U.S. Long-acting Contraception Market Size and Trends

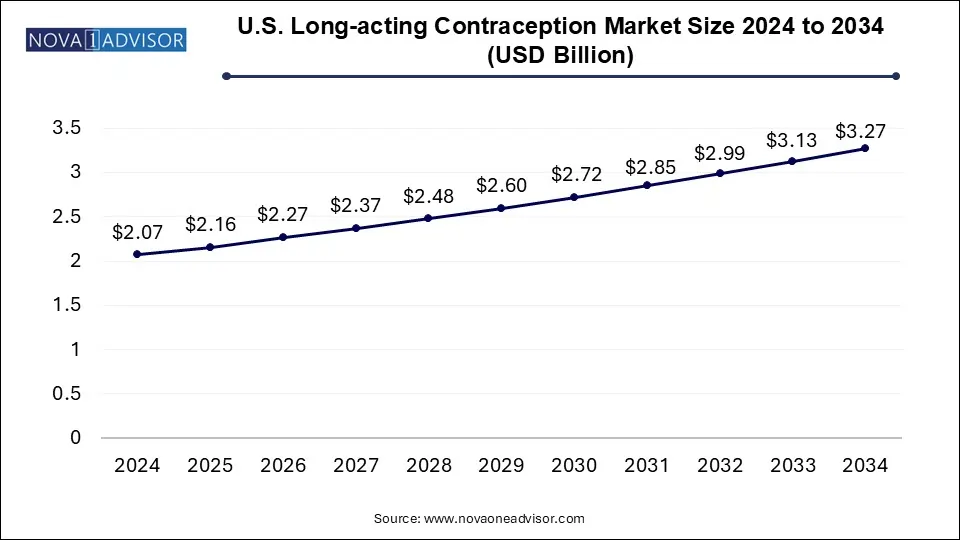

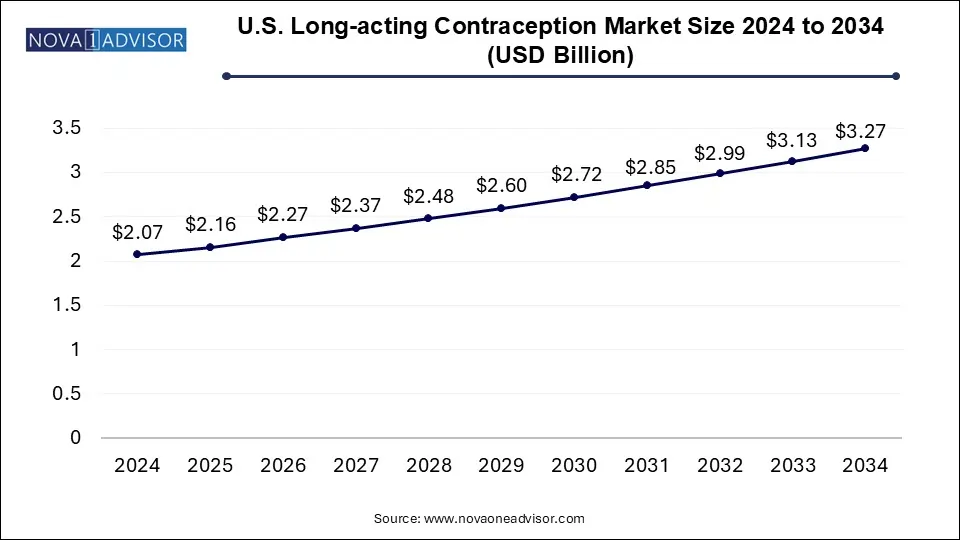

The U.S. long-acting contraception market size was exhibited at USD 2.07 billion in 2024 and is projected to hit around USD 3.27 billion by 2034, growing at a CAGR of 4.71% during the forecast period 2025 to 2034.

U.S. Long-acting Contraception Market Key Takeaways:

- The IUD segment accounted for the largest market share of over 61.0% in 2024.

- The subdermal implants segment is projected to witness the second-fastest CAGR during the forecast period.

Market Overview

The U.S. long-acting contraception market has emerged as a critical segment of the broader reproductive healthcare landscape, driven by increasing awareness, greater access to family planning resources, and a shift toward reliable, low-maintenance birth control options. Long-acting reversible contraceptives (LARCs), which include intrauterine devices (IUDs), subdermal implants, and injectable contraceptives, offer effective, long-term solutions without requiring daily adherence. As a result, LARCs are particularly popular among young adults, women seeking delayed pregnancy, and populations facing access barriers to short-term contraceptive supplies.

