U.S. Long Term Care Software Market Size and Trends

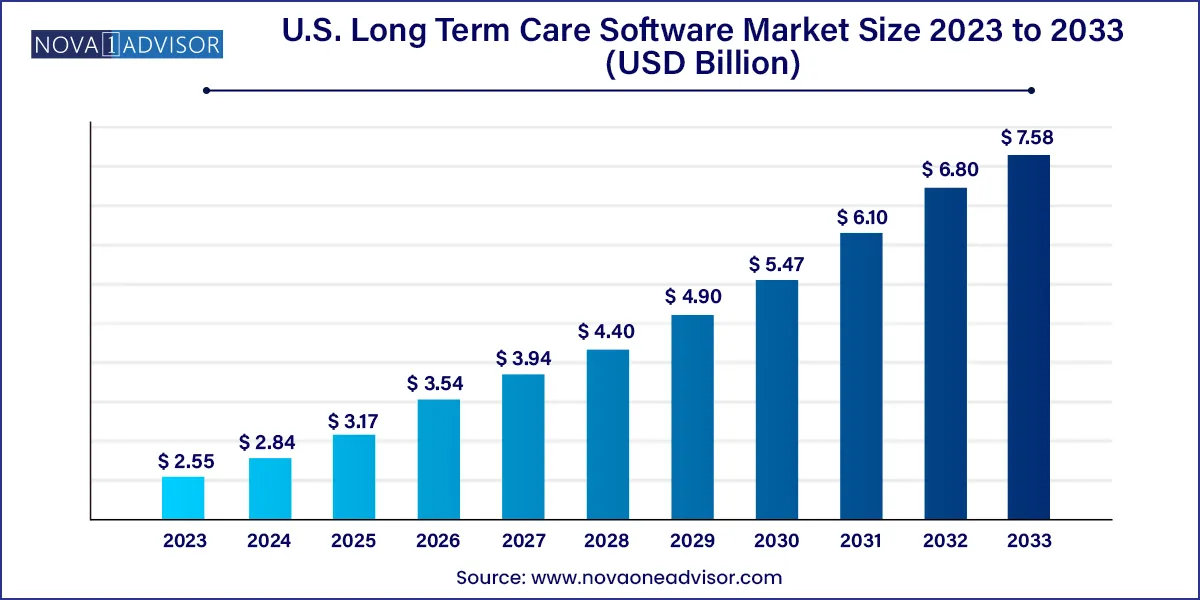

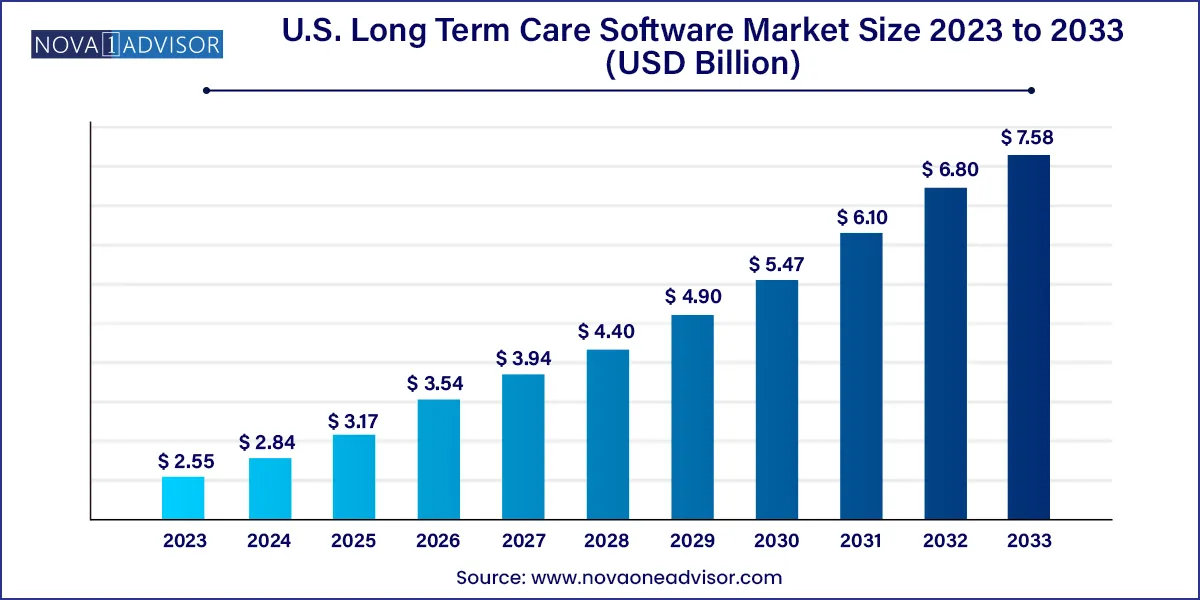

The U.S. long term care software market size was exhibited at USD 2.55 billion in 2023 and is projected to hit around USD 7.58 billion by 2033, growing at a CAGR of 11.55% during the forecast period 2024 to 2033.

