U.S. Mammography Market Size and Growth

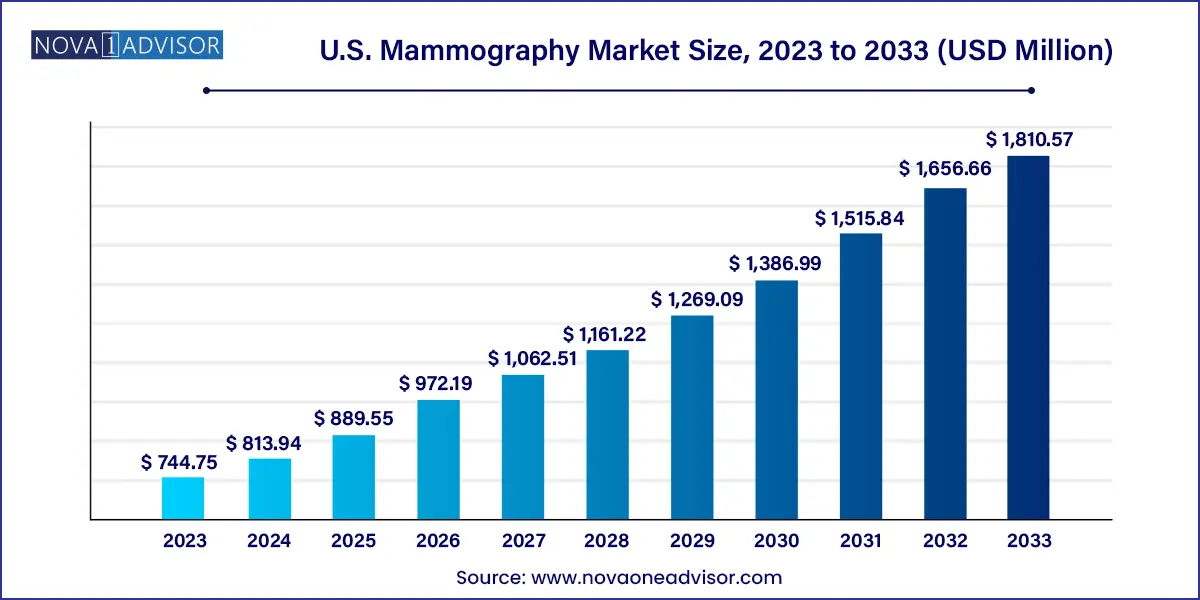

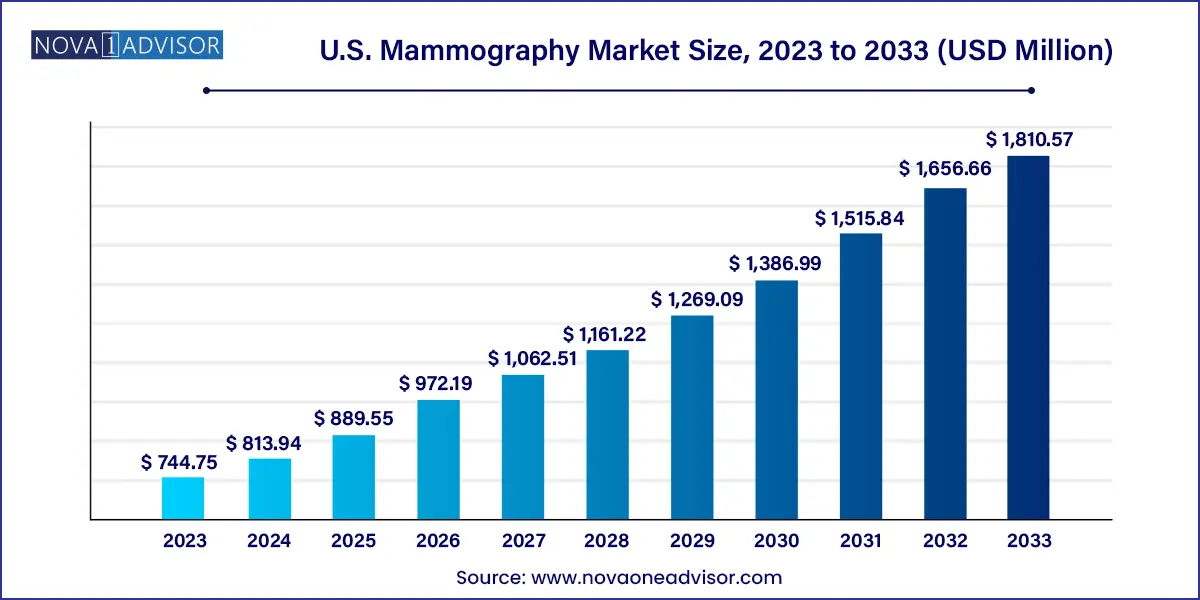

The U.S. mammography market size was exhibited at USD 744.75 million in 2023 and is projected to hit around USD 1,810.57 million by 2033, growing at a CAGR of 9.29% during the forecast period 2024 to 2033.

