U.S. Medical Image Analysis Software Market Size and Trends

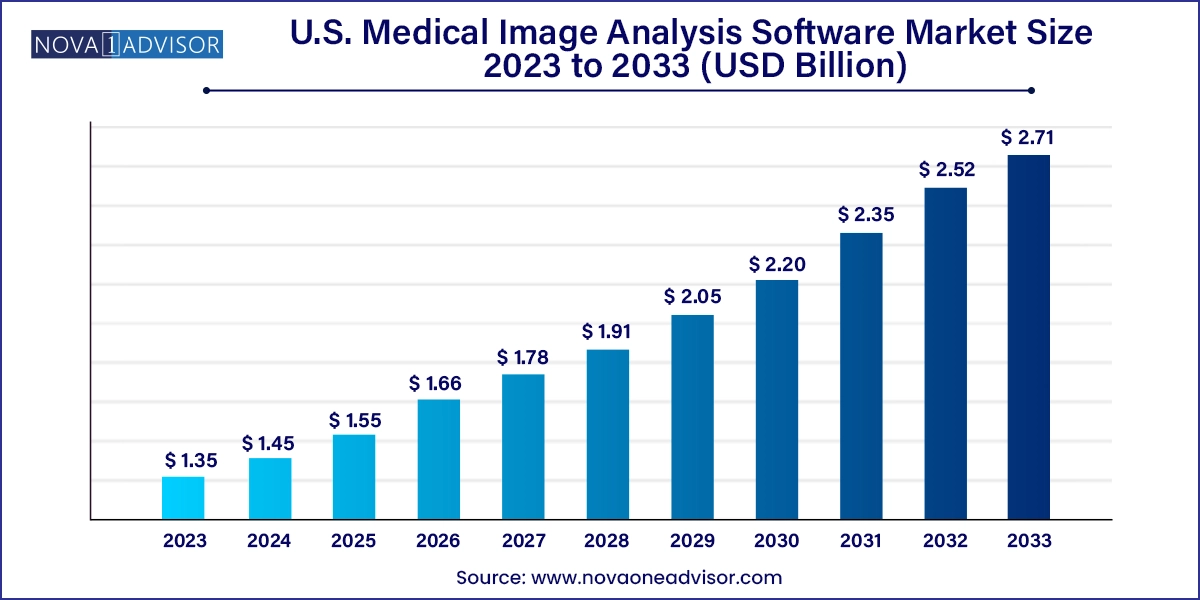

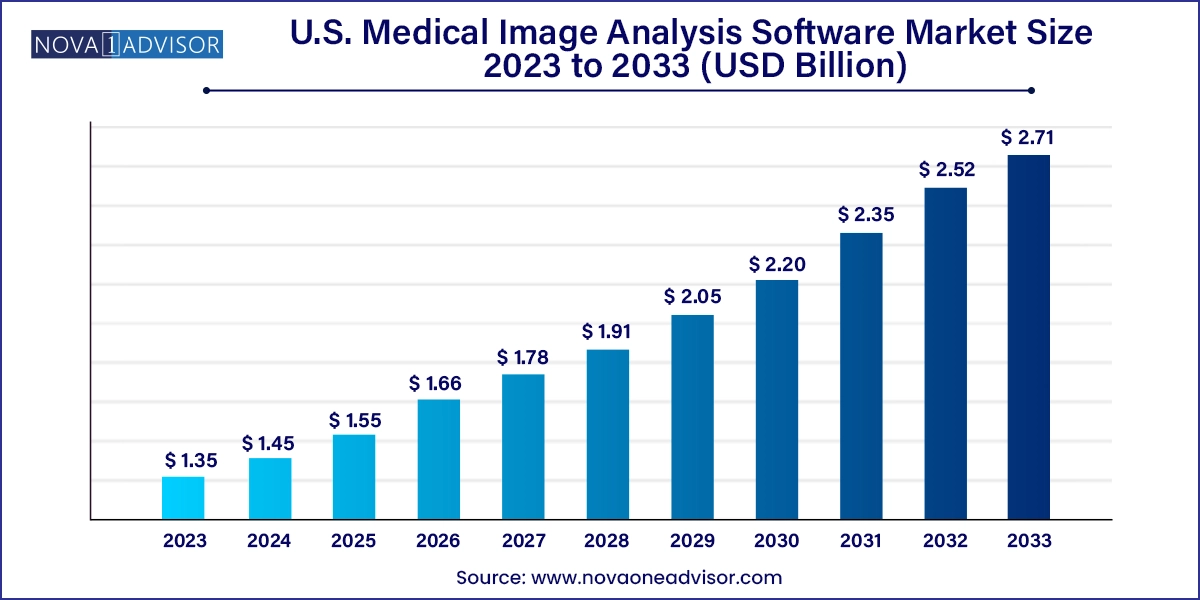

The U.S. medical image analysis software market size was exhibited at USD 1.35 billion in 2023 and is projected to hit around USD 2.71 billion by 2033, growing at a CAGR of 7.2% during the forecast period 2024 to 2033.

U.S. Medical Image Analysis Software Market Key Takeaways:

- Integrated segment dominated the market with a share of 54.85% in 2023.

- The standalone segment is expected to grow most over the forecast period.

- Tomography segment dominated the market with a share of 37.25% in 2023.

