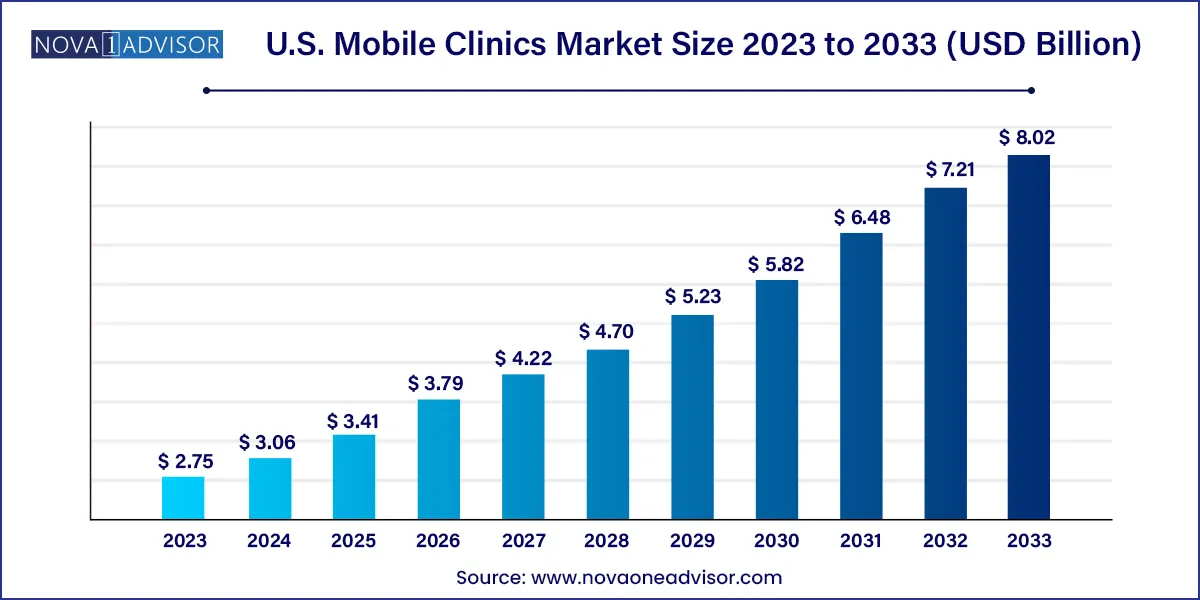

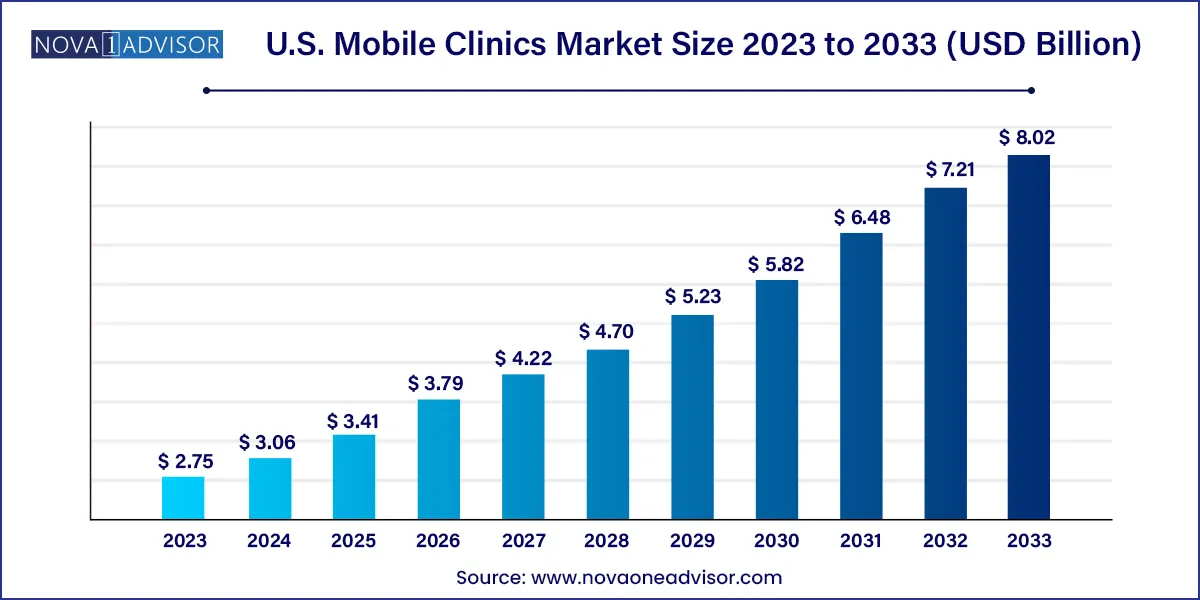

U.S. Mobile Clinics Market Size and Growth

The U.S. mobile clinics market size was exhibited at USD 2.75 billion in 2023 and is projected to hit around USD 8.02 billion by 2033, growing at a CAGR of 11.3% during the forecast period 2024 to 2033.

Key Takeaways:

- The mobile medical van segment accounted for the largest market share of 46.9% in 2023.

- The dental care segment accounted for the largest revenue share of 28.2% in 2023.