Key Takeaways:

- The cloud-based segment accounted for the largest revenue share of 41.06% in 2023.

- The EHR segment accounted for the largest share of revenue in 2023, at 32.39%, in the U.S. long term care software market.

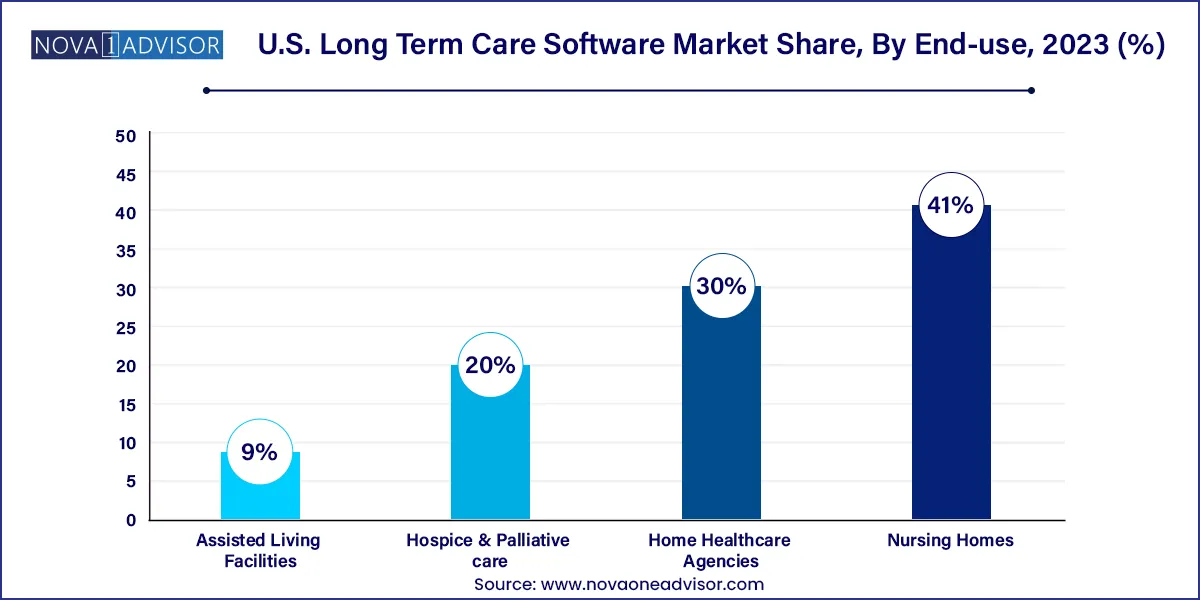

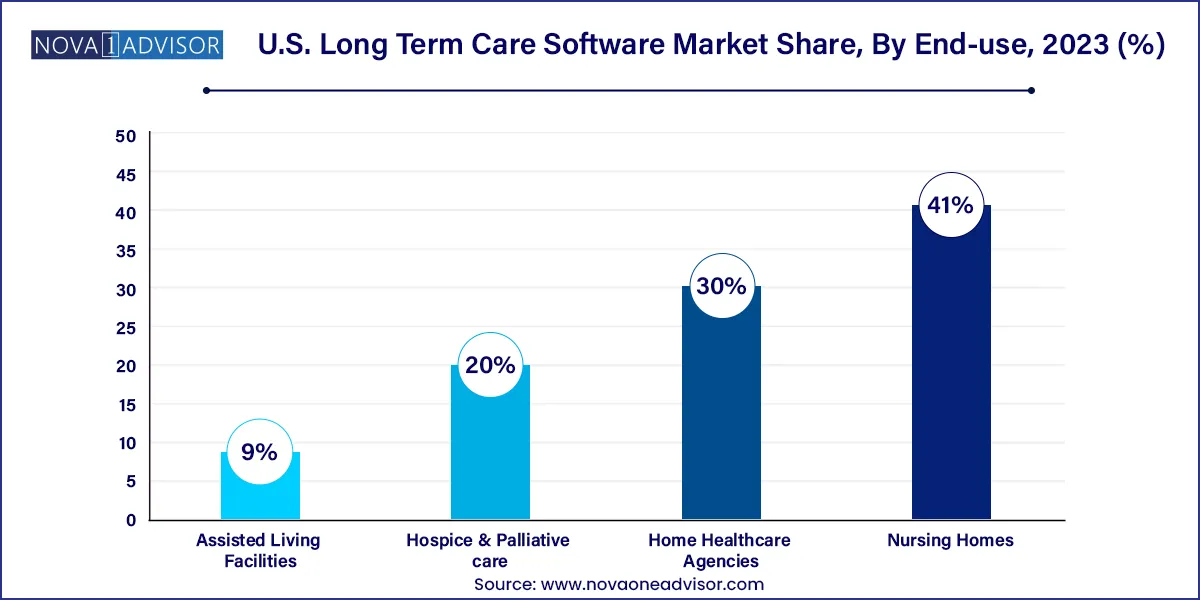

- The nursing homes segment dominated the market with a share of 41.0% in 2023.

- The home healthcare agencies segment is projected to exhibit the maximum CAGR during the forecast period.

Market Overview

The U.S. Long Term Care (LTC) Software Market plays a critical role in transforming how extended healthcare services are administered and managed for aging and chronically ill populations. As healthcare delivery shifts from acute to long-term settings, such as nursing homes, assisted living facilities, and home-based care, the need for advanced, specialized digital tools has become imperative. LTC software systems are designed to automate clinical, financial, and administrative workflows, enabling care providers to deliver high-quality services while ensuring compliance, documentation accuracy, and cost efficiency.

The demographic shift in the U.S. is one of the key forces driving this market. According to the U.S. Census Bureau, more than 77 million Americans will be aged 65 or older by 2034, surpassing the number of children for the first time in U.S. history. This aging population is increasingly vulnerable to chronic illnesses, cognitive impairments, and mobility challenges, which demand continuous care and monitoring. Consequently, healthcare providers are turning to LTC software to streamline operations, improve resident care outcomes, and remain in alignment with evolving healthcare regulations.

Software platforms used in LTC settings provide various functionalities including Electronic Health Records (EHRs), billing and claims processing, e-prescribing, medication tracking (eMAR), and workforce management. These digital solutions help reduce medical errors, enhance interdepartmental communication, and support compliance with Medicare and Medicaid documentation standards. Additionally, cloud computing, mobile access, and AI-powered analytics are transforming how data is used to personalize care and optimize facility performance.