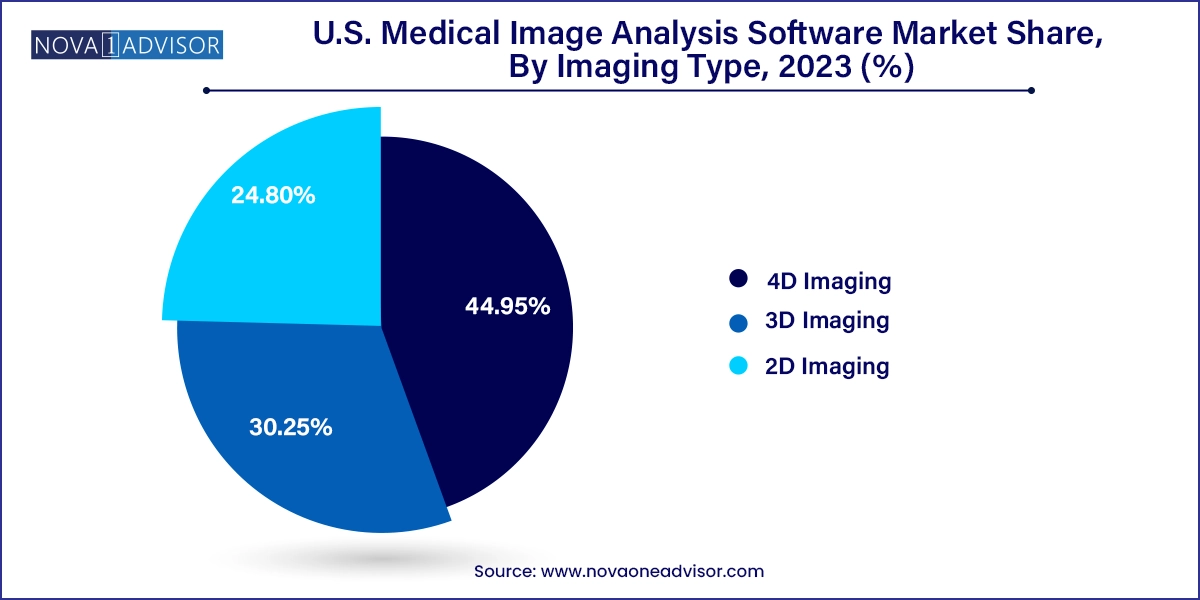

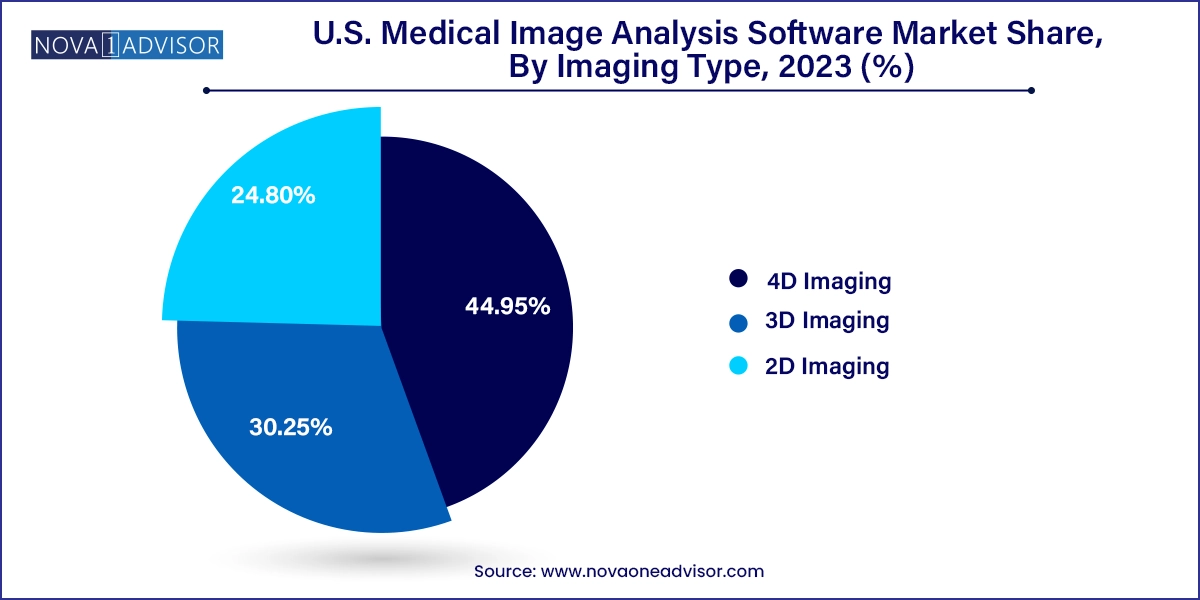

- 4D segment dominated the market with a share of 44.95% in 2023.

- The 3D segment is expected to witness considerable growth over the forecast period.

- Cardiology segment dominated the market with a share of 20.40% in 2023.

- The oncology segment is expected to witness highest growth over the forecast period.

- Diagnostic centers segment dominated the market with a share of 34.35% in 2023.

Market Overview

The U.S. medical image analysis software market plays a pivotal role in advancing diagnostic accuracy, accelerating clinical decision-making, and enabling precision medicine. This market comprises software platforms and tools used to interpret, visualize, and quantify data from various medical imaging modalities such as MRI, CT, PET, ultrasound, mammography, and X-ray. These platforms leverage cutting-edge algorithms, artificial intelligence (AI), and machine learning (ML) to provide actionable insights from medical images in real time.

The demand for medical image analysis software in the U.S. is primarily driven by the rising prevalence of chronic and age-related diseases particularly cardiovascular diseases, cancers, and neurological disorders which necessitate early and accurate diagnosis. Additionally, the growing penetration of advanced imaging systems in hospitals and diagnostics centers, along with government incentives for digital health adoption, is further pushing software integration into imaging workflows.

Software systems are now integral to a radiologist’s or clinician’s toolkit. By automating tedious tasks such as lesion segmentation, organ volumetry, tumor tracking, and image reconstruction, these platforms improve speed and reduce inter-observer variability. Moreover, as value-based care models take root, the emphasis on diagnostic efficiency, interoperability, and longitudinal patient monitoring continues to elevate the market’s relevance. U.S. healthcare providers are investing heavily in interoperable and AI-enhanced systems that not only enhance image interpretation but also integrate seamlessly with Picture Archiving and Communication Systems (PACS), Electronic Health Records (EHRs), and cloud-based platforms.

Major Trends in the Market

-

Integration of AI and Deep Learning Algorithms: AI-powered image analysis software is enabling auto-segmentation, anomaly detection, and decision support in radiology workflows.

-

Rise of 3D and 4D Imaging Capabilities: Demand for volumetric analysis and real-time dynamic imaging is increasing across cardiology, oncology, and orthopedics.