Key Takeaways:

- Based on product, digital systems held the largest market share of 61.11% in 2023.

- The 3D systems segment is anticipated to witness a growth at CAGR of 12% from 2024 to 2033.

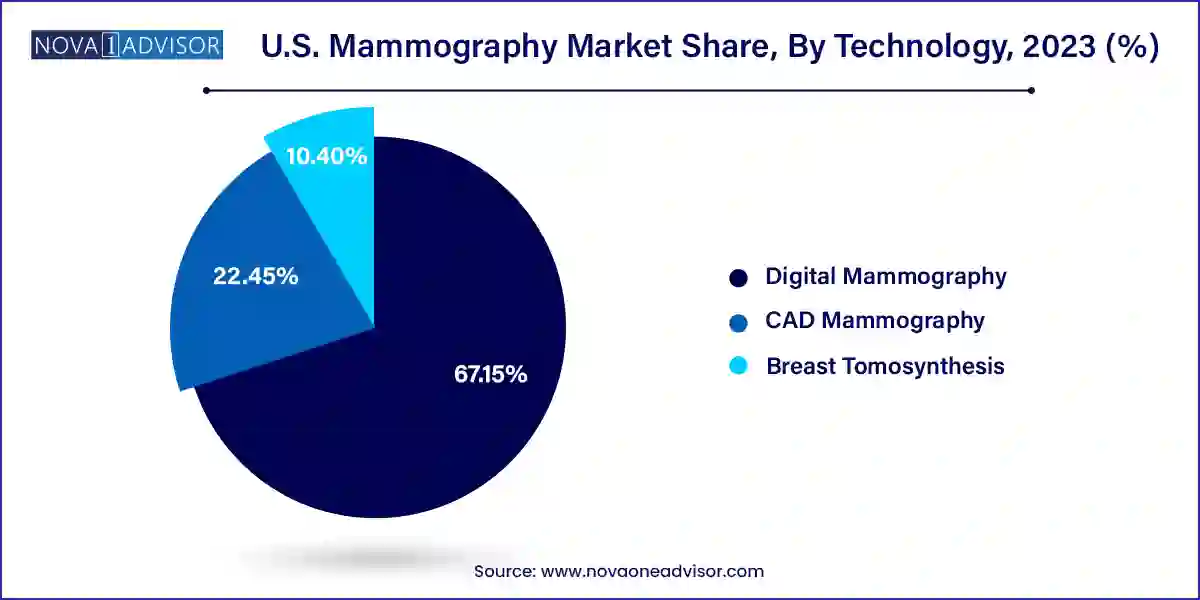

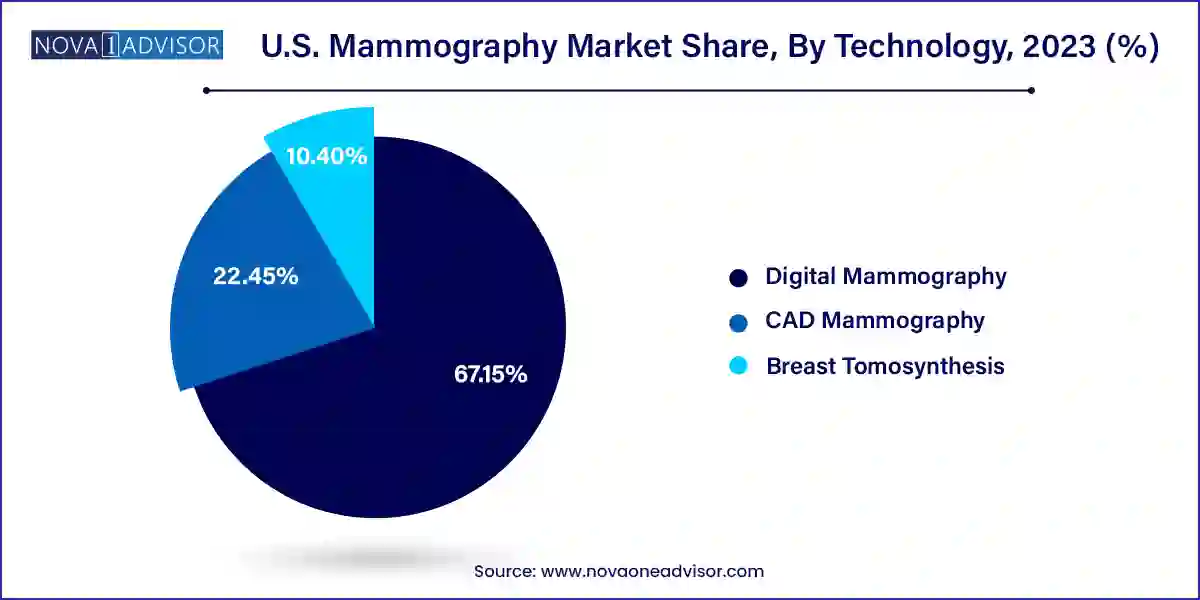

- Based on technology, digital technology of mammography dominated the market with share of 67.15% in 2023.

- Based on end-use, hospital held the largest market share in 2023.

- The diagnostic centers segment is projected to expand at significant CAGR over the forecast period.

Market Overview

The U.S. mammography market is a cornerstone of the national breast cancer diagnostic ecosystem. Mammography, a specialized medical imaging technique that uses low-dose X-rays to examine the human breast, plays a critical role in early detection and diagnosis of breast cancer. It is widely recognized as the most effective screening tool for detecting breast abnormalities before symptoms appear. As breast cancer remains one of the leading causes of cancer-related mortality among women in the U.S., mammography continues to be prioritized in public health policies, insurance mandates, and clinical practice guidelines.

The adoption of advanced imaging technologies, particularly digital mammography and 3D breast tomosynthesis, has revolutionized the accuracy and speed of breast cancer detection. This transformation has been largely driven by major companies such as Hologic, GE Healthcare, and Siemens Healthineers, which have developed FDA-approved systems to improve early-stage cancer identification and reduce false positives. Moreover, government programs such as the CDC's National Breast and Cervical Cancer Early Detection Program (NBCCEDP) and annual Medicare reimbursements have expanded access to mammography services, particularly among underserved populations.

