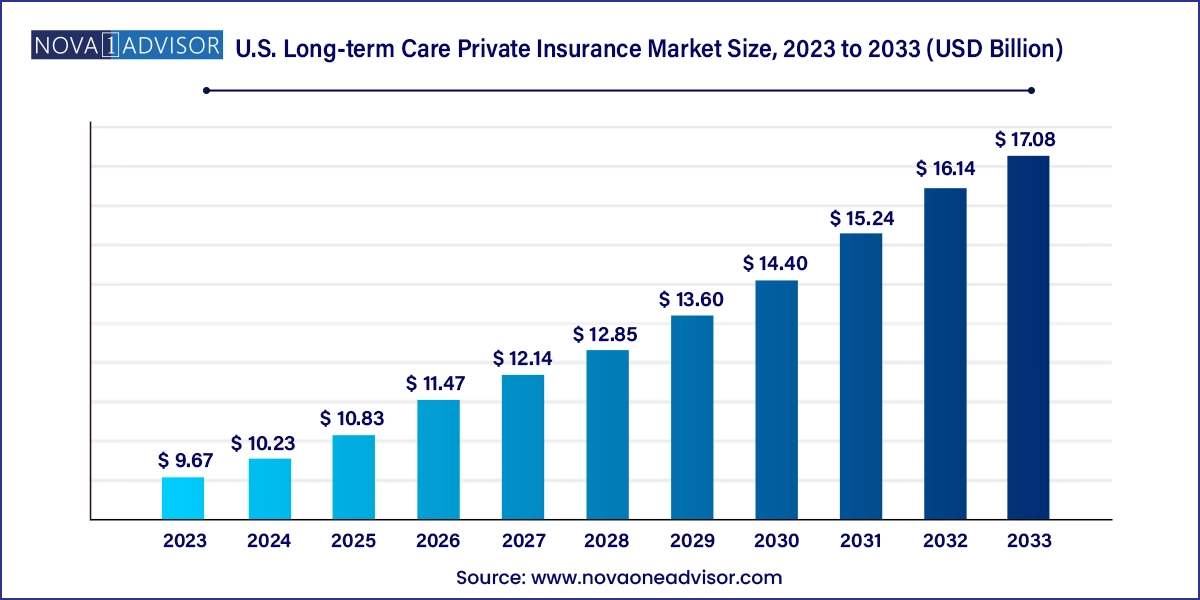

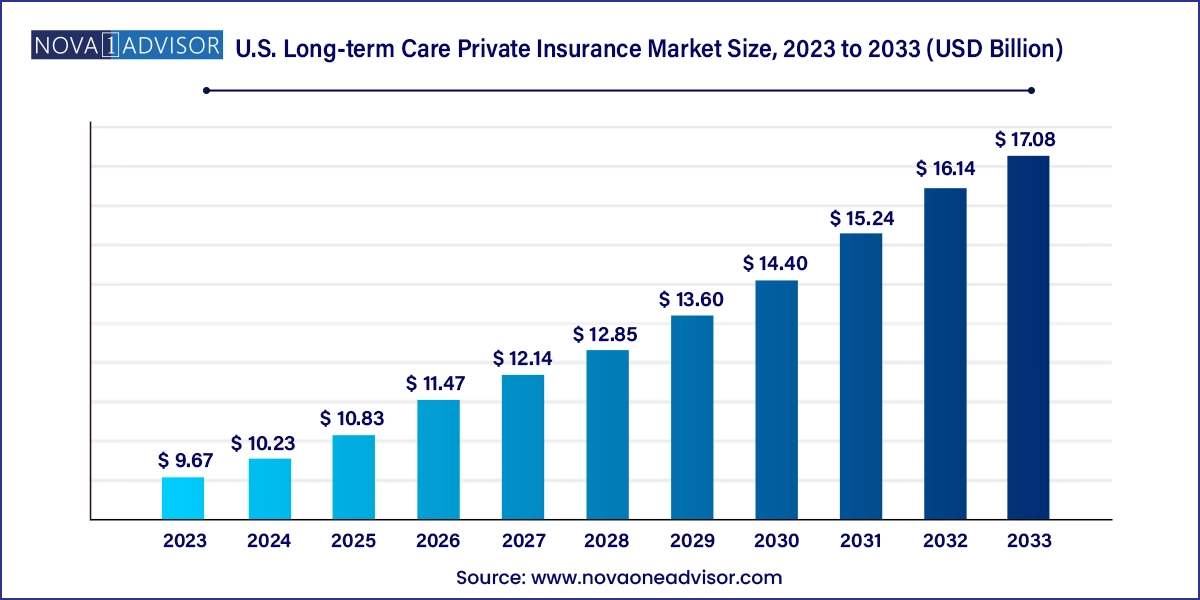

U.S. Long-term Care Private Insurance Market Size and Growth

The U.S. long-term care private insurance market size was exhibited at USD 9.67 billion in 2023 and is projected to hit around USD 17.08 billion by 2033, growing at a CAGR of 5.86% during the forecast period 2024 to 2033.

U.S. Long-Term Care Private Insurance Market By Key Takeaways:

- Based on buyer age, the age 55 to 65 segment accounted for the largest market share of 55% in 2023.

- California state held a significant market share in 2023 and accounted for 8.14% of the revenue.

- Texas State is expected to grow at a substantial CAGR during the forecast period.

Market Overview

The U.S. long-term care (LTC) private insurance market plays a vital role in supporting the financial preparedness of individuals for future healthcare needs associated with aging, chronic illness, or disability. Long-term care encompasses a wide spectrum of services that assist individuals with daily activities such as bathing, dressing, eating, or medical support either in a home setting, assisted living facility, or nursing home. As healthcare costs continue to rise and life expectancy increases, private insurance for LTC has gained importance in mitigating financial burden.

Private long-term care insurance policies in the U.S. are designed to offer flexibility, independence, and peace of mind. Policyholders can tailor benefits such as coverage period, daily benefit amounts, and inflation protection to their needs. The market has evolved significantly over the past decade with new hybrid products, policy customization features, and innovative underwriting models. Moreover, with Medicaid restrictions tightening and traditional sources like employer-provided pensions declining, there is growing consumer awareness of the financial vulnerability associated with out-of-pocket long-term care expenses.

Major Trends in the Market

-

Rising interest in hybrid LTC insurance products combining life insurance or annuities

-

Increasing demand from individuals aged 55 to 65 due to heightened financial planning awareness

-

Premium stabilization efforts by insurers to attract younger policyholders

-

Use of AI and digital tools in LTC underwriting and claims processing

-

Emergence of shared-care policies for couples and family coverage

-

Focus on gender-based pricing models due to higher claim costs for women

-

