U.S. Medical Foods For Orphan Disease Market Size and Research 2026 to 2035

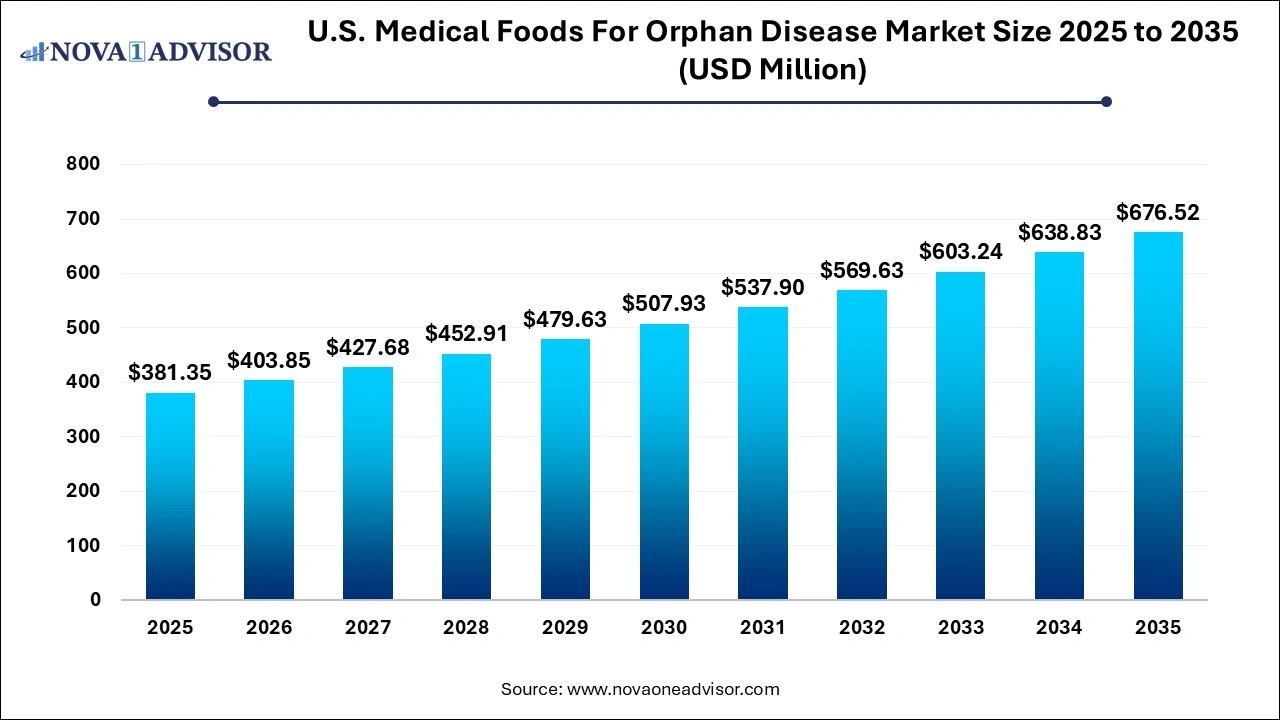

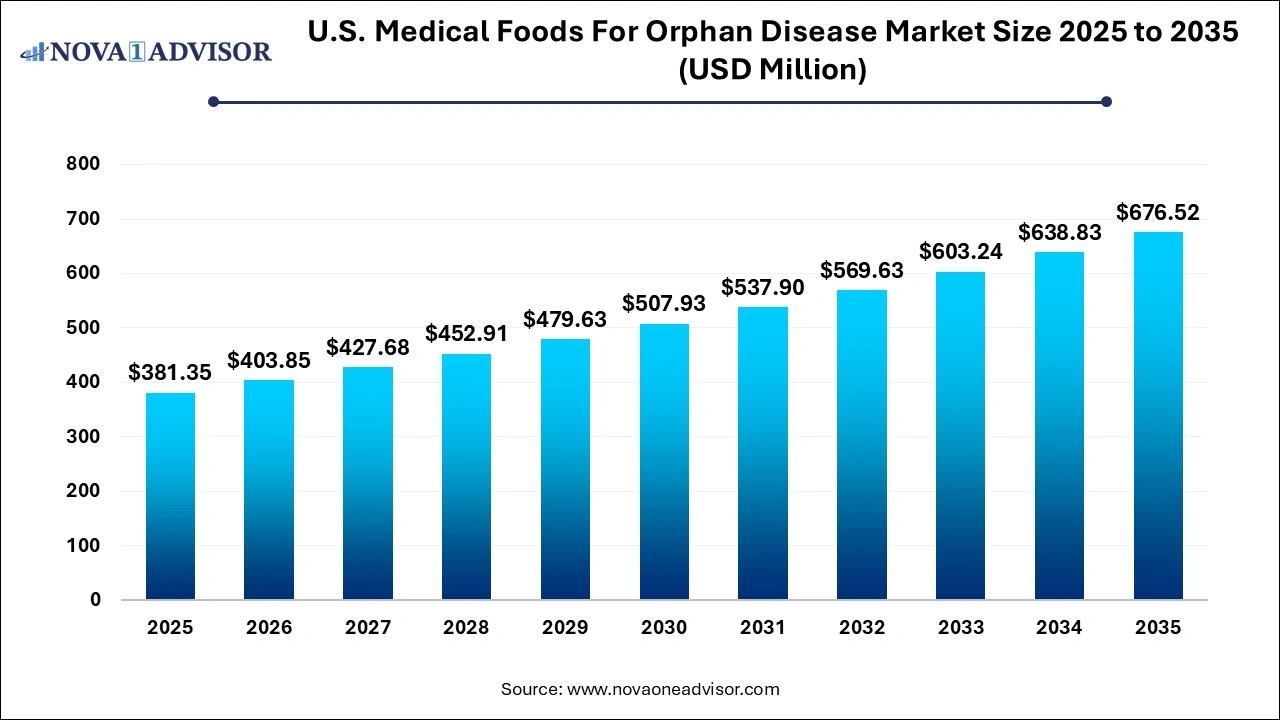

The U.S. medical foods for orphan disease market size was exhibited at USD 381.35 million in 2025 and is projected to hit around USD 676.52 million by 2035, growing at a CAGR of 5.7% during the forecast period 2026 to 2035.

Key Takeaways:

- The oral route segment accounted for the highest revenue share in terms of route of administration in 2025 and its revenue share was 70.8%.

- The powder segment accounted for 35.3% of the revenue share in 2025.

- The other segment accounted for 36.5% of the revenue share in 2025.