The market continues to evolve with the integration of artificial intelligence (AI) and machine learning into radiology workflows, enabling faster and more precise interpretation of mammograms. Additionally, the U.S. Food and Drug Administration (FDA) has strengthened regulations by mandating that all mammography facilities transition to digital imaging, boosting demand for state-of-the-art systems and software. As public awareness increases and screening programs become more widespread, the U.S. mammography market is poised for steady growth, supported by innovation, regulatory guidance, and heightened focus on women's health.

Major Trends in the Market

-

Rapid integration of artificial intelligence and CAD (computer-aided detection): AI-powered tools are transforming mammogram interpretation, improving diagnostic accuracy and reducing radiologist fatigue.

-

Rising adoption of 3D breast tomosynthesis (DBT): This imaging modality is gaining popularity due to its superior lesion visibility and reduced recall rates compared to traditional 2D mammography.

-

Decline of analog and film-screen systems: Healthcare providers are rapidly replacing older modalities with digital and 3D systems to meet current clinical and regulatory standards.

-

Shift towards outpatient diagnostic centers: Freestanding imaging and diagnostic centers are expanding their mammography services to meet growing demand for convenience and rapid turnaround.

-

Increased federal support and insurance coverage: Mandated coverage for screening mammograms and expanded Medicare/Medicaid support are improving access across demographics.

-

Personalized risk-based screening programs: Breast cancer risk stratification models are influencing tailored screening intervals and imaging modalities.

-

Rise in mobile mammography units: To reach rural and underserved populations, mobile clinics equipped with digital mammography units are expanding across the country.