Development of employer-sponsored LTC insurance benefits packages

-

Greater transparency and education initiatives to overcome consumer confusion

Report Scope of U.S. Long-Term Care Private Insurance Market

| Report Coverage |

Details |

| Market Size in 2024 |

USD 10.23 Billion |

| Market Size by 2033 |

USD 17.08 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 5.86% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Buyer Age, State |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Country scope |

U.S. |

| Key Companies Profiled |

Mutual of Omaha; New York Life; Northwestern Mutual; Thrivent; National Guardian Life; Bankers Life; Transamerica; MassMutual; Genworth Financial; John Hancock |

Key Market Driver: Aging Population and Longevity Risk

A significant driver of the U.S. long-term care private insurance market is the aging population and increasing longevity. As of 2024, over 55 million Americans are aged 65 or older, and this number is projected to exceed 70 million by 2030. With age, the likelihood of needing long-term care increases dramatically. According to U.S. government estimates, nearly 70% of those turning 65 today will require some form of long-term care in their lifetime.

Given the high costs of services with nursing home care exceeding $100,000 annually in some states private LTC insurance offers a financial safeguard. It also allows individuals to maintain control over the quality and setting of care received. In an era of shrinking family caregiving capacity and increasing healthcare complexity, private insurance is becoming an indispensable tool in retirement and estate planning.

Key Market Restraint: High Premium Costs and Consumer Skepticism

Despite its importance, private long-term care insurance remains underutilized, primarily due to its high premium costs and the complexity of policies. Many consumers find premiums unaffordable, especially if purchasing coverage later in life. The average annual premium for a couple in their mid-50s can exceed $3,000 for a comprehensive policy.

Furthermore, past experiences of sudden rate hikes and insurer exits from the market have contributed to skepticism. Confusion over what policies cover, how benefits are triggered, and whether claims will be honored discourages many prospective buyers. The perceived lack of value, despite high upfront costs, creates a psychological barrier that insurers must address through better education, product transparency, and financial incentives.