-

Expansion of Cloud-Based Imaging Software: Cloud-enabled image analysis is facilitating remote access, collaborative diagnostics, and storage scalability.

-

Growing Demand for Multi-Modality Imaging Platforms: Hospitals are increasingly opting for software that supports combined modalities such as PET/CT and SPECT/CT.

-

Regulatory Approvals for AI Software as Medical Devices (SaMD): The FDA’s evolving guidelines are accelerating the commercialization of AI-based imaging tools.

-

Customization and Specialty-Specific Software Development: Vendors are developing niche solutions for cardiology, neurology, mammography, and dental imaging.

-

Automated Report Generation and Structured Reporting: Image analysis platforms are now integrating with NLP and automated reporting systems to generate standardized diagnostic reports.

Report Scope of U.S. Medical Image Analysis Software Market

| Report Coverage |

Details |

| Market Size in 2024 |

USD 1.45 Billion |

| Market Size by 2033 |

USD 2.71 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 7.2% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Software Type, Modality, Imaging Type, Application, End use |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

U.S. |

| Key Companies Profiled |

Koninklijke Philips N.V.; Agfa-Gevaert Group; Canon Medical Systems; MIM Software, Inc.; Bruker; Siemens Healthineers AG; ESAOTE SPA; Deep Rui Medical (Deepwise); Infervision Medical Technology Co., Ltd.; Neusoft Medical Systems Co., Ltd. |

U.S. Medical Image Analysis Software Market By Software Type Insights

Integrated software dominated the U.S. medical image analysis software market, largely due to its compatibility with large-scale hospital imaging infrastructure. Integrated solutions are embedded directly within PACS and RIS platforms, allowing seamless communication across the diagnostic imaging workflow. These platforms facilitate centralized access, image retrieval, report generation, and even AI-assisted diagnostics through unified dashboards. Large hospitals and imaging centers favor integrated systems due to reduced interoperability issues and better data security.

However, stand-alone software is witnessing rapid growth, especially among specialized clinics and academic research centers. These systems are often modality-specific or application-focused, providing advanced tools for a particular need such as neuroimaging, orthopedic surgical planning, or mammography CAD. Moreover, the flexibility of stand-alone systems allows users to choose best-in-class software for specific tasks. Many start-ups and niche vendors are entering the market with AI-driven stand-alone platforms that offer cloud-based access and subscription-based pricing, making them attractive to outpatient facilities and remote care providers.

U.S. Medical Image Analysis Software Market By Modality Insights

Tomography held the largest market share by modality, particularly with CT and MRI systems. These high-resolution imaging techniques are central to neurology, cardiology, and oncology, where deep-tissue visualization and contrast analysis are essential. Software platforms for CT and MRI offer 3D reconstruction, automated lesion detection, and cross-sectional analysis. AI enhancements in these modalities have further improved diagnostic precision, especially in brain scans, lung nodule detection, and liver fibrosis assessment.

Meanwhile, combined modalities are the fastest-growing segment, reflecting the rising popularity of hybrid systems like PET/CT, PET/MRI, and SPECT/CT. These combinations offer both functional and anatomical information, improving diagnostic specificity in oncology, cardiology, and neurology. Analysis software that can process data from multiple modalities in a synchronized manner is crucial for interpreting these complex images. As precision medicine and theranostics become more prevalent, software supporting multimodal imaging will be essential in enabling integrated disease assessment.

U.S. Medical Image Analysis Software Market By Imaging Type Insights

2D imaging continues to dominate the market, owing to its broad application in standard radiographs, 2D ultrasound, and mammography. These formats are used in basic screenings, orthopedic diagnostics, and dental imaging. Software for 2D imaging primarily focuses on contrast adjustment, annotation tools, segmentation, and archiving. Despite its simplicity, 2D image analysis remains indispensable in primary care and urgent care settings.