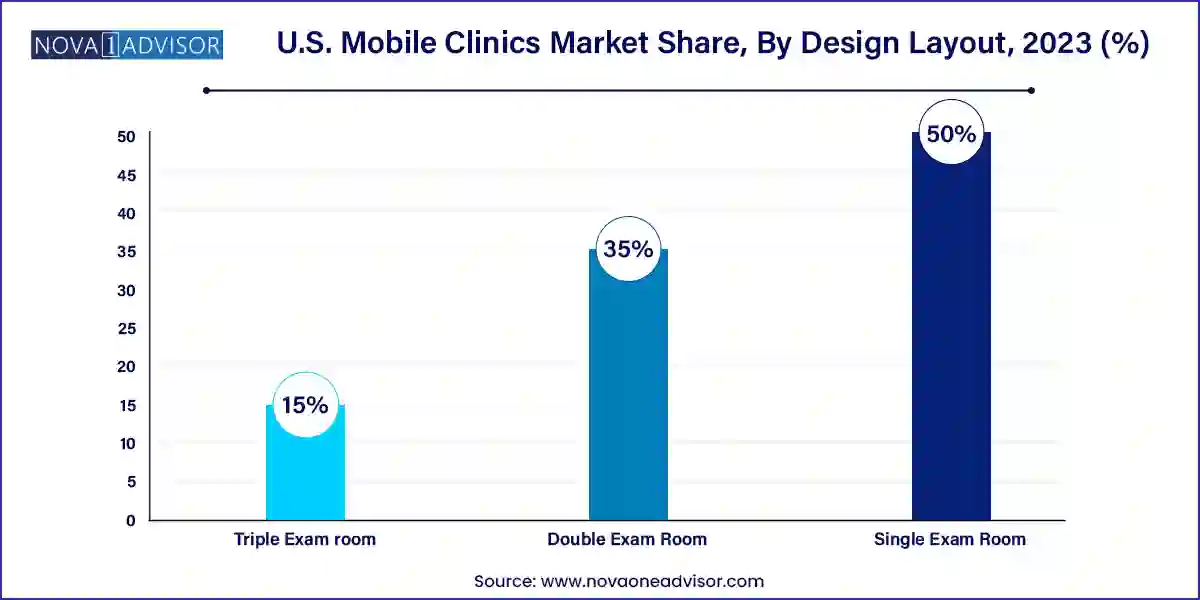

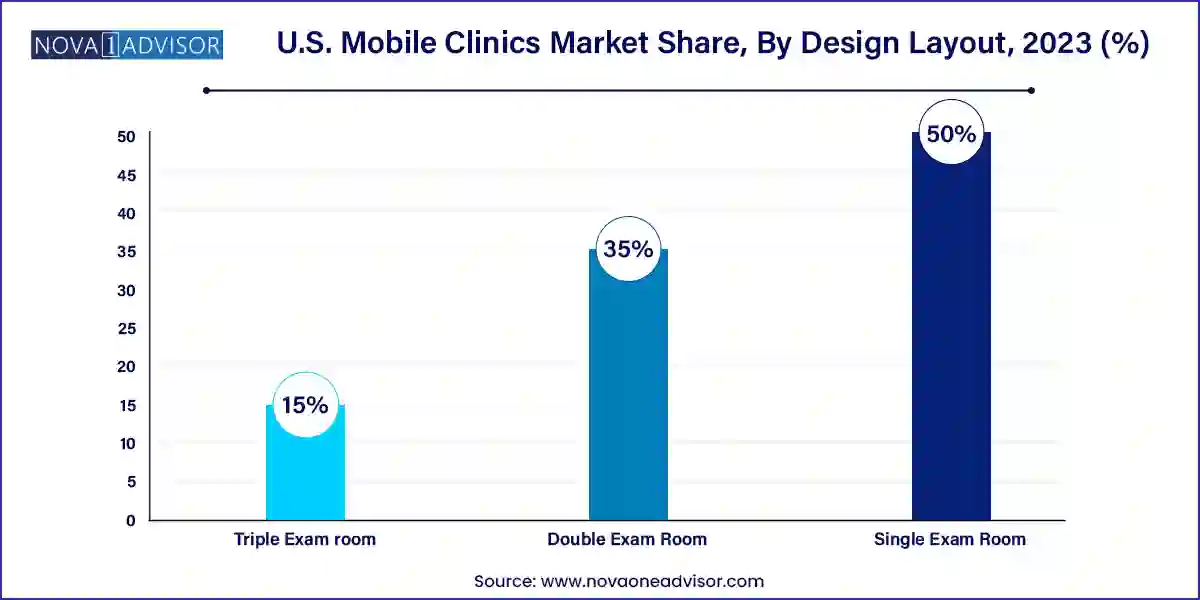

- The single exam room segment dominated the U.S. mobile clinics market with a revenue share of 50.0% in 2023.

- The double exam room segment is expected to be the fastest-growing segment with a CAGR of 11.5% during the period from 2024 to 2033.

Market Overview

The U.S. Mobile Clinics Market has emerged as a transformative model of healthcare delivery, focused on bridging critical gaps in access to primary and specialty medical services for underserved and remote populations. Mobile clinics ranging from vans to buses and container-based units act as traveling medical units equipped with diagnostic tools, treatment supplies, and trained personnel. These mobile healthcare units address some of the most persistent challenges in the American healthcare landscape, including geographical barriers, income-based disparities, and healthcare deserts.

With over 2,000 mobile clinics in operation across the United States as of 2024, this segment is rapidly gaining traction as a viable, cost-effective, and scalable method to provide outreach health services. Mobile units deliver a wide spectrum of care: from maternal and child health, mental wellness, reproductive services, to screenings, dental work, and chronic disease management. These clinics are often operated by hospital systems, universities, nonprofits, or government agencies and are typically funded through a mix of grants, Medicaid reimbursements, philanthropic donations, and partnerships with community health programs.

Rising demand has been further fueled by national movements focused on health equity and value-based care. The COVID-19 pandemic accelerated the relevance of mobile clinics, especially in supporting rural vaccination rollouts and COVID testing. Since then, the infrastructure and public acceptance of mobile clinics have matured significantly, making them a critical component of community health strategies.