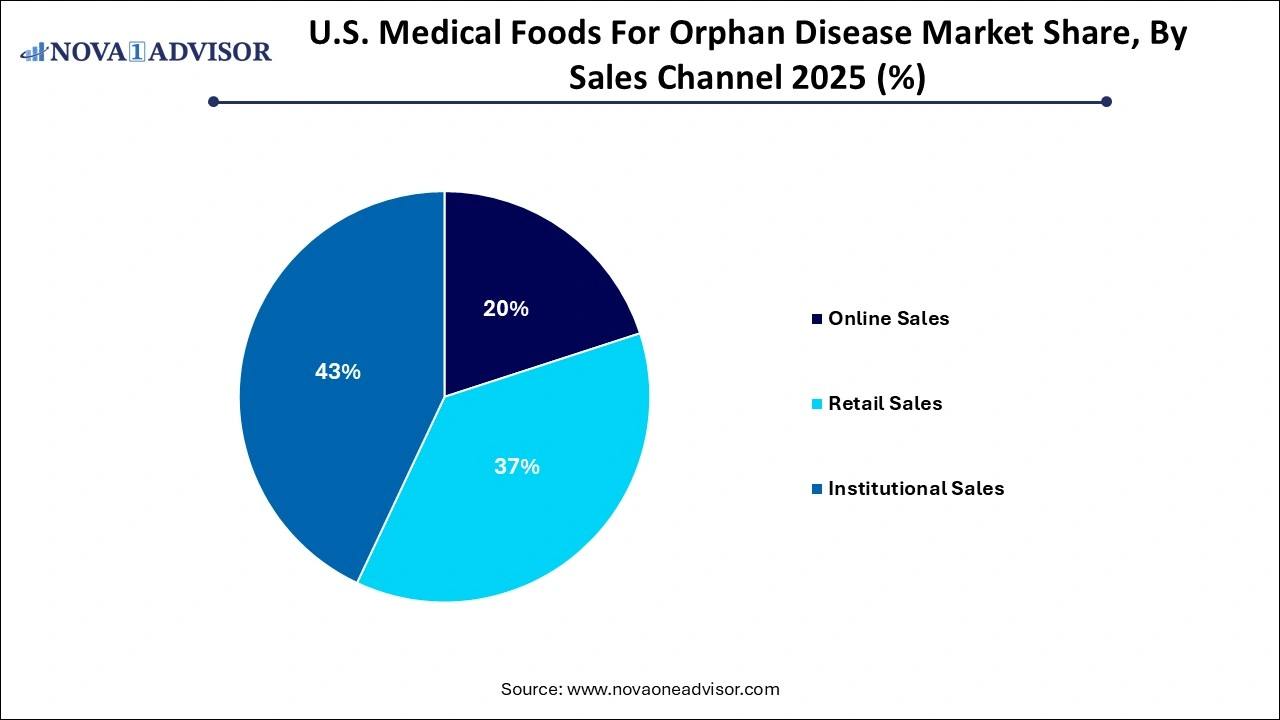

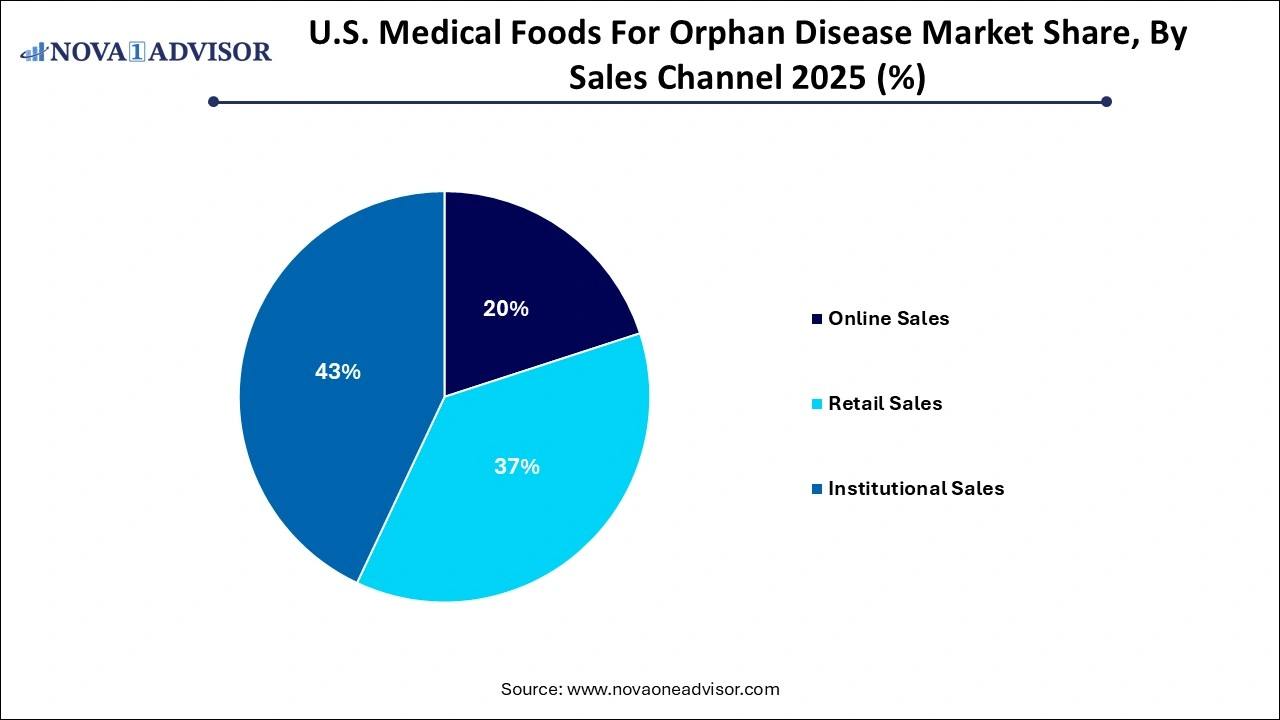

- Institutional sales held the majority share of 43% in 2025.

