U.S. Liquid Biopsy Market Size and Trends

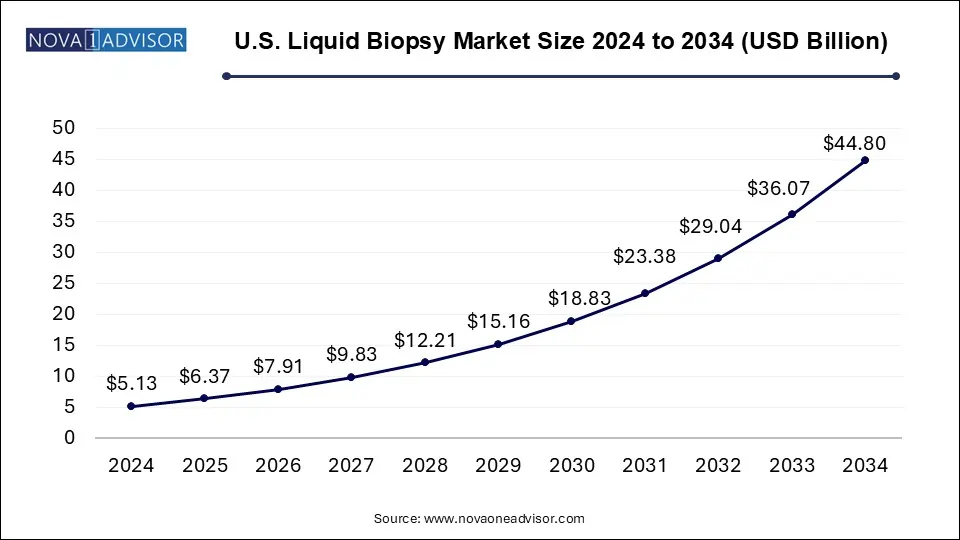

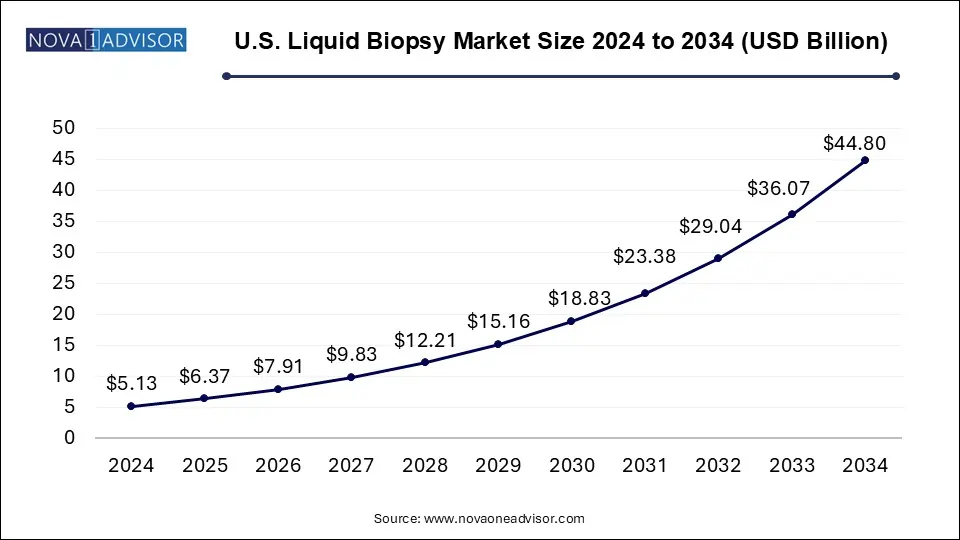

The U.S. liquid biopsy market size was valued at USD 5.13 billion in 2024 and is expected to be worth around USD 44.80 billion by 2034, growing at a CAGR of 24.2% during the forecast period from 2025 to 2034. The U.S. liquid biopsy market is driven by technological advancements, the latest innovations, and government initiatives.