According to the Centers for Disease Control and Prevention (CDC), LARC use among U.S. women has risen steadily over the last decade. Their appeal stems not only from convenience and effectiveness—often exceeding 99%—but also from fewer side effects, decreased user error, and a lower long-term cost compared to oral contraceptives or barrier methods. Moreover, organizations such as the American College of Obstetricians and Gynecologists (ACOG) have publicly endorsed LARCs as a first-line contraceptive option for adolescents and adults alike, further legitimizing their use across demographics.

The U.S. market is also shaped by public policy dynamics, reproductive rights advocacy, and healthcare reimbursement structures. Government initiatives like Title X and Medicaid expansion in several states have helped broaden access to these methods, although disparities remain. Meanwhile, shifts in reproductive health legislation continue to influence usage patterns and provider outreach strategies. Overall, the long-acting contraception market in the U.S. is positioned at the intersection of technological innovation, social empowerment, and evolving healthcare policy.

Major Trends in the Market

-

Surging Preference for Hormonal IUDs Among Adolescents and Young Adults: Enhanced safety profiles and extended effectiveness are making hormonal IUDs a leading choice for younger demographics.

-

Increased Use of LARCs in Postpartum Contraception: Hospitals and birthing centers are integrating LARC placement immediately post-delivery, improving access for new mothers.

-

Growing Demand for Injectable Contraceptives in Underserved Populations: Injectable options offer a discreet, temporary, and low-maintenance solution in both urban and rural low-income settings.

-

Technological Advancements in Implantable Devices: Innovations such as biodegradable implants and next-generation hormonal delivery systems are expanding product portfolios.

-

Policy and Coverage Expansion through Medicaid and Title X Programs: Subsidized access to LARCs is supporting broader uptake across socioeconomically disadvantaged populations.

Report Scope of U.S. Long-acting Contraception Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 2.16 Billion |

| Market Size by 2034 |

USD 3.27 Billion |

| Growth Rate From 2025 to 2034 |

CAGR of 4.71% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

Product |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Key Companies Profiled |

Merck & Co., Inc.; Pfizer Inc.; The Cooper; Allergan (AbbVie Inc.); Bayer AG |

Key Market Driver: Growing Awareness and Endorsement by Medical Bodies

A primary driver propelling the U.S. long-acting contraception market is the increasing endorsement of LARCs by major health organizations and a growing awareness among healthcare providers and patients alike. Multiple professional bodies, including the ACOG and the CDC, have recommended IUDs and implants as first-line contraceptive options, particularly for teens and women who want effective, long-term pregnancy prevention without daily management.

Increased access to education through public health campaigns, OB/GYN counseling, and digital platforms has helped dispel myths about IUDs and implants, especially surrounding concerns about safety and fertility impact. The growing familiarity with and trust in LARC methods has led to a significant uptick in use—particularly hormonal IUDs like Mirena or Liletta, which offer up to 7 years of protection and also reduce heavy menstrual bleeding. Clinics and family planning centers are now more routinely offering LARC options alongside traditional birth control, driving demand and improving overall contraceptive outcomes in the U.S.

Key Market Restraint: High Upfront Costs and Insurance Barriers

Despite long-term cost-effectiveness, the U.S. long-acting contraception market continues to face a major restraint in the form of high initial out-of-pocket expenses for uninsured or underinsured individuals. Although federal programs and the Affordable Care Act (ACA) have significantly improved access, many private insurance plans still impose cost-sharing on contraceptive services or limit coverage to specific brands.

The upfront cost of an IUD insertion, for instance, can exceed $1,000 including consultation, the device, and the procedure itself—making it prohibitive for many women, especially those in the gig economy or without stable healthcare benefits. Moreover, logistical and administrative barriers such as prior authorization, billing complexity, and inconsistent provider availability further hinder market growth. These challenges underscore the need for more uniform insurance policies and transparent coverage guidelines to fully unlock the potential of LARC utilization.

Key Market Opportunity: Expansion of Over-the-Counter and Self-Administered Options

An exciting opportunity lies in the expansion of over-the-counter (OTC) and self-administered long-acting contraception options. With advancements in pharmaceutical formulation and device design, companies are exploring ways to bring injectable and subdermal contraceptive solutions closer to the consumer—outside of traditional clinical settings. The approval of self-injectable depot medroxyprogesterone acetate (DMPA-SC), for example, has allowed women to administer contraceptives at home every 3 months, offering both convenience and privacy.