Key Market Opportunity: Growth of Hybrid Insurance Products

One of the most promising opportunities in the U.S. LTC private insurance market lies in the growth of hybrid insurance products. These combine long-term care coverage with life insurance or annuity features. If long-term care benefits are not used, the policyholder or their beneficiary still receives value in the form of a death benefit or cash surrender value.

Hybrid products address multiple consumer concerns, including the fear of "use it or lose it," the desire for asset protection, and tax-efficient wealth transfer. Many insurers are offering single-premium or flexible-payment hybrid plans, making them attractive for middle-aged individuals planning for retirement. As these products are more widely understood and regulated, they are poised to become the cornerstone of LTC insurance offerings in the coming years.

U.S. Long-Term Care Private Insurance Market By Buyer Age Insights

The 55 to 65 age group dominates the LTC private insurance market in the U.S., accounting for the majority of new policy purchases. Individuals in this cohort are at a key juncture in financial planning approaching retirement, accumulating assets, and becoming more aware of potential future healthcare needs. They are also more likely to qualify for better premiums than older buyers and more motivated than younger ones due to proximity to retirement age.

In contrast, the under-55 segment is showing the fastest growth, as insurers and advisors target younger policyholders with messages of early financial preparedness and premium affordability. Buyers before age 55 can secure lower lifetime costs and higher benefit leverage. Educational campaigns and digital financial planning tools are helping raise awareness and dispel myths, making this segment increasingly attractive for long-term policy retention.

U.S. Long-Term Care Private Insurance Market By State Insights

California leads the market for LTC private insurance, driven by its large aging population, high cost of living, and proactive consumer awareness. The state also has a relatively high rate of early retirees, who seek coverage outside employer-sponsored benefits. California's regulatory framework and pilot initiatives for LTC education contribute to a stronger policyholder base.

Florida and Texas are emerging as high-growth states, largely due to a growing retiree population and expanding urban centers. Florida’s status as a top retirement destination makes it a hotbed for LTC services and insurance demand. Texas benefits from younger population dynamics and greater financial literacy, with insurers tailoring products for diverse demographics. Other notable states showing strong participation include New York, Pennsylvania, and Illinois, where aging demographics and healthcare cost inflation make LTC insurance a strategic necessity.

Country-Level Analysis (United States)

Across the U.S., the long-term care insurance market is experiencing slow but steady transformation. While traditional standalone LTC policies have seen declining sales, newer hybrid models and group coverage options are reviving interest. National policy discussions around the solvency of Medicaid and the need for individual financial responsibility in long-term care have also influenced consumer behavior.

Some states, like Washington, have introduced mandatory LTC payroll taxes unless individuals demonstrate private coverage, spurring a spike in policy purchases. Other states, including California and New York, are exploring similar initiatives. Federal legislative proposals to provide tax incentives or expand long-term care partnerships could reshape the future landscape. Additionally, nationwide insurers are investing in digital underwriting platforms, predictive analytics, and consumer education campaigns to improve reach and engagement.

Some of the prominent players in the U.S. long-term care private insurance market include:

- Mutual of Omaha

- New York Life

- Northwestern Mutual

- Thrivent

- National Guardian Life

- Bankers Life

- Transamerica

- MassMutual

- Genworth Financial

- John Hancock

Recent Developments

-

March 2025: Genworth Financial unveiled a new hybrid LTC-life insurance product with adjustable premium options, targeting mid-career professionals.

-

February 2025: Mutual of Omaha reported a 15% increase in LTC insurance applications, driven by marketing campaigns focused on younger buyers.

-

December 2024: New York Life announced a partnership with fintech firm RetireSmart to offer AI-powered LTC planning tools for financial advisors.

-

October 2024: Northwestern Mutual launched a mobile-friendly customer portal for LTC policyholders to manage benefits, payments, and claims more easily.

-

September 2024: Nationwide Insurance expanded its suite of LTC riders on permanent life insurance products, responding to growing demand for hybrid plans.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. long-term care private insurance market

Buyer Age

- Before Age 55

- Age 55 to 65

- Age 66+

State

- California

- Texas

- New York

- Florida

- Illinois

- Pennsylvania

- Virginia

- Ohio

- New Jersey

- Minnesota

- Other