U.S. Liquid Biopsy Market Key Takeaways

- By biomarker-type insight, The CTC segment dominated the market in 2024.

- By sample insight, the blood samples segment dominated the market.

- By application insight, the cancer segment dominated the market in 2024.

- End-User Insights, the laboratories segment dominated the market.

Report Scope of U.S. Liquid Biopsy Market

Market Overview

The liquid biopsy market is a classification of the non-invasion diagnostic methods identified by the use of biomolecules such as DNA, RNA, and protein in evaluating bodily fluids to detect and monitor diseases, specifically cancers. This process involves the collection of fluid samples and the analysis of tumor-derived biomarkers such as ctDNA, CTCs, and exosomes.

Liquid biopsies are the least invasive, repeatable with ease, and able to detect the disease in an earlier stage, thus enabling intervention and personalized treatment. Liquid biopsy technology is widely applied for the diagnosis of cancers, monitoring their progression, and making decisions for targeted therapies based on genetic mutations. The market is growing due to advances in technology, the demand for early cancer detection procedures, and better acceptance of personalized medicine.

Market Trends

- Rising Adoption of Liquid Biopsy for Early Cancer Detection: Liquid biopsy is now used for early cancer screening and diagnosis. ctDNA and CTCs detection improve its accuracy.

- Advances in Next-Generation Sequencing and AI Integration: Next Generation Sequencing (NGS) paired with AI always improves the sensitivity and specificity of the tests for liquid biopsies.

- Further applications outside oncology: The avenues to liquid biopsy expand to include prenatal testing, monitoring in transplantation plus neurodegenerative diseases.

- Increased Preference to Blood-Based Liquid Biopsies: The biopsies using urine and saliva are also getting their focus because they are invasive and have great potential for disease monitoring.

- Increase in Personalized Medicine: Liquid biopsy has become central in precision oncology, such as monitoring responses for therapeutic intervention and guiding targeted therapies.

Adoption of AI in Liquid biopsy paves the way for market growth

The emerging future of AI in liquid biopsy is expected to create new avenues in cancer diagnostics, treatment monitoring, and personalized medicine. As machine learning algorithms evolve, they will work to increase the sensitivity and specificity of liquid biopsy tests now able to discern complex biomarker patterns. AI technologies will permit real-time analyses of circulating tumor DNA, CTCs, and extracellular vesicles, creating opportunities for early detection of cancer and monitoring of minimal residual disease. With AI incorporation in multi-omics data, we will be able to offer highly personalized and predictive diagnostics. Allowing the AI to further refine and improve the interpretation of biomarkers will push liquid biopsies into an affordable alternative to tissue biopsies, which will render a plausible full-scale acceptance of liquid biopsy in the clinical domain.

Low sensitivity hampering the growth of the market

Potentially a game-changer in the non-invasive diagnosis sphere, liquid biopsy falls short of universal clinical applicability because of certain obstacles. The first challenge is low sensitivity; the circulating tumor DNA (ctDNA) in the bodies' fluids and the other biomarkers are usually found in extremely low concentrations, thus making it more difficult to identify them than their traditional counterparts, tissue biopsies. There is a need to enhance sensitivity either by improving methodologies including next-generation sequencing (NGS) or by optimizing the extraction methods of ctDNA.

Another challenge with liquid biopsy is limited specificity, as certain genetic alterations detected in circulating free DNA (cfDNA) may not be cancer-exclusive. This might lead to false positives and uncertainties related to the diagnosis. Increased analytical variability may also be due to errors during sample acquisition, handling, and analysis; this emphasizes the need for standardized protocols and strict quality control systems.

Country-level Analysis:

The U.S. liquid biopsy market is driven by factors like technological advancements, increased demand for non-invasive diagnostic tools, and rising prevalence of cancer. Liquid biopsies are still gaining traction for early cancer detection along with therapy selection and treatment monitoring, particularly circulating tumor DNA tests. Other possible applications would be automation systems and personalized medicine, among many other factors, such as real-time data on the progression of tumors. Prominent players in this sector include Natera, QIAGEN, Illumina, Thermo Fisher Scientific, and Guardant Health. Future growth is expected to stem from increased adoption, falling prices, and the advance of early detection of cancer.