Report Scope of U.S. Mammography Market

| Report Coverage |

Details |

| Market Size in 2024 |

USD 813.94 Million |

| Market Size by 2033 |

USD 1,810.57 Million |

| Growth Rate From 2024 to 2033 |

CAGR of 9.29% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Product, Technology, End-use |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

U.S. |

| Key Companies Profiled |

GE Healthcare; Hologic Inc.; inVivo; Vision Sciences; Adani Systems; Hausted; Lorad Chemical Corporation; RAM; iCAD; Dilon; RadNet |

Key Market Driver: Increasing Breast Cancer Incidence and Screening Awareness

The primary driver behind the robust expansion of the U.S. mammography market is the increasing prevalence of breast cancer coupled with greater awareness of early detection. According to the American Cancer Society, an estimated 297,790 new cases of invasive breast cancer and 43,170 deaths were expected in the U.S. in 2023 alone. These staggering figures have spurred public and private healthcare entities to double down on preventive measures, with mammography at the forefront.

Awareness campaigns from organizations like Susan G. Komen, Breast Cancer Research Foundation (BCRF), and National Breast Cancer Foundation have significantly elevated public consciousness regarding the importance of early screening. Additionally, annual reminders during Breast Cancer Awareness Month have created a cultural shift, prompting more women especially those above 40 or with a family history to undergo regular mammograms. Insurance coverage under the Affordable Care Act further facilitates access by mandating coverage for preventive breast cancer screenings without copayments. These factors collectively reinforce a steady and increasing demand for advanced mammography equipment and services.

Key Market Restraint: High Capital Investment and Maintenance Costs

Despite the promising growth trajectory, a key restraint affecting the U.S. mammography market is the high initial cost and ongoing maintenance of advanced imaging systems. Transitioning from analog or film-screen to digital mammography especially 3D breast tomosynthesis requires substantial capital investment, often exceeding $300,000 to $500,000 per unit, depending on specifications and features. This is particularly burdensome for small clinics and rural healthcare providers with limited budgets.

Additionally, digital systems require specialized infrastructure, IT support, PACS (Picture Archiving and Communication System) integration, and periodic software updates. Radiology departments also need to invest in technician training and certification. While the long-term benefits of digital and AI-assisted mammography are clear, the short-term cost barriers hinder adoption among smaller players, potentially limiting access in certain communities and widening the healthcare gap between urban and rural areas.

Key Market Opportunity: AI-Driven Screening and Diagnostic Enhancements

A significant opportunity in the U.S. mammography market lies in the integration of artificial intelligence (AI) and machine learning into the diagnostic process. AI-enabled mammography tools are increasingly used to assist radiologists in identifying suspicious lesions, quantifying breast density, and streamlining image interpretation. This technology not only enhances diagnostic accuracy but also mitigates the shortage of specialized radiologists a growing concern in the U.S. healthcare system.

Leading companies like iCAD, ScreenPoint Medical, and Volpara Health are developing AI-based decision support tools that seamlessly integrate with existing imaging platforms. These tools can flag high-risk cases, automate image scoring, and even provide risk assessments based on patient history. In April 2024, Hologic received FDA clearance for its next-generation AI software designed to optimize radiologist performance and reduce false positives. As the regulatory environment becomes more supportive and clinical validation of AI tools increases, the adoption of smart mammography solutions presents a transformative opportunity for providers to enhance throughput, accuracy, and patient outcomes.

U.S. Mammography Market By Product Insights

Digital systems dominated the U.S. mammography market, largely due to their superior image resolution, rapid processing, and compliance with FDA mandates for digital imaging. Digital mammography has become the standard across hospitals, imaging centers, and mobile clinics. These systems allow for enhanced contrast, better visualization of dense breast tissues, and efficient data storage, making them preferable over analog and film-screen counterparts. The transition to digital is further supported by CMS reimbursements and reduced downtime, allowing for higher patient throughput and diagnostic efficiency.

3D systems are the fastest-growing product segment, thanks to the clinical advantages of breast tomosynthesis. These systems produce layered breast images, improving lesion detection, particularly in women with dense breast tissue. 3D mammography has been shown to reduce recall rates by up to 40% and improve invasive cancer detection rates. With the FDA’s 2019 ruling mandating that mammography reports include breast density information, more providers are opting for tomosynthesis to meet regulatory expectations and improve diagnostic accuracy. Moreover, patient demand for more accurate, pain-reduced, and efficient screening options is pushing providers toward 3D solutions.

U.S. Mammography Market By Technology Insights

Digital mammography remains the most widely adopted technology, serving as the foundation for most breast imaging platforms in the U.S. It has nearly replaced analog systems in mainstream healthcare facilities due to its improved accuracy, workflow efficiency, and compatibility with AI tools. Digital systems also enable cloud-based sharing, facilitating second opinions and tele-radiology services, further broadening accessibility.

