U.S. Military Animals Market Size and Trends

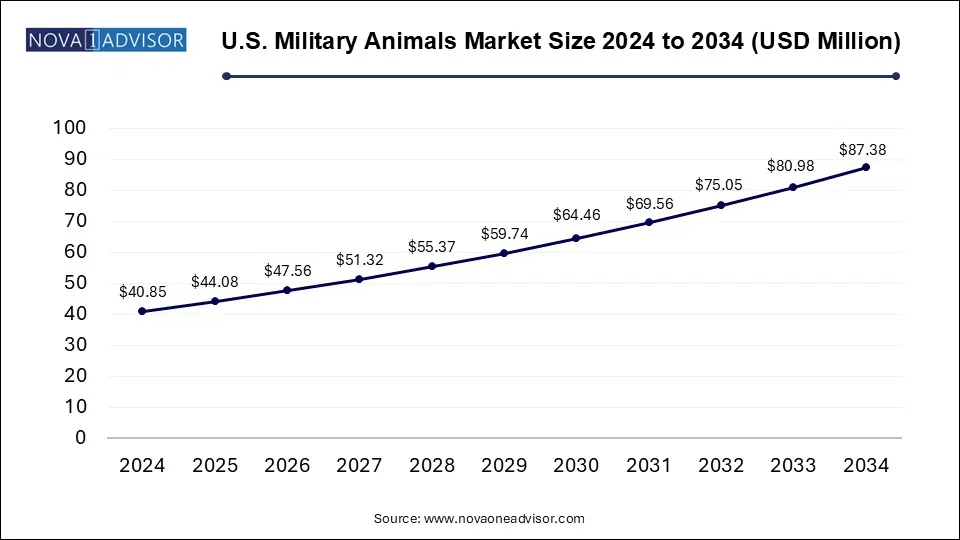

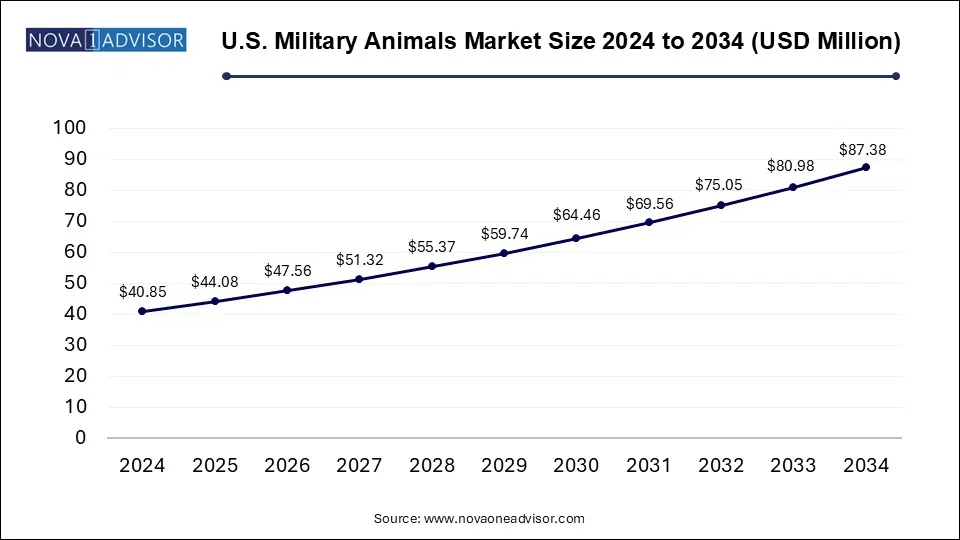

The U.S. military animals market size was exhibited at USD 40.85 million in 2024 and is projected to hit around USD 87.38 million by 2034, growing at a CAGR of 7.9% during the forecast period 2025 to 2034.

U.S. Military Animals Market Key Takeaways:

- The dogs segment dominated the market in 2024 and is expected to witness a lucrative CAGR during the forecast period.

- Based on service type, the scout/patrol search segment dominated the market in 2024.

- Sentry is expected to witness a lucrative CAGR during the forecast period.

- By sector, the army dominated the market in 2024 and is expected to witness a lucrative CAGR during the forecast period.

Market Overview

The U.S. military animals market occupies a unique and strategically significant segment within the broader defense services ecosystem. Animals primarily dogs but also including horses, mules, and even pigeons historically have been a vital asset in military operations, providing functions that range from explosive detection and sentry duty to search-and-rescue and casualty assistance. In the modern era, while technology dominates warfare, military animals continue to serve roles that machines cannot fully replicate particularly in high-risk and unpredictable terrains where instinct, agility, and acute senses are unmatched.