Segment analysis

U.S. Liquid Biopsy Market By Biomarker Type Insights

The CTC segment dominated the U.S. liquid biopsy market in 2024, due to its predictive and prognostic biomarker activities for different cancer types. Increasing ctDNA segment growth is attributed to its potential application in mutation detection, monitoring treatment response, and early detection of cancer. An increase in the adoption of liquid biopsy for personalized cancer therapy and rapid technological advancements in next-generation sequencing and PCR are expected to drive further market growth.

U.S. Liquid Biopsy Market By Sample Insights

The U.S. liquid biopsy market has been segmented based on an examination involving blood and urine samples. The blood samples segment dominated the market, because of their ease of collection, minimal invasiveness, as well as the capability to detect multiple biomarkers. Blood-based biopsies are quick and cheap diagnostic tools. And urine-based biopsies, which have proven their worth in the noninvasive nature and much higher compliance among patients, make them the perfect choice regarding regularly monitoring patients with cancer, especially urothelial.

U.S. Liquid Biopsy Market By Application Insights

By application insight, the cancer segment dominated the market in 2024. Increasing cancer incidences and enhanced research in early detection may boost growth in the liquid biopsy market in the U.S. Cancer is diagnosed and monitored non-invasively by liquid biopsy ctDNA tests, which help in better early-stage detection and a reduction in mortality rates. Personalized treatment with real-time monitoring of the disease allows for greater effectiveness in cancer care. As research continues, the expanding role of liquid biopsy tests will go further to improve patient outcomes.

U.S. Liquid Biopsy Market By End-User Insights

The U.S. liquid biopsy market consists of major components such as hospitals, laboratories, and academic research centers, with laboratories accounting for the largest share of the market. The growth of this industry is on account of outsourcing specialty labs along with the emergence of cancer specialty care centers in developing areas. The improvement will be in the integration of these technologies within hospitals and research centers for early detection of cancer, its personalized treatment, and improved patient outcomes due to advances in liquid biopsy technology.

U.S. Liquid Biopsy Market Companies

- ANGLE plc, Biocept Inc.

- Bio-Rad Laboratories Inc.

- Epigenomics AG

- Exact Sciences Corporation

- F. Hoffmann-La Roche AG

- Guardant Health Inc.

- Illumina Inc.

- MDxHealth SA

- Menarini Silicon Biosystems

- QIAGEN N.V.

- Thermo Fisher Scientific Inc.

U.S. Liquid Biopsy Market By Recent developments

- In October 2024, Shield is the world's first blood test assigned by FDA approval for primary screening for people at average risk for colon cancer. The test takes up changes in cell-free DNA in the blood as indications of tumors or precancerous growths in the colon. The test caught colorectal cancers in over 83% of the participants, but its detection for precancerous growths was just 13%.

- In September 2024, A cloud-native healthcare technology company, SOPHiA GENETICS partnered with AstraZeneca to aid in the acceleration of the global launch of its MSK-ACCESS® liquid biopsy test.

- In May 2024, The FDA granted an official breakthrough designation to the Mercy BioAnalytics' Mercy Halo Ovarian Cancer Screening Test, a minimally invasive liquid biopsy for ovarian cancer detection in asymptomatic premenopausal women.

Segments Covered in the Report

By Biomarker Types

- Circulating Tumor Cells (CTCs)

- Circulating Tumor DNA (CTDNA)

- Extracellular vesicles (EVS)

- Other Biomarkers

By Application

- Cancer Therapeutic Application

- Reproductive Health

- Other Therapeutic Application

By Sample

- Blood Sample

- Urine Sample

- Other

By End User

- Hospitals and Laboratories

- Academic and Research Centers

- Other End Users