Healthcare providers now view mobile clinics as a permanent strategy rather than a temporary fix. With the increase in chronic diseases, healthcare costs, and an aging population, mobile clinics are strategically positioned to relieve pressure from brick-and-mortar facilities, especially in remote areas where transportation is a barrier. As such, this market is expected to experience robust growth over the next decade, bolstered by innovation, federal support, and expanded scope of services.

Major Trends in the Market

-

Integration of Telehealth with Mobile Clinics: Many mobile units are now equipped with telemedicine capabilities, allowing patients to consult with specialists remotely in real-time.

-

Public-Private Partnerships: Collaborations between health systems, local governments, and corporations (e.g., CVS, Walmart) are leading to increased investment in mobile health programs.

-

Customization of Vehicle Design: Clinics are now tailored for specific services like dental care, prenatal exams, or oncology screenings, with custom layouts for efficiency.

-

Focus on Preventive Care: Mobile clinics are shifting from emergency response to providing regular preventive care, including wellness checks and screenings.

-

Data-Driven Operations: Mobile health units are incorporating electronic health record (EHR) systems, cloud-based diagnostics, and AI for service optimization.

-

Expansion into Urban Areas: Initially targeted toward rural zones, mobile clinics are now increasingly present in inner cities to address uninsured and homeless populations.

-

Environmental Considerations: Newer models of mobile clinics feature solar panels, hybrid engines, and energy-efficient layouts to reduce carbon footprints.