This trend aligns with broader shifts toward telehealth, home healthcare, and patient autonomy. Increasing consumer demand for self-care, combined with FDA and state-level interest in expanding OTC access, creates fertile ground for the next wave of innovation in the LARC space. Pharmaceutical companies and device developers investing in simplified, user-friendly, and low-cost delivery systems are poised to gain a competitive advantage in this evolving market.

U.S. Long-acting Contraception Market By Product Insights

Intrauterine Devices (IUDs) dominated the U.S. long-acting contraception market due to their superior efficacy, longevity, and clinical endorsement. IUDs—especially hormonal variants—offer long-term pregnancy prevention ranging from 3 to 10 years with a one-time procedure. Hormonal IUDs like Mirena, Skyla, and Liletta are widely prescribed for their dual benefits of contraception and menstrual regulation. These devices have seen increasing adoption in both public health programs and private practices. Moreover, their safety and suitability for a broad age range have made them a first-line choice for OB/GYNs, resulting in a well-established user base across the U.S.

Hormonal IUDs specifically are also the fastest-growing sub-segment under this category. Their ability to provide consistent hormone release, reduce menstrual pain, and offer effective endometrial management has broadened their appeal. Unlike nonhormonal options, which rely solely on copper’s spermicidal properties, hormonal IUDs serve dual therapeutic and contraceptive roles. Ongoing improvements in device insertion techniques, along with the introduction of lower-dose formulations, have made them more comfortable and accessible, especially for nulliparous women. Furthermore, federal programs and reproductive health campaigns have helped subsidize access, enhancing uptake in community clinics and public hospitals.

Subdermal implants are another significant segment with steady growth in the U.S. Nexplanon, a widely used implant, provides up to three years of effective contraception through the continuous release of etonogestrel. Its discreet nature and low-maintenance profile make it particularly attractive to younger women, women in education or military service, and those with limited access to ongoing healthcare visits. The rise in educational efforts around LARC methods and the increasing number of trained professionals offering implant insertion has further bolstered this segment.

Injectables, while offering shorter duration of action compared to IUDs and implants, are the most flexible and widely accessible LARC option in low-resource or underserved communities. Depo-Provera (DMPA) remains a common injectable solution, requiring administration every 12 weeks. Its success lies in its privacy, ease of administration, and minimal insertion requirements. Recent developments like DMPA-SC enable self-injection, allowing greater autonomy and consistent use even during healthcare disruptions, such as those witnessed during the COVID-19 pandemic.

Country-Level Analysis: United States

The United States has seen a paradigm shift in contraceptive behavior over the past two decades. The uptake of long-acting reversible contraception has increased from around 1% in the early 2000s to over 12% by the 2020s, thanks to favorable policies, product innovations, and increasing consumer trust. Federal and state-level initiatives, such as Medicaid expansion and family planning waivers, have played a pivotal role in increasing LARC adoption among low-income and minority populations.

However, disparities remain. Access to LARC methods varies significantly based on geography, insurance coverage, and provider training. Rural populations often face long wait times or travel distances for LARC services, while undocumented and uninsured individuals may face cost barriers. Efforts by organizations such as Planned Parenthood and state health departments have partially closed these gaps through mobile clinics, telehealth counseling, and subsidized access programs. Continued federal support, including the Title X program and ACA contraceptive coverage mandates, will be vital to ensuring equitable growth across all demographics.

Some of the prominent players in the U.S. long-acting contraception market include:

Recent Developments

-

Bayer (February 2025) announced the launch of a new clinical study in the U.S. for a lower-dose hormonal IUD aimed at reducing side effects while maintaining efficacy. This initiative is part of the company’s strategy to appeal to younger and nulliparous women.

-

Organon (January 2025) introduced a digital patient education platform for Nexplanon users, aimed at improving device awareness, compliance, and access among underserved populations.

-

Pfizer (December 2024) revealed plans to expand manufacturing capacity for DMPA injectable contraceptives to meet growing demand in both clinical and home-care settings, especially with rising interest in self-injection models.

-

Teva Pharmaceuticals (November 2024) re-entered the long-acting contraceptive space with its copper IUD product, offering a nonhormonal alternative under its generics brand with extended price control for Medicaid providers.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the U.S. long-acting contraception market

By Product

- Intrauterine Devices (IUD)

-

- Hormonal IUD

- Nonhormonal IUD

- Subdermal Implants

- Injectable