As value-based care continues to reshape the U.S. healthcare landscape, long-term care providers are pressured to deliver measurable outcomes. LTC software not only improves operational efficiency but also provides transparency through performance dashboards, clinical alerts, and predictive modeling. This shift from manual and paper-based processes to digitized, integrated platforms is becoming indispensable in the modern healthcare continuum.

Major Trends in the Market

-

Increasing Adoption of Cloud-based Solutions: Cloud technology is becoming the default infrastructure due to its scalability, lower upfront costs, and remote accessibility.

-

Growing Demand for Interoperability: Facilities seek seamless data exchange across electronic systems to support care coordination and population health initiatives.

-

Mobile Accessibility and Remote Monitoring: Tablets and mobile apps are enabling nurses and caregivers to update patient data at the point-of-care, improving accuracy and efficiency.

-

Integration of Artificial Intelligence and Predictive Analytics: AI is being used to predict patient deterioration, manage resources, and personalize care pathways in LTC settings.

-

Heightened Focus on Cybersecurity: As cyberattacks on healthcare providers rise, LTC facilities are investing in encryption, multi-factor authentication, and compliance audits.

-

Regulatory Pressure to Modernize: CMS mandates and HIPAA compliance are pushing facilities to digitize records and adopt certified EHR technology.

-

Workforce Management Tools are in Demand: With labor shortages, tools that help with scheduling, time tracking, and burnout reduction are becoming essential.

-

Telehealth Integration into LTC Systems: Especially post-pandemic, telehealth modules within LTC software are helping facilities manage physician consultations and behavioral health services remotely.