-

Insurance Reimbursement Reforms: States are enacting Medicaid provisions that encourage or reimburse mobile clinic visits, driving expansion in low-income zones.

Report Scope of The U.S. Mobile Clinics Market

| Report Coverage |

Details |

| Market Size in 2024 |

USD 3.06 Billion |

| Market Size by 2033 |

USD 8.02 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 11.3% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Vehicles, Services, Design Layout |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

U.S. |

| Key Companies Profiled |

Matthews Specialty Vehicles; Farber Specialty Vehicles; ADI Mobile Health; MinFound Medical Systems Co., Ltd.; Medical Coaches; Odulair LLC |

Market Driver: Rising Healthcare Disparities and Rural Access Challenges

One of the primary drivers of the U.S. mobile clinics market is the increasing gap in healthcare access among rural and underserved populations. Over 60 million Americans live in rural areas, many of which face physician shortages and hospital closures. According to the National Rural Health Association, more than 180 rural hospitals have closed since 2005, and hundreds more are at risk. Mobile clinics act as lifelines in these communities by bringing medical care directly to patients' doorsteps.

Consider the case of a mobile clinic operated by a university hospital in West Virginia. This unit offers diabetic care, hypertension monitoring, and telepsychiatry services to populations with no local clinics within a 50-mile radius. Similarly, mobile dental clinics in Mississippi’s Delta region serve children who have never visited a dentist due to financial and logistical barriers. These real-world examples illustrate how mobile units mitigate systemic barriers and expand reach, making healthcare delivery more equitable and inclusive.

Market Restraint: High Capital Investment and Operational Costs

Despite their benefits, high capital requirements and ongoing operational expenses pose a significant restraint to market expansion. A fully equipped mobile clinic whether a customized bus or a container-based structure can cost between $300,000 to over $1 million, depending on services provided. Maintenance, fuel, insurance, staff salaries, and technological upgrades contribute to recurring costs.

For smaller health providers, community clinics, and rural counties with limited budgets, launching or sustaining a mobile unit can be financially burdensome. Additionally, mobile clinics may face zoning restrictions, limited parking options in urban settings, and technical hurdles such as connectivity issues in remote areas. These factors often require cross-sector coordination and creative financing solutions, which may not be feasible for all potential operators.

Market Opportunity: Growth of Value-based and Community-centric Healthcare

An emerging opportunity lies in the alignment of mobile clinics with value-based care models, where providers are incentivized based on patient outcomes rather than volume of services. Mobile units are ideal for chronic disease management, preventive screenings, and follow-ups functions that directly support improved health outcomes and cost savings for insurers and Medicare/Medicaid.

Community-based organizations and accountable care organizations (ACOs) are increasingly incorporating mobile units into their long-term strategies. For instance, a health system in California deploys mobile buses to provide follow-up care for patients with congestive heart failure, resulting in reduced readmission rates. Additionally, the role of mobile clinics in reducing emergency department visits a major cost driver in the U.S. system positions them as essential tools in the shift toward preventative, decentralized care.

U.S. Mobile Clinics Market By Vehicles Insights

Mobile medical vans continue to dominate the U.S. mobile clinics market due to their affordability, flexibility, and suitability for a wide range of services. Vans are easier to maneuver in urban and rural environments, require less customization, and can be deployed quickly in emergencies. They are particularly popular among nonprofit organizations and small-scale community health providers. Mobile vans used for routine dental check-ups, diabetes screenings, and immunizations have shown high patient throughput with minimal setup costs. Their cost-effective nature and ease of operation make them the first choice for short-term health campaigns and ongoing outreach programs.

Mobile medical shipping containers are emerging as the fastest growing segment, largely due to their modular design and scalability. These units are designed to be stationary or semi-mobile, often placed in underserved areas for extended periods. For instance, FEMA and state agencies used shipping containers to set up vaccination hubs during COVID-19. Post-pandemic, these containers are now being repurposed for maternal health services and chronic disease monitoring in Native American reservations and disaster-prone areas. Their durability, ease of transport, and ability to be outfitted with advanced medical equipment make them ideal for semi-permanent medical infrastructure.