The market in the United States is shaped by the Department of Defense’s growing investment in specialized animal training programs, animal health care, and integration of animals into tactical units. Military Working Dogs (MWDs), in particular, are central to operations carried out by the Army, Navy, Air Force, and Marine Corps. With the U.S. military engaged in complex missions involving counterterrorism, peacekeeping, and homeland security, the demand for highly trained animals remains consistently high.

These animals are trained for several months at specialized facilities like the 341st Training Squadron at Joint Base San Antonio-Lackland, Texas. The procurement, training, deployment, and post-service retirement care of military animals constitute key spending areas in this market. Rising awareness of the contribution and welfare of these animals has also led to policy enhancements, opening avenues for private vendors, NGOs, and veterinary technology firms to participate in the evolving ecosystem.

Major Trends in the Market

-

Increasing Demand for Explosive and Narcotics Detection Dogs: Counterterrorism and border security missions are driving demand for canine teams.

-

Breed Specialization and Genetic Selection: Military breeders are increasingly focusing on genetics to optimize temperament, scent detection, and trainability.

-

Integration of Wearable Tech and Bio-Monitoring: Dogs are being equipped with GPS, health monitoring collars, and communication devices for field coordination.

-

Public-Private Partnerships for Training and Supply: Civilian breeders and training agencies are increasingly collaborating with military procurement offices.

-

Improved Post-Service Retirement Protocols: Enhanced legislation and welfare programs are supporting the transition of military animals into civilian adoption or therapeutic roles.

-

Growth of the K9 Unit Support Industry: Ancillary markets for dog vests, goggles, paw protection gear, and first aid kits are expanding alongside core training services.

-

Behavioral Psychology Integration in Training: Advanced methods based on animal cognition and behavioral research are being integrated into training regimens.

Report Scope of U.S. Military Animals Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 44.08 Million |

| Market Size by 2034 |

USD 87.38 Million |

| Growth Rate From 2025 to 2034 |

CAGR of 7.9% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

Animal Type, Sector, Service Type |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Key Companies Profiled |

Pond & Company; Shultz K9 Enforcement Inc; K9 Partners for Patriots; ExcelsiorK9; TWG Group; Us K9 Unlimited; Worldwide Canine; Cobra Canine; K2 Solutions, Inc |

Market Driver: Expansion of Counterterrorism and Border Security Operations

A significant driver of the U.S. military animals market is the continuous focus on homeland security, counterterrorism, and border surveillance. With growing threats from improvised explosive devices (IEDs), drug trafficking, and human smuggling, the role of detection and patrol animals has expanded considerably. Dogs, particularly trained breeds like Belgian Malinois and German Shepherds, offer unmatched capabilities in sniffing out contraband, explosives, and hidden personnel—often outperforming advanced electronic sensors.

In highly sensitive areas such as border crossings, embassies, and military installations, MWDs are deployed daily to ensure operational security. Canines can search vehicles and luggage faster and more thoroughly than machines, and they can also detect low-volume narcotics and hidden compartments that evade technological screening. The dual-use capability of these animals in both defensive and humanitarian missions, such as natural disaster rescue, further underlines their strategic value to U.S. defense operations.

Market Restraint: Ethical and Logistical Challenges of Animal Deployment

Despite their utility, the military animals market faces ethical and operational constraints. One primary restraint is the growing debate around animal welfare, ethical use, and post-service treatment. Advocacy groups and segments of the public question the use of animals in warfare environments where they are exposed to physical harm, psychological trauma, and high-stress scenarios.

Additionally, logistical complexities in deploying and maintaining animal units across conflict zones add to cost and planning burdens. Animals require veterinary support, rest cycles, acclimatization periods, and specialized transport. In field conditions lacking infrastructure, ensuring their care can be difficult. These constraints necessitate high expenditure on animal welfare and logistics, which can limit expansion and scalability, especially for smaller or temporary operations.

Market Opportunity: Integration of Military Animals with Advanced Technology

One of the most promising opportunities in this market lies in the convergence of animal performance with advanced military technologies. Research is underway on integrating military animals with wearable devices that track physiological health indicators, GPS location, and environmental cues in real-time. These wearables not only enhance animal safety but also allow handlers to assess fatigue, injury risk, and engagement performance remotely.