- The online sales segment is expected to grow lucratively over the forecast period.

U.S. Medical Foods For Orphan Disease Market Overview

The U.S. medical foods for orphan disease market represents a highly specialized yet rapidly growing sector in the broader healthcare and nutrition ecosystem. Medical foods are formulated to be consumed or administered under physician supervision, intended for the specific dietary management of diseases with unique nutritional requirements. When tailored to orphan diseases rare medical conditions affecting fewer than 200,000 individuals in the U.S.these products serve an essential role where traditional pharmacotherapy may fall short or require supplementation.

Orphan diseases, such as Phenylketonuria (PKU), Maple Syrup Urine Disease (MSUD), and Tyrosinemia, are often genetic in origin, requiring lifelong dietary intervention. Medical foods become not only an element of care but a central pillar in disease management. The unique metabolism of patients with these conditions necessitates carefully engineered foods that can control amino acid intake, reduce metabolic by-products, and prevent neurological or organ damage.

Driven by increasing awareness, improved diagnostics, and legislative support through the Orphan Drug Act, the demand for disease-specific nutritional solutions is growing. Innovations in nutrigenomics, bioavailability, and patient-centric formulations are driving this sector beyond niche boundaries, turning it into a strategic frontier for clinical nutrition and biopharma players.

Major Trends in the U.S. Medical Foods For Orphan Disease Market

-

Personalized Nutrition Solutions: Advances in genetic and metabolic profiling are enabling the development of more targeted medical food products tailored to individual needs.

-

Expansion of Home Care Support: With a rise in at-home management of rare diseases, there is greater demand for convenient, orally-administered medical food products.

-

Digital Therapeutic Integration: Medical food brands are increasingly integrating digital apps for dose tracking, metabolic monitoring, and tele-nutrition.

-

Growth in Pediatric Formulations: As many orphan diseases manifest in early childhood, child-friendly flavors and formats (like chewables and liquids) are on the rise.

-

FDA Engagement and Clarifications: New FDA guidelines around what qualifies as medical food are reshaping product formulations and labeling compliance strategies.

-

Public-Private Partnerships: Academic collaborations and non-profit funding are fueling R&D in specialized nutrition targeting rare disorders.

-

E-commerce and Direct-to-Consumer (DTC) Expansion: Brands are establishing online subscription platforms for medical foods, bypassing traditional pharmacy networks.

-

Global Players Entering U.S. Market: Companies like Nestlé and Nutricia are investing in expanding their rare disease medical food portfolios for U.S. patients.

Report Scope of The U.S. Medical Foods For Orphan Disease Market

| Report Coverage |

Details |

| Market Size in 2026 |

USD 403.85 Million |

| Market Size by 2035 |

USD 676.52 Million |

| Growth Rate From 2026 to 2035 |

CAGR of 5.9% |

| Base Year |

2025 |

| Forecast Period |

2026-2035 |

| Segments Covered |

Route of Administration, Product, Application, Sales Channel |

| Market Analysis (Terms Used) |

Value (USD Million/Billion) or (Volume/Units) |

| Regional Scope |

U.S. |

| Key Companies Profiled |

Danone; Abbott; Nestlé; Mead Johnson & Company; Relief Therapeutics |

Market Driver: Rising Prevalence of Diagnosed Orphan Diseases and Clinical Awareness

A key driver of this market is the growing diagnosis rate and clinical awareness of orphan diseases, propelled by improved genetic screening tools and newborn testing programs. Conditions such as PKU or MSUD, once undetected until irreversible damage occurred, are now routinely identified in infancy due to expanded metabolic panels in state-level screening protocols.