In contrast, 3D and 4D imaging are the fastest-growing categories, especially in fields requiring dynamic visualization like cardiology, fetal assessment, and oncology. 3D imaging allows for volumetric analysis, which is vital for tumor tracking, organ modeling, and surgical planning. 4D imaging, which adds the time dimension to 3D visualization, is increasingly used in cardiac imaging and real-time fetal movement monitoring. Software platforms that enable multiplanar reconstruction (MPR) and real-time rendering are seeing heightened demand.

U.S. Medical Image Analysis Software Market By Application Insights

Oncology dominated the application segment, driven by the need for precise tumor localization, staging, and monitoring across multiple cancer types. Image analysis software in oncology supports tumor segmentation, radiomics, and longitudinal tracking to guide treatment decisions. As immunotherapy and targeted therapies grow, there is increased reliance on imaging biomarkers to evaluate treatment response. AI-enhanced oncology tools can detect subtle changes in tumor characteristics, which might be missed by the human eye.

Neurology is emerging as the fastest-growing application, as conditions like Alzheimer’s disease, epilepsy, traumatic brain injuries, and multiple sclerosis require advanced neuroimaging. MRI and PET scans, in particular, provide detailed information about brain structure and function. Image analysis tools that can map neural networks, quantify brain volume loss, and detect plaque deposits are essential in both clinical and research settings. The surge in neuroimaging studies, particularly in dementia-related research, is driving the adoption of specialized analysis software.

U.S. Medical Image Analysis Software Market By End-use Insights

Hospitals lead the market in terms of end-use, as they possess the infrastructure to integrate image analysis software across departments including radiology, oncology, cardiology, and emergency care. Large academic hospitals and cancer centers invest in enterprise-grade platforms that support multi-modality imaging, AI diagnostics, and structured reporting. These institutions also partner with vendors to co-develop and validate AI algorithms under FDA guidelines.

Diagnostic imaging centers and ambulatory surgical centers (ASCs) represent the fastest-growing end-use segments. These facilities are expanding across urban and suburban areas to provide outpatient imaging services, often with shorter wait times and lower costs than hospitals. ASCs, especially those focused on orthopedics, ophthalmology, and gynecology, are deploying image analysis tools to improve surgical planning and post-operative evaluation. Their focus on efficiency and specialization makes them ideal adopters of streamlined, stand-alone, or modular image analysis platforms.

Country-Level Analysis

In the U.S., the adoption of medical image analysis software varies across states and regions based on healthcare infrastructure, investment in technology, and presence of research hubs.

The Northeast U.S. dominates the market, with cities like Boston, New York, and Philadelphia serving as epicenters for academic medical research, AI innovation, and large hospital systems. Institutions like Massachusetts General Hospital, Mount Sinai Health System, and NYU Langone are actively implementing AI-enhanced imaging and partnering with vendors for software development and clinical trials.

The Southwest is the fastest-growing region, particularly in Texas and Arizona, where population growth, hospital expansion, and investment in medical technology are surging. Texas, for example, is home to MD Anderson Cancer Center and a growing network of teleradiology providers, which are driving demand for cloud-native, scalable image analysis solutions.

Some of the prominent players in the U.S. medical image analysis software market include:

- Koninklijke Philips N.V.

- Agfa-Gevaert Group

- Canon Medical Systems

- MIM Software, Inc.

- Bruker

- Siemens Healthineers AG

- ESAOTE SPA

- Deep Rui Medical (Deepwise)

- Infervision Medical Technology Co., Ltd.

- Neusoft Medical Systems Co., Ltd.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. medical image analysis software market

Software Type

- Integrated Software

- Stand-alone Software

Modality

-

- Computed Tomography

- Magnetic Resonance Imaging

- Positron Emission Tomography

- Single-Photon Emission Tomography

- Radiographic Imaging

- Combined Modalities

Imaging Type

- 2D Imaging

- 3D Imaging

- 4D Imaging

Application

- Orthopedic

- Dental

- Neurology

- Cardiology

- Oncology

- Obstetrics & Gynecology

- Mammography

- Urology & Nephrology

End-use

- Hospitals

- Diagnostic Centers

- Ambulatory Surgical Centers (ASCs)

- Others (Academic & Research Centers)