U.S. Mobile Clinics Market By Services Insights

Diagnosis and screening services lead the services segment, driven by public health initiatives and insurance mandates for early detection of diseases. Mobile clinics offering mammograms, blood pressure checks, glucose screenings, HIV tests, and tuberculosis diagnostics are among the most prevalent. These services are essential for communities that lack access to laboratories or hospitals. A real-world case includes mobile mammography buses operated by major hospitals in Texas, which provide free annual screenings to low-income women, significantly improving early detection rates and survival outcomes.

Mental health services are witnessing the fastest growth in mobile clinics, responding to the national mental health crisis intensified by the COVID-19 pandemic. Rising suicide rates, youth depression, substance abuse, and PTSD among veterans are fueling demand for mobile mental health interventions. These units provide on-the-spot counseling, psychiatric evaluations, and medication management. Programs in Oregon and New York are deploying mobile mental health clinics staffed with psychologists and social workers, specifically targeting homeless populations and schools. The flexibility of mobile delivery is helping reduce stigma and remove logistical barriers to care.

U.S. Mobile Clinics Market By Design layout Insights

Single exam room designs dominate the mobile clinic market due to their lower cost, ease of design, and suitability for basic outpatient services. These units are commonly used for services such as vaccinations, vital checks, reproductive health consultations, and minor treatments. Their compact design allows them to fit into standard vans or buses, making them more mobile and easier to deploy in constrained spaces. For example, mobile clinics operated by Planned Parenthood utilize single-room layouts for privacy and efficiency during reproductive health consultations.

Triple exam room layouts are growing fastest, particularly among organizations that offer multi-specialty services in one visit. These larger configurations allow simultaneous consultations, improving throughput and cost-effectiveness. A triple-room mobile clinic operated by a university hospital in Chicago offers pediatric, dental, and geriatric services simultaneously during community outreach programs. This not only improves patient flow but also enhances patient satisfaction by reducing wait times and increasing access to comprehensive care in a single location.

Country-Level Analysis – United States

The United States is witnessing a paradigm shift toward mobile healthcare, driven by a combination of healthcare disparities, technological advancements, and an evolving regulatory landscape. As healthcare costs continue to surge, mobile clinics offer a sustainable alternative, particularly for preventive and low-acuity services. States like California, Texas, Florida, and New York lead in terms of mobile clinic deployment due to their large, diverse, and often underserved populations.

Federal funding, including grants from the Health Resources and Services Administration (HRSA), and policy initiatives like Medicaid expansion are enabling more providers to invest in mobile clinics. Additionally, legislation such as the Bipartisan Infrastructure Law and the American Rescue Plan has indirectly supported mobile health initiatives by improving internet access, rural infrastructure, and public health funding. Moreover, mobile clinics are playing an increasing role in disaster response, opioid treatment programs, and school-based health initiatives across the U.S.

Some of the prominent players in the U.S. mobile clinics market include:

- Matthews Specialty Vehicles

- Farber Specialty Vehicles

- ADI Mobile Health

- MinFound Medical Systems Co., Ltd

- Medical Coaches

- Odulair LLC.

Recent Developments

-

In February 2025, CVS Health expanded its HealthHUB initiative by deploying a new fleet of mobile clinics focused on underserved urban neighborhoods in Atlanta and Philadelphia, offering primary care and screening services.

-

In January 2025, Mobile Health Map (an initiative of Harvard Medical School) published new data showing mobile clinics reduce emergency department visits by 600,000 cases annually, validating their cost-effectiveness in the U.S. healthcare ecosystem.

-

In November 2024, Medline Industries announced a strategic partnership with a California-based mobile clinic provider to supply customized medical equipment kits designed for rapid deployment during disaster relief efforts.

-

In September 2024, Northwell Health launched a mobile behavioral health unit in Long Island, offering psychiatric evaluations, tele-counseling, and crisis intervention, targeting the region’s homeless population.

-

In August 2024, the University of Miami unveiled its latest mobile dental care bus equipped with 3D imaging technology, expanding care for children in South Florida’s public schools.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. mobile clinics market

Vehicle

- Mobile Medical Van

- Mobile Medical Bus

- Mobile Medical Shipping Containers

Services

- Maternal Health

- Neonatal & Infant Health

- Child & Adolescent Health

- Reproductive Health & Contraceptive Services

- Mental Health

- Dental Care

- ENT

- Geriatric Care

- OPD

- Diagnosis/Screening

- Emergency Care

- Others

Design Layout

- Single Exam Room

- Double Exam Room

- Triple Exam room