Another frontier is communication systems embedded in canine gear—allowing handlers to issue voice commands or signals through devices, even at distances or when the dog is out of sight. AI and data analytics are also being used to track training progress, identify stress behaviors, and optimize mission planning. As defense budgets increasingly prioritize unmanned and precision-guided systems, military animals equipped with smart technology can act as biohybrid assets, merging instinct with intelligence.

U.S. Military Animals Market By Animal Type Insights

Dogs dominate the U.S. military animals market, accounting for the vast majority of deployments across services. Breeds such as German Shepherds, Belgian Malinois, and Retrievers are preferred for their intelligence, endurance, obedience, and acute olfactory senses. These breeds are widely used in explosive detection, sentry duty, and casualty assistance. German Shepherds were historically the most deployed, especially in patrol and guard roles due to their strong build and temperament.

Belgian Malinois, however, are the fastest-growing breed in deployment. Lighter, faster, and more agile than German Shepherds, Malinois are now the preferred choice for elite operations like U.S. Navy SEALs and airborne units. Their ability to perform in extreme climates and challenging terrains has made them indispensable in both urban and field operations. Their temperament also lends well to intense tactical training and long mission durations.

Cats and other animals like horses and pigeons represent a niche but historical segment, with contemporary use being symbolic or limited to therapy and ceremonial functions.

U.S. Military Animals Market By Service Type Insights

Explosive detection is the leading service application of military animals in the U.S. Given the increasing threat of IEDs in both domestic and overseas operations, dogs trained to detect specific chemical compounds play a critical role. These services are not limited to combat; they also serve in airport security, naval base inspections, and embassy sweeps. Dogs assigned to these roles undergo rigorous scent recognition training and can differentiate between a wide range of explosive materials.

On the other hand, casualty and rescue services are witnessing the fastest growth. Whether after natural disasters like earthquakes or during combat recovery missions, dogs trained in locating injured personnel or trapped civilians are becoming integral to humanitarian and military aid programs. Their capacity to navigate debris, enter narrow spaces, and use scent to identify survivors makes them superior to many robotic alternatives in these scenarios.

U.S. Military Animals Market By Sector Insights

The U.S. Army is the dominant sector in the military animals market, operating the largest canine units and spearheading dog handler training programs. Army dogs are used for patrol, guard, detection, and scout services, both in training camps and in deployment zones. With sprawling domestic bases and foreign operations, the Army has invested extensively in animal logistics, handler training, and inter-unit deployment systems.

The U.S. Navy is witnessing growing adoption, particularly in special operations forces such as SEAL teams, where stealth, speed, and multi-terrain performance are vital. Navy handlers often train dogs for amphibious and airborne missions. Dogs in the Navy are also trained for shipboard patrol and explosive detection in ports, underscoring their expanding tactical and maritime utility.

Country-Level Analysis

In the United States, the military animals market is deeply embedded in defense and homeland security infrastructure. The Department of Defense operates centralized training and supply chains for working animals, most notably at the Lackland Air Force Base in Texas, which houses the 341st Training Squadron—often referred to as the "Canine Corps" headquarters.

The U.S. also maintains programs for foreign military sales of trained dogs, breeding programs for optimal behavioral traits, and initiatives for service animal retirement and adoption. Laws like the National Defense Authorization Act (2016) mandate that retiring military dogs be reunited with their handlers, which has spurred support organizations and foster networks across the country.

Veterinary care for deployed animals is provided by the Army Veterinary Corps, and military animals are even assigned identification numbers and service records. This institutional structure ensures a sustainable and accountable system, positioning the U.S. as the world leader in the military animal domain, both in operations and ethics.

Some of the prominent players in the U.S. military animals market include:

Recent Developments

-

February 2025: The U.S. Army announced a $20 million investment into upgrading the Military Working Dog Facility in San Antonio, Texas, aimed at expanding training programs and introducing AI-assisted behavioral monitoring.

-

December 2024: K2 Solutions, a prominent canine training company, partnered with the Department of Homeland Security to provide a new generation of dogs trained for fentanyl detection and disaster recovery.

-

October 2024: The U.S. Navy SEALs incorporated a new canine exoskeleton harness system developed by Recon K9, enabling parachute deployment with improved back and leg support.

-

August 2024: The American Humane Association launched a national awareness campaign highlighting the contributions of military dogs, along with a public adoption registry for retired service dogs.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the U.S. military animals market

By Animal Type

-

- German Shepherds

- Belgian Malinois

- Retrievers

- Others

By Service

- Scout/Patrol Search

- Sentry

- Casualty

- Explosive Detection

- Narcotic Detection

- Others

By Sector

- Army

- Air Force

- Marine

- Navy