Breast tomosynthesis (3D mammography) is the fastest-growing technology in this segment. With growing evidence of its superiority over 2D imaging, tomosynthesis is rapidly becoming the gold standard for breast cancer screening. It provides a more detailed view of overlapping breast structures, reducing unnecessary biopsies and patient anxiety associated with false positives. Leading hospitals and outpatient centers across the U.S. are making 3D imaging part of their core diagnostic arsenal, especially as insurance coverage expands and patient outcomes improve.

U.S. Mammography Market By End-use Insights

Hospitals are the dominant end-user of mammography systems in the U.S., accounting for the largest market share due to their comprehensive infrastructure, high patient volumes, and capacity to integrate advanced technologies. Large hospital networks often invest in multi-unit mammography systems to serve both inpatient and outpatient populations, along with dedicated breast care units. Hospitals also attract patients through bundled screening programs, rapid diagnostics, and access to multidisciplinary care teams.

Diagnostic centers are the fastest-growing end-user segment, reflecting a broader healthcare trend toward outpatient services. These facilities offer faster appointments, specialized services, and often lower costs compared to hospitals. They are particularly attractive for routine screenings and follow-ups, and many have adopted digital and 3D systems to enhance service quality. Diagnostic centers are increasingly partnering with insurers and public health agencies to offer subsidized or mobile mammography services in underserved areas.

Country-Level Analysis

The United States leads the global mammography market in terms of technology adoption, screening volumes, and reimbursement infrastructure. The country benefits from a strong policy framework that supports breast cancer awareness, routine screenings, and early diagnostics. Federal initiatives, such as the NBCCEDP and grants from the National Cancer Institute, have contributed significantly to mammography expansion.

Additionally, state-level legislation mandating breast density notification laws and routine screening coverage have pushed providers to invest in advanced imaging technologies. The U.S. has also seen rapid growth in mobile mammography clinics, particularly in states like Texas, California, and Florida, aiming to serve rural populations and increase screening compliance. Private insurance plans, Medicare, and Medicaid programs offer broad coverage for both screening and diagnostic mammograms, ensuring access for a diverse patient base.

Consumer behavior is shifting toward proactive health management, with more women scheduling routine mammograms based on personal or familial risk. Digital health platforms and patient portals allow easy appointment scheduling, reminders, and report access, streamlining the patient experience. These factors collectively reinforce the U.S. as the most mature and innovation-friendly market for mammography worldwide.

U.S. Mammography Market By Recent Developments

-

April 2024 – Hologic received FDA clearance for its Genius AI Detection software, an artificial intelligence tool designed to enhance radiologist efficiency and accuracy in reading mammograms. The tool aims to reduce false positives and improve cancer detection rates, particularly in dense breast tissues.

-

March 2024 – GE HealthCare announced a collaboration with DeepHealth, a Mayo Clinic-backed AI company, to integrate advanced CAD tools into GE’s mammography platforms. The integration is expected to roll out in leading U.S. imaging centers by late 2024.

-

February 2024 – Siemens Healthineers introduced Mammomat B.brilliant, a next-generation digital mammography system with enhanced breast comfort features and dual-energy imaging capabilities. U.S. FDA approval is pending, with trials ongoing in select university hospitals.

-

January 2024 – Volpara Health launched a cloud-based breast screening platform that aggregates mammography data across providers to improve quality metrics, compliance, and patient outcomes. The tool is now used in over 1,000 U.S. imaging facilities.

-

December 2023 – iCAD Inc. expanded its ProFound AI Risk platform, which now offers personalized risk scores during mammogram screenings. The company entered a distribution agreement with large U.S. hospital systems to accelerate adoption.

Some of the prominent players in the U.S. mammography market include:

- GE Healthcare

- Hologic Inc.

- inVivo

- Vision Sciences

- Adani Systems

- Hausted

- Lorad Chemical Corporation

- RAM

- iCAD

- Dilon

- RadNet

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. mammography market

Product

- Film Screen Systems

- Digital Systems

- Analog Systems

- 3D Systems

Technology

- Breast Tomosynthesis

- CAD Mammography

- Digital Mammography

End-use

- Hospitals

- Specialty Clinics

- Diagnosis Centers

- Others