exacerbates this issue.

While cloud-based and SaaS models are helping to reduce some of these barriers, the perception of cost and complexity continues to deter full-scale adoption in parts of the market, particularly outside the well-funded pharmaceutical and healthcare sectors.

Market Opportunity: Expansion of Precision Medicine and Genomic Testing

One of the most promising opportunities for the U.S. laboratory informatics market lies in the rapid expansion of precision medicine and genomic testing. With advances in next-generation sequencing (NGS), companion diagnostics, and biomarker discovery, laboratories are generating massive volumes of complex data that must be processed, stored, and analyzed with high fidelity and speed.

Informatics platforms are essential for managing these datasets—facilitating secure data exchange, variant annotation, and longitudinal data tracking. For instance, molecular diagnostics labs working with oncology data require real-time integration with electronic medical records (EMRs), clinical trial databases, and biobank repositories. Laboratory informatics platforms tailored for genomic workflows can integrate AI to support clinical decision-making and improve patient outcomes.

The U.S. government's continued investment in personalized medicine, such as the NIH’s All of Us research program, coupled with the growing adoption of at-home genetic tests and decentralized clinical trials, is creating a fertile ground for informatics vendors to offer tailored solutions. This marks a significant commercial and technological opportunity for both established players and specialized startups.

LIMS continues to dominate the U.S. laboratory informatics market, owing to its versatility, automation capabilities, and strong foothold in regulated industries. LIMS platforms manage everything from sample tracking and test results to inventory and compliance documentation. Their adaptability makes them the backbone of informatics in pharmaceutical R&D labs, contract research organizations (CROs), and diagnostic centers. Most LIMS solutions in the U.S. are evolving to support modular add-ons, cloud deployment, and mobile access, further reinforcing their dominance.

Electronic Lab Notebooks (ELNs), meanwhile, are the fastest-growing product segment. ELNs enable researchers to capture, store, and share lab notes, experimental protocols, and observations in digital formats, replacing paper notebooks. ELNs have gained traction in academic research institutes and biotech startups where collaboration, data reproducibility, and IP protection are critical. Modern ELNs also integrate AI-powered search, image capture, and version control, making them indispensable for real-time data documentation in dynamic research environments.

On-premise systems have historically led the U.S. market due to data control, customization, and perceived security benefits, especially in pharmaceutical and government labs. Many legacy installations still run on-site servers, with IT teams maintaining and updating the systems regularly. This model remains strong in organizations with stringent data privacy or internal governance policies.

However, cloud-based delivery is emerging as the fastest-growing segment. The flexibility, lower upfront cost, and scalability of cloud-hosted systems are highly appealing, particularly for small and mid-sized labs. Cloud solutions offer remote access, faster deployment, and seamless updates. Vendors like LabVantage, LabWare, and Thermo Fisher have introduced cloud-native or hybrid offerings to meet rising demand. The cloud trend aligns well with the broader push toward digital health and tele-research.

Software components hold the largest share of the U.S. laboratory informatics market, as they form the core functionality enabling automation, data capture, compliance, and analytics. These include LIMS, ELN, SDMS, and other platforms that are typically licensed or subscribed to based on user count or modules. As AI, ML, and data visualization capabilities improve, the software aspect of informatics continues to expand in complexity and value.

Services are growing rapidly, driven by demand for system integration, training, validation, support, and migration. Many laboratories seek assistance in mapping their workflows into the software, ensuring regulatory compliance, and managing change. Vendors offering comprehensive services from consulting to managed hosting are better positioned to build long-term client relationships, particularly in regulated or high-stakes environments like clinical trials and petrochemical labs.

Pharmaceutical and biotechnology companies are the largest users of laboratory informatics in the U.S., due to their need for GxP compliance, IP protection, and efficient R&D operations. Informatics platforms help streamline workflows from drug discovery to clinical development and manufacturing. They also enable effective data governance, audit readiness, and cross-departmental collaboration, which is essential in large enterprise environments.

Academic research institutes are among the fastest-growing end-users, as public and private funding for translational and biomedical research grows. These institutions require flexible, user-friendly, and often cloud-hosted solutions to manage large-scale research data. ELNs and cloud-based LIMS are increasingly adopted in research labs to enable collaboration among researchers and institutions. The pandemic underscored the importance of digitization in university labs, which are now prioritizing informatics in their IT budgets.

Country-Level Analysis

As the sole country under study, the United States represents the world’s most mature and diverse laboratory informatics market. It benefits from a concentration of leading pharmaceutical companies, biotech startups, CROs, clinical labs, and world-renowned academic institutions. Federal funding through the NIH, NSF, BARDA, and other agencies ensures a steady flow of resources into laboratory modernization projects.

The U.S. also sets the standard for global compliance frameworks. FDA, EPA, and other agencies frequently influence international regulations, making U.S.-based informatics vendors highly competitive worldwide. Industry clusters in Boston, San Diego, San Francisco, and Research Triangle Park are hotspots for informatics innovation, attracting new startups and partnerships with universities and health systems.

Recent Developments

-

March 2025: LabVantage Solutions launched its next-gen cloud-native LIMS platform with integrated AI for sample tracking and predictive workflow optimization.

-

February 2025: Thermo Fisher Scientific acquired a Boston-based startup specializing in genomic data integration to expand its informatics capabilities for precision medicine.

-

January 2025: LabWare rolled out its web-based ELN upgrade with enhanced collaboration tools and mobile support for academic and government research labs.

-

December 2024: STARLIMS Corporation (Abbott Informatics) secured a contract with a major U.S. environmental testing agency to digitize and harmonize multi-site lab operations.

-

November 2024: Agilent Technologies announced a strategic partnership with Amazon Web Services (AWS) to offer scalable cloud deployment of its laboratory informatics suite.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the U.S. laboratory informatics market

By Product

- Laboratory Information Management Systems (LIMS)

- Electronic Lab Notebooks (ELN)

- Scientific Data Management Systems (SDMS)

- Laboratory Execution Systems (LES)

- Electronic Data Capture (EDC) & Clinical Data Management Systems (CDMS)

- Chromatography Data Systems (CDS)

- Enterprise Content Management (ECM)

By Delivery Mode

- On-Premise

- Web-hosted

- Cloud-based

By Component

By End-use

-

- Pharmaceutical and Biotechnology Companies

- Biobanks/Biorepositories

- Contract Services Organizations

- Molecular Diagnostics & Clinical Research Laboratories

- Academic Research Institutes

- CROs

- Petrochemical Refineries & Oil and Gas

- Chemical Industry

- Food and Beverages and Agriculture

- Environmental Testing Labs

- Other Industries