Report Scope of The U.S. Long Term Care Software Market

| Report Coverage |

Details |

| Market Size in 2024 |

USD 2.84 Billion |

| Market Size by 2033 |

USD 7.58 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 11.51% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Mode of Delivery, Application, End-use |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

U.S. |

| Key Companies Profiled |

Veradigm LLC (Allscripts Healthcare); Cerner Corporation (Oracle Corporation); Netsmart Technologies, Inc.; MatrixCare; Yardi Systems, Inc.; VITALS SOFTWARE; PointClickCare; Medtelligent, Inc.; AL Advantage, LLC; Genexod Technologies LLC; Revver, Inc |

Market Driver: Expanding Aging Population and Chronic Disease Burden

One of the most compelling drivers of the U.S. long-term care software market is the rapidly growing elderly population and the concurrent rise in chronic diseases. By 2030, all baby boomers will be over the age of 65, accounting for roughly 21% of the U.S. population. This aging demographic has led to a surge in demand for extended care services, especially for conditions such as Alzheimer’s, diabetes, arthritis, and cardiovascular disease, which require ongoing, coordinated care.

LTC software offers real-time tracking and documentation capabilities that are vital for managing complex patient profiles. For instance, a nursing home catering to Alzheimer’s patients can benefit from software features like behavior tracking, medication reminders, and cognitive function logs, which improve care personalization. Furthermore, integration with EHRs allows for accurate clinical histories to be maintained, reducing adverse events and enabling better physician collaboration. As the chronic disease burden escalates, the adoption of robust care management systems becomes not just a strategic choice but a necessity.

Market Restraint: Budget Constraints and High Implementation Costs

Despite its benefits, one significant barrier to the widespread adoption of long-term care software is the high cost associated with implementation, maintenance, and training, especially for smaller or independently operated facilities. Transitioning from paper-based records to a comprehensive digital system requires a substantial financial investment in software licenses, IT infrastructure, and staff onboarding.

For example, many nursing homes operate on thin margins and rely heavily on Medicaid reimbursements, which may not cover the costs of software adoption or upgrades. Moreover, the need to regularly update systems to comply with federal regulations, maintain data security, and integrate new technologies further strains financial resources. Some facilities may also be wary of disruptions during the transition period, which could affect patient care quality. While software-as-a-service (SaaS) models offer subscription-based pricing to reduce upfront costs, affordability remains a pressing concern, particularly for rural and community-based providers.

Market Opportunity: Rise in Home Healthcare and Remote Care Delivery

A prominent opportunity in the U.S. LTC software market is the growing adoption of home-based care and remote service models. Patients increasingly prefer to receive long-term care services at home due to cost advantages, comfort, and pandemic-driven safety concerns. This shift has opened new avenues for software vendors to develop solutions tailored to home healthcare agencies and mobile care teams.

Modern LTC software now includes features like remote vital sign monitoring, secure messaging, telehealth scheduling, and mobile charting—all essential for facilitating efficient home-based services. For example, companies offering software platforms with integrated e-prescribing, real-time patient updates, and compliance checklists are seeing significant growth in their home health client base. The Centers for Medicare & Medicaid Services (CMS) has also expanded reimbursement for remote patient monitoring, further boosting the demand for digital tools in decentralized care environments. Software that supports virtual workflows while maintaining compliance and patient safety has a huge potential in this evolving ecosystem.

U.S. Long Term Care Software Market By Mode of Delivery Insights

Cloud-based delivery dominated the U.S. long-term care software market owing to its scalability, cost-efficiency, and ease of integration with other platforms. Providers across the country are moving away from expensive on-premises infrastructure in favor of cloud-based SaaS models that offer better uptime, data backup, and automatic software updates. In facilities with multiple locations or mobile workforces, cloud solutions enable seamless access to patient records and administrative dashboards. For instance, a home healthcare agency managing patients across five counties can easily coordinate care using a centralized cloud-based platform, ensuring real-time data availability without worrying about server maintenance.

Web-based platforms are emerging as the fastest growing mode of delivery, particularly among mid-sized nursing homes and assisted living centers. These platforms combine the advantages of browser accessibility with customizable workflows that can be tailored to specific organizational needs. Unlike traditional on-premises setups, web-based systems can be deployed without significant hardware investments, making them a viable option for facilities with limited IT capabilities. Moreover, vendors are enhancing web-based applications with offline modes, making them even more attractive for mobile use and field documentation.

U.S. Long Term Care Software Market By Application Insights

Electronic Health Records (EHRs) held the largest market share among applications, largely due to federal incentives, regulatory requirements, and their central role in care coordination. EHRs in LTC settings help maintain comprehensive patient histories, allergies, lab results, and progress notes. They also facilitate care transitions between hospitals and long-term care facilities. EHR platforms with built-in compliance tools ensure that documentation aligns with Medicaid and Medicare billing standards, which is essential for accurate reimbursement. Facilities with integrated EHR systems report fewer clinical errors, improved regulatory audits, and better family satisfaction.