This early identification fuels demand for immediate nutritional intervention. For example, children diagnosed with PKU must avoid phenylalanine, an amino acid found in most proteins. Medical foods tailored for PKU help patients meet their dietary needs without triggering neurological harm. Moreover, rare disease awareness campaigns supported by advocacy groups such as the National Organization for Rare Disorders (NORD) are driving greater demand from clinicians and caregivers for accessible medical nutrition solutions.

Market Restraint: Regulatory Ambiguity and Reimbursement Challenges

One of the principal restraints for market participants is the regulatory gray zone surrounding medical foods, particularly in relation to insurance reimbursement. Although the FDA defines medical foods under the Orphan Drug Act, these products do not undergo premarket approval, leaving manufacturers with significant responsibility for determining compliance with labeling and safety.

Reimbursement policies also vary across states and insurers. Many commercial payers categorize medical foods as non-essential nutrition rather than therapeutic products, limiting access for economically disadvantaged patients. While Medicaid may cover certain conditions, gaps persist, especially for adults. This uncertainty around cost coverage discourages wider prescribing of medical foods and hampers market growth despite their clinical efficacy.

Market Opportunity: Innovation in Oral Nutrient Delivery Systems

A prominent opportunity exists in developing innovative oral formulations that are more palatable, bioavailable, and convenient, especially for pediatric and elderly patients. The traditional model powder mixes requiring careful measurement can be burdensome, especially for caregivers managing dietary adherence in children.

Companies are now investing in chewable tablets, flavored ready-to-drink shakes, and microencapsulated supplements. For instance, Danone’s Nutricia introduced an oral suspension product for Tyrosinemia with chocolate flavoring and improved taste masking, significantly boosting adherence rates in children. As rare disease management moves increasingly to home settings, the opportunity lies in making medical foods not just clinically effective, but enjoyable and manageable in daily life.

Segmental Insights

By Route Of Administration Insights

Oral administration is the dominant route of delivery for medical foods in the U.S., owing to its convenience, patient preference, and compatibility with at-home care routines. Most patients with orphan metabolic disorders, including Homocystinuria and PKU, rely on oral powders, liquids, or tablets. These formats are easier to distribute, store, and dose, making them ideal for chronic conditions. Given that most patients are diagnosed at a young age and require lifelong treatment, palatability and ease of use become paramount. Oral medical foods are also favored in outpatient settings where enteral feeding is not required.

Enteral administration is the fastest growing route, particularly for patients with complex multisystemic disorders or co-morbidities that impair gastrointestinal function. In pediatric hospitals and long-term care facilities, enteral nutrition via tubes is essential for patients who are either neurologically compromised or unable to swallow. For example, children with severe Eosinophilic Esophagitis who cannot tolerate oral intake often require amino acid-based enteral formulas. As clinical protocols increasingly prioritize early nutritional support in hospitalized rare disease patients, enteral products are experiencing steady growth, supported by technological advances in tube-compatible formulations.

By Product Insights

Powder-based medical foods remain the most dominant product category due to their flexibility in dosage, lower shipping costs, and extended shelf life. These formulations are especially preferred in metabolic disorders where protein restriction is key—allowing caregivers to adjust portions based on daily needs. A large share of PKU and MSUD patients rely on powdered phenylalanine-free or leucine-restricted protein supplements that can be mixed with water or juice. Powders also allow manufacturers to bundle nutrients and ensure stable compound delivery across a wide range of applications.

Liquid formulations are rapidly growing, especially among pediatric and geriatric patient populations. Ready-to-drink bottles eliminate the need for preparation and are ideal for school lunches, travel, or emergency intake. Companies like Vitaflo and Cambrooke are focusing on expanding their range of flavored medical drinks, fortified with omega-3, vitamins, and specialized amino acid blends. For patients with limited motor skills or poor appetite, liquids offer an efficient, compliant, and appealing method of nutrient delivery.