Electronic Medication Administration Record (eMAR) solutions are growing at the fastest rate, driven by their ability to reduce medication errors and enhance medication tracking. eMAR modules offer features such as barcode scanning, real-time alerts, and automated refill notifications, improving both safety and efficiency. Given that medication administration is a high-frequency activity in long-term care, especially in nursing homes where residents often take multiple prescriptions daily, these systems are invaluable. For example, a skilled nursing facility using eMAR can prevent missed doses and flag potential drug interactions, thereby improving outcomes and reducing liabilities.

U.S. Long Term Care Software Market By End-use Insights

Nursing homes remain the dominant end-user in the U.S. LTC software market, given their extensive resident capacity, regulatory oversight, and higher complexity of care. These facilities benefit greatly from integrated software solutions that manage clinical documentation, staffing schedules, billing cycles, and resident safety protocols. Since many nursing homes operate under CMS guidelines, the use of certified EHRs and compliance dashboards is critical. Facilities that implement robust software platforms report better care team coordination, improved patient satisfaction scores, and higher occupancy rates due to better reputation and efficiency.

Home healthcare agencies represent the fastest growing end-use segment, reflecting a broader national trend toward decentralized care delivery. These agencies need lightweight, mobile-optimized software that can support field staff in managing patients across different geographic locations. Features like real-time GPS tracking, digital consent forms, and remote assessment tools are particularly valuable. The flexibility and affordability of cloud-based platforms are enabling even smaller agencies to digitize their operations. This growth is further accelerated by CMS’s Home Health Value-Based Purchasing (HHVBP) model, which rewards agencies based on performance metrics many of which can be tracked through advanced LTC software.

Country-Level Analysis

The U.S. long-term care software market is characterized by a highly fragmented yet innovation-driven landscape. As the healthcare system grapples with rising costs, provider burnout, and regulatory complexity, LTC facilities are increasingly turning to technology as a strategic enabler. Federal policies such as the Health Information Technology for Economic and Clinical Health (HITECH) Act and CMS Meaningful Use programs have laid the foundation for digital transformation across the continuum of care.

In states like California, Texas, and Florida where elderly populations are particularly high long-term care software penetration is growing rapidly. These states are also home to several tech-forward providers and pilot programs focusing on AI in elder care. Additionally, interoperability standards introduced by the Office of the National Coordinator (ONC) are pushing software vendors to build systems that can communicate with hospital and payer networks, supporting smoother care transitions and data sharing.

Workforce shortages, especially among registered nurses and certified nursing assistants, are prompting facilities to invest in staff management tools and mobile documentation systems that can ease workloads. Vendors operating in the U.S. are also focusing heavily on cybersecurity, given the rising frequency of ransomware attacks on healthcare institutions.

Some of the prominent players in the U.S. long term care software market include:

- Veradigm LLC (Allscripts Healthcare)

- Cerner Corporation (Oracle Corporation)

- Netsmart Technologies, Inc.

- MatrixCare

- Yardi Systems, Inc.

- VITALS SOFTWARE

- PointClickCare

- Medtelligent, Inc.

- AL Advantage, LLC

- Genexod Technologies LLC

- Revver, Inc.

Recent Developments

-

In March 2025, MatrixCare launched its next-generation mobile EHR module, allowing caregivers to update documentation at the bedside in real-time with voice recognition and AI-powered decision support.

-

In February 2025, PointClickCare announced its strategic partnership with Amazon Web Services (AWS) to expand cloud services and AI integrations across U.S. long-term care facilities, including enhanced fall detection and predictive analytics.

-

In December 2024, Netsmart Technologies acquired CORE Analytics, a move aimed at strengthening its position in real-time data analysis and visualization for LTC providers.

-

In October 2024, Medtelligent rolled out an upgraded eMAR system with integrated pharmacy alerts and customizable workflows tailored to assisted living facilities.

-

In August 2024, SigmaCare (via MatrixCare) introduced a telehealth integration module that allows behavioral health services to be offered remotely within its LTC suite.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. long term care software market

Mode of Delivery

- Cloud-based

- Web-based

- On-premises

Application

- Electronic Health Records

- Electronic Medication Administration Record (eMAR)

- Revenue Cycle Management

- Resident Care

- Staff Management

- Others

End-use

- Home Healthcare Agencies

- Hospice & Palliative care

- Nursing Homes

- Assisted Living Facilities