By Application Insights

Phenylketonuria (PKU) remains the largest application segment in the U.S. medical foods market, accounting for a substantial portion of product usage. PKU affects approximately 1 in 10,000 to 15,000 newborns in the U.S., and treatment necessitates a phenylalanine-restricted diet for life. Since natural protein sources contain phenylalanine, PKU patients rely heavily on specially formulated medical foods to meet nutritional needs. The robust infrastructure of screening, clinical guidelines, and patient support groups ensures sustained demand for PKU-focused products like metabolic protein replacements and amino acid blends.

Eosinophilic Esophagitis (EoE) is emerging as the fastest growing application, driven by increasing diagnosis rates and expanding research into its dietary triggers. EoE is an allergic inflammatory disease of the esophagus that requires stringent food elimination. Medical foods serve as elemental diets, offering amino acid-based nutrition free from common allergens. Recent studies have shown dramatic symptom resolution in children following exclusive medical food nutrition. The growth is further supported by rising awareness among pediatric gastroenterologists and allergists, as well as FDA research into dietary management of EoE.

By Sales Channel Insights

Institutional sales dominate the market, particularly through hospitals, specialty pharmacies, and metabolic clinics. These channels ensure that patients are properly diagnosed, prescriptions are monitored, and nutritional plans are supervised by dietitians. Hospitals use institutional procurement to manage patient transitions from inpatient to outpatient care, especially for neonates with rare metabolic conditions. Insurance billing and Medicaid coverage often require institutional documentation, reinforcing this channel’s relevance.

Online sales are witnessing exponential growth, fueled by subscription-based models and improved DTC logistics. With the rise of specialty e-commerce platforms offering FDA-compliant medical nutrition, caregivers can order products with ease, access bulk pricing, and receive home delivery. Nestlé’s recent e-commerce integration for metabolic medical foods reflects this trend. Additionally, digital engagement enables education, dietary tracking, and refill reminders, fostering adherence and convenience for long-term management.

Country-Level Insights – United States

The U.S. market for medical foods targeting orphan diseases is expanding rapidly, driven by a confluence of demographic, legislative, and technological factors. The U.S. government maintains a proactive stance toward rare disease management through policies such as the Orphan Drug Act, Rare Diseases Clinical Research Network, and expanded newborn screening mandates in most states.

The Food and Drug Administration (FDA) defines medical foods as exempt from typical drug approval processes, provided they are formulated for a specific disease, intended for dietary management, and used under physician supervision. However, the regulatory burden is shifting. Recent updates (2024) from the FDA have emphasized clearer labeling requirements, manufacturing standards, and documentation of medical need.

Insurance coverage remains a contentious area, with advocacy groups pushing for uniform Medicaid policies across states. Some states mandate coverage for inherited metabolic disorders, while others leave it discretionary. This patchwork system has created access inequalities that stakeholders continue to address through lobbying and education.

Pediatric hospitals, rare disease centers, and home health services are increasingly incorporating medical food protocols into chronic disease pathways. As the U.S. rare disease population exceeds 25 million individuals, with over 7,000 recognized conditions, the scope for specialized nutrition will only expand.

Some of the prominent players in the U.S. medical foods for orphan disease market include:

Recent Developments

-

September 2024 – Nestlé Health Science launched a new medical food product in the U.S. for Tyrosinemia Type 1, enhancing palatability and nutritional completeness, with plans for further digital integration into its home monitoring app.

-

August 2024 – Cambrooke Therapeutics announced a partnership with a major telehealth provider to deliver virtual nutritional counseling bundled with metabolic food subscriptions for PKU and MSUD patients.

-

June 2024 – Vitaflo USA introduced a new ready-to-drink formulation for Homocystinuria, improving absorption and taste in pediatric populations.

-

May 2024 – The FDA updated its guidance on medical food classification, clarifying documentation expectations for products treating rare diseases and reinforcing post-market surveillance practices.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2035. For this study, Nova one advisor, Inc. has segmented the U.S. medical foods for orphan disease market

Route Of Administration

Product

- Powder

- Pills

- Liquid

- Others

Application

- Phenylketonuria

- Tyrosinemia

- Eosinophilic Esophagitis

- FPIES

- MSUD

- Homocystinuria

- Others

Sales Channel

- Online Sales

- Retail Sales

- Institutional Sales